|

市場調查報告書

商品編碼

1686670

德國工程塑膠:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Germany Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

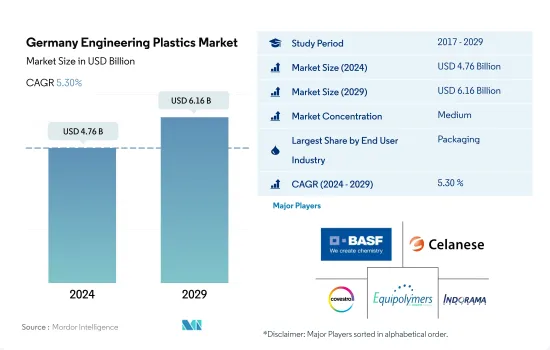

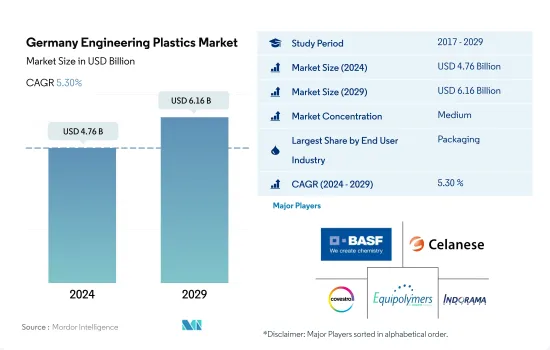

預計 2024 年德國工程塑膠市場規模將達到 47.6 億美元,到 2029 年將達到 61.6 億美元,預測期內(2024-2029 年)的複合年成長率為 5.30%。

先進材料的廣泛應用推動了工程塑膠的需求

- 2022年,德國工程塑膠市場約佔歐洲工程塑膠市場的21.5%(以金額為準)。工程塑膠消費量不斷增加的主要原因之一是其在包裝、電氣電子工業中的應用不斷擴大。

- 包裝產業是市場最大的產業,2022年年與前一年同期比較5.9%(以金額為準)。即食簡便食品的需求不斷成長以及忙碌生活方式的興起推動了包裝材料消費量的增加,從而促進了工程塑膠的銷售。透過電子商務網站進行網路購物的趨勢也推動了包裝產業的發展。

- 電氣和電子產業位居第二,預計 2023 年的消費量將比 2022 年成長 12%。先進材料、有機電子、小型化以及人工智慧 (AI) 和物聯網 (IoT) 等顛覆性技術的使用等趨勢正在推動智慧製造實踐並成為產業發展的驅動力。

- 預計預測期內(2023-2029 年),市場複合年成長率將達到 5.53%,其中航太產業由於航太零件產量的增加,以金額為準複合年成長率最高,為 7.55%。例如,航太零件生產收入預計將在 2029 年達到 662 億美元,而 2022 年將達到 423 億美元。

德國工程塑膠市場趨勢

技術創新可能會增加電氣和電子設備的產量

- 可支配收入的增加、技術進步、生活水準的提高以及對智慧家庭和辦公室的偏好的改變正在推動電氣和電子行業的成長。 2017年,德國是最大的電氣和電子設備生產國,約佔歐洲市場的24.3%。

- 2020年,由於全國範圍內的封鎖和製造工廠的暫時關閉,該國電氣和電子設備產量與前一年同期比較下降3.7%,這導致了供應鏈中斷等一系列問題。 2020年,德國電氣產業出口額為2,240億美元,與前一年同期比較下降6.6%。 2021年,德國電氣電子產業出口額達2,246億歐元,較2020年成長10.1%。因此,2021年該國電氣電子設備產量以銷售量計算成長了7.5%。

- 技術創新的快速步伐推動著對更新、更快的電氣和電子產品的持續需求。預測期內,對虛擬實境、物聯網解決方案、5G 連接和機器人等先進技術的需求預計將會增加。由於技術進步,預測期內對家用電子電器的需求預計會增加。 2027年,該國消費電子產品預計將成長8.7%,市場規模約188億美元。因此,預計電氣和電子設備生產的需求將會增加。到2027年,德國預計將成為歐洲最大的電氣和電子設備生產國,佔約22.2%的市場。

德國工程塑膠產業概況

德國工程塑膠市場格局中等整合,前五大公司市佔率合計為59.43%。該市場的主要企業是: BASF SE、Celanese Corporation、Covestro AG、Equipolymers 和 Indorama Ventures Public Company Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築和施工

- 電氣和電子

- 包裝

- 進出口趨勢

- 價格趨勢

- 回收概述

- 聚醯胺 (PA) 回收趨勢

- 聚碳酸酯 (PC) 回收趨勢

- 聚對苯二甲酸乙二醇酯 (PET) 的回收趨勢

- 苯乙烯共聚物(ABS、SAN)的回收趨勢

- 法律規範

- 德國

- 價值鏈與通路分析

第5章 市場區隔

- 最終用戶產業

- 航太

- 車

- 建築和施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他最終用戶產業

- 樹脂類型

- 氟樹脂

- 依亞型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯 (PVF)

- 聚二氟亞乙烯(PVDF)

- 其他子樹脂類型

- 液晶聚合物(LCP)

- 聚醯胺(PA)

- 副樹脂類型

- 芳香聚醯胺

- 聚醯胺(PA)6

- 聚醯胺(PA)66

- 聚鄰苯二甲醯胺

- 聚丁烯對苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮 (PEEK)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚醯亞胺(PI)

- 聚甲基丙烯酸甲酯 (PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS 和 SAN)

- 氟樹脂

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介.

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty SA

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Rohm GmbH

- Trinseo

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 53990

The Germany Engineering Plastics Market size is estimated at 4.76 billion USD in 2024, and is expected to reach 6.16 billion USD by 2029, growing at a CAGR of 5.30% during the forecast period (2024-2029).

Rising adoption of advanced materials to drive the demand for engineering plastics

- The German engineering plastics market accounted for around 21.5%, by value, of the European engineering plastics market in 2022. One of the major reasons behind the rise in the consumption of engineering plastics is their increasing application in the packaging and electrical and electronics industries.

- The packaging industry comprises the largest industry in the market, with a growth rate of 5.9%, by value, in 2022 compared to the previous year. With the increased demand for ready-to-eat convenience food and the emerging trend of on-the-go lifestyles, the consumption of packaging materials increased, bolstering the sales of engineering plastics. The emerging trend of online shopping from e-commerce websites also serves as a driving factor in the packaging industry.

- The electrical and electronics industry is the second-largest, which is expected to witness a consumption of 12%, by volume, in 2023 compared to 2022. Trends like the use of advanced materials, organic electronics, miniaturization, and disruptive technologies like artificial intelligence (AI) and the Internet of Things (IoT) have enabled smart manufacturing practices and worked as growth drivers for the industry.

- The market is expected to register a CAGR of 5.53% during the forecast period (2023-2029), with the aerospace industry reporting the highest CAGR of 7.55%, by value, due to an increase in the production of aerospace components. For instance, aerospace component production revenue is expected to reach USD 66.2 billion by 2029 compared to USD 42.3 billion in 2022.

Germany Engineering Plastics Market Trends

Technological innovations are likely to increase electrical and electronics production

- Rising disposable incomes, technological advancements, improvement in living standards, and shifting preferences toward smart homes and offices are driving the growth of the electrical and electronics industry. In 2017, Germany was the largest electrical and electronics producer, accounting for around 24.3% of the European market.

- In 2020, the electrical and electronic production in the country decreased by 3.7% by revenue compared to the previous year, owing to country-wide lockdowns and the temporary shutdown of manufacturing facilities, causing several issues, including supply chain disruptions. In 2020, the exports of Germany's electrical industry were USD 224 billion, 6.6% lower than the previous year. In 2021, German export of the electrical and electronics industry reached a value of EUR 224.6 billion, 10.1% higher compared to 2020. As a result, electrical and electronics production in the country increased by a growth rate of 7.5% by revenue in 2021.

- The rapid pace of technological innovation is driving consistent demand for newer and faster electrical and electronic products. The demand for advanced technologies such as virtual reality, IoT solutions, 5G connectivity, and robotics is expected to grow during the forecast period. As a result of technological advancements, demand for consumer electronics is expected to rise during the forecast period. By 2027, consumer electronics in the country are projected to grow by 8.7% and generate a market volume of around USD 18.8 billion. As a result, it is projected to increase the demand for electrical and electronics production. By 2027, Germany is projected to hold the largest electrical and electronics production, accounting for around 22.2% of the European market.

Germany Engineering Plastics Industry Overview

The Germany Engineering Plastics Market is moderately consolidated, with the top five companies occupying 59.43%. The major players in this market are BASF SE, Celanese Corporation, Covestro AG, Equipolymers and Indorama Ventures Public Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Germany

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 BARLOG Plastics GmbH

- 6.4.3 BASF SE

- 6.4.4 Celanese Corporation

- 6.4.5 Covestro AG

- 6.4.6 Domo Chemicals

- 6.4.7 DuBay Polymer GmbH

- 6.4.8 Equipolymers

- 6.4.9 Evonik Industries AG

- 6.4.10 Grupa Azoty S.A.

- 6.4.11 Indorama Ventures Public Company Limited

- 6.4.12 INEOS

- 6.4.13 LANXESS

- 6.4.14 Rohm GmbH

- 6.4.15 Trinseo

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219