|

市場調查報告書

商品編碼

1683754

北美戶外 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

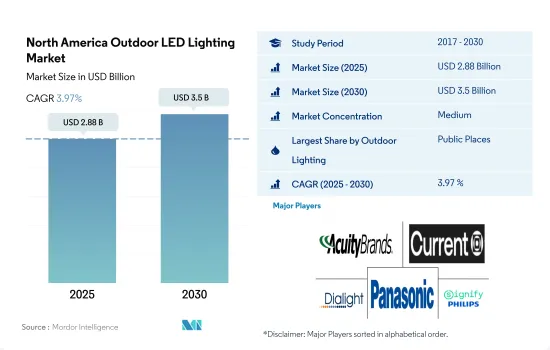

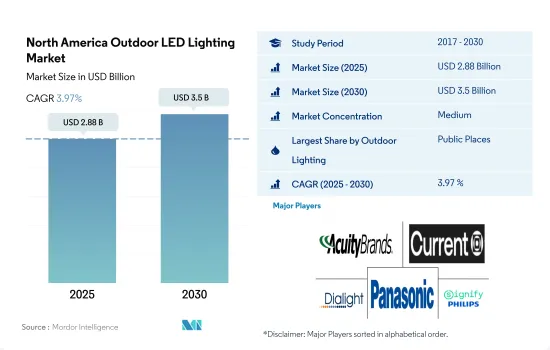

北美戶外 LED 照明市場規模預計在 2025 年為 28.8 億美元,預計到 2030 年將達到 35 億美元,預測期內(2025-2030 年)的複合年成長率為 3.97%。

街道上LED照明的使用增加和企業的策略發展將推動該地區LED照明的成長。

- 從金額和數量來看,2023 年公共空間將佔最大佔有率,其次是街道和道路。在接下來的幾年裡,我們預計其在公共空間中的佔有率將略有下降,而在街道和道路上的佔有率將上升。 2021年3月,加拿大拉瓦爾市核准了一項計劃,將37,000盞路燈升級為智慧控制LED照明。改用 LED 照明每年可節省 275 萬美元。這些努力有助於推動加拿大 LED 的普及。

- 新冠疫情導致照明產業供應鏈嚴重中斷,並嚴重影響了LED照明市場。高速公路/道路/道路建築外部/建築、停車場/停車場、機場圍欄、體育場和運動場等應用對 LED 照明的需求反映了智慧大都市的需求。由於照明領域的連接性、性能、有效性和性能監控的提高,預計未來幾年該市場將大幅成長。

- 在開發和創新方面,Acuity 品牌戶外照明製造商 Cyclone Lighting 宣布將於 2023 年推出其 Elencia 燈。戶外桿頂照明採用高性能光學元件和改良的現代燈籠風格,外觀優雅。 2021 年,LEDVANCE 擴展了其城市戶外產品組合,為道路、停車場、運動場和其他場所等應用提供現代化高亮 LED 照明。這些發展反映出該地區對 LED 照明的需求日益成長。

政府推出節能路燈計畫推動該地區 LED 照明的發展

- 從金額和數量來看,預計 2023 年美國將佔據最大佔有率,其次是北美其他地區。 2023年第一季,美國開工數個大型道路基礎建設計劃。該計劃包括堪薩斯州歐弗蘭帕克的 69 條快速收費車道,預計於 2026 年第三季完工。甘迺迪高速公路延伸線將從伊甸園高速公路延伸至芝加哥的俄亥俄街,全長七英里。這些項目預計將改善街道照明並促進該地區 LED 市場的成長。

- 此外,芝加哥市將於 2022 年 9 月啟動路燈升級計劃,以高效 LED 照明取代 280,000 多盞高壓鈉路燈。這些發展反映出該地區對 LED 照明的需求日益成長。

- 在開發和創新方面,Signify 和 Appcity 將於 2022 年展開合作,幫助北美各地的城市和公共產業利用街道照明基礎設施改善交通、公共和永續性。 Signify 開發的道路和街道 LED 照明、Interact IoT 聯網照明系統以及 Upcity 開發的用於隱私保護的邊緣運算影像分析感測器將有助於改善停車等服務。紐約電力局 (NYPA) 的智慧街道照明專案在競爭性採購流程中選擇了 Signify,這使得奧爾巴尼市能夠將大約 11,000 盞路燈升級為 LED 照明。該城市正在使用 Interact 的物聯網系統來監控和控制照明,使城市變得能源智慧。這些發展反映出該地區對 LED 照明的需求日益成長。

北美戶外 LED 照明市場趨勢

體育場館升級、更換和新建推動 LED 照明成長

- 預計到 2030 年體育場的數量將增加 1,260 個,複合年成長率為 0.7%。美國、加拿大、墨西哥等體育文化強國的存在,推動了各類體育賽事和活動的需求不斷增加。此外,這些國家都有維修體育場的歷史。例如,2015年新洋基體育場的維修增加了LED照明。此外,道奇體育場計劃在 2023 年將其球場照明改為 LED。憑藉 LED 技術,道奇體育場將加入瑞格利球場和芬威球場等 10 多個 MLB 棒球場的行列。這些因素正在支持該地區LED市場的擴張。

- 該地區人們對體育運動,尤其是板球的興趣日益濃厚。例如,2023 年,「Boundaries North」計劃由 WEIC Sports United 協調,並與加拿大板球協會建立策略合作夥伴關係實施。與加拿大板球協會的長期計劃將致力於增加打板球的男女人數。這需要開發基礎設施和資金來支持所有加拿大板球運動員。隨著更多體育場館的建設,預計預測期內加拿大市場將大幅成長。例如,Woodbine Entertainment 於 2022 年宣布將與私人投資者合作在多倫多附近建造足球專用場。該體育場預計可容納 8,000 名觀眾和 38,000 平方英尺的訓練設施。此外,2024 年,加拿大足球協會可能會在安大略省昆特西和新南威爾斯州布雷頓角舉辦豐田全國錦標賽。預計這些因素將在未來幾年推動 LED 的成長。

政府擴大電動車產業的措施推動 LED 市場發展

- 2023年北美的出生率為每千人口11.821名新生兒,較2022年增加0.07%。 2018年北美共有1.5615億套住宅,到2023年,這一數字預計將達到2.5579億套。到 2023 年,美國人口將達到創紀錄的 5 億以上。 2022 年,美國南部住宅數量超過所有其他地區的總合。西部是住宅量第二高的地區,2021 年達到約 40 萬套。東北部是美國2022 年唯一住宅增加的地區。

- 此外,2022 年美國家庭數量為 1.312 億。美國家庭數量現在高於 2020 年(1.2845 億戶)。 2022 年美國典型家庭規模為 3.13 人。 2022年屋主家庭比例將達65.9%。 2020年,六間及六間住宅佔全住宅的19.3%。家庭數量的不斷成長以及房間數量的不斷增加的需求推動了 LED 的普及。

- 北美汽車產量預計將從2022年的1454萬輛增加至2023年的1506萬輛。汽車業是北美最大的製造業之一。政府措施正在幫助大幅推動北美電動車市場的發展。 2022 年 8 月《通膨控制法案》頒布後,各大電動車和電池製造商已宣布,從該法案頒佈到 2023 年 3 月,將在北美電動車供應鏈上投入總計至少 520 億美元。此類措施將使消費者和製造商受益,預計將增加該地區對 LED 照明的需求。

北美戶外 LED 照明產業概況

北美戶外LED照明市場適度整合,前五大公司佔據56.15%的市佔率。該市場的主要企業是:ACUITY BRANDS, INC.、Current Lighting Solutions, LLC.、Dialight PLC、松下控股公司和 Signify Holding (Philips)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共空間

- 道路照明

- 其他

- 國家

- 美國

- 北美其他地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- Cree LED(SMART Global Holdings, Inc.)

- Current Lighting Solutions, LLC.

- Dialight PLC

- EGLO Leuchten GmbH

- Feit Electric Company, Inc.

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Panasonic Holdings Corporation

- Signify Holding(Philips)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The North America Outdoor LED Lighting Market size is estimated at 2.88 billion USD in 2025, and is expected to reach 3.5 billion USD by 2030, growing at a CAGR of 3.97% during the forecast period (2025-2030).

The increased use of LED lights in streets and strategic developments by companies will drive the growth of LED lighting in the region

- In terms of value and volume, public spaces will account for the largest share in 2023, followed by streets and roadways. Market share is expected to decline slightly in public places and increase in streets and roadways in the next few years. In March 2021, the Canadian city of Laval approved plans to upgrade 37,000 street lights to LED lights with intelligent controls. Switching to LED lighting could save USD 2.75 million annually. These efforts are driving the adoption of LEDs in Canada.

- The COVID-19 pandemic caused major disruptions to the lighting industry supply chain, severely impacting the LED lighting market. The LED lighting demand in applications such as highway/street/road building exterior/architecture, car park/parking garages, airport fences, stadiums, and sports arenas mirrors the demand for smart metropolises. This market is expected to grow significantly in the coming years owing to increased connectivity, performance, effectiveness, and performance monitoring in the lighting sector.

- In terms of development and innovation, the Acuity brand outdoor lighting manufacturer Cyclone Lighting announced the debut of the Elencia lamp in 2023. Outdoor pole top lighting looks classy with high-performance optics and an improved modern lantern style. In 2021, LEDVANCE expanded its urban outdoor portfolio with modern highlight LED lights for applications such as streets, parking lots, sports fields, and other venues. These developments reflect the growing demand for LED lighting in the region.

Government initiatives to incorporate energy efficient lights on streets to drive the growth of LED lighting in the region

- In terms of value and volume, the United States was expected to have the largest share in 2023, followed by the rest of North America. In the first quarter of 2023, large-scale road infrastructure construction projects began in the United States. The project includes 69 express toll lanes in Overland Park, Kansas, and is expected to be completed in the third quarter of 2026. The Kennedy Expressway Extension extends 12 kilometers from the Edens Expressway to Ohio Street in Chicago. These cases are expected to lead to improved street lighting and contribute to the growth of the LED market in the region.

- Additionally, the City of Chicago embarked on a streetlight upgrade project in September 2022, replacing more than 280,000 high-pressure sodium streetlights with high-efficiency LED lights. These developments reflect the growing demand for LED lighting in the region.

- From a development and innovation perspective, Signify and Upciti partnered in 2022 to help cities and utilities across North America leverage street lighting infrastructure to improve transportation, public safety, and sustainability. Signify's road and street LED lighting development, Interact IoT connected lighting systems, and Upciti's edge-computing image analytics sensor developments to protect privacy will help cities improve services such as parking. The NYPA (New York Power Authority's Smart Street Lighting Program) selected Signify as part of a competitive procurement process that enabled Albany to upgrade nearly 11,000 streetlights to LED lights. The city uses an Interact IoT system to monitor and control lighting, making it an energy-smart town. These developments reflect the growing demand for LED lighting in the region.

North America Outdoor LED Lighting Market Trends

Upgradation, replacement, and construction of new stadiums to drive the growth of LED lights

- The number of stadiums is expected to witness a growth of 1,260 units in 2030, exhibiting a CAGR of 0.7%. The existence of nations with strong sports cultures, such as the United States, Canada, and Mexico, contributes to the increased demand for various sports events and activities. Additionally, these nations have a history of renovating stadiums. For instance, LED lighting was added to the New Yankee Stadium renovation in 2015. Additionally, the Dodgers Stadium will switch to LED pitch lights in 2023. With LED technology, Dodger Stadium joined over a dozen MLB stadiums, including Wrigley Field and Fenway Park. These elements support the expansion of the LED market in the region.

- The interest in sports, particularly cricket, is growing in the region. For instance, in 2023, Boundaries North, a project coordinated by WEIC Sports United, was implemented as a strategic alliance with Cricket Canada. The long-term project with Cricket Canada will concentrate on increasing the number of men and women who play cricket. This entails developing a supporting infrastructure and funding possibilities for all Canadian cricketers. As more stadiums are being built, the Canadian market is anticipated to increase significantly during the forecast period. For instance, Woodbine Entertainment said in 2022 that it would work with private investors to build a stadium close to Toronto specifically for football. The stadium is anticipated to hold 8,000 spectators and a training facility of 38,000 square feet. Moreover, in 2024, Canada Soccer may host the Toyota National Championship in Quinte West, ON, and Cape Breton, NS. These factors will drive the growth of LEDs in the coming years.

Government initiatives to expand EV industry will boost the LED market

- North America's birth rate in 2023 is 11.821 births per 1,000 people, a 0.07% increase from 2022. In 2018, there were 156.15 million homes in North America, which is set to reach 255.79 million by 2023. The population of the United States has grown from a record more than 500 million people in 2023. In 2022, more new housing started in the South of the United States than in every other region combined. The West was the second region with the highest number of housing starts, which amounted to roughly 400,800 units in 2021. Northeast was the only region in the US that experienced increased housing starts in 2022.

- Further, the United States had 131.2 million households in 2022. There are now more households in the United States than there were in 2020 (128.45 million). In 2022, there were 3.13 people in the typical American family. The proportion of owner-occupied households in 2022 was 65.9%. In 2020, six or more rooms were present in 19.3% of all occupied dwelling units. The expansion of LEDs will be fueled by an increase in families and the need to accommodate this increase in the typical number of rooms.

- The number of automobiles produced in North America in 2022 was 14.54 million; in 2023, that number is predicted to rise to 15.06 million. The automotive industry is one of the largest manufacturing sectors in North America. Government efforts are significantly raising the market for EVs throughout North America. After the Inflation Reduction Act was enacted in August 2022, major EV and battery manufacturers announced expenditures in North American EV supply chains totaling at least USD 52 billion between that time and March 2023. Such measures that benefit consumers and manufacturers will increase the demand for LED lighting in the area.

North America Outdoor LED Lighting Industry Overview

The North America Outdoor LED Lighting Market is moderately consolidated, with the top five companies occupying 56.15%. The major players in this market are ACUITY BRANDS, INC., Current Lighting Solutions, LLC., Dialight PLC, Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

- 5.2 Country

- 5.2.1 United States

- 5.2.2 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Cree LED (SMART Global Holdings, Inc.)

- 6.4.3 Current Lighting Solutions, LLC.

- 6.4.4 Dialight PLC

- 6.4.5 EGLO Leuchten GmbH

- 6.4.6 Feit Electric Company, Inc.

- 6.4.7 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.8 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Signify Holding (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms