|

市場調查報告書

商品編碼

1683467

印度戶外 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

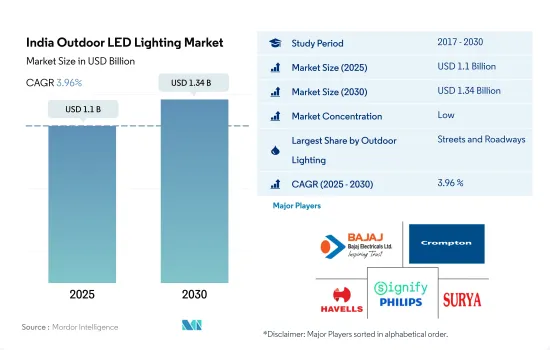

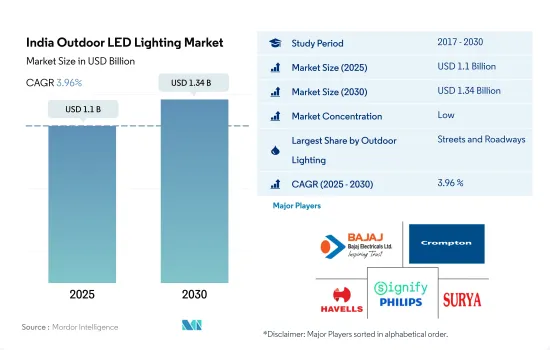

印度戶外 LED 照明市場規模預計在 2025 年為 11 億美元,預計到 2030 年將達到 13.4 億美元,預測期內(2025-2030 年)的複合年成長率為 3.96%。

道路和街道的發展為國家經濟成長將導致 LED 照明的銷售增加

- 就2023年的金額佔有率而言,街道和道路預計將佔大多數,其次是公共設施和其他。印度擁有世界第二大公路網,總長度達640萬公里,包括國道、州道、城市公路和鄉村公路。對道路部門和基礎設施的投資對於確保最後一哩的連通性至關重要。每年,高速公路承載著約85%的客運量和70%的貨運量。短距離旅行非常適合公路運輸,道路的發展對國家至關重要。就2022年的交通量佔有率而言,道路及車道將佔大多數,其次是公共場所和其他。

- 印度政府計劃在 2022 年建造 65,000 公里的國家高速公路,耗資 53.5 億印度盧比(7,415.1 億美元)。安得拉邦將興建8,970公里的道路,耗資2.9605億美元。加爾各答市照明委員會在 Tollygunge-Jadavpur 道路網路的關鍵區域安裝了 75,000 盞 LED 燈,取代傳統的鈉燈,以改善街道照明並降低能源消耗。因此,由於道路上 LED 照明的使用增加而導致的道路網路整體成長可能會增加該國對 LED 照明的需求。

- 智慧街道照明被視為節約能源和降低營運成本的理想起點。例如,2020 年 7 月,印度查謨和克什米爾邦政府主導在斯利那加安裝 LED 路燈,作為其智慧城市計畫的一部分。

印度戶外 LED 照明市場趨勢

國家體育聯賽的推廣促進了體育場館的發展

- 預計體育場數量將從 2022 年的 114 個成長到 2030 年的 137 個,複合年成長率為 2.3%。近年來,體育領域發生了許多變化。例如,在古吉拉突邦特拉的帕特爾體育場,於 2021 年安裝了 LED 泛光燈,以最大限度地減少比賽期間的陰影,讓人們更容易看到空中的球。巴拉巴蒂體育場預計到 2022 年將安裝 384 盞 LED 燈。飛利浦是該照明的供應商。拉傑果德板球場原計劃於 2023 年配備節能 LED。此外,萬克德體育場已於 2023 年世界盃前安裝了新的泛光燈。總合有五座體育場在世界盃前進行了升級和維修。這些因素促進了該國LED市場的成長。

- 亞運會、英聯邦運動會、國際足總 17 歲以下世界盃和板球世界盃只是印度舉辦過的部分國際體育賽事。其他國內體育聯賽包括印度超級聯賽、i 聯賽和印度超級聯賽。除每年的印度板球超級聯賽外,印度各地的體育場還舉辦許多其他板球錦標賽。預計,由於世界盃等大型體育賽事的舉辦,體育場館基礎設施和新建築的資金將會增加。例如,奧裡薩邦政府宣布計劃在 2021 年建造 89 座多功能體育場,預算為 69.335 億印度盧比。此外,一座國際體育場將於 2023 年在瓦拉納西開始建設,預計 2024 年完工。因此,新體育場的維修和建設以及體育賽事的增加預計將增加該國的 LED 照明銷售。

印度政府計劃提供經濟適用住宅,推動該國 LED 照明發展

- 2023年,印度人口將超過14億人。 2021 年,印度每 1,000 人口的出生率約為 16.42,這意味著每位母親大約生育 2.03 個孩子。印度雄心勃勃的 Pradhan Mantri Awas Yojana (PMAY) 計劃推動了住宅行業的發展,該計劃的目標是到 2022 年在全國大都會圈建造 2000 萬套經濟適用住宅。預計都市區住宅單元的成長以及商業和零售辦公空間的擴大將需要提高能源效率。預計這將推動對節能 LED 照明的需求。 2023年7月乘用車、三輪車、摩托車和四輪車總產量為208萬輛。到 2030 年,印度有望成為共享出行領域的領導者,為能源和自動駕駛汽車提供者機。印度政府已設定目標,到2030年,使在印度銷售的新車中有30%實現節能。使用LED燈照明非常重要,預計將促進LED的銷售。

- 印度汽車工業正在大幅擴張。 2021年4月至2022年3月生產的汽車數量為23,040,066輛,而2022年4月至2023年3月生產的汽車數量為25,931,867輛。 2023 年乘用車銷量將從 2022 年的 14,67,039 輛增加到 17,47,376 輛。印度人的汽車持有超過 7%。乘用車的需求龐大,預計在預測期內將繼續成長。隨著道路上車輛數量的增加,對可靠、明亮的車載照明,尤其是節能 LED 的需求也將持續成長。

印度戶外LED照明產業概況

印度戶外LED照明市場較為分散,前五大公司的市佔率為22.31%。市場的主要企業是:Bajaj Electrical Ltd、Crompton Greaves Consumer Electricals Limited、Havells India Ltd.、Signify Holding(飛利浦)和 Surya Roshni Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明電力消耗量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 印度

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共設施

- 道路照明

- 其他

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Bajaj Electrical Ltd

- Crompton Greaves Consumer Electricals Limited

- Eveready Industries India Limited

- Havells India Ltd.

- OPPLE Lighting Co., Ltd

- Orient Electric Limited

- Signify Holding(Philips)

- Surya Roshni Limited

- Syska Led Lights Private Limited

- Wipro Lighting Limited(Wipro Enterprises Ltd.)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The India Outdoor LED Lighting Market size is estimated at 1.1 billion USD in 2025, and is expected to reach 1.34 billion USD by 2030, growing at a CAGR of 3.96% during the forecast period (2025-2030).

The development of roadways and streetways for the economic growth of the country leads to an increase in sales of LED lights

- It is projected that streets and roadways will account for the majority of the value share in 2023, followed by public places and others. India boasts the second-largest road network globally, with a total length of 6.4 million kilometers comprising national, state, urban, and rural roads. Investing in the road sector and infrastructure is crucial to ensure connectivity to the last mile. Every year, highways transport around 85% of passenger and 70% of freight traffic. Shorter trips are better suited to road traffic, making the growth of roadways imperative for the country. In terms of volume share, streets and roadways accounted for the majority share in 2022, followed by public places and others.

- The government plans to spend INR 5.35 billion (USD 741.51 billion) to construct 65,000 kilometers of national highways by 2022. Andhra Pradesh will build 8,970 kilometers of roads for USD 296.05 million. To improve street lighting and reduce energy consumption, the Kolkata Municipal Lighting Department installed 75,000 LED lights in key areas of the Tollygunge Jadavpur street network to replace conventional sodium lamps. Therefore, the road network's overall growth due to the increasing use of LED lighting on roads will increase the demand for LED lighting in the country.

- Smart street lighting is considered an ideal starting point to enable energy savings and operational cost savings. For instance, in July 2020, the Government of Jammu and Kashmir (India) led an effort to install LED street lighting in Srinagar as part of its smart city mission.

India Outdoor LED Lighting Market Trends

The promotion of national-level sports leagues is complementing the growth of stadiums

- The number of stadiums is expected to grow from 114 units in 2022 to 137 units in 2030, exhibiting a CAGR of 2.3%. The sports sector has undergone several changes in recent years. For instance, LED floodlights were placed in the Patel Stadium in Motera, Gujarat, in 2021 to minimize shadows and make it simpler to see aerial balls during games. Barabati Stadium was expected to have 384 LED lights installed by 2022. Philips is the supplier of these lights. The Rajkot Cricket Stadium was expected to be outfitted with energy-efficient LEDs in 2023. Additionally, the Wankhede Stadium had new floodlights built in time for the 2023 World Cup. In total, five stadiums were upgraded and renovated in advance of the World Cup. These factors contributed to the growth of the LED market in the country.

- The Asian Games, the Commonwealth Games, the FIFA Under-17 World Cup, and the Cricket World Cup were just a few of the international sporting events that were held in India. The Indian Premier League, the I-League, and the Indian Super League are additional domestic sports leagues. Numerous more cricket competitions, in addition to the yearly Indian Premier League, are held at Indian stadiums. Funding for stadium infrastructure and new buildings is anticipated to increase as a result of major sporting events like the World Cup. For instance, the Government of Odisha announced plans to build 89 multipurpose stadiums in 2021 at a budget of INR 693.35 Crore. Additionally, Varanasi was expected to start building an international stadium in 2023, which is projected to be finished by 2024. Thus, the renovation and construction of new stadiums and an increase in sporting tournaments are expected to increase sales of LED lights in the country.

Indian government schemes are providing affordable residential homes, boosting the LED light penetration in the country

- In 2023, India had a population of over 1.40 billion. In India, there were roughly 16.42 live births per 1,000 people in 2021, with approximately 2.03 children born to each mother. The national government's ambitious Pradhan Mantri Awas Yojana (PMAY) scheme, which aimed to construct 20 million affordable residences in metropolitan areas all across the nation by 2022, drove the residential sector. The anticipated expansion in urban housing units, along with the rising commercial and retail office space, necessitates greater energy efficiency. This is projected to drive the demand for energy-efficient LED lighting. In July 2023, the total production of passenger vehicles, three-wheelers, two-wheelers, and quad bikes was 2.08 million units. In 2030, India is expected to be a leader in shared mobility, providing opportunities for energy and autonomous vehicles. The Indian government has set a target to have 30% of new cars sold in India be energy-efficient by 2030. Lighting using LED lights will be very important, boosting LED sales.

- In India, the automotive industry has experienced significant expansion. In comparison to 23,040,066 automobiles produced from April 2021 to March 2022, the industry produced 25,931,867 vehicles from April 2022 to March 2023. The sales of passenger cars in 2023 increased from 14,67,039 in 2022 to 17,47,376. The percentage of Indians who own an automobile exceeded 7%. With a sizable demand for passenger vehicles, the expanding trend is anticipated to continue during the forecast period. The demand for dependable and brilliant car lighting, particularly LEDs due to their energy efficiency, will increase more as the number of vehicles on the road rises.

India Outdoor LED Lighting Industry Overview

The India Outdoor LED Lighting Market is fragmented, with the top five companies occupying 22.31%. The major players in this market are Bajaj Electrical Ltd, Crompton Greaves Consumer Electricals Limited, Havells India Ltd., Signify Holding (Philips) and Surya Roshni Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 India

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Bajaj Electrical Ltd

- 6.4.2 Crompton Greaves Consumer Electricals Limited

- 6.4.3 Eveready Industries India Limited

- 6.4.4 Havells India Ltd.

- 6.4.5 OPPLE Lighting Co., Ltd

- 6.4.6 Orient Electric Limited

- 6.4.7 Signify Holding (Philips)

- 6.4.8 Surya Roshni Limited

- 6.4.9 Syska Led Lights Private Limited

- 6.4.10 Wipro Lighting Limited (Wipro Enterprises Ltd.)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms