|

市場調查報告書

商品編碼

1636464

東南亞國協電動車電池分離器:市場佔有率分析、產業趨勢、成長預測(2025-2030)ASEAN Countries Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

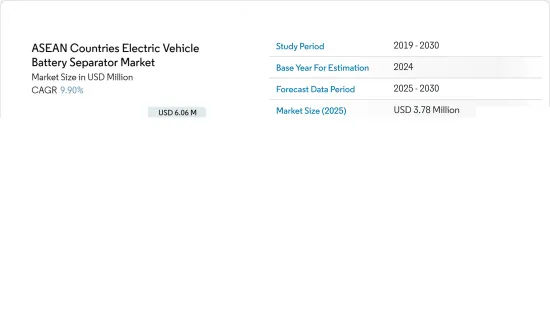

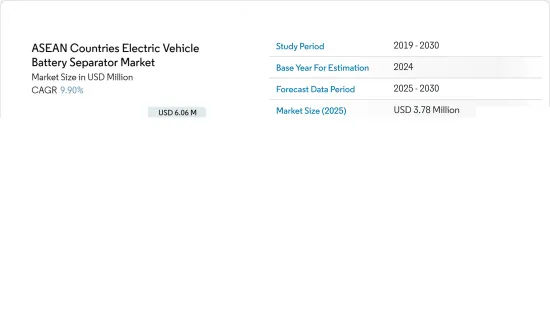

2025年,東南亞國協電動車電池隔膜市場規模預計為378萬美元,預計2030年將達到606萬美元,預測期內(2025-2030年)複合年成長率為9.9%。

主要亮點

- 從中期來看,電動車的普及和鋰離子電池價格的下降預計將在預測期內推動市場發展。

- 另一方面,一些國家的壟斷造成的電池材料供應鏈的差異(例如原料短缺和分銷瓶頸)預計將抑制未來的市場成長。

- 其他電池化學材料(例如固體電池、先進鋰離子化學材料和鈉離子電池)的研發進展預計將為未來的市場提供機會。

- 在東南亞國協的電動車電池分離市場中,由於電動車在全部區域的滲透率不斷提高,泰國預計將顯著成長。

東南亞國協電動車電池隔膜市場趨勢

鋰離子電池類型主導市場

- 鋰離子電池以其高能量密度、長循環壽命和低自放電率而聞名,是電動車(EV)的首選。這種壓倒性的偏好不僅推動了電動車電池隔膜市場的成長,也塑造了電動車產業更廣泛的發展軌跡。

- 主要市場參與企業正在增加研發投資和產能,加劇競爭並降低價格。彭博社 NEF 指出,雖然電動車電池組和電池能源儲存系統(BESS) 的平均價格普遍上漲,但到 2023 年將大幅下降 13% 至 139 美元/kWh。據預測,這種下降預計將持續下去,到2025年將達到113美元/千瓦時,並在2030年進一步降至80美元/千瓦時。

- 泰國、菲律賓、馬來西亞、印尼和越南等東南亞國協正成為全球鋰離子電池供應鏈的主要企業。戰略定位、政府激勵措施和豐富的自然資源成功吸引了對電池製造的投資。

- 2024 年 7 月,印尼推出了第一家電動車電池工廠。印尼是東南亞最大的經濟體,擁有全球最大的鎳蘊藏量,在全球電動車供應鏈中發揮重要作用。該工廠是韓國巨頭 LG Energy Solution (LGES) 和現代汽車集團的合資企業,電池單元年產能為 10 吉瓦時 (GWh)。這些舉措預計將在未來幾年加強該地區的鋰離子電池生產。

- 此外,鋰離子電池技術的進步,例如增加的能量密度、改進的安全特性和更快的充電速度,正在刺激創新隔膜材料的開發。這些隔膜對於滿足鋰離子電池的能源和熱需求至關重要,在確保安全性和可靠性方面發揮關鍵作用,從而推動隔膜市場的創新和需求。

- 2023 年 6 月,輝能宣布推出突破性電池架構,標誌著鋰離子技術 30 年來的重大演進。透過用陶瓷取代傳統的聚合物隔膜,輝能在電動車鋰離子電池領域樹立了新標準。此類創新有望推動該地區對先進鋰電池隔膜的需求。

- 這些發展將導致預測期內鋰離子電池產量激增以及電動車電池隔膜產能大幅增加。

泰國正在經歷顯著的成長

- 憑藉強大的汽車工業、戰略定位和政府支持,泰國已成為東協地區電動車電池隔膜的最大生產國。隨著國家轉向清潔能源並採用電動車,企業越來越關注這一重要領域。消費者的興趣是由日益增強的環保意識、擁有電動車的經濟效益以及行業快速的技術進步所驅動的。

- 近年來,電動車(EV)銷量在東協地區迅速成長。例如,根據泰國汽車實驗室的預測,2023年電池式電動車(BEV)註冊數量將達到76,360輛,與2022年相比成長了6.89倍,與2019年相比成長了47.6倍。隨著包括純電動車在內的電動車銷量預計增加,該地區對電池和電池隔膜的需求預計將擴大。

- 此外,該地區的電池隔膜正在克服鋰離子電池價格下降、需求激增以及電動車應用對安全和效率的迫切需求等挑戰。最近,全球主要公司投資了計劃,以提高該地區電動汽車鋰離子電池的產量。

- 例如,BMW於2024年2月宣布將在泰國羅勇建立新的電動車電池工廠。該舉措預計將加強該國的電池供應鏈。 BMW將泰國定位為電動車電池的重要出口基地,並瞄準了更大的亞太市場。此舉可能會提高泰國的電池產量,並增加未來幾年對鋰離子電池隔離膜的需求。

- 此外,泰國汽車工業正在加大創新電動車 (EV) 車型的生產。隨著全球主要企業將重點轉向電動車製造,對高檔電池組件(尤其是隔膜)的需求正在迅速增加。這一趨勢凸顯了該行業對創新和永續性的承諾。

- 例如,2024 年 8 月,Omoda 和中國汽車製造商奇瑞汽車的子公司 Jaecoo Thai 發布了兩款電動車 (EV) 車型,並加強了在泰國的業務。它們是Omoda C5 EV(緊湊型SUV)和Jaecoo 6 EV(越野SUV)。這些舉措正在擴大該地區的電動車陣容,並支持電動車電池隔膜市場的成長。

- 因此,這些計劃和舉措將推動電動車需求,並在未來幾年顯著增加對電動車電池隔膜的需求。

東南亞國協電動汽車電池隔膜產業概況

東南亞國協的電動車電池隔膜市場呈現半分散狀態。主要參與企業(排名不分先後)包括三菱化學集團公司、日立化成有限公司、東麗工業公司、住友化學公司和帝人公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 降低電池原物料成本

- 抑制因素

- 供應鏈缺口

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池

- 鋰離子

- 鉛酸

- 其他

- 材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

- 地區

- 印尼

- 越南

- 泰國

- 緬甸

- 菲律賓

- 其他東南亞國協

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- Teijin Ltd

- SK Nexilis

- Asahi Kasei

- W-Scope Corporation

- Southeast Asia Manufacturing Co., Ltd

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 增加其他電池化學物質的研究和開發

簡介目錄

Product Code: 50003731

The ASEAN Countries Electric Vehicle Battery Separator Market size is estimated at USD 3.78 million in 2025, and is expected to reach USD 6.06 million by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- Thailand is anticipated to witness significant growth in the ASEAN countries' electric vehicle battery separation market due to the rising adoption of EVs across the region.

ASEAN Countries Electric Vehicle Battery Separator Market Trends

Lithium-Ion Battery Type to Dominate the Market

- Li-ion batteries, known for their high energy density, long cycle life, and low self-discharge rate, are the preferred choice for electric vehicles (EVs). This dominant preference not only propels the growth of the EV battery separator market but also shapes the broader trajectory of the EV industry.

- Key market players are boosting their R&D investments and production capabilities, intensifying competition and driving prices down. Bloomberg NEF highlights that while average battery pack prices for EVs and battery energy storage systems (BESS) have generally risen, 2023 marked a significant 13% drop, bringing prices down to USD 139/kWh. Projections suggest this decline will persist, with prices anticipated to reach USD 113/kWh by 2025 and plummet further to USD 80/kWh by 2030, driven by relentless technological and manufacturing advancements.

- ASEAN nations, including Thailand, the Philippines, Malaysia, Indonesia, and Vietnam, are emerging as key players in the global lithium-ion battery supply chain. Their strategic locations, government incentives, and abundant natural resources have successfully attracted investments into battery manufacturing.

- In July 2024, Indonesia launched its first-ever EV battery plant. As Southeast Asia's largest economy and the custodian of the world's most extensive nickel reserves, Indonesia is carving out a significant role in the global electric vehicle supply chain. This plant, a joint venture between South Korean titans LG Energy Solution (LGES) and Hyundai Motor Group, boasts a robust annual capacity of 10 Gigawatt hours (GWh) for battery cell production. Such initiatives are poised to bolster lithium-ion battery production in the region in the coming years.

- Moreover, advancements in lithium-ion battery technology, such as heightened energy density, improved safety features, and accelerated charging, are spurring the development of innovative separator materials. These separators, crucial for meeting the energy and thermal demands of Li-ion batteries, play a vital role in ensuring safety and reliability, thereby driving innovation and demand in the separator market.

- In June 2023, ProLogium unveiled a groundbreaking battery architecture, marking a significant evolution in three decades of lithium-ion technology. By substituting the traditional polymer separator film with a ceramic alternative, ProLogium has set a new standard in the lithium-ion battery sector for electric vehicles. Such innovations are poised to amplify the demand for advanced lithium battery separators in the region.

- Given these developments, the production of lithium-ion batteries is set to surge, leading to a substantial increase in the capacity of EV battery separators during the forecast period.

Thailand to Witness Significant Growth

- Thailand, with its robust automotive industry, strategic positioning, and government support, has emerged as the top producer of EV battery separators in the ASEAN region. As the country shifts towards clean energy and embraces electric vehicles, companies are sharpening their focus on this crucial segment. Rising consumer interest is driven by increased environmental awareness, the economic advantages of EV ownership, and swift technological progress in the industry.

- Recently, electric vehicle (EV) sales have surged in the ASEAN region. For instance, the Thailand Automotive Institute reported that in 2023, registered battery electric vehicles (BEVs) reached 76.36 thousand units, marking a 6.89-fold increase from 2022 and a staggering 47.6-fold jump since 2019. With EV sales, including BEVs, projected to rise, the demand for batteries and battery separators in the region is set to amplify.

- Additionally, battery separators in the region are navigating challenges like falling lithium-ion battery prices, escalating demand, and the crucial need for safety and efficiency in EV applications. Recently, leading global companies have invested in projects to enhance lithium-ion battery production for EVs in the region.

- For example, in February 2024, BMW announced a new battery factory for electric vehicles in Rayong, Thailand. This initiative is expected to strengthen the country's battery supply chains. BMW sees Thailand as a key export center for its EV batteries, aiming at the larger Asia Pacific market. Such moves are likely to boost battery production in Thailand and heighten the demand for lithium-ion battery separators in the coming years.

- Furthermore, Thailand's automotive industry is ramping up the production of innovative electric vehicle (EV) models. As global leaders pivot to include EV manufacturing, there's a notable surge in demand for premium battery components, especially separators. This trend highlights the industry's commitment to innovation and sustainability.

- For instance, in August 2024, Omoda and Jaecoo Thailand, a branch of the Chinese automaker Chery Automobile, strengthened their presence in Thailand by launching two electric vehicle (EV) models. The debut included two versions for each model: the compact SUV Omoda C5 EV and the rugged off-road SUV Jaecoo 6 EV, making its global debut in a right-hand drive variant. Such initiatives are expanding their electric vehicle offerings in the region, fueling the growth of the EV battery separator market.

- Consequently, these projects and initiatives are poised to boost EV demand and substantially elevate the need for EV battery separators in the coming years.

ASEAN Countries Electric Vehicle Battery Separator Industry Overview

ASEAN Countries' electric vehicle battery separator market is semi-fragmented. Some key players (not in particular order) are Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, Teijin Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Thailand

- 5.3.4 Myanmar

- 5.3.5 Philippines

- 5.3.6 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group Corporation

- 6.3.2 Hitachi Chemical Company Ltd

- 6.3.3 Toray Industries Inc.

- 6.3.4 Sumitomo Chemical Co. Ltd

- 6.3.5 Teijin Ltd

- 6.3.6 SK Nexilis

- 6.3.7 Asahi Kasei

- 6.3.8 W-Scope Corporation

- 6.3.9 Southeast Asia Manufacturing Co., Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219