|

市場調查報告書

商品編碼

1683154

越南作物保護化學品市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Vietnam Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

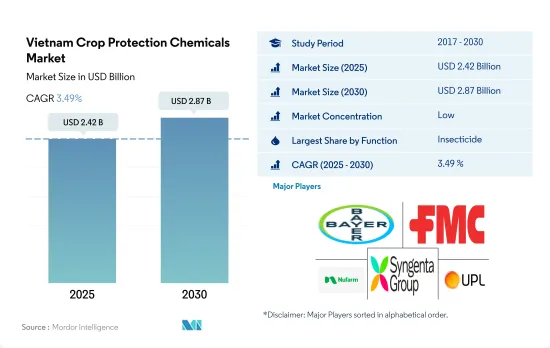

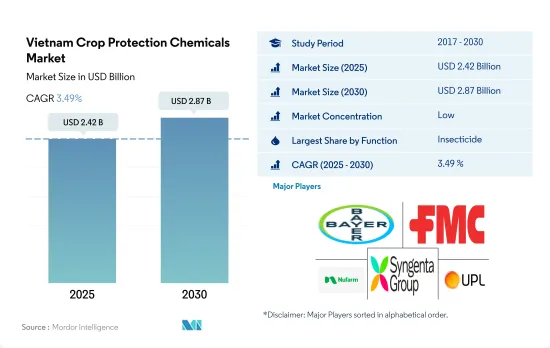

預計 2025 年越南作物保護化學品市場規模將達到 24.2 億美元,到 2030 年將達到 28.7 億美元,預測期內(2025-2030 年)的複合年成長率為 3.49%。

對殺蟲劑的需求源自於有效控制害蟲和疾病的需要。

- 2022 年,越南作物保護化學品市場價值 22 億美元。該國是多種農產品的重要生產國和出口國。

- 2022年,殺菌劑將成為越南作物保護化學品市場第二大細分市場,佔有16.7%的佔有率。該國的農民依靠殺菌劑來保護作物免受真菌疾病的侵害並確保最佳產量。市場成長主要受穀物、穀類、豆類、油籽、水果和作物等主要作物種植的推動,這些作物易受銹病、枯萎病、根腐病、白粉病和紋枯病等真菌感染疾病。 2022年殺蟲劑市佔率為66.4%,除草劑市佔率為15.1%。

- 線蟲侵染對水稻、咖啡、蔬菜和果園等作物構成威脅。水稻佔耕地面積的80%,每年的產量損失為10%至20%,增加了殺線蟲劑噴灑的需求。這些因素可能會導致該領域的成長。

- 越南作物保護化學品市場的成長與該國正在進行的農業發展和商業作物種植的擴張密切相關。越南在農業領域取得了重大進步,特別是天然橡膠等作物,已成為世界第三大生產國。

- 2022年天然橡膠收穫面積將達75.21萬公頃,較2018年成長9.1%。隨著農業部門的不斷擴大,用於保護作物和提高產量的各種作物保護產品的需求預計將相應增加。因此,預計預測期內(2023-2029 年)市場複合年成長率為 3.7%。

越南作物保護化學品市場趨勢

氣候變遷導致害蟲侵擾增加,推動作物保護化學品市場

- 越南作物保護化學物品部門在該國經濟中佔有重要地位。然而,這一領域面臨雜草、害蟲和真菌疾病等重大挑戰,導致每年大量作物損失。為了因應這些挑戰,2022年該國每公頃農地平均使用1.1公斤作物保護化學品。

- 在越南,殺菌劑是主流化學作物保護化學品,廣泛應用於農業領域。 2022年,越南每公頃農業用地的平均殺菌劑消費量將為0.6公斤。氣候條件變化等因素導致越南對殺菌劑的依賴性不斷增加。真菌疾病的傳播對各種作物品種構成了重大威脅,導致產量大幅損失,收穫作物的品質整體下降。因此,越南農民嚴重依賴殺菌劑來控制和有效地管理這些疾病。

- 除草劑在越南作物保護化學品消費量中排名第二。 2022年每公頃除草劑平均施用量為0.2公斤。然而,包括基因改造品種在內的耐除草劑作物的推廣,以及控制雜草和減少作物損失的需要,導致了噴灑量的增加和多種除草劑的使用。

- 由於氣候變遷和產生抗性的昆蟲數量的增加,昆蟲的數量變得越來越多。這兩個因素都推動了對殺蟲劑的需求,以對抗日益嚴重的害蟲問題。 2022 年,殺蟲劑成為越南消費量第三大的作物保護化學品類型,平均施用率為每公頃 0.2 公斤。

越南依賴進口作物保護化學活性成分,因為生產作物成分的公司數量有限。

- 由於作物作物保護化學活性成分的公司數量有限,越南嚴重依賴進口。 2018 年,該國遭遇洪水災害,導致國內和國際供應鏈中斷。結果,運輸路線受到影響,需求增加,活性成分的供應有限。因此,2018年活性成分的價格上漲。

- Cypermethrin是一種合成擬除蟲菊酯殺蟲劑,2022 年價值為每噸 21,100 美元。可廣譜防治影響越南穀物和豆類的鱗翅目、鞘翅目、雙翅目和半翅目害蟲。同樣,Imidacloprid是一種系統性殺蟲劑,2022 年的價格為每噸 17,200 美元。它用於控制各種作物中的吸吮和咀嚼昆蟲。

- Azoxystrobin是一種頻譜殺菌劑,可對抗真菌病原體(例如卵菌綱、子囊菌綱、擔子菌綱)。由於鐮刀菌和木黴菌等真菌感染增加,Azoxystrobin的價格已從 2017 年的每噸 4,000 美元上漲至 2022 年的每噸 4,600 美元。

- 二甲戊靈是一種選擇性出苗前除草劑,2022 年的價格為每噸 3,300 美元。可廣譜防治馬鈴薯、菸草、高粱、水稻和甘蔗中的一年生和闊葉雜草。 2022年,越南將從印度進口約3,000噸二甲戊靈。

- 病蟲害侵擾和疾病負擔的增加以及對作物保護化學品中活性成分的進口依賴可能會影響這些活性成分的價格。

越南作物保護化學品產業概況

越南作物保護化學品市場細分化,前五大公司佔20.54%。該市場的主要企業是拜耳股份公司、FMC 公司、Nufarm 有限公司、先正達集團和 UPL 有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃作物保護化學品消費量

- 有效成分價格分析

- 法律規範

- 越南

- 價值鏈與通路分析

第 5 章。市場細分,包括市場規模(美元和數量)、2030 年預測和成長前景分析

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 滅螺劑

- 殺線蟲劑

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Syngenta Group

- UPL limited

- Wynca Group(Wynca Chemicals)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 54985

The Vietnam Crop Protection Chemicals Market size is estimated at 2.42 billion USD in 2025, and is expected to reach 2.87 billion USD by 2030, growing at a CAGR of 3.49% during the forecast period (2025-2030).

The demand for pesticides is driven by the need for effective control of pests and diseases

- The market for crop protection chemicals in Vietnam was valued at USD 2.2 billion in 2022. The country is a significant producer and exporter of diverse agricultural commodities.

- In 2022, fungicides is the second largest segment with a share of 16.7% of the Vietnamese crop protection chemicals market. Farmers in the country rely on fungicides to protect crops from fungal diseases and ensure optimal yields. The market is driven by the cultivation of major crops such as grains, cereals, pulses, oilseeds, fruits, and vegetables, which are susceptible to fungal infections like rust, Fusarium wilt, root rot, powdery mildew, and common blight. Insecticides and herbicides held shares of 66.4% and 15.1% in 2022.

- Nematode infestations pose a threat to crops like rice, coffee, vegetables, and fruit orchards. Rice, which covers 80% of cultivated land, suffers annual yield losses of up to 10-20%, increasing the need for nematicide application. Such factors may lead to the growth of this segment.

- The growth of the crop protection chemicals market in Vietnam is closely linked to the ongoing agricultural development and the expansion of commercial crop cultivation in the country. Vietnam has witnessed significant progress in the agricultural sector, particularly in crops like natural rubber, for which it ranks as the third-largest global producer.

- The harvested area for natural rubber experienced a notable increase of 9.1% from 2018, reaching 752.1 thousand hectares in 2022. As the agricultural sector continues to expand, there will be a corresponding increase in the demand for various crop protection chemicals to safeguard crops and enhance yields. Thus, the market is expected to record a CAGR of 3.7% during the forecast period (2023-2029).

Vietnam Crop Protection Chemicals Market Trends

Due to climate change, pest infestations have been increasing in the country, driving the crop protection chemicals market

- Vietnam's agricultural sector holds great importance in the country's economy. However, the sector encounters notable difficulties in the form of weeds, insect pests, and fungal diseases, leading to substantial crop losses each year. To combat these challenges, the country used an average of 1.1 kilograms of crop protection chemicals per hectare of agricultural land in 2022.

- In Vietnam, fungicides have become the dominant type of chemical pesticide, being extensively used in the agricultural sector. The average consumption of fungicides per hectare of agricultural land in the country was 0.6 kilograms in 2022. Factors such as shifting climate conditions have played a role in the increased reliance on fungicides in Vietnam. The prevalence of fungal diseases poses a significant threat to various crop varieties, causing significant yield losses and compromising the overall quality of harvested crops. As a result, Vietnamese farmers heavily depend on fungicides to control and effectively manage these diseases.

- In Vietnam, herbicides hold the second position in terms of pesticide consumption. In 2022, the average amount of herbicides applied per hectare was 0.2 kilograms. However, the adoption of herbicide-tolerant crops, including genetically modified varieties, and the need to control weeds and minimize yield losses lead to higher application rates and the use of multiple herbicides.

- The presence of insects is growing due to shifting weather patterns and rising insect populations that have developed resistance. Both these factors have driven the demand for insecticides to combat the growing pest issues. In 2022, insecticides ranked as the third most consumed type of pesticide in Vietnam, with an average application rate of 0.2 kilograms per hectare.

Vietnam is an import-dependent country for crop protection chemicals' active ingredients, as there are limited companies producing active ingredients for pesticides

- Vietnam is an import-dependent country for crop protection chemicals' active ingredients, as there are limited companies producing active ingredients for pesticides. In 2018, a flood in the country disrupted supply chains, both domestically and internationally. As a result, transportation routes were affected, leading to increased demand and a limited supply of active ingredients. As a result, the prices of active ingredients increased in 2018.

- Cypermethrin is a synthetic pyrethroid insecticide, which was valued at USD 21.1 thousand per metric ton in 2022. It controls a wide range of lepidoptera, coleoptera, diptera, and hemipteran pests that affect cereals and pulses in Vietnam. Similarly, imidacloprid is a systemic insecticide, which was valued at USD 17.2 thousand per metric ton in 2022. It is used to control sucking and chewing insects in various crops.

- Azoxystrobin is a broad-spectrum fungicide that is active against fungal pathogens, including oomycetes, ascomycetes, deuteromycetes, and basidiomycetes. Owing to the increase in infestation of fungi like Fusarium and Trichoderma, the price of azoxystrobin increased from USD 4.0 thousand per metric ton in 2017 to USD 4.6 thousand per metric ton in 2022.

- Pendimethalin is a selective pre-emergence herbicide, which was valued at USD 3.3 thousand per metric ton in 2022. It provides broad-spectrum control of annual grasses and broadleaf weeds in potato, tobacco, sorghum, rice, and sugarcane. Vietnam imported around 3.0 thousand metric ton of pendimethalin from India in 2022.

- An increase in pest infestations and diseases and the dependence on imports for the active ingredients of crop protection chemicals in the country may influence the prices of these active ingredients.

Vietnam Crop Protection Chemicals Industry Overview

The Vietnam Crop Protection Chemicals Market is fragmented, with the top five companies occupying 20.54%. The major players in this market are Bayer AG, FMC Corporation, Nufarm Ltd, Syngenta Group and UPL limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Syngenta Group

- 6.4.8 UPL limited

- 6.4.9 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219