|

市場調查報告書

商品編碼

1637828

UCaaS(統一通訊即服務):市場佔有率分析、產業趨勢、成長預測(2025-2030)Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

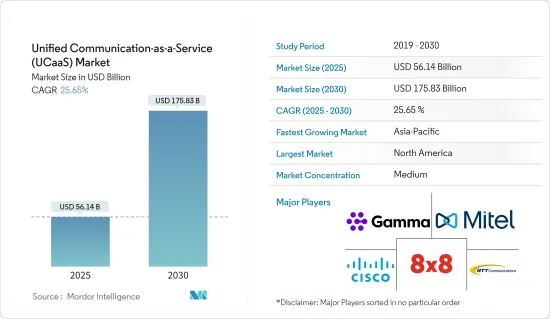

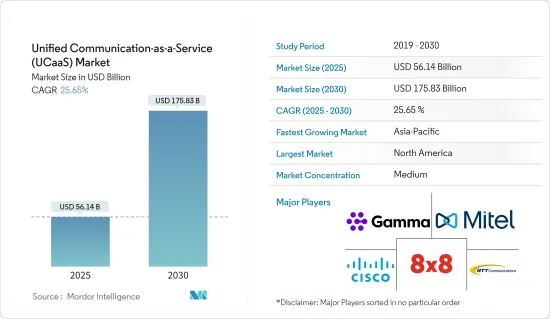

UCaaS(統一通訊即服務)市場規模預計到2025年為561.4億美元,預計到2030年將達到1758.3億美元,在預測期內(2025-2030年)的複合年成長率為25.65%。

在家工作(WFH) 模式的成長趨勢促使雇主利用 UCaaS 解決方案。對於企業來說,UCaaS解決方案有利於審查營運成本並防止邊際收益下降。

主要亮點

- UCaaS(統一通訊即服務)是一種雲端服務,它將各種通訊和協作應用程式整合到一個中央平台中。 UCaaS 讓企業最佳化溝通管道、降低成本並提高效率。

- UCaaS 描述了廣泛的通訊工具,包括語音和視訊會議、通訊、電子郵件和協作軟體。 UCaaS 是一個平台,允許使用者透過網路連線從任何地方、在任何裝置上存取這些工具。對於各種規模的企業來說,這都是一個有吸引力的選擇,無需昂貴的硬體、軟體和維護成本。例如,2023年5月,印度政府向網路會議公司Zoom Video Communications授予統一許可證,進入許可權涵蓋全印度、國內遠距(NLD)和國際遠距(ILD)。這將使我們能夠向印度企業提供雲端基礎的PBX 服務 Zoom Phone。

- 此外,5G 技術和高速網際網路的採用預計將在預測期內提振市場。因為 5G 網路易於用於需要高速度和最小延遲的視訊和音訊會議。據 5G Americas 稱,到 2023 年,全球第五代用戶將達到 19 億。預計2024年人口將達28億,2027年將達59億人。

- 智慧型行動小工具的普及和相關工具的改進正在增強遠端和分散式工作策略。同樣,公司正在其辦公室採用「自帶設備」(BYOD) 規則。這種方法可能有助於組織提高效率、完善內部互動並消除價格差異。預計這將最終推動預測期內整合通訊即服務市場的成長。

- 鑑於人們對數位化的偏好日益增強,隨著客戶繼續使用不同的通訊方式,客戶服務預計將成為一項重大挑戰。

- 此外,過去十年對整合通訊(UC) 的需求不斷成長。疫情爆發後,整合通訊(UC)需求異常成長。隨著COVID-19的出現,數位轉型已成為確保企業生存、成長和市場領先地位的迫切要求。隨時隨地統一、順暢、安全地存取資料和應用程式的需求呈指數級成長。

UCaaS(統一通訊即服務)市場趨勢

從舊有系統遷移到雲端基礎的通訊服務推動了成長

- 隨著業務通訊的興起,公司正在尋找管理複雜性、降低成本和提高整體生產力的方法。這導致雲端基礎的概念整合通訊即服務的使用增加。

- 此外,越來越多的公司正在適應靈活和混合的工作方式,採用雲端基礎的解決方案,使員工能夠跨裝置、部門和時區工作。

- 此外,整合通訊(UC) 雲端解決方案通常具有成本效益,因為它們不需要現場託管基礎設施,易於擴展,並且具有最新的功能和安全性。一系列重大資料外洩事件讓雲端安全成為各企業關注的重點之一,加大了對資料中心安全的投入。

- 私有雲端伺服器是為單一公司提供託管服務的基礎架構。所有優勢包括敏捷性、可擴展性以及為複雜的運算活動和操作建立大量虛擬機器的能力,同時保持高水準的資料安全和隱私保護。

預計北美將佔據較大市場佔有率

- 該地區對所研究的市場成長做出了重大貢獻,這主要是由於最近 IT 消費化導致的移動性激增和 5G 連接的爆炸式成長。

- 在美國,零售、銀行、醫療保健、IT 和通訊等終端用戶產業無論身在何處,都需要為所有通訊、語音、視訊和聊天提供更直接、無縫的體驗。為了滿足這些需求,企業正在尋求來自他們可以信賴的單一供應商的統一部署和管理解決方案來滿足其 UCC 要求。 5G 的出現將允許遠端連接工具整合到單一 UCaaS 平台中。

- 該地區因有效整合線上和線下管道以提供全面客戶體驗而享有盛譽。典型的服務旨在將客戶與各種管道連接起來,例如網路購物平台、社交網路、行動應用程式、零售商店、客戶援助管道等。

- 此外,UCaaS 的需求是由該領域眾多跨國公司的存在所推動的。透過成為人工智慧的中心,組織正在利用最新技術不斷發展,並且在全球範圍內提供人工智慧相關服務的組織數量顯著增加。

UCaaS(統一通訊即服務)產業概述

UCaaS(統一通訊即服務)市場被 8x8 Inc.、Mitel Networks 和 Verizon 等主要參與者適度細分,市場參與企業之間競爭激烈。這些公司有能力透過大力投資研發活動來進行創新,這給了他們競爭優勢。透過策略夥伴關係、併購和收購,這些公司獲得了顯著的市場佔有率。

- 2023年10月,Mitel正式完成先前宣布的對Unify的收購,其中包括Atos Group的通訊與協作服務(CCS)和整合通訊與協作(UCC)業務。透過此次收購,該公司將其客戶群擴大到 100 多個國家的超過 7,500 萬人。

- 2023 年 6 月,思科與 AT&T-Mobile 網路合作,原生整合 Webex Calling。此次合作預計將透過單一企業行動電話號碼提供行動優先、強大、統一的協作體驗。預計此類發展將促進工業成長。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 計量收費模式的出現推動了對傳統統一通訊解決方案的需求

- 不斷變化的勞動力動態導致新的企業合作的出現

- 從舊有系統遷移到雲端基礎的通訊服務推動成長

- 市場問題

- 遷移到現代整合通訊(UC) 的準備工作出現延誤

- UC產業的主要經營模式

第6章技術概述

第7章 市場區隔

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶產業

- BFSI

- 零售

- 醫療保健

- 政府/公共機構

- 資訊科技和電訊

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- 8X8 Inc.

- Cisco Systems Inc.

- Mitel Networks Corporation

- Gamma Communication PLC

- NTT Communication Corporation

- Vodafone Group PLC

- Telia Company AB

- KPN NV

- BT Group PLC

- Verizon Communications Inc.

- Nextiva

- Soluno(Destiny NV)

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- Telstra Corporation Limited

- PCCW Global

- Maxis Communications

第9章 重要建議

- 主要策略建議

- 分析師對區域需求和定位的看法

- 最常採用的策略分析

第10章市場的未來

The Unified Communication-as-a-Service Market size is estimated at USD 56.14 billion in 2025, and is expected to reach USD 175.83 billion by 2030, at a CAGR of 25.65% during the forecast period (2025-2030).

The increasing trend of work from home (WFH) model is compelling employers to use UCaaS solutions as it's beneficial for companies to reevaluate their operational costs and save their marginal revenue from declining.

Key Highlights

- Unified Communications as a Service is the cloud service that brings together different communication and collaboration applications in one central platform. UCaaS allows businesses to optimise their communication channels, reduce costs and improve efficiency.

- UCaaS provides a wide range of communication tools, including voice and video conferencing, communications, email or collaborate software. The platform provides users with access to these tools through an Internet connection wherever they are, on any device. It's an appealing option for businesses of all sizes, eliminating the need to incur expensive hardware, software and maintenance costs. For instance, in May 2023, the Indian government granted Zoom Video Communications, a web conferencing company, a Unified License with access covering all of India, National Long Distance (NLD), and International Long Distance (ILD). This will allow it to offer Zoom Phone, a cloud-based private branch exchange (PBX) service, to enterprises in the country.

- In addition, the introduction of 5G technology and high-speed internet is anticipated to boost the market in the forecasted period, Because the 5G network is easy to use for video and Audio Conferencing, which requires high speed and minimal latency. According to 5G Americas, there are expected to be 1.9 billion fifth generation subscribers in the world by 2023. By 2024 and by 2027, this number is projected to be 2.8 billion and 5.9 billion respectively.

- The rising implementation of smart mobile gadgets and association tool improvements empower remote work and dispersed workforce tactics. Similarly, establishments employ a 'bring your device' (BYOD) rule across their business facilities. This approach will likely help organizations upsurge efficiency, refine internal interaction, and eradicate different prices. This is anticipated to eventually bolster the unified communication as a service market growth during the forecast period.

- Considering the growing preference for digitization, customer service is expected to emerge as a major challenge as customers continue to use various modes of communication.

- Moreover, the demand for Unified Communications has grown over the last decade. It witnessed an exceptional rise after the pandemic outbreak. With the emergence of COVID-19, digital transformation became an urgent requirement for businesses to ensure their survival, growth, and market leadership. The need for unified, frictionless, and secure access to data and applications anytime, anywhere exponentially increased.

Unified Communication as a Service (UCaaS) Market Trends

Migration from Legacy Systems to Cloud-Based Communication Services to Witness the Growth

- As business communications increase, companies are looking for ways of managing complexity, cutting costs and boosting overall productivity. This has led to an increase in the use of unified communications as a service, a cloud based concept.

- Furthermore, more companies are adapting to the flexibility and hybrid working practices as well as adopting cloud based solutions so that employees can be accommodated across devices, departments or timezones.

- Moreover, because they do not need an on site hosting infrastructure and are easy to scale as well as have the latest features and security, cloud solutions for Unified Communications as a Service typically deliver greater cost effectiveness. Due to a series of major breaches that make the security of clouds one of the main concerns for all companies, there has been an increase in investment in data center security.

- A private cloud server is an infrastructure that provides hosted services to a single enterprise. It provides all the advantages, such as agility, scalability, and ability to build many virtual machines for complicated computational activities and operations, while retaining a high level of data security and privacy protection.

North America Expected to Hold a Significant Market Share

- The region is significantly contributing to the studied market growth, primarily due to the recent surge in mobility and the explosion of 5G connections due to the consumerization of I.T., which has aided enterprises in adopting I.P. telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the U.S., end-user verticals, such as retail, banking and finance, healthcare, information technology, and telecommunications, seek a more direct and seamless experience for all of their communications, audio, video, and chat, no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- The region has a reputation for the efficient integration of online and offline channels, which results in an integrated customer experience. Prevailing services aim to connect customers with a variety of channels, including e.g. online shopping platforms, social networks, mobility applications, retail stores and customer assistance channels.

- In addition, demand for UCaaS is driven by the presence of a number of multinational companies in this area. By becoming a hub for artificial intelligence, organizations are evolving through modern technology, and there is considerable growth in organizations providing AI related services at global scale.

Unified Communication as a Service (UCaaS) Industry Overview

The competitive rivalry between market players is high owing to some major players like 8x8 Inc., Mitel Networks, Verizon, and many others, and the Unified Communication-as-a-Service (UCaaS) Market is moderately fragmented. These companies can gain a competitive advantage due to their ability to bring about innovations by investing heavily in research and development activities. Strategic partnerships, mergers, and acquisitions have allowed these companies to occupy a substantial market share.

- In October 2023, Mitel officially completed its previously announced acquisition of Unify, which includes Communication and Collaboration Services (CCS) and Unified Communications and Collaboration (UCC) businesses of the Atos group. With this acquisition, the company has now increased its customers base to more than 75 million users in over 100 countries.

- In June 2023, Cisco partnered with AT&T mobile network to natively integrate Webex Calling. This partnership is expected to deliver a mobile-first, powerful, and unified collaboration experience via a single business mobile number. Such developments are expected to drive the industry growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Pay-as-you-go Model Driving Demand over Legacy UC Solutions

- 5.1.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 5.1.3 Migration from Legacy Systems to Cloud-Based Communication Services to Witness the Growth

- 5.2 Market Challenges

- 5.2.1 Low Readiness to Move to Modern Unified Communications

- 5.3 Key Business Models in the UC Industry

6 TECHNOLOGY OVERVIEW

7 MARKET SEGMENTATION

- 7.1 By Size of Enterprise

- 7.1.1 Small and Medium Enterprises

- 7.1.2 Large Enterprises

- 7.2 By End-user Vertical

- 7.2.1 BFSI

- 7.2.2 Retail

- 7.2.3 Healthcare

- 7.2.4 Government and Public Sector

- 7.2.5 IT and Telecom

- 7.2.6 Other End-user Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 8X8 Inc.

- 8.1.2 Cisco Systems Inc.

- 8.1.3 Mitel Networks Corporation

- 8.1.4 Gamma Communication PLC

- 8.1.5 NTT Communication Corporation

- 8.1.6 Vodafone Group PLC

- 8.1.7 Telia Company AB

- 8.1.8 KPN NV

- 8.1.9 BT Group PLC

- 8.1.10 Verizon Communications Inc.

- 8.1.11 Nextiva

- 8.1.12 Soluno (Destiny NV)

- 8.1.13 VADS Berhad

- 8.1.14 Singapore Telecommunications Limited

- 8.1.15 PLDT Enterprise

- 8.1.16 Telstra Corporation Limited

- 8.1.17 PCCW Global

- 8.1.18 Maxis Communications

9 KEY RECOMMENDATIONS

- 9.1 Key Strategic Recommendations

- 9.2 Analyst's View on Regional Demand and Positioning

- 9.3 Analysis of Most Adopted Strategies