|

市場調查報告書

商品編碼

1683994

印尼殺菌劑:市場佔有率分析、產業趨勢與成長預測(2025-2030)Indonesia Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

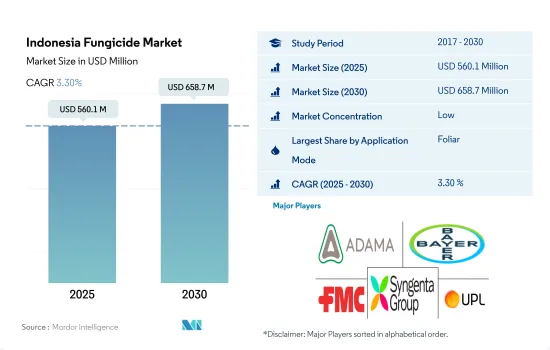

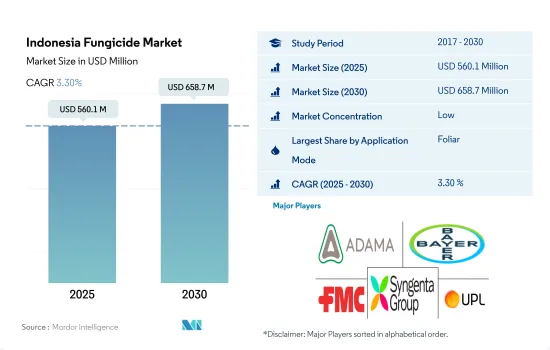

預計 2025 年印尼殺菌劑市場規模將達到 5.601 億美元,到 2030 年將達到 6.587 億美元,預測期內(2025-2030 年)的複合年成長率為 3.30%。

影響棕櫚油、咖啡、水稻和玉米等主要作物的真菌病害正在增加,導致殺菌劑的使用量增加。

- 印尼的熱帶氣候為作物的生長提供了理想的環境,但真菌病害的迅速蔓延給農業部門帶來了重大挑戰。為此,該國農民採取了各種方法來對抗這些真菌疾病,其中殺菌劑是一種有效的解決方案。根據特定疾病和作物的階段,農民實施不同的噴灑方法來控制這些疾病並減少其影響。

- 農民主要採用葉面噴布法,這種方法到 2022 年將佔 60.7% 的較大市場佔有率。這種偏好歸因於其有效的病害控制和其他對植物健康有益的益處,例如提高生長效率和抗逆性,從而提高整個生長季節的生產力。

- 種子處理殺菌劑適用於控制棕櫚油、咖啡、水稻和玉米等作物的土傳疾病。這種積極主動的方法使種植者能夠在作物早期階段有效控制病害,減少其對作物健康和產量的影響。 2022年,種子處理殺菌劑的消費量佔比為13.8%。

- 2022年,化學灌溉應用模式的市佔率為12.3%,這主要是因為該國優先實現灌溉系統的現代化,全國95%的稻米都是透過這些灌溉系統生產的。隨著現代灌溉系統的普及,採用化學灌溉施用殺菌劑的情況也進一步增加。

- 治療農民使用燻蒸和土壤處理作為施用殺菌劑的替代方法,根據特定的真菌疾病和作物類型選擇適當的方法。

印尼殺菌劑市場趨勢

由於玉米等主要作物的真菌病害導致作物感染增加,以及提高生產力的需求可能會推動市場的發展。

- 印尼種植多種高價值作物,包括水果、蔬菜、咖啡、茶和香辛料。這些作物通常易受真菌疾病的侵害,這會直接影響其品質和市場競爭力。殺菌劑有助於保護這些珍貴的作物並確保其生產力和經濟價值。

- 為了提高生產力,許多農民正在採用密集的農業實踐,例如產量作物品種和溫室種植。這種耕作方式雖然有利於提高產量,但也可能為真菌疾病的發展和傳播創造有利條件。在集約化生產系統中,需要使用殺菌劑來控制和預防這些疾病。近年來,印尼的殺菌劑消費量增加。具體而言,2017年至2022年間,殺菌劑使用量預計將大幅增加28.7%。

- 真菌會隨著時間的推移而進化並對殺蟲劑產生抗藥性。這就需要使用新的、更有效的殺菌劑來對抗抗藥性並維持有效的疾病控制。例如,在印度尼西亞,由霜霉屬傳播的霜霉病嚴重限制了玉米的生產。霜霉病因反覆使用Metalaxyl而產生了抗藥性。因此,有必要開發其他可以取代Metalaxyl的殺菌劑。

- 氣候變遷正在改變溫度、濕度和降雨等天氣模式。這些變化可能會影響真菌疾病的流行程度和嚴重程度。殺菌劑用於控制氣候條件變化下滋生的疾病,幫助農民保護作物免受疾病造成的損失。

與貿易、農業和化學品進口相關的政府政策會影響進口過程,進而影響進口殺菌劑的價格。

- Mancozeb、福美鋅和丙森鋅是印尼廣泛使用的殺菌劑。這些殺菌劑屬於二硫代氨基甲酸鹽類,因其對各種作物真菌病害的廣譜防治而聞名。

- Mancozeb是一種接觸性殺菌劑,可用於多種作物,包括水果、蔬菜、堅果和田間作物,以及專業草坪管理。它對多種真菌疾病有效,包括馬鈴薯枯萎病、葉斑病、瘡痂病和銹病。此外,它還可以用作馬鈴薯、玉米、高粱、番茄和穀物的種子處理劑。印度是印尼Mancozeb的主要供應國。 2022 年的價格評估為每噸 7,700 美元,較 2019 年大幅上漲 14.9%。

- 丙森鋅是一種系統性和接觸性殺菌劑,用於控制多種作物(包括葡萄、蔬菜和樹果)的真菌疾病。對白粉病、灰黴病、白粉病等病害有防治效果。 2022 年的價格為每噸 3,500 美元。

- 福美鋅是另一種二硫代氨基甲酸酯類殺菌劑,其價格為每噸 3,300 美元,廣泛用於防治柑橘、蘋果和馬鈴薯等多種作物的病害。這種殺菌劑廣泛用於控制多種作物的疾病,包括柑橘、蘋果和馬鈴薯,並且對某些真菌疾病特別有效,例如馬鈴薯早疫病和晚疫病。

- 該國是殺菌劑的主要進口國之一,其中大部分來自印度、美國和中國。與貿易、農業和化學品進口相關的政府政策會影響進口過程,進而影響進口殺菌劑的價格。

印尼殺菌劑產業概況

印尼殺菌劑市場較為分散,前五大企業市佔率合計為1.82%。該市場的主要企業有:ADAMA Agricultural Solutions Ltd、拜耳股份公司、FMC Corporation、先正達集團和UPL Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 印尼

- 價值鍊和通路分析

第5章市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PT Biotis Agrindo

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001696

The Indonesia Fungicide Market size is estimated at 560.1 million USD in 2025, and is expected to reach 658.7 million USD by 2030, growing at a CAGR of 3.30% during the forecast period (2025-2030).

Growing fungal diseases damages major crops, like palm oil, coffee, rice, and maize, increasing the fungicide adoption rate

- Indonesia's tropical climate provides an ideal environment for crop cultivation and the rapid proliferation of fungal diseases, posing significant challenges to the agricultural sector. In response, farmers in the country are employing various methods to combat these fungal diseases, with fungicides being an effective solution. Depending on the specific disease and crop stage, farmers are implementing different application modes to control and mitigate the impact of these diseases.

- Farmers predominantly adopted the foliar application method, which represented a significant market share of 60.7% in 2022. This preference can be attributed to effective disease control and additional benefits to plant health, including improved growth efficiency and stress tolerance, resulting in enhanced productivity throughout the growing season.

- Seed treatment fungicides are suitable to combat soil-borne diseases in crops like palm oil, coffee, rice, and maize. This proactive approach enables growers to effectively control diseases at the early crop stage, mitigating their impact on crop health and yield. In 2022, the consumption of seed treatment fungicides represented a share of 13.8%.

- The chemigation application mode occupied the market value share of 12.3% in 2022, which is majorly attributed to the country's top priority on modernizing the irrigation systems, and 95% of the country's rice is produced from these irrigation systems. The rising adoption of modern irrigation systems further increases the adoption of chemigation modes for applying fungicides.

- Farmers utilize other fumigation and soil treatment as alternative modes of applying fungicides to their crops, selecting the appropriate method based on the specific fungal disease and crop type.

Indonesia Fungicide Market Trends

Growing crop infestations due to fungal diseases in major crops like maize and need for increasing higher productivity may drive the market

- Indonesia cultivates various high-value crops, such as fruits, vegetables, coffee, tea, and spices. These crops are often susceptible to fungal diseases that can directly impact their quality and marketability. Fungicides help protect these valuable crops and ensure their productivity and economic value.

- With the aim of increasing productivity, many farmers have adopted intensive agricultural practices, such as high-yield crop varieties and greenhouse cultivation. These practices, while beneficial for increasing yields, can also create favorable conditions for the development and spread of fungal diseases. Fungicides are necessary to control and prevent these diseases in intensive production systems. Fungicide consumption in Indonesia has increased in recent years. Specifically, between 2017 and 2022, there was a significant growth of 28.7% in fungicide usage.

- Fungi can evolve and develop resistance to pesticides over time. This has necessitated the use of new and more effective fungicides to combat resistant fungal strains and maintain effective disease control. For instance, in Indonesia, the output of maize is severely constrained by downy mildew brought on by Peronosclerospora spp. Susceptible varieties can have yield losses of around 90 to 100%. Downy mildew has developed resistance due to the continual usage of metalaxyl. As a result, it is essential to have other fungicides that may be used in place of metalaxyl.

- Climate change has led to shifts in weather patterns, including changes in temperature, humidity, and rainfall. These changes can influence the prevalence and severity of fungal diseases. Fungicides are used to manage diseases that thrive under altered climatic conditions, helping farmers protect their crops from disease-related losses.

Government policies related to trade, agriculture, and chemical imports can impact the import process and may affect the prices of imported fungicides

- Mancozeb, ziram, and propineb are widely used fungicides in Indonesia. These fungicides belong to the dithiocarbamate group and are known for their broad-spectrum control of fungal diseases in various crops.

- Mancozeb is a contact fungicide that is used on a variety of crops, including fruits, vegetables, nuts, and field crops, and professional turf management. It is effective against many types of fungal diseases, such as potato blight, leaf spot, scab, and rust. Additionally, it can be used as a seed treatment for potatoes, corn, sorghum, tomatoes, and cereal grains. India is a major supplier of mancozeb to Indonesia. In 2022, the price was valued at USD 7.7 thousand per metric ton and significantly increased by 14.9% from 2019.

- Propineb is a systemic and contact fungicide used to control fungal diseases in various crops, such as grapes, vegetables, and tree fruits. It is effective against diseases like downy mildew, gray mold, and powdery mildew. The price in 2022 accounted for USD 3.5 thousand per metric ton.

- Ziram is another dithiocarbamate fungicide that was valued at USD 3.3 thousand per metric ton, and this fungicide is widely used for disease control in various crops, including citrus, apples, and potatoes. It is particularly effective against diseases caused by certain fungi, including early and late blight in potatoes.

- The country is one of the major importers of fungicides, and most of its fungicides are imported from India, the United States, and China. Government policies related to trade, agriculture, and chemical imports can impact the import process and may affect the prices of imported fungicides.

Indonesia Fungicide Industry Overview

The Indonesia Fungicide Market is fragmented, with the top five companies occupying 1.82%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PT Biotis Agrindo

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219