|

市場調查報告書

商品編碼

1683999

南美殺菌劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)South America Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

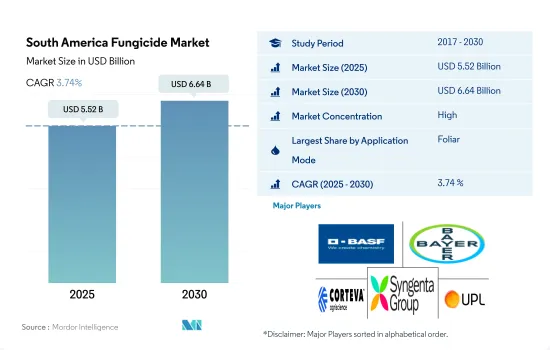

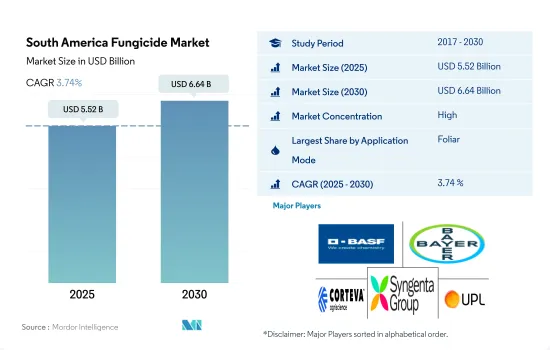

南美殺菌劑市場規模預計在 2025 年達到 55.2 億美元,預計到 2030 年將達到 66.4 億美元,預測期內(2025-2030 年)的複合年成長率為 3.74%。

葉面噴布是施用殺菌劑最重要的主要方法。

- 在南美洲,人們使用多種殺菌劑施用方法來有效控制農業中的真菌病害。選擇正確的施用方法可以為農民提供經濟有效的解決方案,使他們能夠精確覆蓋特定區域並最大限度地減少不必要的使用。功效的提高最佳化了殺菌劑的利用率並降低了農民的投入成本。

- 在農業中各種殺菌劑使用方法中,葉面噴布是主流,佔2022年殺菌劑總使用量的59.8%。此方法主要應用於豆類和油籽,佔市場佔有率最大,為42.1%。葉面噴布的針對性和高效吸收特性有助於控制疾病,從而有可能提高產量並降低農民的成本。

- 2022年,種子治療方法將佔據第二大市場佔有率,佔總量的14.2%。隨著農民越來越意識到使用殺菌劑種子處理產品保護幼苗和提高生產力的好處,其採用率顯著增加。因此,預計南美殺菌劑種子處理市場在 2023-2029 年預測期內的複合年成長率將達到 4.0%。

- 在南美洲,殺菌劑主要用於農業,以最大限度地提高作物產量並提高整體盈利。預計應用領域將大幅成長,2023-2029 年預測期內的複合年成長率為 4.0%。

真菌病害對作物的威脅日益嚴重,巴西佔據市場主導地位

- 許多作物生長在南美洲的熱帶氣候中。巴西、阿根廷、巴拉圭是南美洲三大農業生產國。這些國家是大豆、玉米、糖、咖啡、水果和蔬菜的主要出口國。

- 巴西佔據市場主導地位,2022 年佔 59.4% 的市場佔有率。隨著巴西農業的擴大和多樣化,真菌病害對作物的威脅越來越大。真菌病原體對多種作物不利影響,導致產量下降、品質下降並給農民帶來經濟損失。

- 2022年智利佔南美洲殺菌劑市場的4.8%。智利北部的阿塔卡馬沙漠屬溫帶氣候,中部肥沃的中央谷地地區屬於地中海氣候,南部的低矮沿海山區和東部崎嶇的安地斯山脈屬涼爽濕潤氣候。這些氣候條件有利於該國真菌疾病的傳播。剋菌丹和福美雙是智利廣泛使用的殺菌劑。研究發現,剋菌丹與有機質含量高的天然土壤最容易相互作用,而福美雙則更適合與黏土含量高的土壤相互作用。

- 推動殺菌劑市場發展的因素包括可耕地面積減少、人口成長、提高作物產量的需求。各種真菌對現有殺菌劑的抗藥性以及植物中新疾病的出現促使主要企業尋找新產品來對抗新的真菌突變並減少農民的損失。預計預測期內對抗作物疾病殺菌劑的需求不斷增加將推動市場發展。

南美洲殺菌劑市場趨勢

增加種植密度等強化農業實踐創造了有利於真菌病原體快速繁殖的環境。

- 真菌感染疾病會削弱植物的整體健康並導致生長不良。受感染的植物可能會高度降低、葉子變小、分枝減少,直接導致產量下降。這種真菌也會破壞植物內的荷爾蒙平衡,影響植物的發育和整體生產力。

- 南美洲南錐體是疾病爆發最重要的地區之一。該地區包括阿根廷、玻利維亞、智利、巴西、巴拉圭和烏拉圭。嚴重的疾病包括銹病、白粉病和真菌葉枯病(葉枯病、葉斑病)。這些疾病每年都會發生,因為正常條件有利於疾病的發展和傳播。

- 智利是南美洲最大的殺菌劑消費國,2022 年的消費量為 4.1 公斤/公頃。這是因為智利某些地區的氣候條件較高,濕度大,降雨多,氣溫波動大,有利於真菌病害的發生。為了預防和控制這些疾病,農民經常使用殺菌劑。

- 巴西南部的氣候條件非常適合幾種重要的真菌葉面疾病的發展。經過12年的調查,噴灑殺菌劑的小麥平均產量增加了40%。 2022年,巴西殺菌劑消費量排名第二,為0.9公斤/公頃。

- 增加種植密度等農業實踐的強化創造了有利於真菌病原體快速繁殖和定居的環境,從而推動了預測期內對殺菌劑的需求。

Mancozeb是南美洲使用最廣泛的殺菌劑。

- 代森錳鋅是一種二硫代氨基甲酸鹽類殺菌劑。它在南美洲被廣泛用於控制各種作物的真菌病害。Mancozeb可有效治療馬鈴薯、番茄、葡萄和香蕉等作物的多種真菌疾病,包括晚疫病、霜霉病、早疫病和炭疽病。代森錳鋅透過抑制真菌的代謝過程來發揮作用,阻止其生長和繁殖。代森錳鋅的活性頻譜也比其他殺菌劑更廣,可作用於真菌細胞內的多個部位,因此更有效。 2022年南美代森錳鋅價格為7,800美元。

- 與Mancozeb一樣,丙森鋅是一種二硫代氨基甲酸鹽類殺菌劑。丙森鋅在農業中用於控制各種真菌疾病。丙森鋅可有效治療多種作物的霜霉病、晚疫病、葉斑病和晚疫病等真菌疾病。與Mancozeb一樣,丙森鋅也透過多位點活性發揮作用,減少真菌群體中抗藥性的發生。 2022年南美丙森鋅的價格為3,540美元。

- 與代森錳鋅和丙森鋅一樣,福美鋅屬於Dithiocarbamate化學品類,2022 年的價格為每公尺 3,300 美元。福美鋅通常用於控制農業中的真菌疾病,已知可以有效控制紋枯病、霜霉病、葉斑病和炭疽病等真菌疾病。福美鋅能抑制真菌細胞內的幾種關鍵酶,破壞各種代謝過程,阻礙病原體的生長和繁殖能力。它作用於多個區域,可長期有效控制疾病。

南美洲殺菌劑產業概況

南美洲殺菌劑市場相當集中,前五大公司佔據了70.48%的市場。市場的主要參與者有:BASF公司、拜耳公司、科迪華農業科技公司、先正達集團和聯合磷化有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 阿根廷

- 巴西

- 智利

- 價值鍊和通路分析

第5章市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 阿根廷

- 巴西

- 智利

- 南美洲其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001701

The South America Fungicide Market size is estimated at 5.52 billion USD in 2025, and is expected to reach 6.64 billion USD by 2030, growing at a CAGR of 3.74% during the forecast period (2025-2030).

The foliar application holds the utmost significance as the primary mode of fungicide application

- In South America, numerous methods of fungicide applications are utilized to effectively control fungal diseases in agriculture. By choosing suitable application methods, farmers can attain cost-efficient solutions, ensuring accurate coverage of specific areas and minimizing unnecessary usage. This improved efficacy optimizes fungicide utilization, resulting in decreased input costs for farmers.

- Among various fungicide application methods in agriculture, foliar application is the dominant mode, accounting for 59.8% of the total fungicide usage in 2022. This approach is primarily utilized in pulses and oilseeds, which hold the largest market share at 42.1%. The targeted and efficient absorption properties of foliar application contribute to its effectiveness in controlling diseases, potentially resulting in increased yields and saving costs for farmers.

- In 2022, the seed treatment method held the second-largest market share, comprising 14.2% of the total. The rise in farmers' awareness about the benefits of using fungicide seed treatment products to protect seedlings and boost productivity has resulted in a significant rise in their adoption. As a result, it is projected that the South American fungicide seed treatment market may experience a CAGR of 4.0% during the forecast period from 2023 to 2029.

- In the agricultural sector of South America, fungicides are utilized with the primary aim of maximizing crop yields and improving overall profitability. The mode of the application segment is anticipated to experience substantial growth, with a CAGR of 4.0% during the forecast period from 2023 to 2029.

Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant

- Many crops thrive in the tropical climates of South America. Brazil, Argentina, and Paraguay are the three major agricultural producers in South America. These countries are major exporters of soybeans, maize, sugar, coffee, fruits, and vegetables.

- Brazil dominated the market, accounting for a market share of 59.4% in 2022. As Brazil's agriculture expands and diversifies, the threat of fungal diseases to crops becomes increasingly significant. Fungal pathogens can adversely impact a wide range of crops, leading to yield losses, reduced quality, and economic losses for farmers.

- Chile accounted for 4.8% of the South American fungicide market in 2022. Chile has a temperate climate in the Atacama Desert in the north, a Mediterranean climate in the central and fertile central valley region, and a cool and damp climate in the southern low coastal mountains and rugged Andes in the east. These climatic conditions favor the proliferation of fungal diseases in the country. Captan and thiram are two fungicides widely used in Chile. Captan is found to have the greatest interaction with natural soils with high organic matter content, while thiram showed a preference for soils with high clay content.

- Factors driving the market for fungicides include decreasing arable land, increasing population, and the need to improve crop yields. Resistance of various fungi to the existing fungicides and the emergence of new diseases in plants led the companies to find novel products for fighting the new fungus mutations and reducing the loss to farmers. The increasing demand for fungicides to fight crop diseases is expected to drive the market during the forecast period.

South America Fungicide Market Trends

Intensification of agricultural practices, such as increased planting densities, creates a conducive environment for the rapid proliferation of fungal pathogens

- Fungal infections can weaken the overall health of plants, leading to stunted growth. Infected plants may exhibit reduced height, smaller leaves, and fewer branches, which can directly translate into lower crop yields. Fungi can also disrupt the hormonal balance within plants, affecting their development and overall productivity.

- The Southern Cone of South America is one of the most critical regions for disease epidemics. The region is comprised of Argentina, Bolivia, Chile, Brazil, Paraguay, and Uruguay. Serious diseases that cause epidemics and production losses include leaf rusts, powdery mildew, and fungal leaf blights (Septoria leaf blotch, spot blotch). These diseases are present every year since normal conditions are conducive to their appearance and dissemination.

- Chile is the largest consumer of fungicides in South America, with a consumption of 4.1 kg/ha in the year 2022. This is because certain regions in Chile have climatic conditions, such as high humidity, rainfall, and temperature fluctuations, which can create a conducive environment for fungal disease development. To prevent and manage these diseases, farmers often rely on fungicides as a proactive measure.

- Climatic conditions prevailing in southern Brazil are highly conducive to the development of several important fungal foliar diseases. A twelve-year study demonstrated that wheat plants sprayed with fungicide showed a mean yield increase of 40%. Brazil accounted for the second most fungicide consumption rate of 0.9 kg/ha in 2022.

- The intensification of agricultural practices, such as increased planting densities, creates a conducive environment for the rapid proliferation and establishment of fungal pathogens, thereby fueling the demand for fungicides during the forecast period.

Mancozeb is the most popularly used fungicide in South America

- Mancozeb is a fungicide belonging to the chemical class of dithiocarbamates. It is commonly used in South America to control fungal diseases in various crops. Mancozeb is effective in managing a wide range of fungal diseases, including late blight, downy mildew, early blight, and anthracnose, in crops like potatoes, tomatoes, grapes, and bananas. Mancozeb works by interfering with the metabolic processes of the fungi, preventing their growth and reproduction. In addition, Mancozeb has a broad spectrum of activity compared to other fungicides and acts on multiple sites within the fungal cell, making it more effective. Mancozeb was priced at USD 7.8 thousand in South America in 2022.

- Propineb is also a fungicide belonging to the chemical class of dithiocarbamates, similar to Mancozeb. It is used to control various fungal diseases in agriculture. Propineb is effective in managing fungal diseases such as downy mildew, late blight, leaf spot, and blight in various crops. Like Mancozeb, Propineb also works through multi-site activity, making it less prone to resistance development in fungal populations. Propineb was priced at USD 3.54 thousand in South America in the year 2022.

- Similar to Mancozeb and Propineb, Ziram belongs to the chemical class of dithiocarbamates, priced at USD 3.3 thousand per metric in 2022. It is commonly used to control fungal diseases in agriculture and is known to effectively manage fungal diseases such as common blight, downy mildew, leaf spot, and anthracnose. Ziram inhibits several key enzymes in the fungal cell, disrupting various metabolic processes and interfering with the pathogens' ability to grow and reproduce. The multi-site activity makes it an effective tool for disease control over the long term.

South America Fungicide Industry Overview

The South America Fungicide Market is fairly consolidated, with the top five companies occupying 70.48%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219