|

市場調查報告書

商品編碼

1640382

零售業的 UCaaS:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)UCaaS In Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

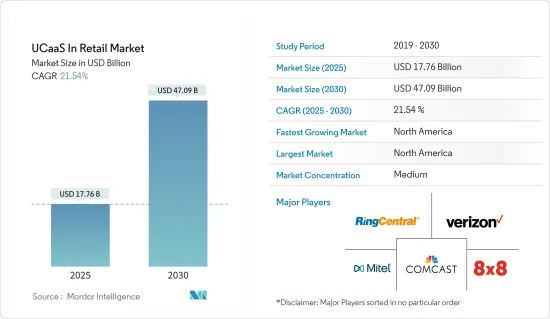

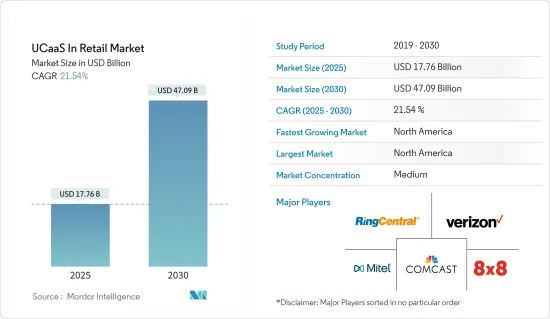

零售業 UCaaS 市場規模預計在 2025 年達到 177.6 億美元,到 2030 年將達到 470.9 億美元,預測期內(2025-2030 年)的複合年成長率為 21.54%。

主要亮點

- 整合通訊(UC) 解決方案使零售商能夠提供豐富的協作平台和無縫、智慧的互動方式。

- 分散的溝通結構使得零售商難以實現其業務目標和維持強大的品牌影響力。統一通訊即服務 (UCaaS) 可協助零售員工進行內部協作並與客戶和潛在客戶更有效率、更盈利互動。

- 透過結合語音、通訊、視訊和行動技術,零售商可以為團隊成員和客戶創造更好的體驗。此次合作確保了更統一的訊息,實現了隨時隨地的營運、清晰的品牌推廣和更高的生產力。

- BYOD 和其他行動解決方案的興起正在推動 UCaaS 解決方案的採用。此外,擴大採用 IP 應用程式來增強客戶體驗和店內業務也有望推動所調查市場的成長。

- 阻礙市場成長的因素是需要提高對這項技術的認知。 《零售週刊》進行的一項調查發現,超過 69% 的零售商不知道整合通訊(UC) 解決方案,其中 38% 的零售商表示他們需要了解實施 UC 的好處。

- 自疫情爆發以來,許多零售企業在看到諸多好處後,已轉向使用遠端和混合員工來執行服務和支援業務。 UCaaS 讓這些公司與更多的支援負責人業務,無論他們是本地的還是異地的,提供急需的協作方式,並且現在可以進行更具建設性的溝通。

零售 UCaaS 市場的趨勢

越來越多的中小型產業推動市場

- 中小型企業 (SMB) 對雲端運算的依賴越來越大,預計這種依賴程度還會持續增加。 UCaaS 主要透過雲端基礎的模型交付,已成為中小型企業的理想解決方案。

- 這些解決方案將即時、整合的語音和協作功能與針對中小型企業的靈活、可擴展的交付模式相結合。對於中小型企業來說,UCaaS 的主要好處是節省成本,而不是對業務的影響。

- 然而,與大型企業相比,中小企業在採用 UCaaS 方面仍有一些工作要做。許多中小型企業尚未遷移到 UCaaS 的主要原因之一是他們依賴 Google Workplace 或 Microsoft 365 等辦公室生產力套件來滿足其溝通和協作需求。

- 整合通訊(UC) 解決方案可讓中小型企業將多個軟體整合到一個平台上,從而降低開支並提高整體效率。您可以將跨業務功能的應用程式統一到單一、高效的平台上,用於進行文字、語音和視訊通訊,並可在任何地方、任何裝置上使用。

- 此外,無論法規和政策如何,許多小型企業都必須花費大量時間和金錢來遵守地方政府的管治和合規義務。然而,當這些公司採用整合通訊解決方案時,滿足這些法律標準就成為解決方案提供者的工作,從而釋放公司的資源以用於更有用的工作。

北美占主要佔有率

- 該地區有許多實體店,它們擴大提供線上購買、店內取貨(BOPIS)、店內退貨(BORIS)的靈活性。這導致退貨核准、庫存查詢、安裝和客製化等附加價值服務的預訂量增加。

- 該地區強勁的零售業為市場提供了巨大的成長機會。例如,零售業是美國最大的私人雇主,每年為 GDP 貢獻 3.9 兆美元(根據 NRF 的數據)。

- 此外,根據美國零售聯合會 (NRF) 的數據,預計 2023 年零售額將成長 4% 至 6%。 NRF預測,2023年零售額將達到5.13兆美元至5.23兆美元之間。由於 UCaaS 正在成為零售業的重要經營模式,這些日益成長的趨勢為市場帶來了有利的前景。

- 此外,該地區的零售商正在努力滿足日益數位化的客戶群的期望和需求,並希望改善員工之間的協作和溝通,為客戶提供無縫服務。該地區的公司正在透過提供創新解決方案進一步推動 UCaaS 的發展。

- 例如,亞馬遜美國公司發布了雲端基礎的UCaaS(託管在亞馬遜網路服務雲端)。它為企業提供視訊會議服務,可在桌上型電腦和行動電話上運行。先導計畫已在零售商 Brooks Brothers 商店推出。由於零售業對 UCaaS 的需求預計將呈指數級成長,其他零售商也可能會將 Chime 引入他們的商店。

零售業的 UCaaS 概述

零售 UCaaS 市場競爭適中。該市場參與者積極參與策略創新、協作和擴張努力,以提供能夠有效應對日益激烈的競爭的永續解決方案。

2023 年 2 月,RingCentral 發布重要公告,宣布延長與 Avaya 的策略夥伴關係關係。根據協議,Avaya Cloud Office by RingCentral(ACO)將繼續作為 Avaya 獨家的多租戶 UCaaS 解決方案提供給客戶。多年期夥伴關係的延長包括改善最低席位承諾和獎勵機制,旨在鼓勵客戶過渡到 ACO 平台。

2022 年 3 月,8x8 推出了 8x8 Conversation IQ,對公司的產品進行了重大改進。此次服務的擴展為 8x8 雲端通訊平台的所有用戶提供了正式的客服中心功能,包括品管和語音分析。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 擴大採用 IP 應用程式來增強客戶體驗和店內業務

- 對行動性和 BYOD 的需求不斷增加

- 中小企業的需求

- 市場限制

- 由於商店基礎設施限制,將現有系統整合到雲端中

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 技術簡介

第6章 市場細分

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 北美洲

第7章 競爭格局

- 公司簡介

- RingCentral Inc.

- 8X8 Inc.

- Verizon Communications Inc.

- Mitel Networks Corporation

- Comcast Corporation

- Vonage Holdins Inc.

- West Corporation

- Star2Star Communications LLC

- DXC Technology Company

- Tieto Oyj

- IBM Corporation

- Alcatel-Lucent USA Inc.

- Cisco Systems Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The UCaaS In Retail Market size is estimated at USD 17.76 billion in 2025, and is expected to reach USD 47.09 billion by 2030, at a CAGR of 21.54% during the forecast period (2025-2030).

Key Highlights

- Unified communication (UC) solutions enable retailers to provide a rich platform for collaboration and a smarter way to interact seamlessly, converging physical experiences with virtual ones while reducing costs and enabling flexible expansions across the enterprise.

- A fragmented communications structure can make it difficult for retailers to reach their business goals and maintain a strong brand presence. Unified Communications-as-a-Service (UCaaS) ensures that retail employees collaborate internally and coordinate more efficient and profitable interactions with the public and potential customers.

- By incorporating voice, messaging, and video and mobile technology, retailers can create an improved experience for both team members and customers. This collaboration secures a more unified message that allows for on-the-go operations, increased brand clarity, and enhanced productivity.

- The growing adoption of BYOD and other mobility solutions has been aiding the adoption of UCaaS solutions. Moreover, the growing adoption of IP applications to enhance customer experience and in-store operations is also expected to boost the growth of the market studied.

- The need for more awareness of the technology is hindering the growth of the market. In one of the surveys done by Retail Week, it was figured out that more than 69% of retailers were not aware of Unified Communication Solutions, and 38% of them said that they needed to learn the benefits of implementing the same.

- Since the start of the pandemic, many retailers have relied on remote or hybrid workers to perform service and support tasks after witnessing a multitude of benefits. UCaaS has made it possible for these businesses to operate with more support agents, whether reps are local or off-site, allowing for a much-needed coordinated approach and more constructive communication.

UCaaS In Retail Market Trends

Increasing Small- and Medium-scale Industries to Drive the Market

- The dependency of small and medium-sized businesses (SMBs) on the cloud is proliferating and is expected to increase in the future. UCaaS has emerged as an ideal solution for SMBs, mainly when delivered in a cloud-based model.

- These solutions combine real-time, integrated voice and collaboration capabilities, along with a flexible and scalable delivery model, making them well suited for SMBs. The primary benefit of UCaaS for SMBs is more about reducing costs than having an impact on business.

- However, compared to large companies, SMBs still need to catch up in their adoption of UCaaS. One key reason many SMBs haven't transitioned to UCaaS is a reliance on their office productivity suite-Google Workplace or Microsoft 365, for instance-for their communications and collaboration needs.

- With unified communication solutions, SMBs are able to integrate multiple software into a single platform, making it possible for them to reduce expenses and increase overall efficiency. Applications across business functions can converge into a single effective platform for text, voice, and video communications, available from anywhere, using any device.

- Moreover, many SMBs are required to spend a significant amount of time and money conforming to their local government's governance and compliance obligations, whether regarding regulations or company policy. However, when these businesses employ unified communication solutions, it becomes the solution provider's job to meet these legal standards, freeing up corporate resources for more useful tasks.

North America to Hold Major Share

- The region has many brick-and-mortar stores, which are increasingly offering buy online and pickup in-store (BOPIS), return in-store (BORIS) flexibility. This is driving more calls for return merchandise authorizations, inventory inquiries, and appointments for value-added services, like installations and customizations.

- The strong retail sector in the region provides significant growth opportunities to the market. For instance, retail is the largest private-sector employer in the United States, contributing USD 3.9 trillion to the annual GDP (as per NRF).

- Moreover, as per the National Retail Federation (NRF), retail sales are expected to grow between 4% and 6% in 2023. In total, NRF forecasts that retail sales will reach between USD 5.13 trillion and USD 5.23 trillion in 2023. With UCaaS becoming an essential business model in the retail sector, such growth trends create a favorable scenario for the market.

- Further, the retailers in the region are scrambling to meet the expectations and demands of an increasingly digital customer base, asking for better cooperation and communication between the staff to provide seamless services to the customers. The companies in the region are further promoting UCaaS by providing innovative solutions.

- For instance, Amazon USA has released Chime, a cloud-based UCaaS hosted in Amazon Web Service's cloud. It provides video conferencing service to enterprises and works on both desktop & mobile phones. It was deployed in retailer Brooks Brothers' stores as a pilot project. Other retailers are expected to incorporate Chime in their stores, as the demand for UCaas in retail is expected to rise dramatically.

UCaaS In Retail Industry Overview

The unified communications-as-a-service (UCaaS) market in the retail sector demonstrates a moderate level of competitiveness. Companies within this market are actively engaged in strategic innovation, collaborative efforts, and expansion endeavors to offer sustainable solutions that can effectively contend with the intensifying competition.

In February 2023, RingCentral made a significant announcement regarding its extended strategic partnership with Avaya. Under this agreement, Avaya Cloud Office by RingCentral (ACO) continues to serve as Avaya's exclusive multi-tenanted UCaaS solution for its customers. This extension of their multi-year partnership involves minimum seat commitments and an improved incentive structure aimed at expediting the migration of customers to the ACO platform.

In March 2022, 8x8 introduced an important enhancement to its offerings by unveiling 8x8 Conversation IQ. This extension of their services brings formal contact center capabilities, including quality management and speech analytics, to all users of the 8x8 cloud communications platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of IP applications to Enhance Customer Experience and In-store Operations

- 4.3.2 The Increased Demand for Mobility and BYOD

- 4.3.3 Demand from Small- and Medium-sized Businesses

- 4.4 Market Restraints

- 4.4.1 Integration Existing System To Cloud Due To Limited To Store Infrastructures

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 Germany

- 6.1.2.3 France

- 6.1.2.4 Italy

- 6.1.3 Asia

- 6.1.3.1 China

- 6.1.3.2 India

- 6.1.3.3 Japan

- 6.1.3.4 Australia and New Zealand

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 RingCentral Inc.

- 7.1.2 8X8 Inc.

- 7.1.3 Verizon Communications Inc.

- 7.1.4 Mitel Networks Corporation

- 7.1.5 Comcast Corporation

- 7.1.6 Vonage Holdins Inc.

- 7.1.7 West Corporation

- 7.1.8 Star2Star Communications LLC

- 7.1.9 DXC Technology Company

- 7.1.10 Tieto Oyj

- 7.1.11 IBM Corporation

- 7.1.12 Alcatel-Lucent USA Inc.

- 7.1.13 Cisco Systems Inc.