|

市場調查報告書

商品編碼

1683930

亞太戶外 LED 照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

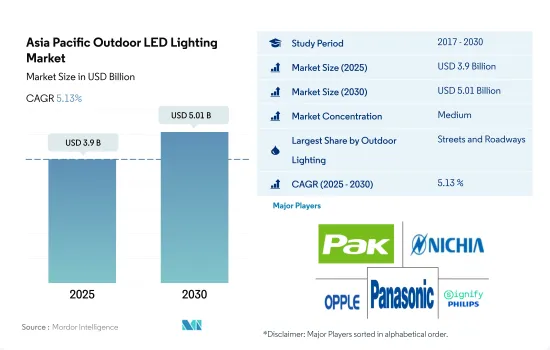

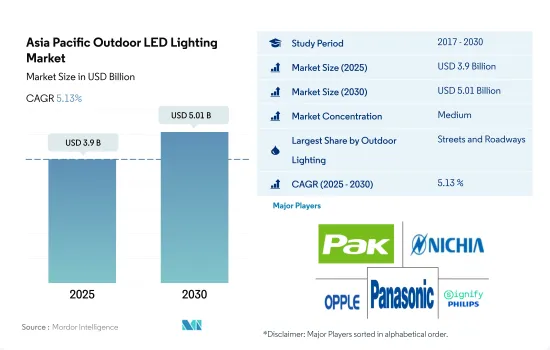

亞太地區戶外 LED 照明市場規模預計在 2025 年為 39 億美元,預計到 2030 年將達到 50.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.13%。

在亞太地區,道路和公共建築的興起正在推動LED照明的發展。

- 就 2023 年的金額佔有率而言,街道和道路子區隔將佔據大部分佔有率,其次是公共場所和其他場所。亞太地區幅員遼闊,大多數國家都開發中國家,因此公路和公路提供了該地區大部分的交通連接。經濟成長高度依賴該行業。該地區正在快速投資重建和擴大現有道路網路。 LED 照明公司正與各國政府合作,以 LED 照明取代傳統路燈。泰國政府計劃將曼谷老舊路燈更換為40萬多盞LED路燈,可節省70%的能源。

- 就 2023 年的體積佔有率而言,公共場所子區隔將佔據大部分佔有率,其次是街道、道路和其他。由於人口、購買力、旅行和旅遊業的成長,停車位的需求逐年增加。韓國、中國和日本三大市場分別實現了8.3%、2.9%和2.3%的門市成長。預計咖啡店市場趨勢將以 alpha 和 beta 世代增加,導致 LED 需求量增加。機場的進一步建設和發展預計將增加市場需求。例如,投資 145 億美元的越南機場發展計劃(它是世界上最昂貴的待開發區機場之一)和由企業集團聖米格爾集團 (SMC) 資助的投資 135 億美元的新計畫。例如,馬尼拉國際機場(NMIA)正在建設中。

印度、中國、日本和其他亞太國家的政府推廣 LED 照明的計畫預計將推動戶外 LED 照明市場的發展。

- 從金額佔有率來看,日本將在 2022 年佔據大部分市場佔有率,其次是印度、中國和亞太地區的其他國家。為了解決電力短缺問題,日本政府正用節能的LED照明系統取代白熾燈泡。日本不斷擴張的消費性電子產業也推動了智慧型手機、功能手機、數位攝影機和其他電子設備中 LED 照明的使用增加。這些燈也用於汽車、通用照明、交通號誌和標誌、醫療、學術和法醫學行業。日本政府設立各種優惠及補貼制度,推動LED照明的引進。 LED 技術的快速進步推動著製造商推出效率和耐用性更高的創新照明產品。

- 從銷售佔有率來看,日本將在 2022 年佔據大部分市場佔有率,其次是印度、中國和亞太地區的其他國家。 UJALA計劃改變了印度的LED照明產業。自 2014 年以來,三年內LED燈的需求增加了 50 倍,但零售市場價格(在 UJALA 以外銷售的燈具)卻下降了三分之一。價格下降是由於 UJALA 計劃帶來的需求大幅增加而實現的規模經濟,同時伴隨著全球 LED 晶片價格下降的趨勢。印度的LED燈生產能力也大幅提升,目前註冊的生產工廠約有176家。

- 亞太地區其他地區正加速採用室內和室外 LED 照明。因此,隨著採用率的提高,預計預測期內亞太地區的 LED 滲透率將會增加。

亞太戶外 LED 照明市場趨勢

新體育場建設維修推動市場成長

- 體育場數量預計將從 2022 年的 650 個成長到 2030 年的 732 個,複合年成長率為 1.5%。近年來,體育領域發生了許多變化。例如,珀斯體育場於 2017 年成為亞太地區首個全面採用 LED 照明的多功能體育場。該地區重要的賽事主辦組織包括印度板球管理委員會 (BCCI)、印度板球超級聯賽 (IPL)、紐西蘭板球協會、撒哈拉印度力量隊和墨爾本板球協會,這些組織對該地區體育場基礎設施建設產生了影響。例如,瓦拉納西體育場的建設將耗資3億美元。印度板球管理委員會 (BCCI) 計劃總合五座新體育場。這些因素正在支持該地區LED市場的擴張。

- 中國、印度、新加坡、澳洲和日本等國家都致力於興建新體育場,同時也維修現有的體育場。例如,2017年新南威爾斯州政府宣布計劃斥資超過15.3億美元重建其足球場和奧林匹克體育場。政府在體育領域的活動正在支持亞太LED市場的擴張。例如,印度政府的「Khelo India」、「Fit India」和「Smart City」等措施推動了印度體育場館的發展。該計劃旨在提高印度全國體育運動的參與度,改善體育設施,使印度在奧運會和其他重大體育賽事上充分發揮其潛力。此外,即將舉行的板球世界盃(印度)和國際足總女子世界盃(澳洲、紐西蘭)等體育賽事可能會推動體育場館 LED 照明的成長。

住宅和銷售的增加將推動LED市場的成長。

- 亞太地區居住世界人口的60%。尤其是中國和印度,人口成長率名列前十大國家。印度最近證明,快速且廣泛地採用 LED 技術是可能的。隨著本土人口和移民人口的快速成長,這些國家的建築業正在蓬勃發展。例如,印尼的住宅建築量在 2017 年成長了 5%,在 2019 年成長了 1%,由於該國人口的成長,這一趨勢可能會在整個預測期內持續下去。因此,亞太地區建築業的快速擴張將推動市場對LED的需求。

- 隨著本土人口和移民人口的快速成長,其他國家的建築業也蓬勃發展。例如,印尼的住宅在 2017 年成長了 5%,2019 年成長了 1%,由於該國人口的成長,這一趨勢將在整個預測期內持續下去。因此,亞太地區建築業的快速擴張將增加該區域市場對LED的需求。

- 截至2021年,中國是亞太地區家庭數量最多的國家,家庭總數超過4.497億戶。此外,印度、印尼和日本分別擁有2.951億戶、6,890萬戶和4,850萬戶家庭。這些國家的家庭數量正在穩步增加,這意味著正在建造的住宅數量將增加,從而推動亞太地區對 LED 的需求。 2022年亞太地區售出的3,750萬輛乘用車中,中國佔了2,360多萬輛。同時,2021年亞太地區乘用車銷量總計約3,457萬輛。亞太地區汽車銷售的成長將推動該地區的 LED 需求。

亞太地區戶外 LED 照明產業概況

亞太戶外LED照明市場呈現適度整合,前五大廠商合計佔有43.01%的市佔率。該市場的主要企業為:廣東百輝光電股份有限公司、日亞化學工業株式會社、歐普照明、松下控股株式會社和 Signify Holding (Philips)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 中國

- 印度

- 日本

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共設施

- 道路照明

- 其他

- 國家

- 中國

- 印度

- 日本

- 其他亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- EGLO Leuchten GmbH

- Guangdong PAK Corporation Co.,Ltd.

- LEDVANCE GmbH(MLS Co Ltd)

- Nichia Corporation

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Toshiba Corporation

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Asia Pacific Outdoor LED Lighting Market size is estimated at 3.9 billion USD in 2025, and is expected to reach 5.01 billion USD by 2030, growing at a CAGR of 5.13% during the forecast period (2025-2030).

Growing number of Streets and Roadways and public places drive the LED lights in APAC.

- In terms of value share in 2023, the streets and roadways subsegment accounted for a majority of the share, followed by public places and others. Asia-Pacific is a vast region, and the majority of the countries are developing nations, due to which streets and roadways account for a majority of the transport connectivity with the region. The economic growth is majorly dependent upon this sector. Redevelopment of existing road networks and investment in expanding them are carried out at an increasing pace in the region. The LED lighting companies are collaborating with country-level governments to replace traditional street lights with LED lights. The Thai government plans to replace old lights in Bangkok with over 400,000 LED street lights, saving 70% of energy.

- In terms of volume share in 2023, the public places subsegment accounted for most of the share, followed by streets, roadways, and others. With increasing population, purchasing power, and travel and tourism, the need for parking lots has also increased over the years. The three largest markets, South Korea, China, and Japan, achieved store growth of 8.3%, 2.9%, and 2.3%, respectively. The trend in the coffee shop market is expected to increase in the alpha and beta generations, leading to massive LED demand. Further construction and development of airports are expected to increase the market demand. Examples include an airport development project in Vietnam worth USD 14.5 billion, one of the most expensive greenfield airports in the world, and a new USD 13.5 billion project funded by the conglomerate San Miguel Corporation (SMC). For example, the Manila International Airport (NMIA) is under construction.

Government programs to promote LED lights undertaken in India, China, Japan, and other APAC countries are expected to boost the outdoor LED lighting market

- In terms of value share, in 2022, Japan accounted for the majority of the market share, followed by India, China, and the Rest of Asia-Pacific. The Japanese government has replaced incandescent bulbs with energy-efficient LED lighting systems to address the problem of power shortages. The expansion of the Japanese consumer electronics sector has also increased the use of LED lighting in smartphones, feature phones, digital video cameras, and other electronic devices. These lights are also used in the automotive, general lighting, traffic lights and signs, medical, academic, and forensic industries. The Japanese government offers various incentives and subsidy programs to promote the introduction of LED lighting in the country. Rapid advances in LED technology have led manufacturers to introduce innovative lighting products with increased efficiency and durability.

- In terms of volume share, in 2022, Japan accounted for the majority of the market share, followed by India, China, and the Rest of Asia-Pacific. The UJALA program has transformed the LED lighting industry in India. Demand for LED lamps increased 50-fold in the three years after 2014, but retail market prices (for lamps sold outside UJALA) fell by a third. This price drop was due to economies of scale achieved by a significant increase in demand from the UJALA program in parallel with the global trend of falling LED chip prices. The production capacity of LED lamps in India has also increased significantly, with around 176 registered manufacturing facilities.

- In the Rest of Asia-Pacific, countries are gaining momentum in the adoption of LED lights in their indoor and outdoor segments. Thus, with rising adoption, LED penetration in Asia-Pacific is expected to increase over the forecast period.

Asia Pacific Outdoor LED Lighting Market Trends

Construction and refurbishing of new stadiums to drive the growth of the market

- The number of stadiums is expected to witness growth from 650 units in 2022 to 732 units in 2030, exhibiting a CAGR of 1.5%. The sports sector has undergone several changes in recent years. For instance, Perth Stadium became the first multi-use stadium in the APAC area to be fully lighted by LEDs in 2017. Some of the organizations that host essential competitions in the region include the Board of Control for Cricket in India (BCCI), Indian Premier League (IPL), New Zealand Cricket, Sahara Force India, and Melbourne Cricket Association, affecting the construction of the stadium infrastructure in the area. For instance, the Varanasi stadium will cost USD 300 million to construct. BCCI has planned a total of five new stadiums. These elements support the expansion of the LED market in the area.

- Countries like China, India, Singapore, Australia, and Japan are concentrating on building new stadiums while refurbishing existing ones. For instance, the government of New South Wales announced plans to spend over USD 1.53 billion on the reconstruction of football and Olympic stadiums in 2017. Government activities in the sports sector support the expansion of the LED market in Asia-Pacific. For instance, the growth of sports facilities in India is fueled by government initiatives like Khelo India, Fit India, and Smart City. The efforts aim to increase sports participation across India and improve sporting facilities so that India performs to its full potential at the Olympics and other important sporting events. Additionally, upcoming sporting occasions like the Cricket World Cup (India) and the FIFA Women's World Cup (Australia and New Zealand) will drive the growth of LED lights in the stadiums.

Increase in construction and sales of residential houses to drive the growth of LED market.

- The APAC is home to 60% of the world's population. Numerous nations in the region, notably China and India, are in the top ten in terms of population growth. India has recently shown that it is possible to install LED technology quickly and extensively. These nations' construction industries are prospering as their native and immigrant populations both grow quickly. For instance, the volume of residential buildings climbed by 5% in Indonesia in 2017 and by 1% in 2019, and this trend will continue throughout the forecast period due to the countries' growing populations. As a result, the rapidly expanding building sector in APAC will increase demand for LEDs in the market.

- The other nations' construction industries are prospering as their native and immigrant populations both grow quickly. For instance, the volume of residential buildings climbed by 5% in Indonesia in 2017 and by 1% in 2019, and this trend will continue throughout the forecast period due to the countries' growing populations. As a result, the rapidly expanding building sector in Asia-Pacific will increase the demand for LEDs in the regional market.

- China has the most households in APAC as of 2021, with a total of over 449.7 million. In addition, there are 295.1, 68.9, and 48.5 million households in India, Indonesia, and Japan, respectively. There is a steady rise in the number of households in these nations, which suggests that more homes are being built and that the demand for LEDs in the APAC area is rising. Over 23.6 million of the 37.5 million passenger cars sold in the Asia-Pacific area in 2022 were in China. Comparatively, the Asia-Pacific area sold about 34.57 million passenger cars in 2021. The demand for LEDs in the region will be aided by the rise in automotive vehicle sales in the APAC region.

Asia Pacific Outdoor LED Lighting Industry Overview

The Asia Pacific Outdoor LED Lighting Market is moderately consolidated, with the top five companies occupying 43.01%. The major players in this market are Guangdong PAK Corporation Co.,Ltd., Nichia Corporation, OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 China

- 4.8.2 India

- 4.8.3 Japan

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

- 5.2 Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 Guangdong PAK Corporation Co.,Ltd.

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 Nichia Corporation

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify Holding (Philips)

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms