|

市場調查報告書

商品編碼

1687042

美國作物保護化學品-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)US Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

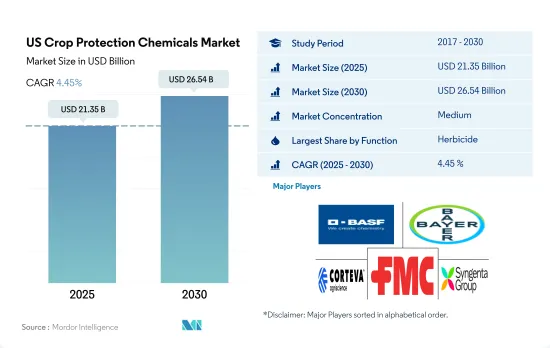

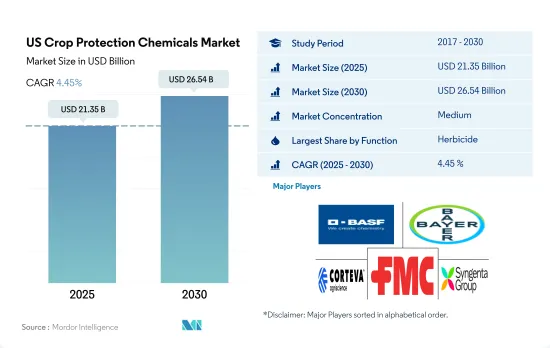

美國作物保護化學品市場規模預計在 2025 年為 213.5 億美元,預計到 2030 年將達到 265.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.45%。

雜草蔓延、勞動力短缺、工資上漲以及糧食生產需求增加可能會推動該國除草劑市場的發展

- 農業在美國經濟中發揮著至關重要的作用,對該國的GDP貢獻巨大。然而,病蟲害嚴重威脅農作物生產,導致產量下降、農民經濟損失、糧食安全隱患。美國是穀物、豆類和油籽的主要生產國和出口國,包括小麥、玉米和大豆。 2022 年,美國佔據北美作物保護化學品市值的 82.4% 的高佔有率。

- 雜草對作物的侵害在美國各地最為常見。田旋花、田旋花和馬尾草是一些常見的雜草,已知它們會破壞作物。由於國內外對玉米和小麥的需求不斷成長,除草已成為該國的必要。因此,該國對除草劑的需求不斷增加,到 2022 年,其以金額為準佔有率將達到 53.3%,最高。

- 同時,油籽和作物作物的蟲害對該國的農業生產力構成了重大挑戰。常見的昆蟲包括甲蟲、葡萄跳蟲、葉蟬和蚜蟲。將新菸鹼類殺蟲劑(包括Imidacloprid和Thiamethoxam)直接施用於種子被認為是有效的解決方案。 2022 年,殺蟲劑市場的價值佔有率位居第二,為 37.5%。

- 人們對糧食安全的日益關注和各種發展鼓勵農民有效率、永續生產糧食,同時盡量減少害蟲對作物的影響。這推動了市場的發展,預計預測期內(2023-2029 年)的複合年成長率為 4.7%。

美國作物保護化學品市場趨勢

隨著抗除草劑雜草種類的增加,需要更高的施用率才能更好控制。

- 在美國,每公頃土地的農藥消費量大幅增加。 2022 年,每公頃農藥消費量將比 2017 年增加 618 克。每公頃農藥使用量的增加是由於多種因素造成的,其中包括氣候變遷。溫暖濕潤的熱帶和亞熱帶氣候遍布世界各地,創造了適合多種作物生長的環境。然而,同樣的氣候也促進了雜草、害蟲和疾病的繁殖,需要增加農藥的使用來保護作物和維持生產力。

- 在所有作物保護化學品中,除草劑的消費量增幅最大,2022 年與 2017 年相比每公頃增加了 462 克。這種激增主要歸因於抗除草劑雜草種類的增加。Glyphosate是該國使用最廣泛的除草劑,與其他方法相比,它具有成本效益,已成為大多數農民控制雜草的主要方法。然而,Glyphosate的大量使用導致雜草產生抗藥性,目前已有14種雜草對Glyphosate產生抗藥性。因此,每公頃土地使用的除草劑量不斷增加。

- 單一栽培和犁地農業在該國的熱帶和亞熱帶地區盛行。這些做法導致了病蟲害的蔓延、作物的大量損失以及每公頃殺菌劑和殺蟲劑消費量的大幅增加。具體而言,2017年至2022年間,殺菌劑使用量每公頃增加了43克,而殺蟲劑使用量每公頃增加了115克。

它能有效控制多種害蟲,包括蚜蟲、介殼蟲、斑甲蟲、粉紅甲蟲、早斑甲蟲和毛蟲,但由於國內活性成分供應有限,價格正在上漲。

- 2022年Cypermethrin的價格為每噸21,200美元。由於它能有效控制多種害蟲,包括蚜蟲、介殼蟲、斑甲蟲、粉紅甲蟲、早斑甲蟲和毛蟲,因此在農業領域被廣泛採用。它的有效性使其成為想要保護作物免受害蟲侵害並確保豐收的農民的熱門選擇。

- Atrazine是一種系統性除草劑,屬於氯化三嗪類,用於一年生禾本科植物和闊葉雜草的出苗前防治。含有Atrazine的農藥配方已被核准用於多種農作物,包括玉米、甜玉米、高粱、甘蔗、小麥、澳洲堅果和番石榴,以及苗圃/觀賞植物和草皮管理等非農業用途。 2022 年Atrazine的價格為每噸 13,800 美元。

- Malathion被廣泛用於控制幾種珍貴作物的害蟲,包括蚜蟲、跳甲和其他吸汁害蟲。美國常見的五種作物,常用Malathion處理,分別是櫻桃番茄、青花菜、桑葚、蔓越莓和無花果。 2022 年Malathion的價格為每噸 12,600 美元。

- Mancozeb是一種廣譜接觸性殺菌劑,可用於美國的許多水果、蔬菜、堅果和田間作物。預防多種真菌疾病,包括馬鈴薯枯萎病、葉斑病、瘡痂病和銹病。它還可以作為馬鈴薯、玉米、高粱、番茄和穀物等作物的種子處理劑。 2022 年的市場價值將達到每噸 7,800 美元。

美國作物保護化學品產業概況

美國作物保護化學品市場適度整合,前五大公司佔45.79%的市場。該市場的主要企業有:BASF公司、拜耳公司、科迪華農業科技公司、富美實公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 殺軟體動物劑

- 殺線蟲劑

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 54017

The US Crop Protection Chemicals Market size is estimated at 21.35 billion USD in 2025, and is expected to reach 26.54 billion USD by 2030, growing at a CAGR of 4.45% during the forecast period (2025-2030).

Rise in weed infestations, shortage of labor, increased wages, and need for higher food production may drive the herbicide market in the country

- Agriculture plays a vital role in the US economy, contributing significantly to the country's GDP. However, pests and diseases significantly threaten crop production, leading to reduced yields, financial losses to farmers, and food security concerns. The country is the major producer and exporter of cereals, pulses, and oilseeds to other countries, such as wheat, maize, and soybeans. The United States occupied the highest share of 82.4% of the North American crop protection chemicals market value in 2022.

- Weed attacks on crops are the most common across the country. Catchweed bedstraw, field bindweed, and horsetail are some common weeds that are considered crop-devastating. With the growing demand for maize and wheat domestically and internationally, the management of weeds has become imperative in the country. This has increased the demand for herbicides in the country, which occupied the highest share of 53.3% by value in 2022.

- At the same time, insect infestations in oilseed and horticultural crops pose a significant challenge to the country's agricultural productivity. Common insects include bean-leaf beetles, grape colaspis, leafhoppers, and aphids. Direct application of neonicotinoid insecticides, including imidacloprid or thiamethoxam on seeds, is considered an effective solution. The insecticide market occupied the second-highest share of 37.5% by value in 2022.

- Increased concerns for food security and various developments have facilitated the efficient and sustainable production of food by farmers while minimizing the impact of pests on their crops. This has driven the market, which is anticipated to witness a CAGR of 4.7% during the forecast period (2023-2029).

US Crop Protection Chemicals Market Trends

The rise in herbicide-resistant weed species is necessitating higher application rates for better control

- There has been significant growth in the consumption of pesticides per hectare in the United States. In 2022, this consumption increased by 618 g per hectare compared to 2017. Several factors contributed to this escalated use of pesticides per hectare, including climate change. The prevalence of tropical and subtropical warm and humid conditions in various regions has created favorable environment for cultivating diverse crops. However, this same climate has also fostered the growth of weeds, pests, and diseases, necessitating a higher application of pesticides to protect crops and maintain productivity.

- Among all crop protection chemicals, herbicides experienced a significant increase in consumption, rising by 462 g per hectare in 2022 compared to 2017. This surge may be mainly attributed to the rise in herbicide-resistant weed species. Glyphosate, the most widely used herbicide in the country, serves as the primary method of weed control for most farmers due to its cost-effectiveness compared to other alternatives. However, the extensive use of glyphosate has led to the development of resistance in weed species, with 14 different weed species showing resistance against glyphosate. As a result, the consumption of herbicides per hectare has increased.

- In the country's tropical and subtropical regions, monoculture practices and the adoption of no-tillage practices are prevalent. These practices have resulted in the proliferation of pests and diseases, leading to significant crop losses and a substantial rise in the consumption of fungicides and insecticides per hectare. Specifically, between 2017 and 2022, there was an increase of 43 g per hectare in fungicide usage and 115 g per hectare in insecticide usage.

Effectiveness in controlling various insects such as aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars, and limited availability of active ingredients in the country is raising the price

- In 2022, cypermethrin was priced at USD 21.2 thousand per metric ton. It has been widely adopted in the agricultural industry for its effectiveness in controlling various types of insects, including aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it a popular choice for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Atrazine, a systemic herbicide belonging to the chlorinated triazine group, is utilized for targeted control of annual grasses and broadleaf weeds prior to their emergence. Pesticide formulations containing atrazine are approved for application on various agricultural crops such as corn, sweet corn, sorghum, sugarcane, wheat, macadamia nuts, and guava, in addition to non-agricultural applications like nursery/ornamental and turf management. Atrazine was priced at USD 13.8 thousand per metric ton in 2022.

- Malathion is used to control a wide range of pests, including aphids, fleas, and other sucking pests on several valuable crops. Five crops that are extensively grown in the United States that use malathion frequently are cherry tomatoes, broccoli, mulberries, cranberries, and figs. Malathion was priced at USD 12.6 thousand per metric ton in 2022.

- Mancozeb is a broad-spectrum contact fungicide that is labeled for use on many fruits, vegetables, nuts, and field crops in the United States. It provides protection against a wide spectrum of fungal diseases, including potato blight, leaf spot, scab, and rust. It serves as a seed treatment for crops such as potatoes, corn, sorghum, tomatoes, and cereal grains. In 2022, its market value reached USD 7.8 thousand per metric ton.

US Crop Protection Chemicals Industry Overview

The US Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 45.79%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219