|

市場調查報告書

商品編碼

1686174

歐洲工程塑膠:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Europe Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

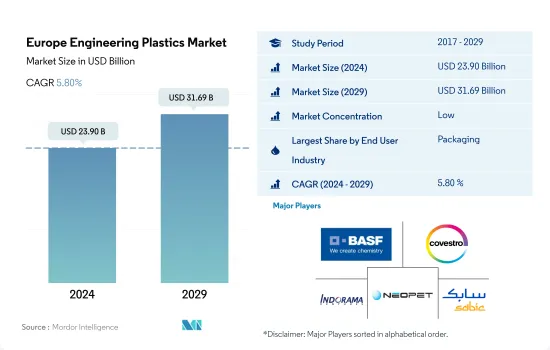

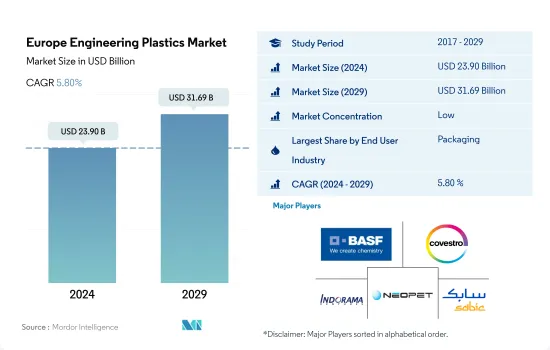

預計 2024 年歐洲工程塑膠市場規模將達到 239 億美元,到 2029 年預計將達到 316.9 億美元,預測期內(2024-2029 年)的複合年成長率為 5.80%。

預測期內包裝將佔據市場主導地位

- 工程塑膠的用途無窮,而且往往比通用塑膠或一般塑膠具有更好的機械性能和熱性能。受包裝、電氣和電子產業需求成長的推動,歐洲工程塑膠消費量在2017年至2019年間成長了5.1%。

- 由於大量生產用於包裝飲料、飲用水、個人護理、家用產品等的塑膠瓶,包裝行業消耗了該地區大部分的工程塑膠。由於全球供應鏈中斷,2020年疫情期間所有產業的消費量總合去年同期與前一年同期比較了6.2%。但預計2021年市場將復甦,2022年成長4.6%,延續穩定成長。

- 由於歐洲生產的汽車數量龐大,汽車產業是繼包裝產業之後工程塑膠的第二大消費產業。 2020年,受疫情封鎖、出行限制及汽車工廠關閉等影響,汽車產量大幅下降,導致汽車領域消費量與前一年同期比較下降22.69%。

- 預計歐洲航太領域的支出將出現最快的成長,預測期內(2023-2029 年)的複合年成長率為 7.78%。這是因為生產飛機零件是為了滿足對更輕、更省油的飛機日益成長的需求。

未來幾年德國將主導市場

- 在歐洲,工程塑膠作為聚合物在各種終端使用者產業中發揮重要作用,包括包裝、電氣和電子、汽車、航太、工業和機械。

- 由於包裝、建築、電氣電子和汽車行業的不斷發展,德國是該地區最大的工程塑膠消費國。 2022年,德國包裝產業的銷售額佔整個歐洲的18.7%。德國塑膠包裝產量預計將從 2021 年的 437 萬噸增加到 2022 年的 446 萬噸。

- 義大利是該地區第二大工程塑膠消費國。受建設業和電氣行業快速發展的推動,該國在 2022 年佔歐洲樹脂市場總銷售額的 12%。 2022 年,義大利新建占地面積將達到 1.885 億平方英尺,高於 2021 年的 1.672 億平方英尺。預計未來幾年,建築業的不斷發展將推動義大利對工程塑膠的需求。

- 英國是歐洲工程塑膠市場成長最快的國家,預計預測期內(2023-2029 年)的以金額為準年成長率為 6.70%。英國航太工業是世界第二大工業。 2021年,英國民用航太業的營業額約為320億美元。英國政府計劃在 2027 年將研發支出增加到 GDP 的 2.4%。預計預測期內航太工業的產量和投資增加將推動該國對工程塑膠的需求。

歐洲工程塑膠市場趨勢

科技創新助力家電市場

- 2017 年至 2021 年,歐洲電氣和電子設備產量的複合年成長率超過 3.8%。電子創新的快速發展推動著對更新、更快的電氣和電子產品的持續需求。因此,該地區對電氣和電子設備生產的需求也在增加。

- 儘管遠距工作和學習導致對電腦和筆記型電腦的需求增加,但歐洲消費性電子產品領域的每位用戶平均收入仍下降了 6.3%。 2020年銷售額約2,521億美元。結果導致該地區2020年電氣及電子設備產量較去年與前一年同期比較2.8%。

- 2021年,歐洲電氣和電子設備出口額約2,283.7億美元,比2020年成長12.4%。因此,該地區電氣和電子設備產量有所成長,2021與前一年同期比較成長11.6%。

- 預測期內,機器人、虛擬和擴增實境實境、物聯網 (IoT) 和 5G 連線預計將實現成長。由於技術進步,預測期內對家用電子電器的需求預計會增加。該地區的消費電子產品銷售額預計將從 2023 年的 1,211 億美元成長到 2027 年的約 1,572 億美元。到 2027 年,歐洲預計將成為第二大電氣和電子設備生產國,佔全球市場的 12.7% 左右。因此,預計未來幾年家用電子電器的興起將推動對電氣和電子設備生產的需求。

歐洲工程塑膠行業概況

歐洲工程塑膠市場較為分散,前五大公司佔比為37.52%。市場的主要企業是: BASF SE、Covestro AG、Indorama Ventures Public Company Limited、NEO GROUP 和 SABIC(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築和施工

- 電氣和電子

- 包裝

- 進出口趨勢

- 氟樹脂交易

- 聚醯胺(PA)貿易

- 聚碳酸酯(PC)貿易

- 聚對苯二甲酸乙二酯(PET)貿易

- 聚甲基丙烯酸甲酯(PMMA)貿易

- 聚甲醛(POM)貿易

- 苯乙烯共聚物(ABS 和 SAN)貿易

- 價格趨勢

- 回收概述

- 聚醯胺 (PA) 回收趨勢

- 聚碳酸酯 (PC) 回收趨勢

- 聚對苯二甲酸乙二醇酯 (PET) 的回收趨勢

- 苯乙烯共聚物(ABS、SAN)的回收趨勢

- 法律規範

- EU

- 法國

- 德國

- 義大利

- 俄羅斯

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 最終用戶產業

- 航太

- 車

- 建築和施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他最終用戶產業

- 樹脂類型

- 氟樹脂

- 依亞型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯 (PVF)

- 聚二氟亞乙烯(PVDF)

- 其他子樹脂類型

- 液晶聚合物(LCP)

- 聚醯胺(PA)

- 副樹脂類型

- 芳香聚醯胺

- 聚醯胺(PA)6

- 聚醯胺(PA)66

- 聚鄰苯二甲醯胺

- 聚丁烯對苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮 (PEEK)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚醯亞胺(PI)

- 聚甲基丙烯酸甲酯 (PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS 和 SAN)

- 氟樹脂

- 國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 英國

- 其他歐洲國家

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介.

- Arkema

- BASF SE

- Celanese Corporation

- Covestro AG

- DSM

- DuPont

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Mitsubishi Chemical Corporation

- NEO GROUP

- SABIC

- Solvay

- Trinseo

- Victrex

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50097

The Europe Engineering Plastics Market size is estimated at 23.90 billion USD in 2024, and is expected to reach 31.69 billion USD by 2029, growing at a CAGR of 5.80% during the forecast period (2024-2029).

Packaging to dominate the market during the forecast period

- Engineering plastics have endless applications today and tend to have better mechanical and thermal properties than common or commodity plastics. The European engineering plastics consumption volume witnessed a growth of 5.1% from 2017 to 2019 due to increasing demand from the packaging and electrical and electronics segments.

- The packaging segment consumes most of the engineering plastics in the region due to the large-scale production of plastic bottles used in packaging beverages, drinking water, personal care, household care, etc. Due to disruptions in the global supply chain, all industries' combined consumption volume fell by 6.2% in the pandemic year 2020 compared to the previous year. However, the market recovered in 2021 and continued to grow steadily, increasing by 4.6% in 2022.

- Because of the large number of vehicles produced in Europe, the automotive segment is the second largest consumer of engineering plastics after the packaging segment. Vehicle production dropped significantly in 2020 due to lockdowns, travel restrictions, and the closure of automotive factories, resulting in a 22.69% decrease in consumption volume from the previous year in the automotive segment.

- The European aerospace segment is expected to be the fastest growing in terms of consumption value during the forecast period (2023-2029) with a CAGR of 7.78%, owing to the production of aircraft components in response to the increasing demand for lighter and more fuel-efficient aircraft.

Germany to dominate the market over the coming years

- Engineering plastics play the role of an important polymer in Europe for various end-user industries, including packaging, electrical and electronics, automotive, aerospace, and industrial and machinery.

- Germany is the largest consumer of engineering plastics in the region owing to its growing packaging, construction, electrical and electronics, and automotive industries. In 2022, the German packaging industry held a share of 18.7% by revenue compared to the entire Europe. In Germany, plastic packaging production reached 4.46 million tons in 2022 from 4.37 million tons in 2021.

- Italy is the second-largest consumer of engineering plastics in the region. The country held a share of 12% by revenue of the overall resin market in Europe in 2022 due to its rapidly growing construction and electrical industries. The new floor area in the country reached 188.5 million sq. ft in 2022 from 167.2 million sq. ft in 2021. The rising construction industry is projected to drive the demand for engineering plastic in Italy in the future.

- The United Kingdom is the fastest-growing country in the European engineering plastics market, which is expected to register a CAGR of 6.70% in terms of value during the forecast period (2023-2029). The aerospace industry in the United Kingdom is the second-largest in the world. In 2021, the UK civil aerospace turnover totaled approximately USD 32 billion. The government of the United Kingdom is planning to increase its R&D spending to 2.4% of GDP by 2027. The increasing production and investment in the aerospace industry are projected to drive the demand for engineering plastics in the country during the forecast period.

Europe Engineering Plastics Market Trends

Technological innovations to boost the consumer electronics market

- Europe's electrical and electronics production registered a CAGR of over 3.8% between 2017 and 2021. The rapid pace of electronic technological innovation is driving consistent demand for newer and faster electrical and electronic products. As a result, it has also increased the demand for electrical and electronics production in the region.

- Despite the increased demand for computers and laptops due to remote working and distance learning, the average revenue per user in the European consumer electronics segment dropped by 6.3%. It generated a revenue of around USD 252.1 billion in 2020. As a result, in 2020, the electrical and electronic production in the region decreased by 2.8% by revenue compared to the previous year.

- In 2021, Europe's electrical and electronic equipment exports were around USD 228.37 billion, 12.4% higher compared to 2020. As a result, electrical and electronic production in the region increased and registered 11.6% in 2021 compared to the previous year.

- Robotics, virtual reality and augmented reality, IoT (Internet of Things), and 5G connectivity are expected to grow during the forecast period. As a result of technological advancements, demand for consumer electronics is expected to rise during the forecast period. The consumer electronics segment in the region is projected to reach a revenue of around USD 157.2 billion in 2027 from USD 121.1 billion in 2023. By 2027, Europe is projected to be the second-largest electrical and electronics production accounting for around 12.7% of the global market. As a result, the rise in consumer electronics is projected to increase the demand for electrical and electronics production in the coming years.

Europe Engineering Plastics Industry Overview

The Europe Engineering Plastics Market is fragmented, with the top five companies occupying 37.52%. The major players in this market are BASF SE, Covestro AG, Indorama Ventures Public Company Limited, NEO GROUP and SABIC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Fluoropolymer Trade

- 4.2.2 Polyamide (PA) Trade

- 4.2.3 Polycarbonate (PC) Trade

- 4.2.4 Polyethylene Terephthalate (PET) Trade

- 4.2.5 Polymethyl Methacrylate (PMMA) Trade

- 4.2.6 Polyoxymethylene (POM) Trade

- 4.2.7 Styrene Copolymers (ABS and SAN) Trade

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 EU

- 4.5.2 France

- 4.5.3 Germany

- 4.5.4 Italy

- 4.5.5 Russia

- 4.5.6 United Kingdom

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 United Kingdom

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 Celanese Corporation

- 6.4.4 Covestro AG

- 6.4.5 DSM

- 6.4.6 DuPont

- 6.4.7 Indorama Ventures Public Company Limited

- 6.4.8 INEOS

- 6.4.9 LANXESS

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 NEO GROUP

- 6.4.12 SABIC

- 6.4.13 Solvay

- 6.4.14 Trinseo

- 6.4.15 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219