|

市場調查報告書

商品編碼

1684001

南美作物保護化學品:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)South America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

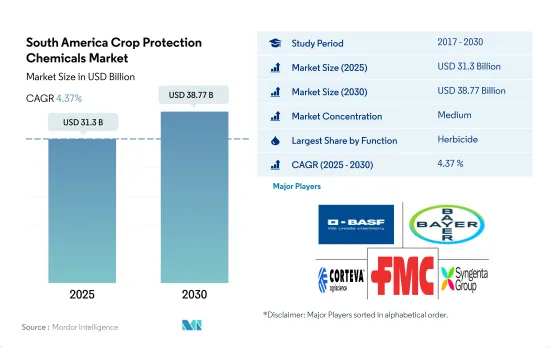

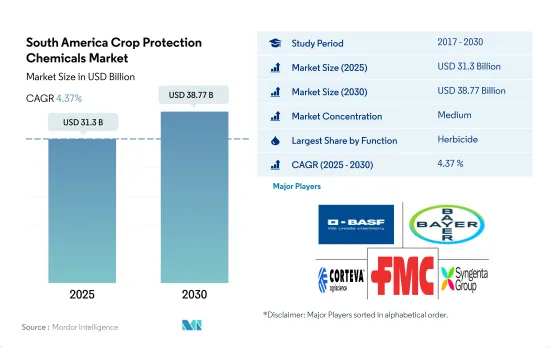

南美作物保護化學品市場規模預計在 2025 年為 313 億美元,預計到 2030 年將達到 387.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.37%。

農藥市場受到該地區重要經濟作物產量過度損失的推動。

- 2022年南美洲消費的作物保護化學品中,除草劑佔比最高,為48.7%,市價為134.1億美元。雜草對作物種植構成了持續的挑戰,控制雜草的需求已成為除草劑市場持續最大限度提高作物產量的驅動力。

- 莧菜是巴西和阿根廷大豆種植區常見的雜草。研究表明,大豆作物遭遇輕度莧菜雜草侵染時產量損失可達 20.28%,而遭遇重度感染時產量損失則高達 62.8%。

- 蚜蟲、薊馬、粉蝨、葉蟬、黑蚜、豆莢螟和莖蠅對該地區主要種植的作物和油料作物造成了廣泛破壞,導致嚴重的產量損失和作物品質下降。 2022年,農藥將佔南美洲作物保護化學品市場的28.4%,同年市場價值為78.2億美元。

- 在南美洲,真菌疾病是大豆生產的主要限制因素,估計有 8-10% 的大豆產量因疾病而損失。該地區影響大豆葉片的主要疾病是葉斑病、尾孢葉枯病和亞洲大豆銹病。諸如阿司匹林、氟唑菌醯胺和Azoxystrobin等殺菌劑對這些疾病非常有效。

- 最常見的線蟲是根結線蟲。胡蘿蔔容易受到嚴重損失,平均損失 20.0%,而馬鈴薯可能因這些線蟲的感染而遭受更高的損失,高達 33.0%。

- 因此,預計南美洲提高農作物產量的需求將推動殺蟲劑市場的發展。

農藥需求的驅動力是病蟲害的激增和農業種植的擴大。

- 害蟲、疾病和雜草已成為巴西農業領域的重大議題。為了有效應對這些威脅,農民很大程度上依靠噴灑農藥,2022 年的市值為 176.8 億美元。巴西的大豆種植面臨許多害蟲的挑戰,其中鱗翅目和臭蟲是需要特別注意的主要害蟲。特別是南方樹皮甲蟲,已知會造成大豆生產 17.0% 的嚴重產量損失。

- 阿根廷以其廣闊的農田、良好的氣候和農業專業知識而聞名,是世界領先的農業生產國和出口國之一。在阿根廷的農業領域,產量種植是滿足國內和全球需求的首要任務。農藥在減少病蟲害造成的產量方面發揮著至關重要的作用。 2022年,阿根廷在南美洲作物保護化學品市場中按以金額為準佔據第二大佔有率,佔19.7%。

- 智利的農業產業多樣化,全國各地種植著各種各樣的作物,需要各種各樣的農藥來控制各種害蟲和疾病。此外,近年來,具有不同作用方式的創新產品不斷推向市場,為農民提供了更多的作物保護選擇,促進了作物保護市場的成長。 2022 年,智利市場佔有率整個作物保護化學品市場的 1.5%。

- 由於氣候條件有利於病蟲害的繁殖以及農業種植面積的擴大等因素,預計預測期內(2023-2029 年)該市場的複合年成長率將達到 4.7%。

南美洲作物保護化學品市場趨勢

乾旱、熱浪等氣候變遷更頻繁,農業生產方式更密集,導致每公頃農藥消費量整體增加

- 2017年至2022年期間,南美洲每公頃農藥消費量顯著增加,增加5,277克/公頃。這一顯著成長凸顯了該地區農業實踐中對農藥的依賴日益增加。這些因素包括氣候變遷的不利影響,例如頻繁的乾旱和熱浪,以及採用犁地和單一栽培等集約化農業技術。

- 因此,雜草和害蟲的氾濫變得更加普遍,需要增加農藥的使用和施用來保護有價值的作物。巴西、阿根廷和巴拉圭等國家在農業產量方面面臨氣候條件帶來的挑戰。

- 除草劑是該地區每公頃土地使用的主要農藥類型,2022 年與 2017 年相比每公頃顯著增加了 3,702 克。這一顯著成長主要是由於農田雜草感染增加。巴西和阿根廷等國家的農民擴大採用耐除草劑的主食作物品種,如大豆、玉米和小麥。然而,這種廣泛的使用也導致了對除草劑具有抗性的雜草種類的增加。在阿根廷,有超過30種雜草對各種除草劑具有抗藥性,在巴西這一數字達到51種。這可能會導致每公頃除草劑的使用量增加。因此,氣候變遷和其他集約化農業實踐等因素導致每公頃殺菌劑和殺蟲劑的使用量增加。

大量使用農藥和從歐洲國家進口導致有效成分價格大幅波動

- 南美洲是農藥的重要使用者,主要原因是該地區採用單一栽培和犁地等集約化農業實踐,以及增加糧食產量的目標。然而,許多被禁產品卻被允許出口,使得該地區嚴重依賴從歐洲國家進口的農藥。

- 2019年,由於乾旱加劇導致農藥使用量增加、農藥需求激增、某些農藥缺貨,農藥價格大幅上漲。這些因素共同導致農藥價格上漲,較2017年價格上漲了5-10%。

- 2022年,Cypermethrin主導最廣泛使用的殺蟲劑,有效成分的價格達到每噸21,087.6美元。由於它能有效控制多種昆蟲,包括斑甲蟲、粉紅甲蟲、早期斑螟和毛蟲,因此被廣泛應用於農業領域。

- 2022年,Atrazine價格大幅上漲,達到每噸1,3810.3美元。Atrazine用於闊葉雜草和禾本科雜草的出苗前和出苗後控制,最常用於田間玉米、甜玉米、高粱和甘蔗。Atrazine在歐盟國家受到使用限制,但可以出口。因此,南美國家是歐盟國家Atrazine的主要進口國。

- 2022年Mancozeb價格約為每噸7,810.9美元。這種接觸性殺菌劑可以保護多種作物,包括水果、蔬菜、田間作物和草皮。它的多功能性和有效性在農民中贏得了寶貴的聲譽。

南美洲作物保護化學品產業概況

南美洲作物保護化學品市場呈現中度整合態勢,前五大公司市佔率合計為61.32%。市場的主要企業是:BASF公司、拜耳公司、科迪華農業科技、FMC 公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 阿根廷

- 巴西

- 智利

- 價值鏈與通路分析

第5章 市場區隔

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 滅螺劑

- 殺線蟲劑

- 如何使用

- 化學處理

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 阿根廷

- 巴西

- 智利

- 南美洲其他地區

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001703

The South America Crop Protection Chemicals Market size is estimated at 31.3 billion USD in 2025, and is expected to reach 38.77 billion USD by 2030, growing at a CAGR of 4.37% during the forecast period (2025-2030).

The market for pesticides is driven by the excessive yield losses in economically important crops in the region

- Herbicides accounted for the highest share of 48.7% of the crop protection chemicals consumed in South America in 2022, with a market value of USD 13.41 billion. Weeds pose persistent challenges to crop cultivation, and the need to control weeds has emerged as a driving force behind the herbicide market to sustainably maximize crop productivity.

- Amaranthus palmeri is a prevalent weed species in soybean-producing regions of Brazil and Argentina. Studies have shown that soybean crops experience yield losses ranging from 20.28% in cases of minimal Amaranthus weed infestation to as high as 62.8% when facing severe infestations.

- Aphids, thrips, whiteflies, leafhoppers, black aphids, pod borers, and stem fly insects cause considerable damage to major pulses and oilseed crops grown in the region, leading to severe yield losses and reduced crop quality. Insecticides accounted for 28.4% of the South American crop protection chemicals market in 2022, with a market value of USD 7.82 billion in the same year.

- Fungal diseases are a major constraint in soybean production in South America, and it is estimated that between 8-10% of soybean production is lost to diseases. The main diseases that affect the foliage of soybean plants in this region are target spot, Cercospora leaf blight, and Asian soybean rust. Fungicides such asmepoxiconazole, fluxapyroxad, and azoxystrobin are highly effective against these diseases.

- Among nematodes, root-knot nematode is the most prevalent. Carrots are susceptible to considerable losses, averaging up to 20.0%, while potatoes can experience even higher losses of up to 33.0% due to infestations caused by these nematode species.

- Thus, the need to increase the yield of crops in South America is anticipated to drive the market for pesticides.

Demand for pesticides is driven by the increased pest and disease proliferation, and expansion of agricultural cultivation

- Pests, diseases, and weeds are emerging as a significant problem in the Brazilian agriculture sector. To counter these threats effectively, farmers predominantly depend on the application of pesticides, and the market was valued at USD 17.68 billion in 2022. Soybean cultivation in Brazil faces numerous pest challenges, with lepidopterans and stink bugs being the primary pests demanding special attention. Particularly, the southern armyworm is known to inflict a significant 17.0% yield loss on soybean production.

- Renowned for its expansive agricultural expanse, favorable climate, and agricultural proficiency, Argentina stands as a prominent global agricultural producer and exporter. The nation's agricultural domain prioritizes high-yield cultivation to address both domestic and global requisites. Pesticides play a pivotal part in augmenting yields through the mitigation of pest and disease-induced losses. In 2022, Argentina held the second-largest portion, accounting for 19.7% by value, within the South American crop protection chemicals market.

- Chile's diverse agricultural landscape, with a variety of crops grown throughout the country, creates a demand for a broad range of pesticides to control various pests and diseases. Additionally, the launch of innovative products with different modes of action in the market in recent years provides farmers with more choices for crop protection, contributing to the growth of the pesticide market. Chile accounted for a market share of 1.5% of the total crop protection chemicals market in 2022.

- The market is estimated to register a CAGR of 4.7% during the forecast period (2023-2029) due to factors like favorable climatic conditions for pest and disease proliferation and expansion of agriculture cultivation.

South America Crop Protection Chemicals Market Trends

Frequent climate changes like drought and heat waves and intensive agriculture practices raised the overall pesticide consumption per hectare

- Between 2017 and 2022, there has been a remarkable surge in pesticide consumption per hectare across South America, witnessing a growth of 5,277 grams per hectare. This significant increase highlights the region's escalating reliance on pesticides in agricultural practices, spurred by a combination of influential factors. These include the adverse effects of climate change, such as frequent droughts and heat waves, as well as the adoption of intensive farming techniques like no-tillage and monoculture practices.

- Consequently, the proliferation of weeds, pests, and diseases has become more frequent, necessitating the intensified utilization of pesticide products and their application rates to protect valuable crops. Countries like Brazil, Argentina, and Paraguay faced challenges from climate conditions with respect to agriculture yields.

- In the region, herbicides have become the predominant pesticides utilized per hectare, experiencing a substantial growth of 3,702 grams per hectare in 2022 compared to 2017. This remarkable increase can be mainly attributed to the rising prevalence of weed infestations in agricultural fields. Farmers in countries like Brazil and Argentina have increasingly adopted herbicide-resistant varieties for major crops such as soybeans, maize, and wheat. However, this widespread adoption has also led to a rise in weed species developing resistance to herbicides. In Argentina, more than 30 weed species have shown resistance to various herbicides, while in Brazil, the number has risen to 51. This could lead to higher utilization of herbicides per hectare. Thus, factors like climate change and other intensive agricultural practices increased the fungicides and insecticides consumption per hectare

Heavy pesticide usage and imports from European countries majorly fluctuate the active ingredient prices

- South America stands out as a prominent user of pesticides, primarily driven by intensive agricultural practices like monoculture, no-tillage, and the goal to increase food production. However, the region heavily relies on pesticide imports from European countries, as many products that are banned from use are permitted to export.

- In 2019, pesticide prices witnessed substantial growth attributed to the increased drought conditions, leading to higher pesticide usage, a surge in demand for pesticides, and the unavailability of certain pesticides. All these factors contributed to the rise in pesticide prices, which recorded growth of up to 5-10% from the prices in 2017.

- In 2022, cypermethrin took the lead as the extensively utilized insecticide, with the price of the active ingredient standing at USD 21,087.6 per metric ton. Its widespread adoption in the agricultural industry is due to its effectiveness in controlling a range of insects, including spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars.

- In 2022, atrazine experienced a notable price hike, reaching USD 13,810.3 per metric ton. It finds application in both pre and post-emergence control of broadleaf and grassy weeds, with its highest usage in field corn, sweet corn, sorghum, and sugarcane crops. The use of atrazine is restricted in EU countries, but it is approved for exportation. As a result, South American countries serve as major importers of atrazine from EU countries.

- The price of mancozeb was approximately USD 7,810.9 per metric ton in 2022. This contact fungicide offers protection to a diverse array of crops, such as fruits, vegetables, and field crops, as well as turf management. Its versatility and effectiveness have earned it a valuable reputation among farmers.

South America Crop Protection Chemicals Industry Overview

The South America Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 61.32%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219