|

市場調查報告書

商品編碼

1683102

中國作物保護化學品市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

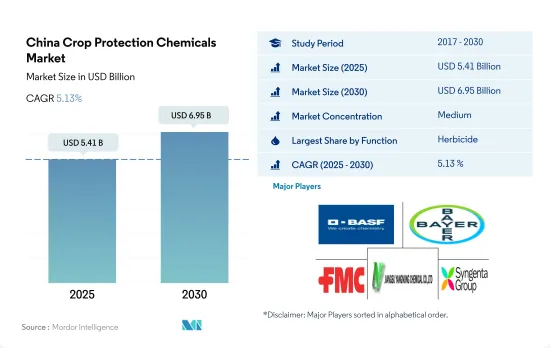

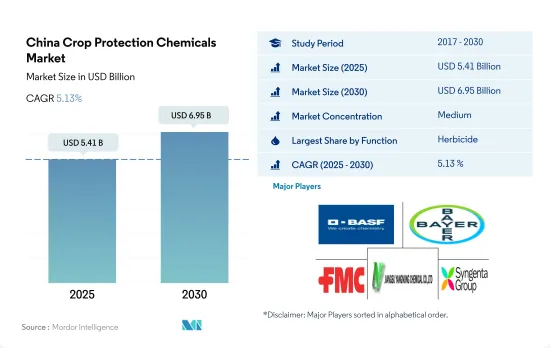

預計 2025 年中國農藥保護化學品市場規模為 54.1 億美元,到 2030 年將達到 69.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.13%。

除草劑佔領市場

- 中國是活性成分的主要生產國,而活性成分是許多國家銷售的配方和現成農藥保護化學品的基礎。中國是世界上最大的農藥和防護化學品生產國和出口國之一。農藥是作物保護化學品市場的重要組成部分。市場的主要促進因素是人口眾多、土地面積有限、糧食安全日益提高以及對高效農業生產的迫切需求。 2022 年,在亞太地區整體作物保護化學品市場中,中國將佔最高以金額為準,達到 20.8%。

- 2022年中國農藥保護化學品市場中,除草劑佔最大佔有率,以金額為準38.2%。在中國,除草劑的使用有助於控制雜草,使農民能夠種植更多能戰勝雜草的矮化水稻品種,從而提高產量。除草劑使農民能夠控制雜草,隨著農民從農村轉移到工業區,傳統的體力勞動力大大減少。

- 2022 年,殺蟲劑領域佔了市場很大佔有率,以金額為準為 30.0%。登記用於棉花最常見的農藥保護化學品是殺蟲劑。其中辛硫磷登記有效成分最多,包括Cypermethrin和BETA-Cypermethrin。

- 隨著人們對蟲害侵擾的擔憂日益加劇以及國際需求不斷成長,企業和政府不斷投入研究計劃,開發新的活性成分,防止害蟲破壞作物。預計預測期內市場複合年成長率將達到 5.4%。

中國作物保護劑市場趨勢

IPM 策略和其他保護性化學品減少措施有助於減少每公頃保護性化學品的消費量

- 過去幾年,中國每公頃土地的農藥保護化學品消費量大幅下降。過去,農藥保護化學品的使用量已大幅減少至每公頃約 300 克。 2017 年的消費量為每公頃 1,700 克,到 2022 年將降至每公頃 1,400 克。

- 每公頃農藥保護化學品使用量的大幅減少,很大程度上得益於實施了嚴格的措施,確保農藥保護化學品消費量零成長。

- 中國一直在積極推動綜合害蟲管理(IPM)策略,其中包括一系列預防措施、替代技術和謹慎使用保護性化學品。這種綜合方法大大減少了農藥保護化學品的使用。

- 在中國,除草劑使用量大幅下降至88.78克,主要原因是農民採取了輪作等做法。輪作透過交替作物具有不同生長模式和營養需求的作物,有效地阻斷了雜草的生命週期。透過實施這項做法,中國農民能夠打斷雜草的生長週期,從而減少雜草數量並減少對除草劑的依賴。

- 其他顯著下降體現在殺蟲劑類農藥使用量上,從2017年到2022年下降了58.31克。這種下降主要是由於政府採取措施禁止使用有害殺蟲劑和採用基因改造作物。

- 其他因素,例如對農藥使用實施最大殘留基準值,也減少了每公頃的國內消費量。

活性成分的價格受當地氣候、蟲害、能源價格和人事費用等因素的影響很大。

- 中國是製劑化農藥保護化學品基礎活性成分的主要生產國之一。殺蟲劑佔農藥產量的大部分。

- Cypermethrin是使用最廣泛的擬除蟲菊酯殺蟲劑,用於控制許多害蟲,包括蔬菜和水果上的果蠅、掃帚蟲和紅蟲。 2022 年其價格為每噸 20,900 美元。

- Atrazine是一種廣泛用於控制多種闊葉雜草和禾本科植物的除草劑。中國每年消耗超過16,000噸的Atrazine(技術上佔97%)。Atrazine主要用於控制玉米和甘蔗田的一年生雜草。中國是世界Atrazine的主要供應國之一。 2022 年的價格為每噸 13,700 美元。

- 代森錳鋅是一種頻譜接觸性殺菌劑,用於控制油菜、生菜、小麥、蘋果、番茄、鮮食葡萄、釀酒葡萄、洋蔥、胡蘿蔔、歐洲防風草、青蔥和硬粒小麥中的許多真菌疾病,包括炭疽病、腐霉病、葉斑病、白粉病、灰黴病、銹病和真菌疾病。 2022 年的價格為每噸 7,700 美元。

- Glyphosate是一種頻譜廣譜系統性除草劑和作物乾燥劑,2022 年價格為每噸 1,100 美元。Glyphosate主要用於控制禾本科、莎草科和闊葉雜草。中國是世界上最大的Glyphosate生產國和出口國。 2017年,中國出口Glyphosate原藥30多萬噸,滿足了全球一半以上的Glyphosate需求。

- 當地氣候、蟲害、能源價格和人事費用等因素顯著影響活性成分的價格。

中國農藥及防護化學品產業概況

中國農藥和保護化學品市場格局適度整合,前五大企業佔52.57%的市場。該市場的主要參與企業包括BASF公司、拜耳公司、FMC公司、江蘇揚農化工和先正達集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥保護化學品消費量

- 有效成分價格分析

- 法律規範

- 中國

- 價值鏈與通路分析

第 5 章。市場細分,包括市場規模(美元和數量)、2030 年預測和成長前景分析

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 滅螺劑

- 殺線蟲劑

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Lianyungang Liben Crop Technology Co. Ltd

- Rainbow Agro

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 49061

The China Crop Protection Chemicals Market size is estimated at 5.41 billion USD in 2025, and is expected to reach 6.95 billion USD by 2030, growing at a CAGR of 5.13% during the forecast period (2025-2030).

Herbicides dominate the market

- China is a major producer of active ingredients that serve as the foundation for formulated agrochemicals and ready-made pesticides sold in many countries. The country is one of the world's largest producers and exporters of crop protection chemicals. Insecticides comprise an important segment in the crop protection chemicals market. The key drivers of the market are a high number of people, limited size of farms, rising food security, and an urgent need for efficient agricultural production. China occupied the highest share of 20.8% by value of the overall Asia-Pacific crop protection chemicals market in 2022.

- Herbicides accounted for the largest share of 38.2% by value in the Chinese crop protection chemicals market in 2022. In China, the use of herbicides has helped in weed control and, thus, increased yields by making it easier for farmers to grow more dwarf rice varieties that are less likely to compete with weeds. Even though there has been a large decline in traditional hand laborers who have moved out of rural areas to industrial zones, herbicides have allowed farmers to control weeds.

- In 2022, the insecticide segment held a significant share of 30.0% by value in the market. The most common pesticides registered for use in cotton are insecticides. Among them, phoxim has the highest number of registered active substances, including cypermethrin and beta-cypermethrin.

- With the increasing concern over the infestation of pests and diseases and the rise in international demand, companies and the government are continuously investing in research projects and developing new active ingredients to prevent crop damage from pests. The market is anticipated to register a CAGR of 5.4% during the forecast period.

China Crop Protection Chemicals Market Trends

IPM strategies and other pesticide reduction policies contributed to reduction in per hectare pesticides consumption

- Over the past few years, there has been a notable reduction in pesticide consumption per hectare in the country. During the historical period, there was a significant decline in pesticide usage to approximately 300 grams per hectare. In 2017, the consumption stood at 1,700 grams per hectare; however, by 2022, it had dropped to 1,400 grams per hectare.

- The considerable reduction in pesticide utilization per hectare can be largely attributed to the country's implementation of a stringent policy of zero growth in pesticide consumption.

- China has proactively promoted the adoption of Integrated Pest Management (IPM) strategies, encompassing a range of preventive measures, alternative techniques, and careful pesticide applications. As a result of this holistic approach, there has been a notable reduction in pesticide usage rates.

- China witnessed a significant decline in herbicide usage by 88.78 grams, primarily driven by the adoption of practices such as crop rotation by farmers. Crop rotation involves alternating different crops with varying growth patterns and nutritional requirements, effectively breaking the lifecycle of weeds. By implementing this practice, Chinese farmers have successfully disrupted weed growth cycles, resulting in reduced weed populations and a decreased reliance on herbicides.

- The other substantial decrease in pesticide usage per hectare was observed specifically in the category of insecticides, with a reduction of 58.31 grams from 2017 to 2022. This decline can be primarily attributed to government policies aimed at banning harmful insecticides and the adoption of transgenic crops.

- Other factors like setting limits on the maximum residue levels on the usage of pesticides reduced the per hectare consumption in the country.

The active ingredients' prices are majorly influenced by factors like weather conditions, pest outbreaks, energy prices, and labor costs in the country

- China is one of the major producers of active ingredients that form the base of formulated crop protection chemicals. Insecticides constitute the major share of pesticide production.

- Cypermethrin is the most widely used pyrethroid pesticide to control many pests, such as fruit flies, borers, and mealy bugs in vegetables and fruits in China. It was valued at USD 20.9 thousand per metric ton in 2022.

- Atrazine is a herbicide widely used to control various broadleaved weeds and grasses. China consumes more than 16,000 ton (97% technical) of atrazine annually. Atrazine is mainly used to control annual weeds in corn or sugarcane fields. China is one of the major suppliers of atrazine worldwide. It was priced at USD 13.7 thousand per metric ton in 2022.

- Mancozeb is a broad-spectrum contact fungicide used to control a number of fungal diseases, such as anthracnose, Pythium blight, leaf spot, downy mildew, Botrytis, rust, and scab in oilseed rape, lettuce, wheat, apples, tomatoes, table grapes, wine grapes, bulb onions, carrot, parsnip, shallot, and durum wheat. It was priced at USD 7.7 thousand per metric ton in 2022.

- Glyphosate is an organophosphorus broad-spectrum systemic herbicide and crop desiccant, priced at USD 1.1 thousand per metric ton in 2022. Glyphosate is mainly used to control weeds like grasses, sedges, and broadleaves. China is the largest producer and exporter of glyphosate in the world. In 2017, China exported over 300,000 ton of glyphosate technical, which met more than half of the global glyphosate demand.

- Factors like weather conditions, pest outbreaks, energy prices, and labor costs in the country majorly influence the prices of active ingredients.

China Crop Protection Chemicals Industry Overview

The China Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 52.57%. The major players in this market are BASF SE, Bayer AG, FMC Corporation, Jiangsu Yangnong Chemical Co. Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.6 Lianyungang Liben Crop Technology Co. Ltd

- 6.4.7 Rainbow Agro

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219