|

市場調查報告書

商品編碼

1683955

日本戶外 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Japan Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

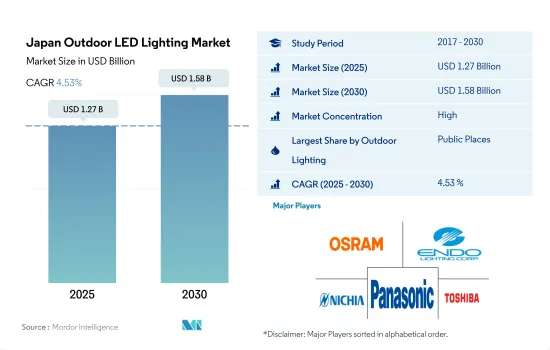

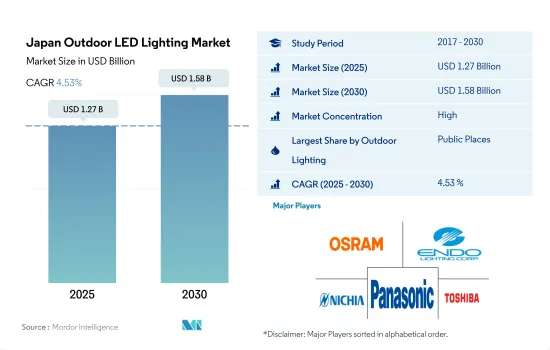

日本戶外 LED 照明市場規模預計在 2025 年為 12.7 億美元,預計到 2030 年將達到 15.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.53%。

旅遊業的蓬勃發展和政府在公共設施領域的舉措將推動日本 LED 照明的需求

- 從金額佔有率來看,2023年公共場所將佔據大部分佔有率,其次是道路和公路以及其他。隨著旅遊業的發展,日本的公共空間也逐年擴大。自 COVID-19 疫情爆發以來,日本政府已逐步取消旅行限制。鑑於邊境管制方面的積極進展以及業界為鼓勵日本消費者出國旅遊所做的努力,現在是美國旅遊業向日本市場推廣旅遊目的地和服務的好機會。因此,旅遊業的成長為該國美化和展示公共空間創造了機會。隨著遊客數量的增加,遊樂園、機場/火車站停車場等都出現了各種各樣的發展,LED照明在這些領域也越來越受歡迎。

- 從體積佔有率來看,2023年公共場所將佔據大部分佔有率,其次是道路和公路以及其他。由於旅遊業的熱烈反應和技術的不斷進步,LED 照明主要用於公共場所。東京都政府發起了宣傳活動,透過在家庭中改用 LED 照明來推動節能。東京都政府在2016年制定的2020年行動計畫中,致力於建立一個不斷發展、充滿活力、向世界開放、環境友善的「智慧城市東京」。

- 人們對日本政府主導的新道路建設和現有國道的再開發寄予厚望。這些因素也推動了日本戶外對 LED 照明的需求。

日本戶外LED照明市場趨勢

新體育場館的建設和 LED 照明的安裝將推動市場成長

- 預計體育場數量將從 2022 年的 105 個成長到 2030 年的 128 個,複合年成長率為 2.5%。近年來,體育領域發生了許多變化。例如,位於愛知縣的豐田體育場,Signify 於 2019 年在此推出了其互聯照明系統「Interact Sports」。在 2019 年橄欖球世界盃和 2020 年東京奧運足球比賽之前,日本橫濱國際體育場(日產體育場)已經安裝了 LED 技術 Total Light Control-TLC。在日本 2019 年橄欖球世界盃之前,Signify 已經在神戶三崎體育場安裝了 LED 照明。這些因素正在支持該地區LED市場的擴張。

- 在日本,我們為許多體育項目的體育場建設做出了貢獻。例如長崎體育場城的建設將於2022年開始,該計劃先前預計耗資700億日圓(4.274億英鎊,4.936億歐元)。但由於計畫變更和材料成本增加,目前預計總建設成本將超過800億日圓。該體育場還將配備LED照明以節省能源。根據日本體育理事會的契約,將於 2022 年在東京市中心建造一座新體育場,以取代秩父宮橄欖球場。新球場預計2024年開始動工,2027年後開始營運。此外,金澤球場預計於2023年建成,2024年賽季開始前開放。預計這些因素將在未來幾年推動 LED 市場的發展。

家庭數量增加推動 LED 照明市場成長

- 2021年日本總人口預計為1.2551億人。在日本,2021年每名婦女將生育1.3名孩子。 2021年,日本登記出生嬰兒約811,600名。住宅空置率上升將擴大市場規模。 2022年日本住宅數約85.95萬棟。政府支出增加、住宅項目補貼以及政府對重大計劃項目的預期關注都有望促進日本住宅市場的擴張,最終導致 LED 銷售增加。因此,商業房地產價格下跌將鼓勵更多的商業土地購買,這將有助於未來幾年 LED 使用量的擴大。

- 截至2020年,日本家庭數約為5,570萬戶。其中核心家庭戶佔54.2%,單人家庭戶佔38.1%。 2022 年的平均家庭規模將為 2.2 人。日本平均每個家庭有4.4個房間。 2021年日本住宅數量為5,560萬套。當年該指標較去年與前一年同期比較成長0.6%。該指數從2010年到2021年成長了8.5%。日本LED的擴張將受到家庭數量的成長所推動。

- 截至2020年8月31日,日本有近46.1%的家庭持有至少一輛乘用車。日本新車註冊量將從去年的約445萬輛減少到2022年的約420萬輛。此外,2022年新車註冊量約420萬輛。這些註冊量顯示汽車領域LED市場正在成長。

日本戶外LED照明產業概況

日本戶外LED照明市場格局較為集中,前五大公司合計佔66.76%的市佔率。市場的主要企業是:ams-OSRAM AG、Endo Lighting Corporation、Nichia Corporation、Panasonic Holdings Corporation 和 Toshiba Corporation(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 日本

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共設施

- 道路照明

- 其他

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ams-OSRAM AG

- Endo Lighting Corporation

- Japan Street Light Mfg. Co., Ltd.

- Lumileds Holding BV

- Nichia Corporation

- NVC INTERNATIONAL HOLDINGS LIMITED

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Takasho Digitec Co. Ltd

- Toshiba Corporation

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Japan Outdoor LED Lighting Market size is estimated at 1.27 billion USD in 2025, and is expected to reach 1.58 billion USD by 2030, growing at a CAGR of 4.53% during the forecast period (2025-2030).

Increased tourism and government initiatives in public places in Japan to boost the demand for LED lights in the country

- In terms of value share, in 2023, public places accounted for the majority of the share, followed by streets and roadways and others. Public places in Japan have grown over the years with increasing travel and tourism. The Government of Japan (GOJ) has been gradually lifting travel restrictions since the start of the COVID-19 pandemic. Given these positive developments in border controls and the industry's efforts to encourage Japanese consumers to travel abroad, now is the perfect time for the US travel industry to promote its destinations and services to the Japanese market. Thus, the growth in tourism creates an opportunity for the country to display its public places in a beautified manner. Amusement parks and parking lots in airports and railway stations have gone through various developments due to increased tourism, thus increasing the penetration of LED lights in this segment.

- In terms of volume share, in 2023, public places accounted for the majority of the share, followed by streets and roadways and others. The majority of LED lights are used in the public places segment due to the overwhelming response from tourism and the growth in technological advancement. The Tokyo government launched a campaign to promote energy-saving activities by converting home lighting to LEDs. Under the 2020 Action Plan formulated in 2016, the Tokyo Metropolitan Government aims to become a "Smart City Tokyo" that is constantly evolving, dynamic, open to the world, and has excellent environmental performance.

- Japanese government-led initiatives are expected to develop new roadways and redevelop existing national highways and other roadways. These factors are also propelling the demand for LED lights in the outdoor segment in Japan.

Japan Outdoor LED Lighting Market Trends

Construction of new stadiums and installation of LED lights to drive the growth of the market

- The number of stadiums segment is expected to witness growth from 105 units in 2022 to 128 units in 2030, exhibiting a CAGR of 2.5%. The sports sector has undergone several changes in recent years. For instance, the Toyota Stadium in Aichi, Japan, where Signify installed its connected lighting system Interact Sports in 2019. Before the Rugby World Cup 2019 and the Tokyo Olympic Soccer matches slated for 2020, Total Light Control - TLC for LED technology was installed at the International Stadium Yokohama (Nissan Stadium) in Yokohama City, Japan. Ahead of the 2019 Rugby World Cup Japan, Signify installed LED lights in Kobe Misaki Stadium. These elements support the expansion of the LED market in the area.

- The nation is helping to build stadiums for numerous sports. For instance, work on Nagasaki Stadium City will start in 2022. The project was previously projected to cost JPY 70 billion (GBP 427.4 million or EUR 493.6 million). Still, it is now anticipated that the total cost will exceed JPY 80 billion due to changes in the planning and increased material costs. To save energy, the stadium will also have LED lighting installed. According to a contract awarded by the Japan Sport Council, a new stadium will be built in central Tokyo in 2022 to replace the Chichibunomiya Rugby Stadium. The new stadium is expected to break ground in 2024. After 2027, it will start operating. Additionally, Kanazawa Stadium will be constructed by 2023 and opened before the start of the 2024 season. These factors will drive the LED market in the coming years.

The increasing number of households drives the growth of the LED lighting market

- The overall population of Japan was estimated to be 125.51 million in 2021. In Japan, there are 1.3 children for every woman in 2021. Around 811.6 thousand live births were registered in Japan in 2021. The market will expand due to the rise in residential space availability. Approximately 859.5 thousand home starts were started in Japan in 2022. Increased government spending, housing program subsidies, and the government's anticipated focus on major infrastructure projects will all contribute to Japan's residential market expansion, ultimately resulting in higher LED sales. Consequently, more commercial land will be purchased as a result of the drop in the price of commercial real estate, and thus, will contribute to the greater use of LEDs in coming years.

- Around 55.7 million private households existed in Japan as a whole in 2020. About 54.2% of those were nuclear families, and 38.1% were single-person households. In 2022, there were 2.2 household members on average. Japan had 4.4 rooms per home, on average. In 2021, Japan had 55.6 million homes. In the same year, the indicator showed a 0.6% year-over-year growth. The indicator increased by 8.5% from 2010 to 2021. The expansion of LEDs in Japan will be fueled by an increase in the number of households.

- Nearly 46.1% of households in Japan had at least one passenger car as of August 31, 2020. The number of newly registered motor cars in Japan fell from roughly 4.45 million the year before to about 4.2 million in 2022. Additionally, in 2022, Japan saw the registration of almost 4.2 million new cars. These registrations show that there is a growing market for LEDs in the automobile sector.

Japan Outdoor LED Lighting Industry Overview

The Japan Outdoor LED Lighting Market is fairly consolidated, with the top five companies occupying 66.76%. The major players in this market are ams-OSRAM AG, Endo Lighting Corporation, Nichia Corporation, Panasonic Holdings Corporation and Toshiba Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Japan

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 Endo Lighting Corporation

- 6.4.3 Japan Street Light Mfg. Co., Ltd.

- 6.4.4 Lumileds Holding B.V.

- 6.4.5 Nichia Corporation

- 6.4.6 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Signify Holding (Philips)

- 6.4.9 Takasho Digitec Co. Ltd

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms