|

市場調查報告書

商品編碼

1683974

美國戶外 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)US Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

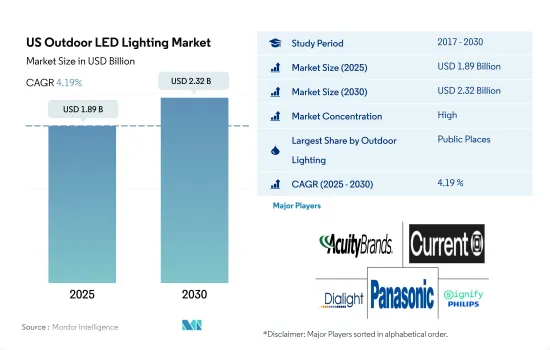

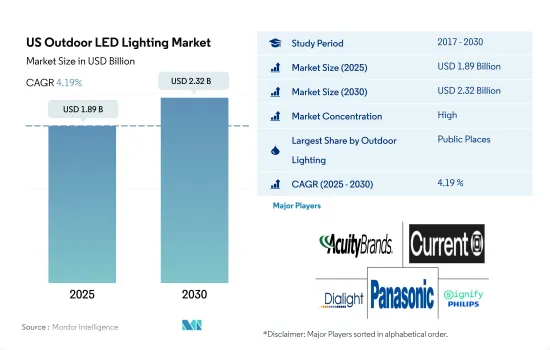

預計 2025 年美國戶外 LED 照明市場規模為 18.9 億美元,到 2030 年將達到 23.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.19%。

道路和零售店擴張的持續需求以及體育運動的興起預計將推動市場成長。

- 2023 年,公共區域將佔據大部分金額佔有率,其次是道路和公路(S&R)以及其他區域。未來幾年,我們預計 S&R市場佔有率將略有下降,而公共場所市場佔有率將上升。關閉全部區域的體育場、游泳池、海灘和堡壘等公共場所是遏制新冠肺炎疫情傳播的措施之一。

- 2021年美國政府放寬了COVID-19規則,北美大型道路基礎建設計劃於2023年第一季開始實施。堪薩斯州歐弗蘭帕克69號快速收費車道、芝加哥肯尼迪高速公路延長線(從伊登斯高速公路到俄亥俄街全長12公里)等計劃預計將增加道路照明,從而推動該地區LED市場的成長。 2022 年零售業前景強勁,今年第一季新開店數量約為關閉門市數量的七倍。

- 2023 年 1 月,零售商塔吉特開設了 23 家新店,以提升未來幾年超過 200 萬顧客的購物體驗。案例預計將增加該地區對停車位的需求,從而推動對戶外 LED 照明的需求。足球在美國越來越受歡迎,甚至超過了冰球。然而,舉辦2026年世界盃也帶來了新的挑戰。美國計劃為2026年世界盃維修其一座體育場。擁有 76,416 個座位的箭頭體育場是第一個被確定進行升級以迎接 2026 年錦標賽的體育場。由於上述案例,預計在研究期間該地區對戶外照明的需求將會增加。

美國戶外 LED 照明市場趨勢

體育場館升級、更換和新建推動 LED 照明成長

- 體育場數量預計將從 2023 年的 901 個增加到 2030 年的 937 個。近年來,體育領域發生了一些變化。例如,NRG 體育場於 2014 年透過使用多盞高效 LED 燈照亮球場,提升了其專業足球場的地位。新的高效系統耗電量為 337kW,比體育場以前的照明系統節省 60%。安裝在 480 個光學增強燈具中的 65,000 多個發光二極體) 構成了現場照明陣列。新洋基體育場於 2015 年進行了 LED 照明昇級。此外,凱南體育場正在進行安裝 LED 體育場照明的計劃,吉列體育場正在進行超過 3 億美元的維修,其中包括添加 LED 照明。這些因素正在促進該地區 LED 市場的成長。

- 美國對觀看現場比賽和其他國際聯賽的興趣日益濃厚,美國板球協會宣布將在 2022 年向美國T20 板球聯賽投資 10 億美元就是明證。此外,美國一直在興建體育場。例如,多功能體育場Acrisure Arena於2021年在加州開始建造。美國冰球聯盟的科切拉穀火鳥隊將在這個可容納11,000名觀眾的體育場進行主場比賽。第 48 屆美洲盃和國際足總世界盃是即將在該國舉辦的兩場體育賽事。因此,隨著新體育場館的建設和體育賽事的擴大,該國的 LED 照明銷售預計將會增加。

家庭數量增加推動 LED 市場成長

- 2021年,美國總人口為3.3218億。預計 2021 年美國總體生育率為每名婦女生育 1.66 個孩子。比前一年增加了 0.01 個。粗略地說,美國每 1,000 人中就有 11 名新生兒。比上年增加了0.1。 2021 年美國的出生預期壽命為 76.33 歲。根據這些資料,世界上出生的嬰兒越來越多,人口也越來越多。這意味著需要更多的空間來居住,導致市場擴大。因此,住宅的建設將導致新 LED 銷售的增加。

- 2022年,美國家庭數為1.312億。美國家庭數量現在高於 2020 年(1.2845 億戶)。 2022 年美國典型家庭規模為 3.13 人。 2022年屋主家庭比例將達65.9%。 2020年,六間及六間住宅佔全住宅的19.3%。家庭數量的不斷成長以及房間數量的不斷增加的需求推動了 LED 的普及。

- 電動車(EV)市場正在迅速擴張,預計未來十年仍將持續擴張。美國的電動車銷量已從 2011 年佔所有汽車銷量的 0.2% 成長至 2021 年的 4.6%。從 2011 年到 2021 年的 10 年間,道路上的電動車數量大幅增加,從約 22,000 輛增加到 200 多萬輛。因此,隨著電動車的普及,各種電動車應用中使用的半導體晶片的需求不斷增加,這反過來又導致對 LED 照明的需求不斷成長。

美國戶外 LED 照明產業概況

美國戶外LED照明市場相當集中,前五大公司佔74.35%的市佔率。該市場的主要企業是:ACUITY BRANDS, INC.、Current Lighting Solutions, LLC.、Dialight PLC、松下控股公司和 Signify Holding (Philips)(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均收入

- LED進口總量

- 照明耗電量

- 家庭數量

- LED滲透率

- 體育場數量

- 法律規範

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 戶外照明

- 公共空間

- 道路照明

- 其他

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ACUITY BRANDS, INC.

- Cree LED(SMART Global Holdings, Inc.)

- Current Lighting Solutions, LLC.

- Dialight PLC

- EGLO Leuchten GmbH

- Feit Electric Company, Inc.

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- Panasonic Holdings Corporation

- Signify Holding(Philips)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The US Outdoor LED Lighting Market size is estimated at 1.89 billion USD in 2025, and is expected to reach 2.32 billion USD by 2030, growing at a CAGR of 4.19% during the forecast period (2025-2030).

The continued demand for road and retail expansion, along with the growing sport, is expected to drive the growth of the market

- In 2023, public places accounted for the majority of the value share, followed by streets and roadways (S&R) and other areas. It is expected that there will be a small reduction in S&R's market share and an increase in public places' market share in the coming years. Shutting down public places like stadiums, pools, beaches, and forts throughout the region was one of the measures taken to limit the spread of COVID-19.

- In 2021, the US government relaxed COVID-19 rules, and major road infrastructure construction projects were launched during the first quarter of 2023 in North America. Projects such as the 69 Express Toll Lane in Overland Park, Kansas, and the Kennedy Expressway Extension, covering 12 km from Edens Expressway to Ohio Street in Chicago, are expected to increase roadway lighting, thus boosting the growth of the LED market in the region. Retail sales boomed in 2022, and there were nearly seven times as many store openings as closings in Q1 of that year.

- In January 2023, Target, a retail corporation, opened 23 new locations to enhance the shopping experience for more than two million guests over the coming years. This instance is anticipated to increase the demand for parking lots in the region, resulting in more demand for outdoor LED lights. Soccer is becoming increasingly popular in the US, surpassing ice hockey. However, hosting the World Cup in 2026 presents new challenges. The US plans to upgrade one of the stadiums for the 2026 World Cup. The 76,416-capacity Arrowhead Stadium has been the first to be identified as undergoing an upgrade in preparation for the 2026 event. The above instances are expected to create more demand for outdoor lighting in the region during the study period.

US Outdoor LED Lighting Market Trends

Upgradation, replacement, and construction of new stadiums to drive the growth of LED lights

- The number of stadiums segment is expected to witness a growth of 937 units in 2030 from 901 units in 2023. The sports sector has undergone several changes in recent years. For instance, NRG Stadium enhanced its professional football stadium status in 2014 by illuminating its pitch with several high-efficiency LED lights. At full power, the new high-efficiency system consumes 337 kW, 60% less than the stadium's prior lighting system. More than 65,000 light-emitting diodes (LEDs) installed in 480 optically improved luminaries make up the field lighting array. New Yankee Stadium underwent an LED lighting upgrade in 2015. Additionally, Kenan Stadium is now through a project to install LED stadium lights, while Gillette Stadium has spent more than USD 300 million renovating the venue, which includes adding LED lighting. These factors contribute to the growth of the LED market in the region.

- Americans are becoming more interested in watching live matches and other international leagues, as evidenced by USA Cricket's announcement in 2022 that it would invest USD 1.0 billion in the organization of the US T20 cricket league. Additionally, the nation is constantly building stadiums. For instance, work on the multifunctional Acrisure Arena began in California in 2021. The Coachella Valley Firebirds of the American Hockey League will play their home games in the stadium, which can accommodate 11,000 spectators. The 48th Copa America and the FIFA World Cup are two forthcoming sporting events in the nation. Consequently, it is anticipated that the building of new stadiums and the expansion of athletic events are expected to increase sales of LED lights in the country.

Increase in the number of households to drive the growth of the LED market

- In 2021, there were 332.18 million people living in the US as a whole. The overall fertility rate in the US was expected to be 1.66 children per woman in 2021. When compared to the prior year, it went up 0.01. In rough terms, there were 11 live births per 1,000 people in the US. This rose from the previous year by 0.1. In the US, the average life expectancy at birth was 76.33 years in 2021. According to the data, more children are being born and more people in the world, which means that more space will need to be inhabited by people, which will help the market expand. Thus, the sale of new LEDs will rise as a result of the building of the new home.

- The United States had 131.2 million households in 2022. There are now more households in the United States than there were in 2020 (128.45 million). In 2022, there were 3.13 people in the typical American family. The proportion of owner-occupied households in 2022 was 65.9%. In 2020, six or more rooms were present in 19.3% of all occupied dwelling units. The expansion of LEDs will be fueled by an increase in families and the need to accommodate this increase in the typical number of rooms.

- The market for electric cars (EVs) has expanded quickly and is anticipated to do so throughout the next ten years. From just 0.2% of all car sales in 2011 to 4.6% in 2021, electric car sales in the US grew. Over the decade of 2011-21, the number of EVs on the road increased significantly, from around 22,000 to over 2 million. As a result, the need for semiconductor chips used in various EV applications rose along with the popularity of EVs, raising the need for LED illumination.

US Outdoor LED Lighting Industry Overview

The US Outdoor LED Lighting Market is fairly consolidated, with the top five companies occupying 74.35%. The major players in this market are ACUITY BRANDS, INC., Current Lighting Solutions, LLC., Dialight PLC, Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Cree LED (SMART Global Holdings, Inc.)

- 6.4.3 Current Lighting Solutions, LLC.

- 6.4.4 Dialight PLC

- 6.4.5 EGLO Leuchten GmbH

- 6.4.6 Feit Electric Company, Inc.

- 6.4.7 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.8 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Signify Holding (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms