|

市場調查報告書

商品編碼

1683983

中國殺菌劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

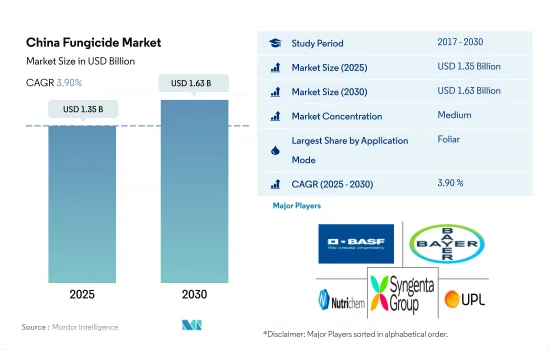

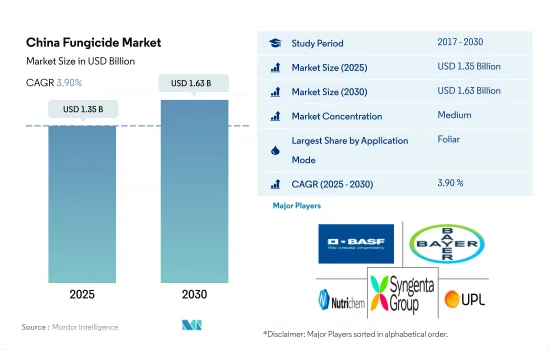

預計 2025 年中國殺菌劑市場規模將達到 13.5 億美元,預計到 2030 年將達到 16.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.90%。

葉面噴布因其快速起效的特性而佔據中國殺菌劑市場的主導地位

- 中國擁有成熟的殺菌劑製造業,國內有多家公司生產殺菌劑製劑及活性成分。我國使用的殺菌劑主要有三唑類、甲氧基丙烯酸酯類、苯並咪唑酮、二硫代氨基甲酸、醌類外抑制劑(QoIs)等。這些殺菌劑具有不同的作用方式並針對特定的真菌病原體。 2022年中國將佔亞太殺菌劑市場的31.5%。

- 葉面噴布佔據中國殺菌劑市場的主導地位,2022 年的佔有率為 60.1%。葉面噴布殺菌劑可以快速對抗真菌病原體。殺菌劑通常被配製成能夠在植物內快速吸收和轉移。這使得殺菌劑能夠到達受影響的組織並抑製或殺死真菌,從而減緩疾病的進展並防止進一步的損害。

- 2022 年,種子處理佔中國殺菌劑市場的 14.1%。真菌感染會削弱植物並阻礙其發育。殺菌劑種子處理有助於預防或減少疾病的侵襲,維持植物的健康和活力。這使得植物能夠將更多的能量用於生長發育,產生更健康、更高產的作物。 2017 年至 2022 年,種子處理市場價值將增加 9,190 萬美元。

- 預計到 2026 年,中國殺菌劑出口量也將增加。 2021 年,中國出口了 1.102 億公斤殺菌劑。預計2026年出口量將達1.256億公斤。這一因素可能會進一步推動殺菌劑市場的發展,預計預測期內複合年成長率將達到 3.7%。

中國殺菌劑市場趨勢

最大殘留量規定的製定和疾病控制其他替代方法的採用已導致每公頃殺菌劑消費量大幅減少。

- 過去一段時間,中國每公頃殺菌劑消費量下降了約16%。中國政府已經推出了管理殺菌劑使用的法規和政策。這包括對農產品中殺菌劑的最大殘留量設定限制,並制定安全和負責任使用殺菌劑的指南。透過實施這些法規,中國旨在確保殺菌劑合理使用並採取適當的預防措施。

- 中國積極鼓勵實施綜合蟲害管理(IPM)策略,包括預防措施、生物防治技術和殺菌劑等農藥的適當使用。這種綜合方法已成功降低殺菌劑的使用率。

- 中國政府也探索了疾病控制的替代方案,例如透過傳統育種和基因工程技術開發抗病作物品種。透過注重提高作物對疾病的天然抵抗力,中國減少了對殺菌劑的依賴。

- 中國一直在使用生物防治劑來取代殺菌劑。這些生物防治劑包括有益微生物,如細菌和真菌,它們可以抑製或阻止植物病原體的生長。將這些生物防治劑應用於作物可以減少殺菌劑的使用。

- 農民採用輪作和土壤管理等技術來有效地預防和控制疾病。這些技術減少了中國每公頃殺菌劑的消費量。

Mancozeb、丙森鋅、福美鋅是我國最常使用的殺菌劑成分。

- Mancozeb、丙森鋅、福美鋅是我國最常使用的殺菌劑成分。 2021年,中國殺菌劑出口量達1,1,025萬公斤,位居德國、法國、中國之後,位居第四。自1997年以來,出口與前一年同期比較%。預計到2026年將達到1.2564億公斤。

- 代森錳鋅是一種頻譜接觸性殺菌劑,用於控制油菜、生菜、小麥、蘋果、番茄、鮮食葡萄、釀酒葡萄、洋蔥、胡蘿蔔、歐洲防風草、青蔥和硬粒小麥中的多種真菌疾病,包括炭疽病、腐霉菌、葉斑病、白粉病、灰黴病、銹病和多種真菌疾病。 2022 年的價格為每噸 7,700 美元。

- 丙森鋅是一種Dithiocarbamate接觸性殺菌劑,2022 年的價格為每噸 3,500 美元。丙森鋅適用於番茄、大白菜、黃瓜、芒果和花卉等作物。用於防治芒果早疫病、晚疫病,白菜炭疽病,馬鈴薯霜霉病,黃瓜霜霉病,番茄晚疫病。

- 福美鋅是一種氨基甲酸酯類農業殺菌劑。它可以施葉面噴布,也可以用作土壤或種子處理。可用於仁果、核果、堅果、攀緣植物、蔬菜和觀賞植物,特別適用於防治蘋果、梨的黑星病,以及其他作物上的黑星病、斑枯病、桃葉病、穿孔病、銹病、黑腐病和炭疽病。 2022 年 Ziram 的價格為每噸 3,300 美元。

- 活性成分價格受到當地天氣、疾病爆發、能源價格和人事費用等因素的顯著影響。

中國殺菌劑產業概況

中國殺菌劑市場格局適度整合,前五大企業市佔率合計為63.77%。市場的主要企業有:BASF公司、拜耳公司、穎泰化工、先正達集團和聯合磷化有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 中國

- 價值鍊和通路分析

第5章 市場區隔

- 執行模式

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nutrichem Co. Ltd

- Rainbow Agro

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001685

The China Fungicide Market size is estimated at 1.35 billion USD in 2025, and is expected to reach 1.63 billion USD by 2030, growing at a CAGR of 3.90% during the forecast period (2025-2030).

Foliar application dominated the Chinese fungicide market owing to its quick action

- China has a well-established fungicide manufacturing industry, with several domestic companies producing fungicide formulations and active ingredients. Major fungicide classes used in China include triazoles, strobilurins, benzimidazoles, dithiocarbamates, and quinone outside inhibitors (QoIs). These fungicides have different modes of action and target specific fungal pathogens. China accounted for 31.5% of the Asia-Pacific fungicide market in 2022.

- Foliar application dominated the Chinese fungicide market and accounted for a share of 60.1% in 2022. Fungicides applied in foliar can provide rapid action against fungal pathogens. They are typically formulated to have quick absorption and translocation properties within the plant. This allows the fungicide to reach the affected tissues and inhibit or kill the fungi, reducing disease progression and preventing further damage.

- Seed treatment accounted for 14.1% of the Chinese fungicide market in 2022. Fungal infections can weaken and stunt the development of plants. Fungicide seed treatments can help plants maintain their health and vigor by preventing or lowering disease damage. This allows the plants to allocate more energy toward growth and development, leading to healthier and more productive crops. The market value of seed treatment between 2017 and 2022 increased by USD 91.9 million.

- Exports of fungicides from China are also projected to increase by 2026. In 2021, the country exported 110.2 million kg of fungicides. By 2026, exports are projected to reach 125.6 million kg. This factor may further drive the fungicide market, which is anticipated to register a CAGR of 3.7% during the forecast period.

China Fungicide Market Trends

Setting regulations for controlling maximum residue levels and adopting other alternatives for disease control significantly reduced per-hectare fungicide consumption

- During the historical period, China witnessed a notable decrease of approximately 16% in the consumption of fungicides per hectare, attributed to several reasons. The Chinese government has implemented regulations and policies to control the use of fungicides. These include setting limits on the maximum residue levels of fungicides in agricultural products and establishing guidelines for their safe and responsible use. By enforcing these regulations, China aims to ensure that fungicides are used judiciously and with proper precautions.

- China has actively encouraged the implementation of integrated pest management (IPM) strategies, which encompass preventive measures, biological control techniques, and judicious application of pesticides, such as fungicides. This comprehensive approach has successfully led to a decrease in the rate of fungicide usage.

- The Chinese government has also explored alternative methods of disease control, including the development of disease-resistant crop varieties through traditional breeding or genetic modification techniques. By focusing on enhancing the natural resistance of crops to diseases, China has reduced the reliance on fungicides.

- China has been utilizing biological control agents as an alternative to fungicides. These agents include beneficial microorganisms, such as bacteria and fungi, which can suppress or inhibit the growth of plant pathogens. Applying these biocontrol agents to crops could lead to a reduction in the rate of fungicide usage.

- The farmers adopted techniques, such as crop rotation and soil management, to prevent and manage diseases effectively. These techniques reduced the consumption of fungicide per hectare in China.

Mancozeb, propineb, and ziram are the most commonly used fungicide ingredients in China

- Mancozeb, propineb, and ziram are the most commonly used fungicide ingredients in China. In 2021, the country exported 110,250,000 kg of fungicides and was fourth behind Germany, France, and China. On average, exports have grown by 2.2% Y-o-Y since 1997. Exports are projected to reach 125,640,000 kg by 2026.

- Mancozeb is a broad-spectrum contact fungicide that is used to control a number of fungal diseases, such as anthracnose, pythium blight, leaf spot, downy mildew, botrytis, rust, and scab, in oilseed rape, lettuce, wheat, apples, tomatoes, table grapes, wine grapes, bulb onions, carrots, parsnip, shallots, and durum wheat. It was priced at USD 7.7 thousand per metric ton in 2022.

- Propineb is a dithiocarbamate contact fungicide, priced at USD 3.5 thousand per metric ton in 2022. Propineb is applicable to tomato, Chinese cabbage, cucumber, mango, flowers, and other crops. It is used in preventing and treating early late blight of mango, anthracnose of Chinese cabbage, potato downy mildews, cucumber downy mildew, and tomato late blight.

- Ziram is a carbamate, agricultural fungicide. It can be applied to the foliage of plants, but it is also used for soil and/or seed treatment. It can be used in pome fruit, stone fruit, nuts, vines, vegetables, and ornamentals, particularly to control scabs in apples and pears, as well as Alternaria, Septoria, peach leaf curl, shot-hole, rusts, black rot, and anthracnose in other fruit crops. Ziram was priced at USD 3.3 thousand per metric ton in 2022.

- The active ingredient prices are majorly influenced by factors like weather conditions, disease outbreaks, energy prices, and labor costs in the country.

China Fungicide Industry Overview

The China Fungicide Market is moderately consolidated, with the top five companies occupying 63.77%. The major players in this market are BASF SE, Bayer AG, Nutrichem Co. Ltd, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.6 Nutrichem Co. Ltd

- 6.4.7 Rainbow Agro

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219