|

市場調查報告書

商品編碼

1636473

南美洲電動車電池製造:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

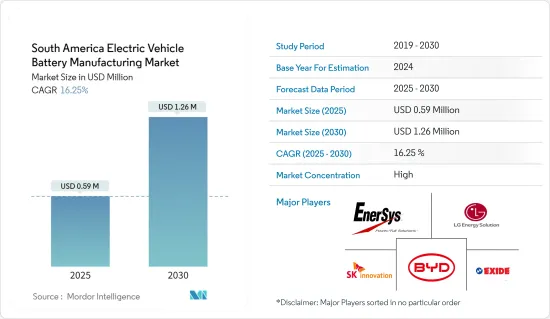

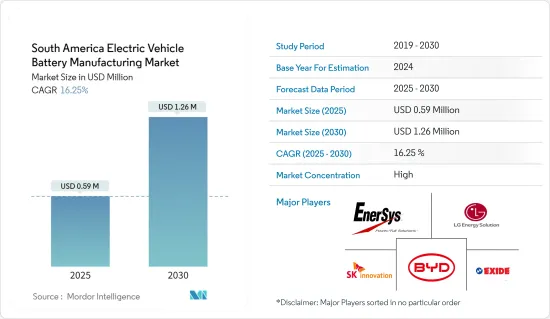

南美洲電動車電池製造市場規模預計到2025年為59萬美元,預計到2030年將達到126萬美元,預測期內(2025-2030年)複合年成長率為16.25%。

主要亮點

- 從中期來看,電動車滲透率的提高和該地區原料豐富等因素預計將成為預測期內南美電動車電池製造市場最重要的驅動力之一。

- 另一方面,亞太地區等現有電池市場正在競爭。這對預測期內的南美洲電動車電池製造市場構成威脅。

- 南美國家不斷努力建立合作夥伴關係,預計未來將為市場創造許多機會。

- 由於政府加大力度建立電池製造和提高電動車的普及率,預計巴西將主導市場並在預測期內實現最高成長。

南美洲電動汽車電池製造市場趨勢

鋰離子電池實現顯著成長

- 鋰離子電池領域是南美洲電動車(EV)電池製造市場的基石,受到該地區豐富的自然資源、不斷發展的工業能力和不斷發展的永續性舉措的推動。南美洲是「鋰三角」的所在地,其中包括巴西、智利和阿根廷,這些國家佔世界鋰蘊藏量的大部分。

- 例如,能源研究所《世界能源統計評論》報告稱,2023年南美鋰蘊藏量將超過71,030噸。這意味著較 2022 年大幅成長 22.82%,使其成為全球成長最快的地區之一。值得注意的是,2018年至2023年,南美洲的複合年成長率超過38.1%,支撐了該地區鋰蘊藏量和產能的不斷上升。

- 這一戰略優勢使該地區成為全球鋰離子電池供應鏈的主要參與企業。鋰離子電池由於具有高能量密度、長循環壽命和相對較低的自放電率,作為電動車的動力來源極為重要。鋰的萃取和加工變得越來越複雜,南美國家投資於提高萃取效率和環境永續性的技術。儘管存在用水和採礦作業對環境影響等挑戰,但人們仍在尋求綠色採礦技術的進步來緩解這些問題。

- 2024 年 5 月,力拓、埃赫曼和 LG 能源在智利 Salales Alto Andinos提案了一種創新方法。該舉措不僅是增加產量,還旨在重新定義鋰開採對環境的影響,並建立開創性的永續性基準。

- 這種方法稱為直接鋰萃取方法(DLE),代表了傳統方法的重大飛躍。與南美洲富鋰地區常見的耗時且主導的蒸發池不同,DLE 方法使用化學、物理和電氣過程從鹽水中提取鋰。這不僅提高了效率,還最大限度地減少了對環境的破壞。

- 同樣,巴西正在努力開發一個全面的電池製造生態系統,該生態系統不僅包括原料開採,還包括正在形成的電池製造和回收設施。擁有大量鋰蘊藏量的阿根廷也在專注於吸引外資建立當地電池製造設施,旨在從出口原料轉向增值生產。

- 鑑於這些發展,鋰離子電池產業在未來幾年有顯著成長的潛力。

巴西主導市場

- 由於戰略、經濟和技術因素的綜合作用,巴西有望主導南美洲電動車(EV)電池製造市場。巴西作為南美洲最大的經濟體,擁有雄厚的工業基礎和完善的汽車工業,為拓展電動車電池製造提供了堅實的基礎。

- 巴西豐富的自然資源,特別是鎳、鈷和鋰等礦產,對於鋰離子電池的生產至關重要,並為關鍵原料的國內採購提供了巨大潛力。巴西的地理位置和發達的基礎設施進一步增強了其作為非洲大陸進出口物流中心的潛力,促進了貨物的高效流動並促進了國際貿易關係。

- 此外,巴西政府展現了向永續能源解決方案過渡和減少碳排放的堅定承諾,與全球趨勢一致,國內電動車銷售和相關電池技術市場的成長前景正在加強。

- 根據國際能源總署(IEA)的數據,2023年巴西電動車銷量激增,達19,000輛。這比 2022 年大幅成長了 123.5%。令人印象深刻的是,過去五年銷售額激增,成長了 100 倍以上。

- 巴西政府正在積極推動獎勵可再生能源發展和電動車採用的措施,這刺激了對國產電池的需求。稅收減免、補貼和研發投資等舉措旨在吸引國內外投資進入電池製造業。這些措施得到了與熱衷於利用巴西巨大市場潛力和熟練勞動力的國際科技公司的合作夥伴關係的補充。

- 例如,比亞迪計劃於2023年7月在巴西前福特工廠舊址上建造三座生產設施。一座工廠將加工用於電動車和混合動力汽車生產的磷酸鋰和鐵,一座用於電動巴士和卡車底盤,第三座用於電動車電池市場。比亞迪願意斥資高達6.17億美元對巴西巴伊亞州卡馬卡里工業園區進行改造。

- 這種情況預計將導致巴西在預測期內主導市場。

南美洲電動車電池製造業概況

南美洲的電動車電池製造市場正在變得半固體。該市場的主要企業(排名不分先後)是比亞迪、SK Innovation、EnerSys、LG Chem Ltd 和 Exide Industries。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 原料豐富

- 抑制因素

- 與現有市場的競爭

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他

- 電池形式

- 方形

- 袋型

- 圓柱形

- 車輛

- 客車

- 商用車

- 其他

- 晉升

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

- 地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- SK innovation Co., Ltd.

- EnerSys

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- 其他知名公司名單

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 區域合作

簡介目錄

Product Code: 50003740

The South America Electric Vehicle Battery Manufacturing Market size is estimated at USD 0.59 million in 2025, and is expected to reach USD 1.26 million by 2030, at a CAGR of 16.25% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing adoption of electric vehicles in the region coupled with the abundance of raw materials in the region are expected to be among the most significant drivers for the South American electric Vehicle Battery Manufacturing Market during the forecast period.

- On the other hand, established battery markets such as Asia Pacific are competing. This poses a threat to the South American electric Vehicle Battery Manufacturing Market during the forecast period.

- Nevertheless, continued efforts to create collaborations and partnerships between South American countries are expected to create several opportunities for the market in the future.

- Brazil is expected to dominate the market and will likely register the highest growth during the forecast period due to the government's rising efforts to establish battery manufacturing and the growing adoption of electric vehicles.

South America Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery to Witness Significant Growth

- The lithium-ion battery segment is a cornerstone of the electric vehicle (EV) battery manufacturing market in South America, driven by the region's abundant natural resources, evolving industrial capabilities, and increasing commitment to sustainability. South America is home to the "Lithium Triangle," encompassing Brazil, Chile, and Argentina, which collectively hold over a significant share of the world's known lithium reserves.

- For instance, the Energy Institute Statistical Review of World Energy reported that South America's lithium reserves exceeded 71.03 thousand tonnes of lithium content in 2023. This marked a substantial growth of 22.82% from 2022, positioning it as one of the fastest-growing regions globally. Notably, from 2018 to 2023, South America boasted an impressive annual average growth rate of over 38.1%, underscoring the region's escalating lithium reserves and production capacity.

- This strategic advantage positions the region as a vital player in the global supply chain for lithium-ion batteries, which are pivotal in powering electric vehicles due to their high energy density, long cycle life, and relatively low self-discharge rates. The extraction and processing of lithium have become increasingly sophisticated, with South American countries investing in technology to improve extraction efficiency and environmental sustainability. Despite challenges such as water usage and the environmental impact of mining operations, advancements in green mining techniques are being explored to mitigate these issues.

- In May 2024, Rio Tinto, Eramet, and LG Energy proposed an innovative approach in Chile's Salares Altoandinos: a new lithium extraction technology. This initiative goes beyond mere production increases; it aims to redefine lithium mining's environmental impact, establishing pioneering sustainability benchmarks.

- Known as Direct Lithium Extraction (DLE), this method marks a notable leap from conventional practices. Unlike the slow and landscape-dominating evaporation ponds typical in South America's lithium-rich areas, DLE methods employ chemical, physical, or electrical processes to extract lithium from brine. This not only enhances efficiency but also minimizes environmental disturbances.

- Similarly, in Brazil, initiatives are underway to develop a comprehensive battery manufacturing ecosystem that includes not only raw material extraction but also the production of battery cells and recycling facilities, thus creating a circular economy around battery use. Argentina, with its significant lithium reserves, is also focusing on attracting foreign investment to establish local battery manufacturing facilities, aiming to move beyond raw material exportation to value-added production.

- Given these developments, the lithium-ion battery sector is poised for significant growth in the coming years.

Brazil to Dominate the Market

- Brazil is poised to dominate the South American electric vehicle (EV) battery manufacturing market due to a confluence of strategic, economic, and technological factors that favor its development as a regional powerhouse in this burgeoning sector. As the largest economy in South America, Brazil offers a robust industrial base and a well-established automotive industry, which collectively provide a solid foundation for expanding into electric vehicle battery manufacturing.

- Brazil's extensive natural resources, particularly minerals such as nickel, cobalt, and lithium, are crucial for lithium-ion battery production and offer significant potential for domestic sourcing of critical raw materials. Brazil's geographical location and developed infrastructure further enhance its potential as a logistical hub for both import and export within the continent, facilitating the efficient movement of goods and fostering international trade relationships.

- In addition, Brazil's government has demonstrated a solid commitment to transitioning toward sustainable energy solutions and reducing carbon emissions, aligning with global trends and reinforcing the domestic market's growth prospects for electric vehicle sales and related battery technologies.

- According to the International Energy Agency, Brazil witnessed a surge in electric vehicle sales in 2023, reaching 19,000 units. This marked a notable 123.5% increase from 2022. Impressively, over the last five years, sales have skyrocketed, growing by over 100 times, underscoring the escalating demand for electric vehicles in the nation.

- The Brazilian government is actively promoting policies to incentivize the development of renewable energy and the adoption of electric vehicles, which in turn is stimulating demand for locally manufactured batteries. Initiatives such as tax breaks, subsidies, and investment in research and development are designed to attract both domestic and foreign investment into the battery manufacturing sector. These policy measures are complemented by partnerships with international technology firms, which are eager to leverage Brazil's vast market potential and skilled labor force.

- For instance, in July 2023, BYD is planning to build three production facilities on a former Ford industrial site in Brazil: one for the production of electric and hybrid cars, one for chassis for electric buses and trucks, and a third that will process lithium and iron phosphate for the electric vehicle battery market. To convert the site in the Camacari industrial park in the Brazilian state of Bahia, BYD is ready to spend up to USD 617 million.

- Thus, such a scenario is expected to Brazil the dominating player in the market during the forecast period.

South America Electric Vehicle Battery Manufacturing Industry Overview

The South America Electric Vehicle Battery Manufacturing Market is semi-consolidated. Some of the key players in this market (in no particular order) are BYD Co. Ltd, SK innovation Co., Ltd., EnerSys, LG Chem Ltd, and Exide Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Abundance of Raw Materials

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

- 5.5 Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Colombia

- 5.5.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 SK innovation Co., Ltd.

- 6.3.3 EnerSys

- 6.3.4 LG Chem Ltd

- 6.3.5 Exide Industries

- 6.3.6 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Regional Collaboration

02-2729-4219

+886-2-2729-4219