|

市場調查報告書

商品編碼

1683942

法國戶外 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)France Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

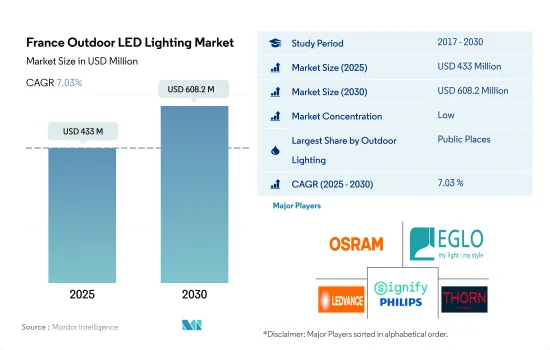

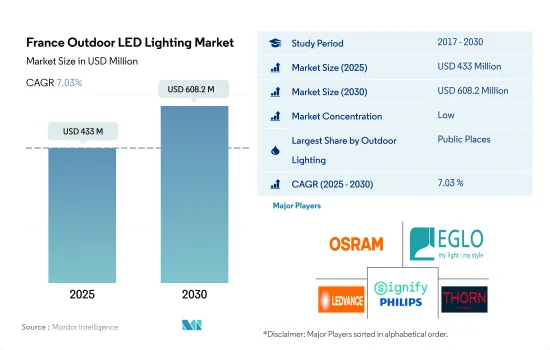

預計 2025 年法國戶外 LED 照明市場規模為 4.33 億美元,到 2030 年將達到 6.082 億美元,預測期內(2025-2030 年)的複合年成長率為 7.03%。

智慧城市計劃推動LED照明市場成長

- 2023年,公共空間在金額和數量方面佔比最大。在整個疫情期間,法國政府對娛樂中心、購物中心、公園、旅行、活動等實施了臨時關閉和限制措施,以遏制COVID-19疫情的蔓延。政府機構採取的這些措施對公共支出產生了影響。隨著 2021 年封鎖限制的放鬆,開放的公共空間刺激了火車站、購物中心和機場附近的停車需求。政府也推出了舉措,放鬆防疫措施並發展能源效率和永續性舉措。其中之一就是減少鹵素燈的使用,並用 LED 照明代替。

- 為了促進智慧城市發展,該國已與照明製造商簽署了計劃協議。其中一項協議是 Jardins de l'Arche 照明計劃,這是建築公司 AWP 的城市重建計劃。該區域佔地15公頃,旨在打造為文化娛樂中心。該計劃將建造一條從新凱旋門到楠泰爾平台的 600 公尺步行長廊、一個可容納 40,000 名觀眾的體育場以及商業、行政、學校和酒店設施。法國照明設計工作室8'18''負責這個新公共空間和行人用長廊的照明。 LED 照明正在此類開發和計劃中得到應用,從而增加了該國對 LED 照明的需求和市場價值。

法國戶外LED照明市場趨勢

體育和相關基礎設施投資推動 LED 照明成長

- 預計法國的體育場數量將從 2023 年的 139 個成長到 2030 年的 152 個,複合年成長率為 1.2%。近年來,體育產業發生了許多變化。 2015 年,裡爾皮埃爾莫魯瓦體育場的維修工程安裝了泛光燈。 2019 年,馬賽橙色自行車館安裝 Signify LED 照明,成為法國最大的 100% LED 體育場。 2020 年,路易二世體育場引入了採用 LED 技術的全面燈光管理。這些因素支持了法國戶外LED照明市場的擴張。

- 國家支持體育場館建設,為各類運動提供投資機會。例如,法國政府對體育的投資預計將在 2020 年大幅增加,為 2024 年巴黎奧運和殘奧做準備。作為展示政府支持體育運動承諾的計劃的一部分,體育部的預算將在 2020 年增加,達到 7.104 億歐元(6.138 億英鎊/7.935 億美元)。預計未來幾年將有超過 1.29 億歐元(1.115 億英鎊/1.441 億美元)投資於體育設施。

- 預計尼姆 2022 年奧運會的新體育場將是最近完成的計劃之一,第二座體育場將於 2026 年完工。邁瑙體育場是一座可容納 26,280 人的專業足球場,即將進行全面維修,工程將於 2021 年開始。在研究期間,在法國舉行的重要賽事包括 2023 年法國橄欖球世界盃、國際排聯男子排球國家聯賽、國際籃球總會女子 3x3 系列賽和 2024 年奧運會。由於這些發展,戶外 LED 照明市場預計在未來幾年將會成長。

乘用車和電池式電動車註冊量成長將推動 LED 市場成長

- 法國總人口逐年增加,2021年將達6764萬人。法國的生育率為每名婦女生育1.83個孩子。 2021年法國的預期壽命預計為82.32歲。過去幾年,法國的預期壽命保持穩定。 2021 年法國每 1,000 名居民的死亡率與 2020 年相比下降了 0.2 人(-2.02%)。整體而言,死亡率下降,2021年達到每千人口9.7人死亡。資料顯示,該國越來越多的人需要更多的居住空間,這可能會促進市場的擴張。

- 在法國,2021 年共有約 3,100 萬個家庭,2018 年平均家庭規模為 2.19 人。截至 2021 年第四季度,法國已售出或預留待售的新住房單元超過 29,712 套。 2020 年第四季度,約有 27,918 套住宅銷售已完成或計劃銷售。預計住宅銷售量的增加將增加該國的 LED 使用量。

- 截至 2022 年 1 月,法國持有的乘用車數量已超過 3,870 萬輛,高於 2011 年的 3,580 多萬輛。到 2022 年,乘用車持有將持續成長。此外,自從法國汽車市場出現電動車註冊以來,其數量急劇增加。 2022 年,法國將註冊近 219,800 輛新的電池電動個人車和多功能車,與前一年同期比較成長近 26.1%。法國的 LED 銷售可能會受益於汽車銷售的成長。

法國戶外LED照明產業概況

法國戶外LED照明市場較為分散,前五大企業佔比為30.14%。市場的主要企業是:ams-OSRAM AG、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、Signify Holding(飛利浦)和Thorn Lighting Ltd.(Zumtobel Group)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 法國

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共設施

- 道路照明

- 其他

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ams-OSRAM AG

- BEGA Lighting

- EGLO Leuchten GmbH

- Fagerhult(Fagerhult Group)

- Feilo Sylvania(Shanghai Feilo Acoustics Co., Ltd)

- LEDVANCE GmbH(MLS Co Ltd)

- Signify Holding(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The France Outdoor LED Lighting Market size is estimated at 433 million USD in 2025, and is expected to reach 608.2 million USD by 2030, growing at a CAGR of 7.03% during the forecast period (2025-2030).

Smart city projects drive the growth of the LED lighting market

- Public spaces held the largest share by value and volume in 2023. During the pandemic, the French government imposed temporary closures and restrictions on entertainment centers, shopping malls, parks, travel, events, etc., to control the spread of the COVID-19 pandemic. These measures by government agencies impacted public spending. When lockdown restrictions eased in 2021, the open public spaces accelerated demand for parking near railway stations, shopping malls, and airports. The government also introduced initiatives to ease COVID-19 measures and develop energy efficiency and sustainability initiatives. One of them was to reduce the use of halogen lamps and replace them with LED lighting.

- To facilitate smart city development, the country signed project agreements with lighting manufacturers. One such agreement is the Jardins de l'Arche lighting project, an urban renewal project by AWP, an architectural firm. The district covers an area of 15 hectares and is intended as a center of culture and entertainment. The project encloses a 600 m pedestrian promenade that leads from La Grande Arche to the terraces of Nanterre, a sports arena that can accommodate up to 40,000 spectators, and to areas intended for commercial, administrative, school, and hospitality buildings. The French lighting design studio 8'18'' was responsible for lighting this new public space and pedestrian promenade. Such developments and projects involve the use of LED lighting, increasing the demand and market value of these lights in the country.

France Outdoor LED Lighting Market Trends

Investments in sports and related infrastructure to drive the growth of LED lighting

- The number of stadiums in France is expected to grow from 139 in 2023 to 152 in 2030, with a CAGR of 1.2%. The sports industry has undergone a number of changes in recent years. Floodlights were installed in 2015 as part of renovations at the Pierre Mauroy stadium in Lille. The Orange Velodrome in Marseille became France's largest 100% LED stadium in 2019 when Signify installed LED lighting. Total light management for LED technology was featured at Stade Louis II in 2020. These elements support the expansion of the French outdoor LED lighting market.

- The nation supports the building of stadiums and provides investment opportunities for different sports. For instance, as the nation prepared for the Paris 2024 Olympic and Paralympic Games, the French government's investments in sports were expected to increase significantly in 2020. The budget for the Sports Ministry was expected to increase in 2020 and reach EUR 710.4 million (GBP 613.8 million/USD 793.5 million) as part of plans to demonstrate the government's desire to support sports. Over EUR 129 million (GBP 111.5 million/USD 144.1 million) is anticipated to be invested in sporting facilities over the coming years.

- The new stadium building for Nimes Olympique 2022 is expected to be among the most recently completed projects, while the second stadium will be finished by 2026. A professional football stadium with a capacity of 26,280, Stade de la Meinau, will be revamped completely, with construction having started in 2021. Some of the significant tournaments in France during the study period have been the Rugby World Cup France 2023, FIVB Volleyball Men's Nations League, FIBA 3x3 Women's Series, and the 2024 Olympic Games. Due to such developments, the outdoor LED lighting market is expected to grow in the coming years.

Increasing passenger car and battery electric private and utility car registration to drive the growth of LED market.

- France's total population has been growing for years, reaching 67.64 million in 2021. The fertility rate in France looks to be 1.83 children for every woman. The overall life expectancy at birth in France was expected to be 82.32 years in 2021. Over the years, the nation's rate has remained consistent. The death rate in France fell by 0.2 per 1,000 people (-2.02%) in 2021 compared to 2020. Overall, the death rate decreased, falling to 9.7 deaths per 1,000 people in 2021. According to the data, there are more people in the country who will need more space to live in, which may help the market expand.

- In France, there were about 31 million households in 2021, and there were 2.19 individuals in each family on average as of 2018. In France, as of the fourth quarter of 2021, there were over 29,712 new dwelling units that had been sold or reserved for sale. There were around 27,918 completed or scheduled house sales in the fourth quarter of 2020. The rising number of homes sold is expected to increase the usage of LEDs in the country.

- As of January 2022, there were more than 38.7 million passenger vehicles in the French fleet, up from over 35.8 million in 2011. Until 2022, the number of passenger vehicles on the road had continuously increased. Additionally, since electric passenger car registrations first appeared on the French automobile market, they have dramatically increased. Nearly 219,800 new battery-powered electric private and utility cars were registered in France in 2022, which was an increase of almost 26.1% from the previous year. The sale of LEDs in France may benefit from the rise in automotive vehicle sales.

France Outdoor LED Lighting Industry Overview

The France Outdoor LED Lighting Market is fragmented, with the top five companies occupying 30.14%. The major players in this market are ams-OSRAM AG, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Signify Holding (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 BEGA Lighting

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 Fagerhult (Fagerhult Group)

- 6.4.5 Feilo Sylvania (Shanghai Feilo Acoustics Co., Ltd)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Signify Holding (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms