|

市場調查報告書

商品編碼

1683815

法國工程塑膠市場:佔有率分析、產業趨勢和成長預測(2025-2030 年)France Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

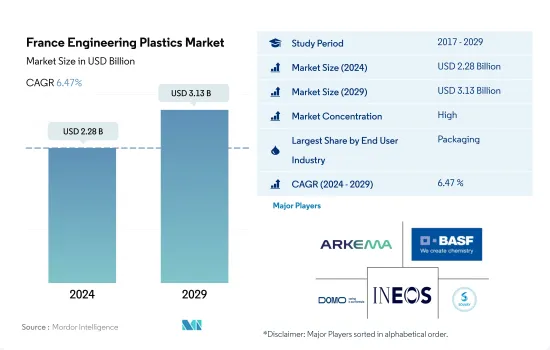

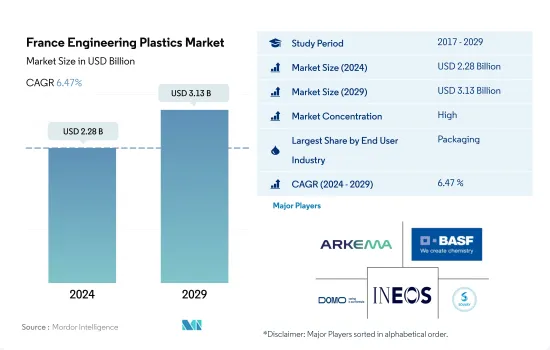

預計 2024 年法國工程塑膠市場規模將達到 22.8 億美元,到 2029 年將達到 31.3 億美元,預測期內(2024-2029 年)的複合年成長率為 6.47%。

先進材料的廣泛應用推動了工程塑膠的需求

- 工程塑膠由於其重量輕、強度高、低疲勞和低可燃性而被用於航太、包裝和其他應用的內牆板和門。

- 2022 年,法國工程塑膠市場佔歐洲工程塑膠市場的 9%(以金額為準)。消費量增加的主要促進因素之一是包裝和電氣電子行業的使用量增加。

- 包裝產業是全國最大的工程塑膠消費產業,2022年與前一年同期比較成長8.72%(以金額為準)。由於對即食簡便食品的需求增加和忙碌生活方式的興起,包裝材料的消費量增加,從而促進了這些塑膠的銷售。預計在預測期內,透過電子商務網站進行網路購物的趨勢也將推動包裝產業的發展。法國電子商務市場是最大的市場之一,在歐洲排名第二,在全球排名第五。預計將從 2023 年的 1,065 億美元成長到 2027 年的 1,517 億美元。

- 航太工業是工程塑膠成長最快的消費產業,預計在預測期內將實現最高的以金額為準,達到 8.22%。預計預測期內該國飛機零件產量的增加將推動這些塑膠的需求。例如,該國的飛機零件產量將從2022年的645億美元增加到2029年的1,030億美元。

法國工程塑膠市場趨勢

技術創新可能促進電氣和電子設備產量的增加

- 電氣電子產業技術創新的快速步伐推動著對更新、更快的電氣電子產品的持續需求,從而促進了法國的電氣電子產品生產。 2022年,法國是歐洲第二大電氣和電子產品生產國,佔8.1%的市場。

- 2020年,由於全國範圍內的封鎖和製造工廠的暫時關閉,導致供應鏈和進出口貿易中斷,該國電氣和電子產品產量與前一年同期比較減13.7%。 2021年,法國家用電器出口額達13.6億歐元,比2020年成長16.4%。因此,2021年法國電氣和電子產品生產收入與前一年同期比較成長了27.5%。

- 由於政府投資增加,法國電子產業預計將實現成長。預計到2030年將投資超過50億歐元用於電子技術的開發和工業化。預測期內,對虛擬實境、物聯網解決方案、5G 連接和機器人等先進技術的需求預計會增加。由於技術進步,預測期內對消費性電子產品的需求預計會增加。到2027年,該國消費電子產品銷售額預計將成長11.9%,市值達193億美元。

法國工程塑膠產業概況

法國工程塑膠市場相當集中,前五大公司佔據100%的市場。市場的主要企業是:阿科瑪、BASFSE、道默化學、英力士和索爾維(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築和施工

- 電氣和電子

- 包裝

- 進出口趨勢

- 價格趨勢

- 回收概述

- 聚醯胺 (PA) 回收趨勢

- 聚碳酸酯 (PC) 回收趨勢

- 聚對苯二甲酸乙二醇酯 (PET) 的回收趨勢

- 苯乙烯共聚物(ABS、SAN)的回收趨勢

- 法律規範

- 法國

- 價值鏈與通路分析

第5章 市場區隔

- 最終用戶產業

- 航太

- 車

- 建築和施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他最終用戶產業

- 樹脂類型

- 氟樹脂

- 按子類型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙烯丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯 (PVF)

- 聚二氟亞乙烯(PVDF)

- 其他子樹脂類型

- 液晶聚合物(LCP)

- 聚醯胺(PA)

- 依樹脂類型分

- 芳香聚醯胺

- 聚醯胺(PA)6

- 聚醯胺(PA)66

- 聚鄰苯二甲醯胺

- 聚丁烯對苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮 (PEEK)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚醯亞胺(PI)

- 聚甲基丙烯酸甲酯 (PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS 和 SAN)

- 氟樹脂

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務以及最新發展分析。

- Alfa SAB de CV

- Arkema

- BASF SE

- Celanese Corporation

- Domo Chemicals

- INEOS

- Mitsubishi Chemical Corporation

- Radici Partecipazioni SpA

- Rohm GmbH

- Solvay

- Teijin Limited

- Trinseo

- Victrex

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 5000156

The France Engineering Plastics Market size is estimated at 2.28 billion USD in 2024, and is expected to reach 3.13 billion USD by 2029, growing at a CAGR of 6.47% during the forecast period (2024-2029).

Rising adoption of advanced materials to drive the demand for engineering plastics

- Engineering plastics are used in interior wall panels and doors in aerospace, packaging, and other applications due to their lightweight nature, high strength, low fatigue, and low flammability.

- The French engineering plastics market accounted for 9% (by value) of the European engineering plastics market in 2022. One of the primary drivers of the increasing consumption is their increased use in the packaging and electrical and electronics industries.

- The packaging industry is the country's largest consumer of engineering plastics, accounting for 8.72% (by value) in 2022 compared to the previous year. Packaging material consumption increased due to increased demand for ready-to-eat convenience foods and the emerging trend of on-the-go lifestyles, thus boosting sales of these plastics. The growing trend of online shopping via e-commerce websites is also expected to propel the packaging industry during the forecast period. The French e-commerce market is one of the largest markets, ranking second in Europe and fifth in the world. It is projected to reach USD 151.7 billion in 2027 from USD 106.5 billion in 2023.

- The aerospace industry is expected to be the fastest-growing consumer of engineering plastics, with the highest CAGR of 8.22% in terms of value during the forecast period. The rising aircraft component production in the country is projected to drive the demand for these plastics during the forecast period. For instance, the country's aircraft component production reached USD 103 billion in 2029 from USD 64.5 billion in 2022.

France Engineering Plastics Market Trends

Technological innovations may increase electrical and electronics production

- The rapid pace of technological innovation in the electrical and electronics industry is driving consistent demand for newer and faster electrical and electronic products, thus boosting their production in France. In 2022, France was the second-largest producer of electrical and electronic products, accounting for 8.1% of the European market.

- In 2020, the country's electrical and electronic production decreased by 13.7% in terms of revenue compared to the previous year, owing to country-wide lockdowns and the temporary shutdown of manufacturing facilities, leading to disruptions in supply chains and import and export trade. In 2021, France's consumer electronics exports reached EUR 1.36 billion, 16.4% higher than in 2020. As a result, electrical and electronic production in France recorded a growth rate of 27.5% by revenue in 2021 compared to the previous year.

- The French electronics industry is expected to grow due to rising government investments. It is expected to receive more than EUR 5 billion in investment by 2030 for the development and industrialization of electronic technologies. The demand for advanced technologies such as virtual reality, IoT solutions, 5G connectivity, and robotics is expected to grow during the forecast period. Due to technological advancements, the demand for consumer electronics is expected to rise during the forecast period. By 2027, the sales of consumer electronics in the country are projected to grow by 11.9% and generate a market value of USD 19.3 billion.

France Engineering Plastics Industry Overview

The France Engineering Plastics Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are Arkema, BASF SE, Domo Chemicals, INEOS and Solvay (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 France

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alfa S.A.B. de C.V.

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 Celanese Corporation

- 6.4.5 Domo Chemicals

- 6.4.6 INEOS

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Radici Partecipazioni SpA

- 6.4.9 Rohm GmbH

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Trinseo

- 6.4.13 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219