|

市場調查報告書

商品編碼

1686256

德國作物保護化學品-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Germany Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

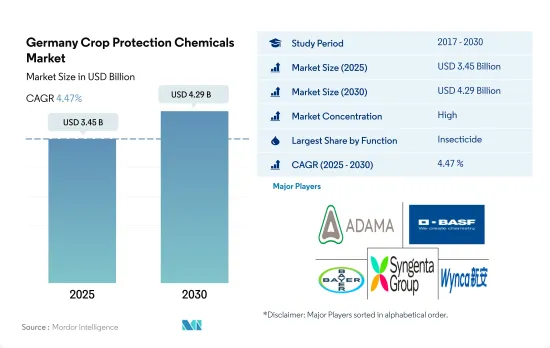

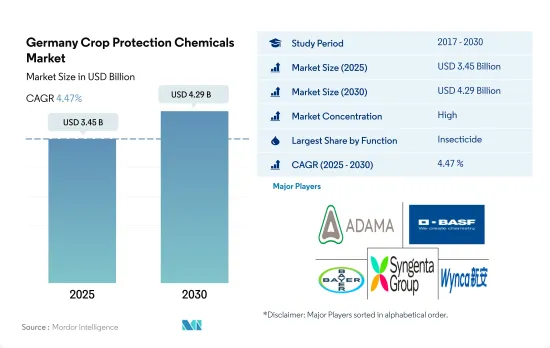

德國作物保護化學品市場規模預計在 2025 年為 34.5 億美元,預計到 2030 年將達到 42.9 億美元,預測期內(2025-2030 年)的複合年成長率為 4.47%。

將昆蟲和害蟲侵襲造成的損失降至最低的需求可能會推動市場的發展。

- 德國是繼法國和義大利之後的歐盟第三大農業生產國。

- 殺蟲劑佔據了市場主導地位,2022 年佔德國作物保護化學品市場的 63.3%。然而,害蟲的發生會隨著時間而改變,並可能因氣候、農業實踐和害蟲管理策略的變化而改變。已知在德國造成作物損失的主要害蟲包括科羅拉多馬鈴薯甲蟲、甘藍秋季網蟲、西部玉米根蟲、蚜蟲、歐洲玉米天蛾和蘋果蘋果卷葉蛾。最常用的殺蟲活性成分是氨基甲酸酯和擬除蟲菊酯。

- 2022 年,除草劑佔德國作物保護化學品市場的 20.4%。根據使用時間,除草劑可分為兩種類型。播種前除草劑在播種前施用於土壤,以便在作物播種前控制雜草。這些通常是選擇性和非選擇性除草劑。經過除草劑處理過的土地可用於農業目的,種植農作物。可以在雜草幼苗從土壤中冒出之前施用出苗前除草劑。使用時,這種除草劑可以控制從土壤中冒出的雜草。但它對已經生長的雜草無效。

- 在德國,不斷成長的糧食需求給糧食生產帶來了越來越大的壓力,同時也帶來了減少昆蟲和害蟲侵襲造成的損失的需求。預計預測期內市場複合年成長率將達到 3.7%。

德國作物保護化學品市場趨勢

害蟲增加導致農藥使用增加

- 2022年,德國每公頃農藥消費量明顯增加,大幅增加了6400克/公頃。這種顯著的成長主要是由於氣候變遷的影響,例如乾旱和熱浪的增加,這促進了真菌感染疾病、雜草和害蟲的蔓延。

- 在德國,昆蟲對農業構成重大挑戰,影響小麥、稻米、棉花、水果和蔬菜等多種作物。病蟲害危害嚴重,造成產量下降、品質下降。這種情況使農民面臨財務壓力,並引發了人們對糧食短缺的擔憂。殺蟲劑是最常用的農藥,2022 年平均使用量為每公頃 2,400 公克。這一趨勢反映了防治害蟲並減少其對作物生產的負面影響的必要性。

- 殺菌劑在德國農藥消費量中排名第二。 2022年的平均施用量為每公頃2,200公克。德國農業廣泛使用殺菌劑,因為該國高度依賴農業實踐,並且需要保護作物免受真菌感染。殺菌劑對於控制可能損害作物並降低產量的疾病至關重要。

- 2022年,每公頃平均施用除草劑量為1800公克。這種現象的出現是因為人們認知到使用除草劑來提高作物產量(無論是數量還是品質)都是有利的,而且經濟可行。這種方法有效地抑制了雜草的生長,同時降低了勞動成本。

出於環境考量以及為了保護清潔的昆蟲棲息地,最常用的除草劑Glyphosate預計將於 2024 年停用。

- Cypermethrin和Emamectin benzoate是價格上漲的一些主要活性成分。 2022 年Cypermethrin的價格為每噸 21,300 美元,較 2020 年上漲 14.6%。這種合成擬除蟲菊酯殺蟲劑具有觸殺和胃毒作用,可有效控制多種昆蟲,包括鱗翅目、鞘翅目、雙翅目和半翅目。它對於控制導致葉子掉落的毛蟲和果實昆蟲很有效。

- 2019年至2022年,甲氨基阿維菌素苯甲酸鹽價格上漲了6%。這種以活性成分為基礎的殺蟲劑用於蔬菜、棉花和煙草,以對抗有害的鱗翅目害蟲,如粘蟲、蟯蟲、小菜蛾、果蟲和捲葉蟲。

- Azoxystrobin是一種廣譜頻譜殺菌劑,廣泛應用於農業,尤其是穀物,2022 年的零售價將達到每噸 4,600 美元。預防各種疾病。值得注意的是,德國大部分Azoxystrobin都是從印度進口的。

- 德國Metalaxyl出口主要到印度、越南和秘魯。偽霜黴菌(Pseudoperonospora humuli)可侵染啤酒花,疫黴菌(Phytophthora infestans)可侵染馬鈴薯和番茄,葡萄生根病菌(Plasmopara viticola)可侵染葡萄,萵苣盤孢菌(Bremia lactucae)可侵染萵苣,黴菌可侵染各種霜。

- Glyphosate是德國最常用的除草劑,到2022年,其價格將達到每噸1,200美元。出於對環境問題的考慮以及為了保護原始昆蟲棲息地,德國內閣核准了一項法案,將從2024年起禁用Glyphosate。預計德國農民將逐步減少Glyphosate的使用,到2024年徹底停止使用嘉磷塞。

德國作物保護化學品產業概況

德國作物保護化學品市場相當集中,前五大公司佔了71.10%的市場。該市場的主要企業有:ADAMA Agricultural Solutions Ltd、 BASF SE、Bayer AG、Syngenta Group 和 Wynca Group(Wynca Chemicals)(按字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 德國

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 殺軟體動物劑

- 殺線蟲劑

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PI Industries

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Germany Crop Protection Chemicals Market size is estimated at 3.45 billion USD in 2025, and is expected to reach 4.29 billion USD by 2030, growing at a CAGR of 4.47% during the forecast period (2025-2030).

The need to minimize the losses caused due to the attack of insects and pests may drive the market

- Germany is the third-largest producer of agricultural goods in the European Union, following France and Italy.

- Insecticides dominated the market and accounted for 63.3% of the German crop protection chemicals market in 2022. However, the prevalence of insect pests can vary over time and may change due to changing climate, agricultural practices, and pest management strategies. Some major insect pests known to cause crop losses in Germany include the Colorado potato beetle, cabbage white butterfly, western corn rootworm, aphids, European corn borer, and apple codling moth. Carbamates and pyrethroids are the most commonly used insecticide-active ingredients.

- Herbicides accounted for 20.4% of the German crop protection chemicals market in 2022. Herbicides have two types, based on the time of application. Pre-plant herbicides are applied to the soil before planting to control the weeds before the crops are sown. These are typically selective and non-selective herbicides. The herbicide-treated land can then be used for agricultural purposes to grow crops. Pre-emergence herbicides can be applied before the weed seedlings emerge from the soil. When applied, these herbicides control the weeds as they grow out of the soil. However, they do not affect the weeds that are already grown.

- With the increasing demand for food in Germany, the country's pressure to produce sufficient food is increasing, which comes with the need to minimize the losses caused by the attack of insects and pests. The market is anticipated to register a CAGR of 3.7% during the forecast period.

Germany Crop Protection Chemicals Market Trends

Increasing pest proliferation is leading to higher application of pesticides

- In 2022, there was a notable rise in pesticide consumption per hectare in Germany, showing a significant increase of 6.4 thousand g per hectare. This considerable uptick can be mainly attributed to the profound effects of climate variations, marked by increased instances of droughts, heatwaves, and other circumstances that encourage the spread of fungal infections, weeds, and insect pests.

- In Germany, insects present a significant challenge to agriculture by affecting a range of crops, including wheat, rice, cotton, fruits, and vegetables. Their presence leads to considerable damage, resulting in lower yields and inferior quality production. This situation places farmers under financial strain and raises concerns about possible food scarcity. Insecticides take the forefront in terms of pesticide usage, with an average consumption of 2.4 thousand g per hectare in 2022. This trend reflects the necessity to counter insects and mitigate their detrimental effects on crop production.

- Fungicides take the second spot in pesticide consumption in Germany. The year 2022 recorded an average application of 2.2 thousand g per hectare. The prevalence of fungicide use in German agriculture is attributed to the nation's strong dependence on agricultural methods and the necessity to shield crops from fungal infections. Fungicides are crucial in managing diseases that can harm crops and diminish yields.

- In 2022, the rate of herbicide application per hectare averaged 1.8 thousand g. This phenomenon is a result of recognizing the advantageous and economically viable nature of using herbicides to improve crop yields in both quantity and quality. This approach effectively controls weed proliferation while also reducing labor costs.

The most commonly used herbicide glyphosate is expected to be banned by 2024 due to environmental concerns, as well as to preserve clean habitats for insects

- Cypermethrin and emamectin benzoate are some of the major active ingredients that are witnessing an increase in prices. In 2022, cypermethrin was priced at USD 21.3 thousand per metric ton, reflecting a 14.6% increase from 2020. This synthetic pyrethroid exhibits both contact and stomach action, effectively controlling a broad spectrum of insects, including lepidoptera, coleoptera, diptera, and hemiptera. It is suitable for managing defoliating caterpillars and fruit borers.

- Between 2019 and 2022, the price of emamectin benzoate rose by 6%. This active ingredient-based insecticide is used in vegetables, cotton, and tobacco to combat damaging lepidopteran pests like armyworms, pinworms, diamondback moths, fruit worms, and leafrollers.

- Azoxystrobin, priced at USD 4.6 thousand per metric ton in 2022, serves as a broad-spectrum systemic fungicide widely utilized in agriculture, particularly in cereals. It provides protection against various diseases. Notably, Germany imports most of its azoxystrobin from India.

- Germany predominantly exports metalaxyl to India, Vietnam, and Peru. It exhibits both protective and curative action, targeting diseases caused by Pseudoperonospora humuli in hops, Phytophthora infestans in potatoes and tomatoes, Plasmopara viticola in vines, Bremia lactucae in lettuce, and downy mildew in various vegetables.

- Glyphosate, the most commonly used herbicide in Germany, was priced at USD 1.2 thousand per metric ton in 2022. In response to environmental concerns and to preserve clean habitats for insects, the German cabinet approved legislation to ban glyphosate from 2024. Farmers in Germany are expected to gradually reduce their usage of glyphosate and cease its use completely by 2024.

Germany Crop Protection Chemicals Industry Overview

The Germany Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 71.10%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Syngenta Group and Wynca Group (Wynca Chemicals) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Germany

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PI Industries

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms