|

市場調查報告書

商品編碼

1626331

中東和非洲的個人護理包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)Middle East And Africa Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

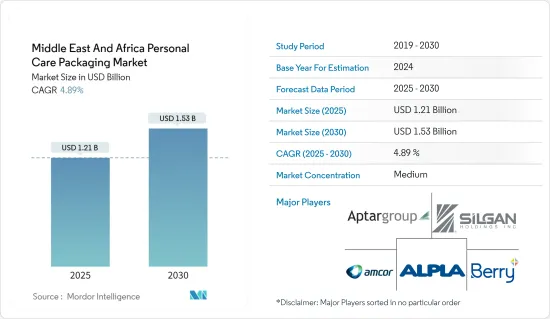

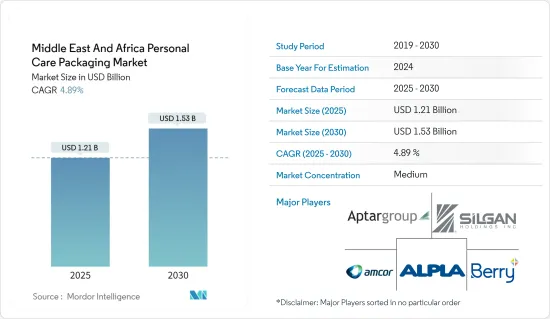

中東和非洲個人護理包裝市場規模預計到2025年為12.1億美元,預計到2030年將達到15.3億美元,預測期內(2025-2030年)複合年成長率為4.89%。

主要亮點

- 對個人保健產品的需求不斷成長正在推動中東個人護理包裝市場的成長。製造商透過提供專業知識、擴充性、法規遵循、成本效益和創新能力來支持這種成長。隨著消費者偏好的變化,包裝在滿足品牌的多樣化需求和確保個人保健產品的高效生產方面發揮著至關重要的作用。

- 近年來,在可支配收入增加、生活方式改變以及個人衛生和整裝儀容意識增強的推動下,中東的個人護理行業顯著擴張。這導致對各種個人保健產品的需求激增,包括護膚、護髮和化妝品。因此,包裝產業必須進行調整和創新,以滿足這些產品的獨特要求,例如免受環境因素影響、易於使用和美觀。該地區的製造商投資先進技術和永續材料來創建包裝解決方案,以保持產品完整性並滿足消費者對環保選擇日益成長的偏好。

- 此外,個人護理領域電子商務的興起進一步影響了包裝設計,重點關注耐用性和防篡改功能,以實現安全運輸和交付。大城市的年輕消費者正在消費更多具有抗衰老和美白功效且採用天然有機成分配製的護膚品。社會意識的增強使得年輕消費者對使用和消費的產品更加挑剔。

- 千禧世代和 Z 世代更喜歡購買那些積極考慮對地球和環境影響並有明確目標的品牌。具有社會意識的消費者的需求正在導致天然和有機個人保健產品的增加,以及從採購、生產到包裝的供應鏈中對永續實踐的需求。

- 阿拉伯國家由於國內消費旺盛,近年來在個人照護市場展現出巨大潛力。主要市場包括沙烏地阿拉伯和阿拉伯聯合大公國等海灣國家,以及摩洛哥和突尼斯等北非國家。這些國家正在經歷快速的都市化、可支配收入的增加和消費者偏好的變化,促進了個人護理行業的成長。特別是在沙烏地阿拉伯,由於年輕人口和美學意識的提高,對優質個人保健產品的需求正在迅速成長。

- 阿拉伯聯合大公國擁有多元化的外籍居住者和蓬勃發展的旅遊業,為本地和國際個人護理品牌提供了獨特的市場。在北非、摩洛哥和突尼斯,人們對天然有機個人保健產品的興趣與日俱增,反映了清潔美容的全球趨勢。包括電子商務平台在內的零售通路的擴張進一步推動了這些地區的市場成長,並使個人保健產品更容易接觸到更廣泛的消費者群體。

- 此外,沙烏地阿拉伯是中東和北非地區化妝品的主要市場。該市場的成長是由對天然、有機、草藥和清真產品以及創新和環保包裝的需求不斷成長所推動的。沙烏地阿拉伯消費者對美妝內容高度關注,YouTube 上美妝相關影片的人均觀看次數位居全球第一。沙烏地阿拉伯消費者熟知化妝品產業的產品成分和全球趨勢。

- 該地區的個人護理包裝市場受到與研發 (R&D) 和製造新包裝解決方案相關的高成本的限制。這些成本是個人護理行業市場擴張和創新的主要障礙。

- 開發新的包裝解決方案需要大量的研發投資,包括材料研究、設計流程和原型測試。此外,安裝或修改製造設備來生產這些新的包裝解決方案需要大量的資本支出。這些高昂的初始成本可能會阻礙中小型企業,尤其是對創新包裝技術的投資。

中東和非洲個人護理包裝市場趨勢

玻璃領域佔主要市場佔有率

- 玻璃包裝已在各種行業中流行,用於儲存液體藥品、化妝品和香水。這些容器由優質玻璃製成,並配有塑膠滴管,這使它們與傳統藥瓶不同。滴管可以精確分配液體並最大限度地減少浪費。在這些容器中使用玻璃具有多種優點,包括化學惰性、透明度和可回收性。

- 玻璃瓶廣泛用於儲存液體藥品、護膚品、香水和其他需要精確劑量控制的應用。製藥業尤其受益於玻璃包裝,因為它可以保持產品完整性並延長保存期限。化妝品和個人護理行業也利用玻璃瓶來生產奢侈品,充分利用其美學吸引力和感知品質。玻璃包裝的多功能性和滴管的功能使其在各種利基市場中採用,例如精油和芳香療法產品。

- 由於對天然香料的需求超過合成香料以及豪華香水的日益普及,預計玻璃瓶市場將在預測期內顯著成長。順應這一趨勢,該公司正在投資玻璃香水瓶的創新設計,探索獨特的形狀、紋理和裝飾,以增強其產品的吸引力。香水玻璃瓶因其規則的形狀和良好的反射率而被認為是奢侈品,這有助於提升香味的整體感覺。

- 近年來,由於網路普及率和智慧型手機使用率的提高,阿拉伯聯合大公國電子商務市場經歷了顯著成長。截至2023年,阿拉伯聯合大公國電商中個人護理類別的市場佔有率已達19%。它在線上零售領域也佔有重要地位,反映了消費者偏好和購物習慣的變化。該地區個人保健產品的市場佔有率為27%,這對玻璃包裝的需求影響重大。這一趨勢是由玻璃包裝的奢華和環保特性推動的,這符合消費者在線購買個人保養用品的偏好。隨著品牌尋求在競爭激烈的線上市場中脫穎而出,個人保養用品電子商務銷售的成長推動了對創新和有吸引力的玻璃包裝解決方案的需求。

- 這種向可再填充玻璃瓶的轉變解決了環境問題,並為消費者提供了更奢華、更持久的產品體驗。香水品牌正在響應這一趨勢,推出流行香水的填充用,讓顧客重複使用原始的瓶子並減少整體包裝廢棄物。此外,從長遠來看,使用填充用的玻璃瓶可以節省消費者的錢,因為填充用通常比購買含有相同數量香水的新瓶子便宜。

預計阿拉伯聯合大公國將佔據主要市場佔有率

- 阿拉伯聯合大公國年輕、都市化且具有時尚意識的人口正在推動對化妝品和個人保健產品的需求。這種趨勢在杜拜和阿布達比等大城市尤其明顯,那裡的消費者對高品質、優質美容產品的要求也越來越高。

- 杜拜正成為中東包裝產業的重要市場,重點關注創新和永續的解決方案。阿拉伯聯合大公國擁有龐大的消費群和除石油天然氣以外的多元化產業,對塑膠包裝的需求每年都在穩步成長。其作為貿易中心的戰略定位進一步推動了這一成長,吸引了國際品牌並培育了具有競爭力的零售環境。

- 阿拉伯聯合大公國是中東地區最重要、成長最快的化妝品市場之一。這種成長歸因於多種因素,包括該國人口眾多、遊客人數眾多以及成為化妝品行業區域中心的雄心壯志。在15個穆斯林國家中,阿拉伯聯合大公國清真化妝品和藥品市場規模排名第一。市場也見證了兩個重要趨勢:高級產品的重要性日益增加以及大麻化妝品的興起。杜拜政府是阿拉伯世界第一個對大麻化妝品進行認證的政府,這是一項開創性舉措。

- 杜拜因其精通科技的人口而成為中東電子商務的領導者。該國網路購物的持續成長得益於數位化的提高以及對線上付款系統和行動電子錢包的信任度的提高。關鍵的市場發展因素包括電子商務的擴張、全通路策略的發展以及線上訂單中更多地使用生物分解性塑膠包裝。為了支持電子商務包裝的成長,公司正在採用包括線上銷售在內的全通路分銷方法。

- 該國的電子商務零售額成長強勁,增幅最大,從2021年的51.12億美元增至2023年的62.17億美元。過去十年,電子商務銷售額呈現穩定、近乎線性的成長。中國成長最快的十大電子商務類別展示了受益於線上銷售的產品多樣性,特別是食品和寵物用品。然而,休閒用品、時尚和個人護理仍然是主要的電子商務領域。

- 阿拉伯聯合大公國的零售電子商務產業正在經歷顯著成長,許多品牌和零售商都希望加強其線上業務。該國的電子商務市場包括 Noon 等本土品牌和亞馬遜等國際公司。電子商務的成長為整個全部區域提供了包裝機會。

- 杜拜正在轉型為全球工業和製造中心,旨在吸引重點產業的大規模投資。這項舉措符合《杜拜 2030 年工業戰略》,預計到 2030 年產業部門將再成長 50 億美元。作為該開發案的一部分,藥品、草藥和個人保健產品跨國製造商喜馬拉雅健康公司將在該地區主要製造地杜拜工業城設立一家工廠。該計劃預計將於 2024 年第一季開始商業生產,可能會增加該國對個人護理包裝產品的需求。

中東和非洲個人護理包裝產業概況

由於許多公司在國內外開展業務,中東和非洲個人護理包裝市場競爭激烈。這個分散的市場擁有 Amcor Group GmbH、AptarGroup Inc.、Berry Global、Silgan Holdings Inc. 和 Alpla Group 等重要公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 隨著可支配收入的增加,個人保健產品的消費不斷擴大

- 越來越注重創新和有吸引力的包裝

- 市場限制因素

- 新包裝解決方案的研發和製造成本較高

第6章 市場細分

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙板

- 按包裝類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管棒

- 蓋子與封口裝置

- 泵浦分配器

- 軟質塑膠包裝

- 其他包裝類型

- 依產品類型

- 口腔護理

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 除臭劑

- 其他產品類型

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- AptarGroup Inc.

- Berry Global

- Silgan Holdings Inc.

- Alpla Group

- Huhtamaki Oyj

- Mondi PLC

- EPL Limited

- Innovative Group

- Sonoco Products Company

第8章投資分析

第9章 未來展望

簡介目錄

Product Code: 47663

The Middle East And Africa Personal Care Packaging Market size is estimated at USD 1.21 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 4.89% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for personal care products drives the growth of the personal care packaging market in the Middle East. Manufacturers support this growth by providing expertise, scalability, regulatory compliance, cost-effectiveness, and innovation capabilities. As consumer preferences evolve, packaging plays a crucial role in meeting brands' diverse needs and ensuring the efficient production of personal care products.

- The personal care industry in the Middle East has experienced significant expansion in recent years, driven by rising disposable incomes, changing lifestyles, and increased awareness of personal hygiene and grooming. This has led to a surge in demand for a wide range of personal care products, including skincare, haircare, and cosmetics. Consequently, the packaging industry has had to adapt and innovate to meet the specific requirements of these products, such as protection from environmental factors, ease of use, and aesthetic appeal. Manufacturers in the region are investing in advanced technologies and sustainable materials to create packaging solutions that preserve product integrity and align with growing consumer preferences for eco-friendly options.

- Additionally, the rise of e-commerce in the personal care sector has further influenced packaging design, focusing on durability and tamper-evident features for safe shipping and delivery. Young customers in large cities spend more on skin care products with anti-aging and whitening advantages and natural and organic ingredients. Rising social consciousness drives young consumers to be more discerning about the products they use and consume.

- Millennials and Gen Z prefer to purchase products from brands with a clear purpose, actively considering the impact on the planet and the environment. The demand for socially conscious consumers leads to the rise in natural and organic personal care products and the need for sustainable practices in the supply chain-from sourcing and production to packaging.

- Several Arab nations have shown significant potential for the personal care market due to their high domestic consumption in recent years. Key markets include Gulf countries such as Saudi Arabia and the United Arab Emirates and North African nations like Morocco and Tunisia. These countries have experienced rapid urbanization, rising disposable incomes, and changing consumer preferences, which have contributed to the growth of the personal care industry. Saudi Arabia, in particular, has seen a surge in demand for premium personal care products, driven by a young population and increasing beauty consciousness.

- The United Arab Emirates, with its diverse expatriate population and thriving tourism industry, offers a unique market for local and international personal care brands. In North Africa, Morocco and Tunisia have witnessed a growing interest in natural and organic personal care products, reflecting a global trend toward clean beauty. Expanding retail channels, including e-commerce platforms, has further facilitated market growth in these regions, making personal care products more accessible to a broader consumer base.

- Further, Saudi Arabia represents a key market for cosmetics in the MENA region. This market's growth is driven by increasing demand for natural, organic, herbal, and halal products and innovative and environment-friendly packaging. Saudi Arabian consumers demonstrate high engagement with beauty content, watching the highest number of beauty-related YouTube videos per capita globally. This audience is well-informed about product ingredients and current global trends in the cosmetics industry.

- The personal care packaging market in the region is limited by the high costs associated with research and development (R&D) and manufacturing new packaging solutions. These expenses pose significant barriers to market expansion and innovation in the personal care sector.

- Developing new packaging solutions requires substantial investment in R&D, including materials research, design processes, and prototype testing. Additionally, setting up or modifying manufacturing facilities to produce these new packaging solutions involves considerable capital expenditure. These high upfront costs can deter companies, especially smaller ones, from investing in innovative packaging technologies.

Middle East And Africa Personal Care Packaging Market Trends

Glass Segment to Hold Significant Market Share

- Glass packaging has gained popularity for storing liquid medicines, cosmetics, and perfumes across various industries. These containers are crafted from high-quality glass and feature a plastic dropper, distinguishing them from traditional medicine bottles. The dropper enables precise dispensing of liquids and minimizes waste. Using glass for these containers offers several advantages, including chemical inertness, transparency, and recyclability.

- Glass bottles are widely used for storing liquid medicines, skincare products, perfumes, and other applications requiring accurate dosage control. The pharmaceutical industry, in particular, benefits from glass packaging because it maintains product integrity and extends shelf life. The cosmetics and personal care industries also utilize glass bottles for premium products, leveraging their aesthetic appeal and perceived quality. The versatility of glass packaging and the functionality of droppers has led to its adoption in various niche markets, such as essential oils and aromatherapy products.

- The market for glass bottles is expected to grow significantly during the forecast period, driven by the increasing demand for natural fragrances over synthetic-based ingredients and the rising popularity of luxury perfumes. This trend has prompted companies to invest in innovative designs for perfume glass bottles, exploring unique shapes, textures, and embellishments to enhance product appeal. Perfume glass bottles are considered high-end luxury items due to their well-rounded shapes and excellent reflectivity, which contribute to the overall sensory experience of the fragrance.

- The UAE e-commerce market has experienced significant growth in recent years, driven by increasing internet penetration and smartphone usage. As of 2023, the personal care category in e-commerce in the United Arab Emirates held a market share of 19%. This substantial presence in the online retail space reflected changing consumer preferences and shopping habits. The region's 27% market share of personal care products has notably impacted the demand for glass packaging. This trend is attributed to the perceived premium quality and eco-friendly nature of glass containers, which align well with the preferences of consumers purchasing personal care items online. The rise in e-commerce sales for personal care products has consequently led to increased demand for innovative and attractive glass packaging solutions as brands seek to differentiate themselves in the competitive online marketplace.

- This shift toward refillable glass bottles addresses environmental concerns and offers consumers a more luxurious and long-lasting product experience. Perfume brands respond to this trend by introducing refill options for their popular fragrances, allowing customers to reuse their original bottles and reducing overall packaging waste. Additionally, using refillable glass bottles often results in cost savings for consumers in the long run, as refills are typically priced lower than purchasing a new bottle with the same amount of perfume.

United Arab Emirates is Expected to Hold a Major Market Share

- The United Arab Emirates exhibits a growing demand for cosmetics and personal care products, driven by its young, urbanizing, and fashion-conscious population. This trend is particularly evident in major cities like Dubai and Abu Dhabi, where consumers increasingly seek high-quality, premium beauty products.

- The country is emerging as a significant market for the Middle East's packaging industry, focusing on innovative and sustainable solutions. With its substantial consumer base and diverse industrial industries beyond oil and gas, the United Arab Emirates is experiencing a steady increase in demand for plastic packaging annually. This growth is further supported by the country's strategic location as a trade hub, attracting international brands and fostering a competitive retail environment.

- The United Arab Emirates is one of the Middle East's most significant and fastest-growing cosmetics markets. This growth is attributed to several factors, including the country's considerable population, high tourist activity, and ambition to become the regional hub for the cosmetics industry. Among 15 Muslim nations, the United Arab Emirates leads in market size for halal cosmetics and pharmaceuticals. The market is also witnessing two significant trends: the expanding importance of premium products and the emergence of hemp-based cosmetics. In a pioneering move, Dubai's administration has become the first in the Arab world to accredit hemp-based cosmetic products.

- The country has emerged as a leader in Middle Eastern e-commerce, driven by its tech-savvy population. The country's consistent growth in online shopping is attributed to increased digital adoption and growing confidence in online payment systems and mobile wallets. Key market factors include the expansion of e-commerce, the development of omnichannel strategies, and the increased use of biodegradable plastic packaging for online orders. Companies are implementing omnichannel distribution approaches, including online sales, to support e-commerce packaging growth.

- The country's e-commerce retail value has grown significantly, with the most substantial increase of USD 6,217 million in 2023, up from USD 5,112 million in 2021. Over the past decade, e-commerce sales have shown steady, near-linear growth. The top ten fastest-growing e-commerce categories in the country demonstrate the diverse range of products benefiting from online sales, particularly food and pet products. However, recreational items, fashion, and personal care remain the dominant e-commerce segments.

- The UAE retail e-commerce industry has experienced significant growth, prompting many brands and retailers to enhance their online presence. The country's e-commerce market includes local brands like Noon and international players like Amazon. This growth in e-commerce provides packaging opportunities throughout the region.

- Dubai is advancing its transformation into a global industrial and manufacturing hub, aiming to attract substantial investments across key industries. This initiative aligns with the Dubai Industrial Strategy 2030, which forecasts an additional USD 5 billion in industrial sector growth by 2030. As part of this development, Himalaya Wellness, a multinational manufacturer of medicines, herbal, and personal care products, plans to establish a factory in Dubai Industrial City, a major manufacturing center in the region. The project was expected to commence commercial production in the first quarter of 2024, potentially increasing demand for personal care packaging products in the country.

Middle East And Africa Personal Care Packaging Industry Overview

The Middle East and Africa personal care packaging market is competitive because many players operate their businesses nationally and internationally. The fragmented market has significant players like Amcor Group GmbH, AptarGroup Inc., Berry Global, Silgan Holdings Inc., and Alpla Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper and Paperboard

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.2.10 Other Packaging Types

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Haircare

- 6.3.3 Color Cosmetics

- 6.3.4 Skincare

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.3.7 Other Products Types

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 AptarGroup Inc.

- 7.1.3 Berry Global

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 Alpla Group

- 7.1.6 Huhtamaki Oyj

- 7.1.7 Mondi PLC

- 7.1.8 EPL Limited

- 7.1.9 Innovative Group

- 7.1.10 Sonoco Products Company

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219