|

市場調查報告書

商品編碼

1683976

非洲殺菌劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Africa Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

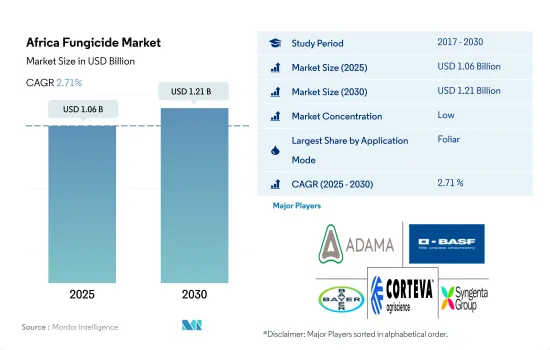

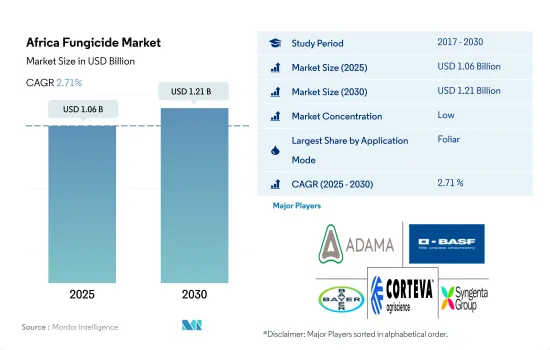

預計 2025 年非洲殺菌劑市場規模為 10.6 億美元,到 2030 年將達到 12.1 億美元,預測期內(2025-2030 年)的複合年成長率為 2.71%。

人們越來越重視保護產量和避免因病害造成作物損失,這推動市場的發展。

- 2022 年,葉面噴布領域將佔最大佔有率,預計在預測期內的複合年成長率為 3.0%,成為成長最快的應用。推動這一細分市場成長的因素是葉面噴布因其系統性效應以及與其他處理方法的兼容性而呈現出的日益成長的優勢。

- 種子處理佔據第二大市場佔有率,預計在預測期內(2023-2029 年)的複合年成長率為 2.8%。全國各地的農民普遍採用農藥種子處理來提高種子性能並防治疾病。

- 2022 年,化學灌溉佔非洲殺菌劑市值的 12.3%。預計在預測期內,該方法的複合年成長率將達到 2.6%。在非洲,隨著農民採用灌溉系統,農業生產力提高了。這可能會在未來幾年刺激該領域的成長。

- 預計 2023 年至 2029 年期間土壤治療方法的複合年成長率將達到 2.7%。例如,種植者可以使用系統性殺菌劑來控制土壤害蟲和侵襲植物地上部部分的害蟲等,這使得該地區的農民很高比例地採用此類噴灑技術。

- 研究表明,燻蒸劑在控制疾病和透過控制土傳疾病來提高產量非常有效。例如,已發現達隆(DZ)燻蒸對鐮刀菌和疫黴菌的有效性為 89.62% 至 93.33%。由於這些因素,燻蒸劑的需求預計會增加。

- 殺菌劑市場預計在 2023-2029 年期間的複合年成長率為 2.9%。非洲農民根據需求採用各種方法來保護作物並確保最佳產量。

農民對使用殺菌劑保護農作物的意識不斷增強,這將推動市場

- 非洲殺菌劑市場在歷史時期內穩步成長,佔 2022 年整個作物保護化學品市場的 27.3%(以金額為準計算)。Mancozeb、Metalaxyl和苯並咪唑酮等系統性殺菌劑是該地區最常使用的殺菌劑。

- 玉米是非洲最重要的主糧作物,主要玉米生產國為奈及利亞、南非和衣索比亞。該地區是玉米和小麥等主要穀物的最大出口地和生產地,因此殺菌劑在穀物和穀類上被大量使用。到 2022 年,該部分的以金額為準佔有率將達到 45.8%。

- 同樣,97%的山藥都產自該地區的西非國家。山藥炭疽病是最具破壞性的真菌病害,造成的損失可達50-90%。化學殺菌劑如苯菌靈(Benlate)、代森錳、Chlorothalonil和Mancozeb主要用於防治山藥炭疽病,應每兩週或每月噴灑一次。

- 殺菌劑抗藥性的產生帶來了重大挑戰,因為它縮小了有效疾病管理可用的殺菌劑選擇範圍。同時,各國政府正在投資研究新的疾病和防治殺菌劑,並投資建立農民支持系統。

- 政府推出的此類政策和農民意識的不斷增強,進一步鼓勵農民採取作物保護措施,旨在擴大市場,預計在預測期內(2023-2029 年)的複合年成長率將達到 2.9%。

非洲殺菌劑市場趨勢

非洲的氣候條件從亞熱帶到半乾旱,有利於真菌病原體的繁殖。

- 植物病原真菌是導致植物患病的真菌。真菌感染疾病會削弱植物的整體健康並導致生長不良。受感染的植物可能會高度降低、葉子變小、分枝減少,直接導致作物產量下降。這種真菌也會破壞植物內的荷爾蒙平衡,影響植物的發育和整體生產力。

- 預計2022年非洲殺菌劑消費量將達2.2公斤/公頃。非洲是一個環境條件多樣化的大陸。氣候條件從半乾旱到半乾旱。非洲大部分國家以夏季降雨為主,西南沿海地區以冬季降雨為主。這些氣候變遷導致許多真菌疾病的傳播。

- 某些作物易受真菌疾病的侵害,其嚴重程度在非洲不同地區有所不同。例如,玉米是許多撒哈拉以南非洲國家的主要作物,容易受到玉米銹病和玉米葉斑病等病害的侵害。另一種重要的主糧作物木薯易感染木薯褐條病、木薯花葉病等病害。此外,咖啡、香蕉、番茄和其他作物也容易受到各種真菌病原體的侵害,例如銹病和花葉病。

- 非洲的商業性農業正在不斷擴大,大規模農業經營和高價值經濟作物的種植不斷增加。商業農民通常依靠殺菌劑來保護作物免受真菌疾病的侵害並最大限度地提高產量。預計這些因素將在預測期內推動商業性農業對殺菌劑的需求。

預防性和治療性殺菌劑在病害防治方面的需求以及由於生產能力有限導致的活性成分價格波動

- 在非洲地區,Mancozeb、Azoxystrobin、Metalaxyl、丙森鋅、福美鋅等殺菌劑在農業中扮演重要角色。它們被廣泛用於防治對穀物、水果、蔬菜和經濟作物等作物構成重大威脅的各種真菌疾病。

- 2022年Mancozeb價格為每噸7,793.2美元。這種殺菌劑是一種接觸型產品,廣泛應用於各種作物,包括水果、蔬菜、堅果、田間作物和專業管理的草皮。它對馬鈴薯的多種真菌疾病有效,包括晚疫病、葉斑病、瘡痂病和銹病。

- Azoxystrobin是一種系統性、頻譜預防性殺菌劑,是該地區第二廣泛使用的殺菌劑。Azoxystrobin具有系統性和治療性,可有效控制多種重要植物疾病並提高作物產量。中國是該地區Azoxystrobin主要供應國,南非、埃及、肯亞、烏干達和吉布地是主要進口國。該活性成分的價格為每噸 4,579.6 美元,受進口關稅、監管部門核准和關稅等因素的影響,可能會導致成本波動。

- 2018年至2022年,Metalaxyl價格明顯上漲,上漲了542.20美元/噸。目前價格為每噸 4,454 美元。Metalaxyl是一種系統性殺菌劑,以其保護和治療特性而聞名。它被植物的葉、莖、根吸收,有效防治晚疫病、早疫病、葉斑病、霜霉病等病害。活性成分的成本可能會因原料價格的變動而波動。

非洲殺菌劑產業概況

非洲殺菌劑市場較為分散,前五大企業佔25.63%。該市場的主要參與者有:ADAMA Agricultural Solutions Ltd、 BASF SE、Bayer AG、Corteva Agriscience 和 Syngenta Group(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 南非

- 價值鍊和通路分析

第5章 市場區隔

- 應用模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 南非

- 其他非洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001678

The Africa Fungicide Market size is estimated at 1.06 billion USD in 2025, and is expected to reach 1.21 billion USD by 2030, growing at a CAGR of 2.71% during the forecast period (2025-2030).

The growing focus on protecting the yield and avoiding crop losses due to disease infestation is driving the market

- In 2022, the foliar segment held a significant share, which is expected to grow the fastest among applications with a 3.0% CAGR during the forecast period. This segment's growth is driven by the increased advantages of foliar use due to its systemic effect and compatibility with other treatments.

- Seed treatment holds the second-largest market share and is projected to record a 2.8% CAGR during the forecast period (2023-2029). Farmers in the country have adopted a common practice of pesticide seed treatment to improve seed performance and protect against diseases.

- Chemigation accounted for 12.3% of the African fungicide market value in 2022. This method is projected to record a 2.6% CAGR during the forecast period. In Africa, farmers are experiencing growing agricultural productivity as a result of adopting an irrigation system. This is likely to stimulate the growth of this segment over the coming years.

- The soil treatment method is anticipated to register a 2.7% CAGR during the period 2023-2029. The adoption of such application techniques was high among farmers in the region due to its various benefits, for instance, growers being able to control soil pests and those attacking aerial parts of the plant with a systemic fungicide.

- Studies have shown that fumigants are highly effective in controlling diseases and improving yields by protecting against soil-borne diseases. For instance, dazomet (DZ) fumigation was found to be 89.62% to 93.33% effective against fusarium and phytophthora. Due to these factors, the demand for fumigants is expected to increase.

- The fungicide market is projected to record a 2.9% CAGR during the period 2023-2029. African farmers are adopting different methods based on their requirements to protect crops and ensure optimal yields.

Increased awareness among farmers for using fungicides to protect crops is boosting the market

- The fungicide market in Africa witnessed steady growth during the historical period, with the region occupying a share of 27.3%, by value, of the total crop protection chemical market in 2022. Mancozeb and systemic fungicides such as metalaxyl and benzimidazoles are the most frequently used fungicides in the region.

- Maize is the most important staple crop cultivated throughout Africa, with leading maize-producing countries being Nigeria, South Africa, and Ethiopia. Fungicides are mostly used in grains and cereals in the region as it is the largest exporter and producer of staple grains such as maize and wheat. The segment occupied a share of 45.8%, by value, in 2022.

- Similarly, 97% of yam is produced in the West African countries of the region. Anthracnose disease of yam is the most devastating fungal disease, leading to 50-90% losses. The control of yam anthracnose has been accomplished mainly with chemical fungicides such as benomyl (benlate), maneb, chlorothalonil, and mancozeb, which require biweekly or monthly applications.

- The occurrence of fungicide resistance presents a big challenge as it limits fungicide choices for effective disease management. At the same time, governments of various countries are investing in research initiatives to discover new diseases and their subsequent fungicides, along with supportive schemes for farmers.

- Such policies initiated by the government and a rise in awareness among farmers have further encouraged farmers to adopt crop protection practices that aim to expand the market, which is anticipated to record a CAGR of 2.9% during the forecast period (2023-2029).

Africa Fungicide Market Trends

African climatic conditions ranging from semi-tropic to semi-arid favor the proliferation of fungal pathogens

- Phytopathogenic fungi are fungi that cause diseases in plants. Fungal infections can weaken the overall health of plants, leading to stunted growth. Infected plants may exhibit reduced height, smaller leaves, and fewer branches, which can directly translate into lower crop yields. Fungi can also disrupt the hormonal balance within plants, affecting their development and overall productivity.

- The fungicide consumption rate in Africa was 2.2 kg/ha in the year 2022. Africa is a continent with diverse environmental conditions. The climatic conditions range from semi-tropic to semi-arid. Although the majority of African countries have summer rainfall, the southwestern coastal region is predominantly a winter rainfall area. These variations in climate allow infestation of a large number of fungal diseases.

- Certain crops are more susceptible to fungal diseases, and their importance varies across regions in Africa. For example, maize is a staple crop in many Sub-Saharan African countries and is affected by diseases like maize rust and maize smut. Cassava, another crucial staple crop, is susceptible to diseases such as cassava brown streak disease and cassava mosaic disease. Additionally, coffee, bananas, tomatoes, and other crops are also susceptible to various fungal pathogens like rusts and mosaics.

- Commercial farming is expanding in Africa, with larger-scale agricultural operations and increased cultivation of high-value cash crops. Commercial farmers often rely on fungicides to protect their crops from fungal diseases and maximize yields. Such factors are expected to drive the demand for fungicides in the commercial farming industry during the forecast period.

Need for preventive and curative disease control fungicides and their limited production capabilities resulting in fluctuations in the prices of active ingredients

- In the African region, fungicides such as mancozeb, azoxystrobin, metalaxyl, propineb, and ziram play a crucial role in agricultural practices. They are widely utilized to combat various fungal diseases that pose significant threats to crops, including cereals, fruits, vegetables, and cash crops.

- The price of mancozeb stood at USD 7,793.2 per metric ton in 2022. This fungicide is a contact-type product widely applied on various crops, including fruits, vegetables, nuts, field crops, and professionally managed turf. Its effectiveness extends to combat numerous fungal diseases, including potato blight, leaf spot, scab, and rust.

- Azoxystrobin, a systemic and broad-spectrum preventive fungicide, holds the position of the second most widely used fungicide in the region. It exhibits both systemic and curative properties, effectively controlling various significant plant diseases and enhancing crop yield. China serves as the primary supplier of azoxystrobin to the region, while South Africa, Egypt, Kenya, Uganda, and Djibouti are the major importing countries. The price of this active ingredient, which was at USD 4,579.6 per metric ton, can be influenced by factors such as importing tariffs, regulatory approvals, and customs duties, leading to fluctuations in its cost.

- Between 2018 and 2022, the price of metalaxyl experienced a notable rise, with an increase of USD 542.20 per metric ton. Currently, it stands at USD 4,454.0 per metric ton. Metalaxyl is a systemic fungicide known for its protective and curative properties. It is absorbed through the leaves, stems, and roots of plants, effectively controlling diseases like late blight, early blight, leaf spot, and downy mildew. The cost of the active ingredient may vary due to fluctuating raw material prices.

Africa Fungicide Industry Overview

The Africa Fungicide Market is fragmented, with the top five companies occupying 25.63%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Corteva Agriscience and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 South Africa

- 5.3.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219