|

市場調查報告書

商品編碼

1640475

美國工廠自動化與工業控制:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)United States Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

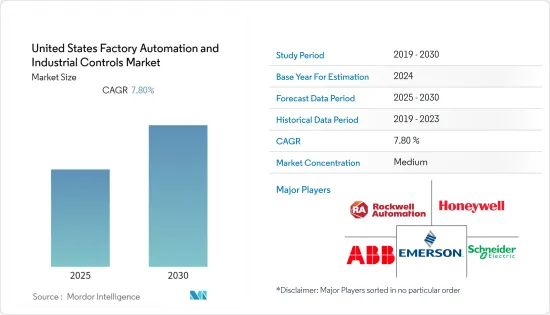

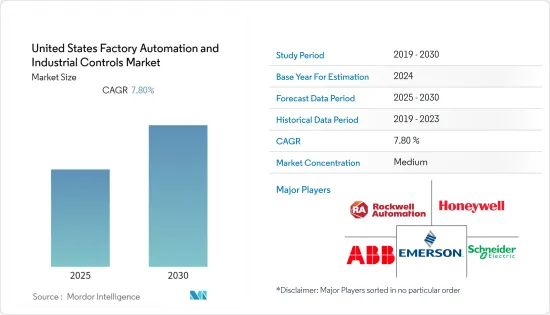

預計預測期內美國工廠自動化和工業控制市場的複合年成長率將達到 7.8%

關鍵亮點

- 工廠自動化和控制解決方案透過設計和建構完全整合的智慧控制系統(包括感測器、機器人、電腦、工業儀器和先進的資料處理解決方案),促進整個製造/生產設施的自動化。

- 這些解決方案主要用於減少公司對不可靠、容易出錯的手動流程的依賴,並用機械化設備執行的邏輯編程命令和命令響應活動取而代之。通用工業製程控制器包括可程式邏輯控制器 (PLC) 和獨立 I/O 模組。

- 美國工業領域受到了 COVID-19 的顯著影響。工業領域對人力部署有多項限制,對工業部門的成長產生了不利影響。根據美國經濟分析局(BEA)的資料,2020 年第一季,該國實際 GDP 折合成年率下降了 4.8%。然而,這場疫情大大提高了人們對自動化、人工智慧和工業物聯網等先進技術的使用的認知。預計這些將對美國研究市場的成長產生長期影響。

- 近年來,尤其是疫情發生後,美國政府開始專注於透過「美國製造」等措施促進本土製造業,預計將推動受訪市場的成長。例如,美國政府在2022年3月宣布,一款產品要獲得聯邦採購的「美國製造」認證,其零件價格的60%必須在國內生產。計劃到 2024 年這一比例將增至 65%,到 2029 年將增至 75%。

美國工廠自動化和工業控制市場的趨勢

分散式控制系統 (DCS) 預計將廣泛採用

- DCS 是一個以流程為導向的平台,依靠互連的感測器、控制器、終端和致動器網路作為設施中所有生產業務的集中主控制器。因此,DCS 專注於製程控制和監控,讓設備操作員可以單一視圖查看所有設備操作。

- DCS 在閉合迴路控制平台上運行,能夠實施更先進的製程自動化策略。這使得 DCS 成為控制單一設施或工廠操作的理想選擇。此外,DCS 對於提供設施日常營運流程的最大可視性至關重要。

- DCS 系統的一大優點是分散式控制器、工作站和其他運算元素之間的數位通訊遵循P2P存取的原則。石化、核能、石油和天然氣等製程工業越來越需要控制器,這些控制器能夠在確定的設定點附近提供指定的製程公差,以實現更高的精度和控制。

- 這些需求正在推動 DCS 的採用。這些系統降低了操作複雜性、計劃風險,並提供了在嚴苛的應用中實現敏捷製造的靈活性等功能。 DCS 能夠整合各種工廠製程控制(如 PLC、渦輪機械控制、安全系統、第三方控制、熱交換器、給水加熱器、水質等),進一步推動了 DCS 在能源領域的應用。

- 鑑於人們對 DCS 等工業控制系統的網路安全問題日益擔憂,一些組織和 DCS 供應商正在努力使分散式控制系統更加安全。

預計汽車業將大量採用

- 汽車工業是世界自動化製造設施中佔有重要地位的主要產業之一。據觀察,各汽車製造商的生產設施都已自動化,以保持精度和效率。此外,以電動車取代傳統汽車的趨勢日益成長,預計將進一步增加汽車產業的需求。

- 汽車業主要關注的問題之一是計劃工期。具有快速回報期的計劃以及低成本的自動化和創新可以幫助您透過提高效率來提高競爭力。

- 此外,製造過程中自動化程度的提高、數位化和人工智慧的參與是推動汽車領域工業機器人發展的關鍵因素。隨著自動化的使用,汽車組裝將大幅增加,代表著全球汽車產量的成長模式,同時節省成本,為該領域的智慧工廠普及鋪平道路。

- 對於提供智慧工廠解決方案的供應商來說,美國是最有前景的市場之一。該國正在迅速採用先進的工業技術,並大規模使用資料進行生產,並將其與整個供應鏈中的各種製造系統結合。預計該市場在預測期內將經歷顯著的成長機會。

- 美國汽車工業是世界上最大的汽車工業,擁有通用汽車、福特、克萊斯勒等主要汽車製造商。根據 OICA 的數據,2021 年美國汽車產量約為 917 萬輛,高於 2020 年的 882 萬輛。由於汽車產業正在大量採用自動化技術來提高生產效率,該國提供了龐大的商機。

美國工廠自動化與工業控制產業概況

美國工廠自動化和工業控制市場參與者眾多,競爭激烈。參與企業參與產品開發、夥伴關係、合併和收購等策略活動。市場的主要發展包括:

- 2021 年 4 月 - Google Cloud 與西門子合作簡化製造流程並提高生產車間的效率。西門子計畫將Google雲端的頂尖資料雲和人工智慧/機器學習(AI/ML)功能整合到其工廠自動化解決方案中,以協助製造商的生產流程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 自動化的興起

- 積極的政府政策和充滿活力的新興企業生態系統

- 市場問題

- 貿易緊張局勢與貨幣政策收緊

- 行業政策法規

- 關鍵用案例和部署場景

第6章 市場細分

- 按類型

- 工業控制系統

- 分散式控制系統(DCS)

- 可程式邏輯控制器 (PLC)

- 監控、控制和資料採集 (SCADA)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 人機介面 (HMI)

- 其他工業控制系統

- 現場設備

- 機器視覺

- 工業機器人

- 馬達和驅動器

- 安全系統

- 感應器和變送器

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 電力和公共產業

- 飲食

- 汽車與運輸

- 藥品

- 其他

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

第8章投資分析

第9章:未來展望

簡介目錄

Product Code: 53448

The United States Factory Automation and Industrial Controls Market is expected to register a CAGR of 7.8% during the forecast period.

Key Highlights

- Factory automation and control solutions facilitate the automation of an entire manufacturing/production facility by designing and constructing a fully integrated and intelligent control system, including sensors, robots, computers, industrial instruments, and advanced data processing solutions.

- These solutions are implemented primarily to reduce companies' reliance on unreliable and error-prone manual processes and replace them with command-response activities executed by logical programming commands and mechanized equipment. Some general-purpose industrial-process controllers include programmable logic controllers (PLCs) and stand-alone I/O modules.

- A notable impact of COVID-19 was observed in the US industrial sector. Due to several restrictions on staffing in industries, the growth of the industrial sector was negatively impacted. According to the Bureau of Economic Analysis (BEA) data, the country's real GDP decreased at an annual rate of 4.8% in the first quarter of 2020. However, the pandemic significantly enhanced awareness about using advanced technologies such as automation, AI, IIoT, etc. These are expected to have a long-term impact on the growth of the market studied in the United States.

- In recent years, especially after the pandemic, the US government started focusing on boosting its local manufacturing industries with initiatives like "Make in America," which is expected to drive the growth of the market studied. For instance, in March 2022, the US government announced that for the products to qualify as Made in America for federal procurement, 60% of the value of their parts should be manufactured in the country, which earlier accounted for 55%. The government plans to enhance it further to 65% in 2024 and 75% in 2029.

US Factory Automation and Industrial Controls Market Trends

Distributed Control Systems (DCS) are Expected to Witness Significant Adoption

- DCS are process-oriented platforms that depend on a network of interconnected sensors, controllers, terminals, and actuators to act as a centralized master controller for all of a facility's production operations. Thus, a DCS focuses on controlling and monitoring processes and allowing facility operators to see all facility operations in one place.

- DCS allows the implementation of more advanced process automation strategies because it operates on a closed-loop control platform. This makes DCS ideal for controlling operations at a single facility or factory. Additionally, a DCS is critical for maximizing the visibility of a facility's day-to-day operational processes.

- One of the significant benefits of DCS systems is that the digital communication between distributed controllers, workstations, and other computing elements follows the peer-to-peer access principle. To achieve greater precision and control in process industries, like the petrochemical, nuclear, and oil and gas industries, there is an increasing demand for controllers which offer specified process tolerance around an identified set point.

- These requirements have driven the adoption of DCS, as these systems provide lower operational complexity, project risk, and functionalities, like flexibility for agile manufacturing in highly-demanding applications. The ability of DCS to integrate PLCs, turbomachinery controls, safety systems, third-party controls, and various other plant process controls for heat exchangers, feedwater heaters, and water quality, among others, further drives the adoption of DCS in the energy sector.

- Considering the growing concern regarding cybersecurity issues with industrial control systems such as DCS, several organizations and DCS providers are taking initiatives to make distributed control systems more secure.

Automotive Industry is Expected to Exhibit Significant Adoption

- The automotive industry is one of the prominent sectors that hold a significant in worldwide automated manufacturing facilities. It is observed that the production facilities of various automakers are automated to maintain accuracy and efficiency. Further, the growing trend of replacing conventional vehicles with EVs is expected to further augment the automotive industry's demand.

- One of the primary concerns of the automotive industry is the duration of a project. Quick return-on-investment projects, along with low-cost automation and cost innovation, help the manufacturers to improve competitiveness through efficiency improvement.

- Moreover, the growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots in the automotive sector. It has been identified that auto assembly increased significantly, using automation, showing a growth pattern in the number of cars being produced worldwide while simultaneously cutting costs, paving the way for the growth of smart factory implementation in this sector.

- The United States is among the most promising markets for vendors offering smart factory solutions, owing to its presence in some of the biggest industries. The country is fast adopting advanced industrial technologies, where data is being used on a large scale for production while integrating the data with various manufacturing systems throughout the supply chain. The market studied is expected to receive significant growth opportunities during the forecast period.

- The US automotive industry is among the largest globally and is home to some of the biggest auto manufacturers, such as General Motors, Ford, Chrysler, etc. According to OICA, in 2021, about 9.17 million motor vehicles were manufactured in the United States, compared to 8.82 million in 2020. The country offers a huge opportunity as the automotive sector accounts for the significant adoption of automation technologies to enhance production efficiency.

US Factory Automation and Industrial Controls Industry Overview

The United States factory automation and industrial controls market is competitive due to several players in the market. Players are involved in product development and strategic activities such as partnerships, mergers, and acquisitions. Some of the key developments in the market are:

- April 2021 - Google Cloud and Siemens collaborated to streamline production operations and boost shop floor efficiency. Siemens plans to integrate Google Cloud's top data cloud and artificial intelligence/machine learning (AI/ML) capabilities with its factory automation solutions to assist manufacturers in the manufacturing process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID -19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies

- 5.1.2 Proactive Government Policies and a Vibrant Startup Ecosystem

- 5.2 Market Challenges

- 5.2.1 Trade Tensions and Monetary Policy Tightening

- 5.3 Industry Policies and Regulations

- 5.4 Key Case Studies and Implementation Scenarios

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Motors and Drives

- 6.1.2.4 Safety Systems

- 6.1.2.5 Sensors & Transmitters

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Fanuc Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219