|

市場調查報告書

商品編碼

1683215

戶外 LED 照明市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

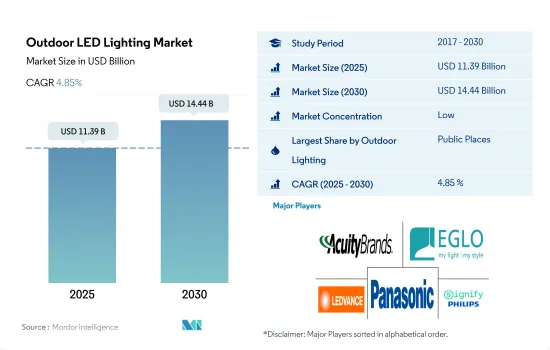

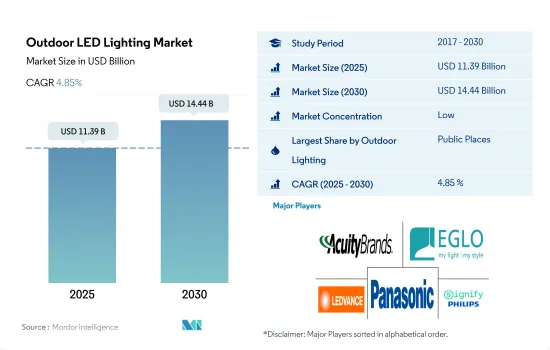

戶外 LED 照明市場規模預計在 2025 年為 113.9 億美元,預計到 2030 年將達到 144.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.85%。

由於都市化、旅遊業和貿易網路的不斷擴大,公共場所和道路的成長將推動 LED 照明市場的發展

- 從金額佔有率來看,到2023年,公共場所的LED照明應用將佔據大部分市場佔有率,其次是街道和道路以及其他部分。全球約有 55% 的人口居住在都市區,預計到 2050 年將上升到 68%。都市化最高的地區是北美洲(2018 年 82% 的人口居住在都市區)、拉丁美洲和加勒比海地區(81%)、歐洲(74%)和大洋洲(68%)。亞洲的都市化約為50%。相較之下,非洲仍以農村為主,43%的人口居住在都市區。隨著都市區逐年發展,遊樂園、停車場等公共空間也不斷增加。旅遊業和各種交通服務的增加也大大促進了公共空間的擴大。因此,LED在該領域的滲透率很高,預計未來將繼續佔據主導地位。

- 就2023年的銷售佔有率而言,公共場所的LED照明應用將佔據大部分市場佔有率,其次是街道和道路以及其他部分。隨著全球貿易持續成長,新興市場需要可行的替代方案來運輸貨物,同時保持競爭力和相關性。世界各大洲沿海和地區的傳統海上運輸需要其他選擇,例如道路運輸,有時還需要鐵路運輸。汽車產業與鐵路一樣,處於改變運輸業的突破性發展的前沿。從長遠來看,道路運輸可能仍將發揮重要作用,因為它是促進國民經濟貿易的重要手段。因此,世界各地道路網路的擴張也有望推動該領域對 LED 照明的採用。

全球各主要地區擴大採用 LED 照明,預計將推動 LED 照明的銷售。

- 從金額佔有率來看,2022年亞太LED市場將佔據大部分市場佔有率,其次是北美、歐洲、南美、中東和非洲。同樣,就 2022 年的銷量佔有率而言,亞太 LED 市場將佔據大部分市場佔有率,其次是北美、歐洲、中東和非洲以及南美。

- 到2025年,亞洲將成為世界上最大的能源消耗地區。越來越多的LED照明晶片製造商、新興企業、都市化、越來越多的公共事業以及其他對區域經濟做出貢獻的部分都在影響LED照明市場。

- LED 技術的進步和持續創新推動了北美 LED 照明銷售的成長。園藝中使用 LED 技術可以根據植物的生長階段控制不同的頻譜,從而減少能源浪費。智慧光學灌裝技術的出現也有望為市場帶來潛在機會。例如,2017 年,Signify 推出了 GreenPower LED Interlighting Gen 3 技術,用於高效能作物種植。預計這些發展將為該地區新的成長機會鋪平道路。

- 隨著中東、非洲和南美洲等地區的主要國家紛紛採用 LED 照明,這些地區採用 LED 照明的現像也日益增加。例如,阿根廷於 2020 年 11 月首次交付用於街道照明的最先進的LED燈,達到了一個里程碑。在9個地方政府的資金支持下,這些城市設立了12.1萬美元的緊急基金,用於購買652盞先進的LED燈。

- 因此,技術的快速變化和全球範圍內 LED 照明的日益普及預計將推動 LED 照明的使用。

全球戶外 LED 照明市場趨勢

體育場館的升級和維修以及政府對體育領域的資金援助預計將推動市場成長。

- 預計體育場數量將從 2022 年的 3,957 個成長到 2030 年的 4,205 個,複合年成長率為 0.9%。在北美,政府鼓勵興建新體育場館和維修維修體育場館,以刺激消費需求。在 2022 年足球賽季前夕,美國55 億美元的 SoFi 體育場進行了升級,採用了 LED 照明的新照明系統。此外,瓊斯AT&T體育場宣布計劃安裝新的LED照明和草皮,重點關注兩個計劃。瓊斯 AT&T 體育場正在進行耗資 2 億美元的翻新,其中理工大學體育部為該附加改進計劃共投入 220 萬美元。這些因素將支持LED市場的擴大。

- 此外,建築業的繁榮將促進歐洲市場的需求增加。例如,德國正在為 2023 年特殊奧運會建造柏林最具包容性的體育場。這座新田徑場取代了老化的弗里德里希·路德維希·雅恩體育公園,由當局資助,耗資 1.6 億歐元(1.7544 億美元)。

- 預計亞太市場對體育領域政府津貼的增加以及各種賽事的舉辦也將產生正面影響。例如,中國政府已宣布資助體育場維護和基礎設施建設的計劃。例如,上海提出到2025年建成“體育之城”,併計劃通過舉辦2023年亞足聯亞洲杯、2023年第十二屆全國少數民族傳統體育錦標賽、第三屆全國青年錦標賽等賽事來實現這一目標。由於這些發展,LED 市場預計在未來幾年將會成長。

節能建築的興起和電動車全球銷售的上升預計將推動市場成長

- 2021年世界人口達78.9億。預計2022年全球就業人數將達33.2億,高於2015年的31.6億,增加近1.3億。隨著就業人數的增加以及民眾掌握的知識越來越多,LED 的使用預計會增加。

- 儘管受到新冠疫情影響,全球在節能建築方面的支出仍從 2019 年的 1,650 億美元成長了 11.4%,增至 2020 年的 1,840 多億美元。自 2015 年以來,能源效率投資的年成長率首次超過 3%。由於節能建築的不斷發展,以及需要在住宅中建造更多房間以滿足不斷成長的人口的住宅需求,對 LED 的需求預計會增加。

- 2022年,全球汽車產量為1.4396億輛。預計2023年將增加至1.5092億輛。預計2022年全球電動車銷量將超過1,000萬輛,2023年將成長35%,達到1,400萬輛。由於這種快速擴張,電動車的市場佔有率從2020年的4%增加到2022年的14%。電動車每輛車所需的處理器比傳統汽車多得多,因此隨著電動車數量的成長,對車載半導體晶片的需求也會增加。汽車產業對半導體的需求不斷增加,預計將推動 LED 照明市場的發展。

戶外 LED 照明產業概況

戶外LED照明市場較為分散,前五大企業佔了34.47%的市佔率。該市場的主要企業是 ACUITY BRANDS, INC.、EGLO Leuchten GmbH、LEDVANCE GmbH (MLS)、松下控股公司和 Signify Holding (飛利浦)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明電力消耗量

- #家庭數量

- LED滲透率

- #體育場數量

- 法律規範

- 阿根廷

- 巴西

- 中國

- 法國

- 德國

- 波灣合作理事會

- 印度

- 日本

- 南非

- 英國

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共空間

- 道路照明

- 其他

- 地區

- 亞太地區

- 歐洲

- 中東和非洲

- 北美洲

- 南美洲

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- EGLO Leuchten GmbH

- Guangdong PAK Corporation Co.,Ltd.

- LEDVANCE GmbH(MLS Co Ltd)

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 65300

The Outdoor LED Lighting Market size is estimated at 11.39 billion USD in 2025, and is expected to reach 14.44 billion USD by 2030, growing at a CAGR of 4.85% during the forecast period (2025-2030).

The growth in public places and roadways due to increased urbanization, tourism, and trade networks would boost the LED lights market

- In terms of value share in 2023, the utilization of LED lights in public places accounted for the majority of the market share, followed by the street and roadways and others segments. Around 55% of the world's population lives in urban areas, and this proportion is expected to rise to 68% by 2050. The most urbanized regions include North America (82% of the population lived in urban areas in 2018), Latin America and the Caribbean (81%), Europe (74%), and Oceania (68%). The degree of urbanization in Asia is around 50%. In contrast, Africa is still largely rural, with 43% of the population living in urban areas. As urban areas have grown over the years, so have public places such as amusement parks and parking lots. The rise in tourism and various transportation services has also contributed significantly to the growth of public spaces. Hence, the penetration of LEDs in this sector is high and will continue to be mainstream.

- In terms of volume share in 2023, the utilization of LED lights in public places accounted for the majority of the market share, followed by the street and roadways and others segments. As global trade continues to grow, emerging markets need viable alternatives to transport goods while remaining competitive and relevant. Conventional maritime reach along the coasts and geographies of the world's continents requires other options: road transport and possibly rail. The automotive industry, like railroads, has been at the forefront of groundbreaking developments transforming the transportation sector. In the long term, road transport will remain relevant and an important tool for promoting trade in the domestic economy. Therefore, the growing road network around the world will also promote the penetration of LED lighting in this sector.

The rising adoption of LED lights in every major region across the world is expected to boost LED lighting sales

- In terms of value share in 2022, the Asia-Pacific LED market accounted for the majority of the share, followed by North America, Europe, South America, and the Middle East and Africa. Similarly, in terms of volume share in 2022, the Asia-Pacific LED market accounted for the majority of the share, followed by North America, Europe, the Middle East and Africa, and South America.

- Asia is set to become the world's largest energy consumer by 2025. The growing number of LED lighting chip manufacturers, startups, urbanization, growth in public places, and other sectors contributing to the local economy are impacting the LED lighting market.

- Advancements and continued innovation in LED technology are contributing to the increased sales of LED lighting in North America. The use of LED technology in horticulture has reduced energy waste by controlling different light spectrums according to plant growth stages. The emergence of intelligent light-filling technology is also expected to bring potential opportunities to the market. For instance, in 2017, Signify introduced its GreenPower LED Interlighting Gen 3 technology for efficient crop development. Such developments are expected to pave the way for new growth opportunities in the region.

- Regions such as the Middle East, Africa, and South America are also seeing increased adoption of LED lighting as major countries in the regions are adopting LED lighting. For example, in Argentina, November 2020 marked a milestone with the first delivery of modern LED lamps for street lighting. With funding from nine municipalities, these cities established a USD 121,000 temporary fund to purchase 652 advanced LED lights.

- Thus, rapid technological changes and increased adoption of LED lights across the world are expected to boost their use.

Global Outdoor LED Lighting Market Trends

Upgradation and renovation of sports stadiums and government funding in the sports sector are expected to drive the growth of the market

- The number of stadiums is expected to witness a growth from 3,957 units in 2022 to 4,205 units in 2030, registering a CAGR of 0.9%. Upgrading new venues as well as the rehabilitation of existing stadiums are encouraged in North America in an effort to increase consumer demand. For the 2022 football season, the new USD 5.5 billion SoFi Stadium in the United States received an upgrade with new illumination that incorporated LED lights. In addition, Jones AT&T Stadium announced plans to focus on two projects and install new LED lights and turf. Jones AT&T Stadium is undergoing a USD 200 million restoration, and Tech Athletics is contributing a total of USD 2.2 million to the project for the additional improvements. These elements support the expansion of the LED market.

- In addition, increasing construction will help fuel the demand in the European market. For instance, Germany constructed its most inclusive stadium in Berlin for the Special Olympics in 2023. The new athletics stadium, which replaced the venerable Friedrich-Ludwig-Jahn-Sportpark, was given EUR 160 million (USD 175.44 million) by the authorities.

- The demand for goods and services in the Asia-Pacific market will also be positively influenced by the increasing government funding for the sports sector and the staging of various events. For instance, the Chinese government announced plans to fund stadium maintenance and infrastructural improvements. For instance, Shanghai suggested that a "sports city" will be built by 2025. The nation hosted competitions like the AFC Asian Cup 2023, the 12th National Traditional Minority Sports in 2023, and the third National Youth Games in order to achieve that. Due to these developments, the LED market is expected to grow in the coming years.

Increasing energy-efficient construction and the rise in global sales of EVs are expected to drive the growth of the market

- The world's population reached 7.89 billion people in 2021. Global employment figures reached 3.32 billion in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion. The use of LEDs is expected to increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals.

- Despite the COVID-19 pandemic, worldwide spending on energy-efficient construction increased by an exceptional 11.4% in 2020 to over USD 184 billion, up from USD 165 billion in 2019. The yearly growth rate for investments in energy efficiency surpassed 3% for the first time since 2015. The requirement for additional rooms in a house is anticipated to result in increased demand for LEDs due to the rise in the development of energy-efficient buildings and to meet the residential needs of the expanding population.

- In 2022, there were 143.96 million automobiles produced worldwide. In 2023, that number was projected to rise to 150.92 million. Global sales of electric vehicles exceeded 10 million in 2022, and it was predicted that sales in 2023 would rise by another 35% to a total of 14 million. The market share of electric cars rose from 4% in 2020 to 14% in 2022 as a result of this quick expansion. Due to the fact that electric cars need more processors per vehicle than conventional automobiles, there has also been an increase in the need for automotive semiconductor chips as more of them are used. The rise in semiconductor demand in the automotive industry is likely to help the market for LED lighting.

Outdoor LED Lighting Industry Overview

The Outdoor LED Lighting Market is fragmented, with the top five companies occupying 34.47%. The major players in this market are ACUITY BRANDS, INC., EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Brazil

- 4.8.3 China

- 4.8.4 France

- 4.8.5 Germany

- 4.8.6 Gulf Cooperation Council

- 4.8.7 India

- 4.8.8 Japan

- 4.8.9 South Africa

- 4.8.10 United Kingdom

- 4.8.11 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.2 Europe

- 5.2.3 Middle East and Africa

- 5.2.4 North America

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Current Lighting Solutions, LLC.

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 Guangdong PAK Corporation Co.,Ltd.

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify Holding (Philips)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219