|

市場調查報告書

商品編碼

1683920

東協國內宅配:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)ASEAN Domestic Courier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

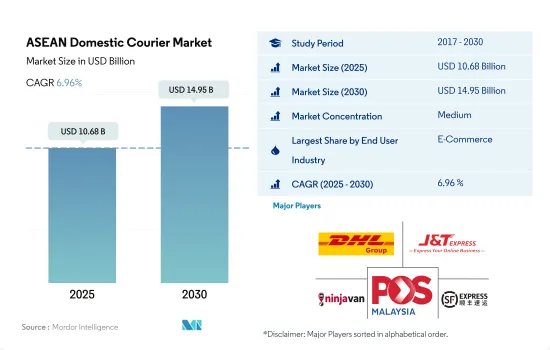

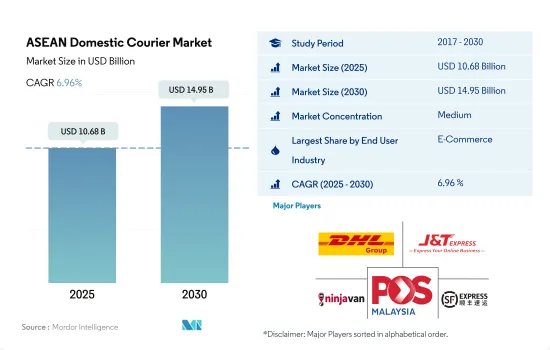

預計 2025 年東協國內宅配市場規模為 106.8 億美元,到 2030 年將達到 149.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.96%。

2017年至2022年間,該地區電子商務產業的複合年成長率預計將達到37%,從而推動市場成長。

- 國內宅配服務在電子商務產業的重要性日益凸顯。過去幾年,疫情導致購物行為發生了巨大變化,全球購物流程轉向網路購物。 2017 年至 2022 年間,該地區電子商務產業的複合年成長率為 37.71%。電子商務領域的發展預計將促進國內宅配市場的成長。此外,受人口趨勢、富裕程度提高以及新冠疫情快速復甦等因素影響,東南亞的奢侈品零售市場正在成長,也增加了對國內宅配的需求。

- 2017年至2022年期間,醫療設備市場複合年成長率為6.52%,到2022年將達到100.2億美元。疫情也加速了該地區對醫療設備快捷郵件服務的需求。東協國內醫療設備宅配服務的成長受到醫療保健服務需求不斷成長、物流技術進步以及醫療保健電子商務成長等多種因素的推動。因此,預計東協國內宅配市場在預測期內將出現積極成長。

馬來西亞宅配服務受電子商務推動激增,預計到 2027 年國內 CEP 將達到 14.44% 的複合年成長率

- 馬來西亞電子商務產業的興起推動了當地宅配服務業的顯著成長,導致市場上 100 多家服務供應商之間的競爭加劇。由於電子商務用戶滲透率預計到 2027 年將達到 55%,預計國內 CEP 服務量在 2023 年至 2027 年期間的複合年成長率也將達到 14.44%。因此,我們預計宅配許可證的發放量將大幅增加,國內 CEP服務供應商的數量也將增加,以滿足日益成長的需求。

- 國內 CEP 行業經歷了顯著成長,主要受電子商務的推動。 2020年,電子商務產業與前一年同期比較增57.76%,達到353.4億美元,這主要得益於遠距工作和政府的社交距離規定。 2021年,網路購物趨勢依然強勁,電子商務產業規模與前一年同期比較成長58.43%,達到559.9億美元。預計電子商務產業在預測期內將繼續保持強勁成長,到 2025 年將達到 885.4 億美元。

東協國內宅配市場趨勢

在政府基礎建設計劃,對東南亞國協的直接投資不斷增加,推動了經濟成長

- 2024年5月,日本政府宣布貸款約1,407億日圓(9億美元),用於在印尼雅加達興建高速鐵路線。東西鐵路計劃全長84.1公里,將於2026年至2031年分兩階段完工。新鐵路線的列車和號誌系統將採用日本技術。透過這樣的努力,預計運輸和倉儲業將對GDP做出貢獻。

- 2024 年 2 月,運輸部宣布計劃在 2025年終投資 188.3 億美元用於約 150 個交通計劃,以加強泰國的基礎設施建設。 2024 年將有 64 個計劃開工,另有 31 個計劃(價值 112.3 億美元)正在籌備中。 2025年計畫新計畫,總投資額達75.9億美元。這些舉措包括18個公路計劃、9個鐵路計劃和一項區域港口發展計劃,旨在加強運輸和倉儲行業未來對GDP的貢獻。

兩以衝突、烏俄戰爭對東南亞國協的影響,導致油價上漲、供應鏈中斷。

- 印尼在殼牌和雪佛龍近期撤出後加大了鑽探和探勘,預計 2024 年其石油和天然氣行業的投資將成長 29%。在石化燃料計劃資金籌措日益困難的當下,這項措施對於印尼應對長期產量下滑至關重要。埃尼、埃克森美孚和英國石油等外國公司將貢獻2024年計畫投資的40%。此外,在2024年初,石油和天然氣部宣布,儘管伊朗-以色列衝突有可能將原油價格推高至每桶100美元,但加油站的燃油價格至少在2024年6月之前將保持穩定。

- 作為馬來西亞總理安瓦爾·易卜拉欣 (Anwar Ibrahim) 改革長期燃油補貼制度的努力的一部分,2024 年 6 月馬來西亞柴油價格上漲了 50% 以上。改革的目的是透過取消普遍能源補貼並將援助重點放在最需要的人身上來緩解國家財政壓力。此舉也旨在解決補貼柴油被走私到鄰國並以高價交易的問題。

東協國內宅配產業概況

東協國內宅配市場適度整合,主要有五家參與者(依字母排列):DHL集團、J&T Express、Ninja Van、POS Malaysia Bhd 和順豐速運(KEX-SF)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 經濟活動帶來的 GDP 成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 印尼

- 馬來西亞

- 菲律賓

- 泰國

- 越南

- 價值鍊和通路分析

第5章 市場區隔

- 送貨速度

- 表達

- 非快遞

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 最終用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

- 模型

- 企業對企業(B2B)

- 企業對消費者(B2C)

- 消費者對消費者(C2C)

- 符合條件的國家

- 印尼

- 馬來西亞

- 菲律賓

- 泰國

- 越南

- 其他東南亞國協

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BEST Inc.

- City-Link Express

- CJ Logistics Corporation

- DHL Group

- FedEx

- J&T Express

- JWD Group

- Ninja Van

- POS Malaysia Bhd

- PT Pos Indonesia(Persero)

- SF Express(KEX-SF)

- SkyNet Worldwide Express

- Thailand Post

- United Parcel Service of America, Inc.(UPS)

- Vietnam Posts and Telecommunications Group(including Vietnam Post Corporation)

- ViettelPost

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001610

The ASEAN Domestic Courier Market size is estimated at 10.68 billion USD in 2025, and is expected to reach 14.95 billion USD by 2030, growing at a CAGR of 6.96% during the forecast period (2025-2030).

The e-commerce sector in the region grew at a CAGR of 37% during 2017-22, driving the growth of the market

- Domestic courier services are becoming increasingly important in the e-commerce industry. The pandemic brought a drastic change in shopping behavior over the past years, shifting the shopping process worldwide toward online shopping. During 2017-2022, the e-commerce sector in the region registered a CAGR of 37.71%. The development of the e-commerce sector is expected to contribute to the growth of the domestic courier services market. Moreover, the demand for domestic couriers has been increasing as the luxury retail markets in Southeast Asia have been growing due to a combination of demographics, increasing wealth, and their rapid emergence from the COVID-19 pandemic.

- During 2017-2022, the medical devices market recorded a CAGR of 6.52% and reached USD 10.02 billion in 2022. The pandemic has also accelerated the region's demand for express delivery services for healthcare equipment. The growth of domestic courier services for medical devices in ASEAN is driven by a combination of increasing demand for healthcare services, advancements in logistics technology, and the growth of healthcare e-commerce. As a result, the ASEAN domestic courier market is expected to grow positively during the forecast period.

Malaysia's courier services soar with e-commerce, expected 14.44% CAGR in domestic CEP by 2027

- The flourishing e-commerce segment in Malaysia has driven significant growth in the local courier services industry, resulting in intense competition among more than 100 service providers operating in the market. As e-commerce user penetration is projected to reach 55% by 2027, the volume of domestic CEP services is also expected to register a CAGR of 14.44% from 2023 to 2027. Consequently, it is anticipated that there will be a substantial increase in the number of courier licenses issued and a rise in the number of domestic CEP service providers to meet the growing demand.

- The domestic CEP segment has experienced significant growth primarily driven by e-commerce. In 2020, the e-commerce segment saw a YoY increase of 57.76%, reaching USD 35.34 billion, mainly due to remote working and government-imposed social distancing regulations. This trend of online buying remained strong in 2021, with the e-commerce industry growing by 58.43% YoY and reaching USD 55.99 billion. The strong growth in the e-commerce industry is expected to continue during the forecast period and reach USD 88.54 billion by 2025.

ASEAN Domestic Courier Market Trends

Rising FDI in ASEAN countries supported by infrastructure construction projects by country governments driving economic growth

- In May 2024, the Japanese government announced a loan of about JPY140.7 billion (USD 900 million) to build a high-speed rail line in Jakarta, Indonesia. The East-West rail project will cover 84.1 km and be completed in two phases, starting in 2026 and finishing by 2031. The new rail line will feature Japanese technology for trains and signaling systems. Such initiatives are expected to boost GDP contribution from transport and storage sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance Thailand's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

Impact of the Iran-Israel conflict and Ukraine-Russia war on ASEAN countries led to increased fuel prices and supply chain disruptions

- Indonesia expects a 29% increase in oil and gas sector investments in 2024 to boost drilling and exploration after Shell and Chevron's recent exits. This push is vital for Indonesia to counter a long-term decline in output amid rising financing challenges for fossil fuel projects. Foreign companies like Eni, Exxon Mobil, and BP will contribute 40% of 2024's planned investments. Also, in early 2024, the Ministry of Oil and Gas announced that fuel prices at gas stations will stay stable until at least June 2024, despite the Iran-Israel conflict potentially raising oil prices to USD 100 per barrel.

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

ASEAN Domestic Courier Industry Overview

The ASEAN Domestic Courier Market is moderately consolidated, with the major five players in this market being DHL Group, J&T Express, Ninja Van, POS Malaysia Bhd and SF Express (KEX-SF) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Indonesia

- 4.12.2 Malaysia

- 4.12.3 Philippines

- 4.12.4 Thailand

- 4.12.5 Vietnam

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speed Of Delivery

- 5.1.1 Express

- 5.1.2 Non-Express

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Model

- 5.4.1 Business-to-Business (B2B)

- 5.4.2 Business-to-Consumer (B2C)

- 5.4.3 Consumer-to-Consumer (C2C)

- 5.5 Country

- 5.5.1 Indonesia

- 5.5.2 Malaysia

- 5.5.3 Philippines

- 5.5.4 Thailand

- 5.5.5 Vietnam

- 5.5.6 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BEST Inc.

- 6.4.2 City-Link Express

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 FedEx

- 6.4.6 J&T Express

- 6.4.7 JWD Group

- 6.4.8 Ninja Van

- 6.4.9 POS Malaysia Bhd

- 6.4.10 PT Pos Indonesia (Persero)

- 6.4.11 SF Express (KEX-SF)

- 6.4.12 SkyNet Worldwide Express

- 6.4.13 Thailand Post

- 6.4.14 United Parcel Service of America, Inc. (UPS)

- 6.4.15 Vietnam Posts and Telecommunications Group (including Vietnam Post Corporation)

- 6.4.16 ViettelPost

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219