|

市場調查報告書

商品編碼

1628724

北美個人護理包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)NA Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

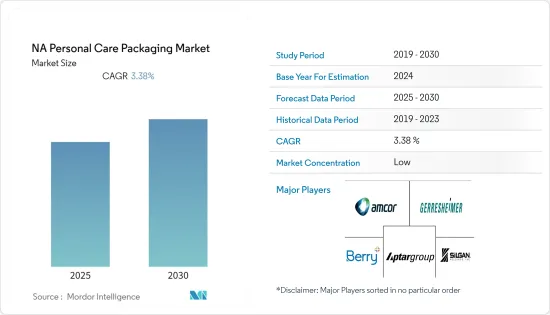

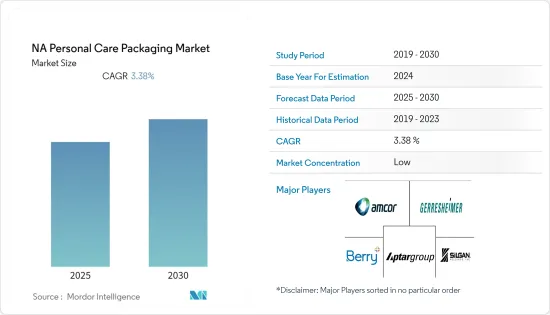

北美個人護理包裝市場預計在預測期內複合年成長率為3.38%

主要亮點

- 根據美國勞工統計局的數據,2020年,美國消費者每年將在護髮產品上花費64.7美元。這種護髮產品的支出將推動永續個人護理包裝市場的需求。

- 例如,2021年8月,歐萊雅旗下卡尼爾公司在美國推出了全混合洗髮精。此次首次亮相是品牌永續性努力的一部分,其用水量比液體洗髮精少,並且不使用塑膠包裝。

- 另外,根據美國著名雜誌《Nail Magazine》的一項調查顯示,去美甲沙龍的女性中有超過74%是自己購買用品、工具和設備,而不是使用沙龍用品。

- 為了滿足日益成長的管材需求,各供應商正在市場上進行各種合作和創新。例如,2021 年 11 月,化妝品、護膚、個人護理和口腔護理市場塑膠和積層軟管的領先供應商之一 Albea Tubes 與 UTCG 和 eXpackUSA 合作開發消費後可回收 (PCR) 管)為美容和個人護理企業提供美國製造的塑膠管。

- 消費者對實用、易於使用的分配器和產品的需求不斷成長,促使化妝品公司採用創新的包裝解決方案,例如使用可回收、可堆肥和生物分解的塑膠,並促進化妝品包裝的創新。

北美個人護理包裝市場趨勢

護髮顯著成長

- 護髮品牌在沙龍內外都使用包裝。護髮零售領域競爭激烈,護髮品牌依賴包裝差異化與消費者建立連結。繼護膚之後,護髮產品佔據了化妝品市場的最大佔有率。

- 大多數護髮品牌擴大將感官元素融入其包裝中,嘗試霧面和光澤印刷技術的相互作用。由於使用護理油來保護熱誘導造型、增加光澤和減少毛躁,滴管式包裝的使用越來越多。

- 自成立以來,總部位於紐約的 Oribe Hair Care 以其棱角分明的線條和大膽色彩的自訂包裝在貨架上佔據了獨特的地位。該品牌還採用創新的包裝,將舊世界的複雜性與時尚、現代設計的優雅融為一體,每個瓶子、直立的管子和時尚的罐子都採用香水瓶的輪廓,結果是一個有凝聚力的展示。

- 專門開發洗髮精和護髮產品的公司也在尋求擴展到零售店,以最大限度地提高收益。例如,Olaplex Holdings 於 2021 年 11 月與 Ulta Beauty Salons 建立了分銷合作夥伴關係。從 2022 年 1 月開始,我們的零售產品將在超過 1,250 家 Ulta 商店和 ulta.com 上出售。

- 許多護髮品牌正在夥伴關係提供更好的包裝替代方案。公司擴大參與補充舉措,鼓勵消費者外帶並以比單獨購買產品更優惠的價格補充。 2020年10月,寶潔美妝宣佈在歐洲大規模推出其海飛絲、潘婷、Herbal Essences和Aussie品牌下的首款填充用鋁瓶系統。此再填充系統使用新型可重複使用的 100% 鋁瓶和可回收填充用袋,將塑膠用量減少 60%(與標準品牌瓶相比,每毫升)。預計它將為改變消費者購買、使用和處置洗髮精瓶的方式鋪平道路。

塑膠佔據主要市場佔有率

- 塑膠因其成本低、重量輕、柔韌、耐用等因素而成為個人保健產品包裝的主要材料。在個人保健產品方面,塑膠是製造防碎和「防溢」瓶子、罐子、管子、蓋子和封口的首選材料。

- 根據包裝器材工業協會 (PMMI) 的數據,瓶子、罐子、粉盒和管材等塑膠包裝的市場佔有率為 61%,而化妝品和其他個人保健產品中瓶子是最常用的容器。

- 由 HDPE 生產的個人保健產品瓶是最常見且最便宜的,經濟、抗衝擊且保持良好的防潮性。乳液瓶有各種形狀、尺寸和規格,但有些是帶蓋的管子。這些管子通常由塑膠製成,具體取決於其尺寸。然而,一些乳液瓶是由塑膠製成的,但有一個泵分配器而不是有蓋的頂部。這對於許多不想擰上和擰開頂蓋或翻轉蓋子的人來說非常有用。

- Gerresheimer Plastic Packaging 致力於解決環境問題,提供一系列由各種消費後回收材料製成的 PET 產品。我們可以生產 100% R-PET 製成的化妝品瓶。除了使用回收材料外,Gerresheimer 還熱衷於透過使用生醫材料來幫助客戶減少溫室氣體排放。生醫材料是傳統 PE/PET 的可再生替代品。甘蔗是用於生產生醫材料的材料之一,從甘蔗工廠提取乙醇並轉化為綠色乙烯,然後運送到聚合工廠,在那裡轉化為綠色PE/PET。

- 此外,為了完全消除原生塑膠的使用,該公司正在探索其他材料,例如主要由甘蔗製成的生質塑膠,人們認為在不久的將來可能會成為石油基原生塑膠的可行替代品。 。

北美個人護理包裝產業概況

由於 Amcor、AptarGroup Inc.、Gerresheimer AG、RPC Group Plc(Berry Global Group)和 Silgan Holdings Inc. 等公司的存在,北美個人護理包裝市場高度分散。 Amcor、AptarGroup Inc.、Gerresheimer AG、RPC Group Plc (Berry Global Group)、RPC Group Plc (Berry Global Group) 和 Silgan Holdings Inc. 等公司正在進行大量研發投資,以維持北美包裝產業的發展。永續性數位化來擴大我們的市場。

- 2021 年 6 月 - Amcor 宣布推出新機器來生產超透明耐熱薄膜。 AmPrima 生產線採用機器方向定向技術,能夠以我們的競爭對手在可回收解決方案中無法比擬的速度生產薄膜。

- 2021 年 1 月 - Silgan Holdings Inc. 與 Bondi Sands 合作推出新推出的美黑產品 Pure。 Silgan Dispensing 的 EZ'R 發泡劑是 100% 可回收的聚丙烯 (PP) 流,是市場上第一個完全由塑膠組件製成的泡沫應用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 隨著可支配收入的增加,個人保健產品的消費增加

- 越來越注重創新和有吸引力的包裝

- 市場限制因素

- 新包裝解決方案的研發和製造成本較高

第6章 市場細分

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 按包裝類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管和棒

- 蓋子與封口裝置

- 泵浦和分配器

- 軟塑膠包裝

- 其他包裝類型

- 依產品類型

- 口腔護理

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 除臭劑

- 其他產品類型

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc(Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

- Gerresheimer AG

- Raepak Ltd

第8章投資分析

第9章 市場機會及未來趨勢

The NA Personal Care Packaging Market is expected to register a CAGR of 3.38% during the forecast period.

Key Highlights

- According to the Bureau of Labor Statistics, in 2020, American consumers spent between 64.7 U.S. dollars in a year on hair care products. Such spending on hair products will drive the demand for the sustainable personal care packaging market.

- For Instance, in August 2021, Garnier, a subsidiary of L'Oreal, introduced Whole Blends Shampoo Bars in the United States. The debut is part of the brand's greater sustainability effort, as they are made with less water than their liquid counterparts and have no plastic packaging.

- Further, according to a survey conducted by the Nail Magazine, a prominent magazine based in California, the United States, more than 74% of the women who visit nail salons buy their own supplies, tools, and equipment rather than using salon supplies.

- In order to cater to the increasing demand for tubes, various suppliers have come up with different collaborations and innovations in the market. For Instance, in November 2021, Albea Tubes, one of the major providers of plastic and laminate tubes for the cosmetic, skincare, personal care, and oral care markets, partnered with U.T.C.G and eXpackUSA to offer Made in America tubes made from post-consumer recycled (PCR) plastics to beauty and personal care businesses.

- The increasing demand from consumers for practical and user-friendly dispensing solutions and products is prompting cosmetic companies to adopt innovative packaging solutions such as the use of recyclable plastic and compostable and biodegradable plastics, thereby driving the innovations in cosmetic packaging.

North America Personal Care Packaging Market Trends

Haircare Will Observe a Significant Growth

- Haircare brands use packaging to their advantage, both in the salon and beyond. Haircare for the retail segment is highly competitive, and hair care brands are relying on packaging differentiation to forge a connection with consumers. After skincare, hair care commands a significant share of the cosmetic market.

- Most hair care brands experiment with the interplay of matte and gloss printing techniques and are increasingly incorporating sensory elements into their packaging. The use of treatment oils for added heat styling protection, imparting shine, or decreasing frizz has led to the increased use of dropper packaging as a dosing and precision application method.

- Oribe Hair Care, based in New York, recently cultivated a distinctive shelf presence with its angularly lined, boldly-hued, custom packaging since its inception. The brand also has innovative packaging, which blends old-world intricacy with sleekly modern engineered elegance, and all the bottles, upright tubes, and sophisticated jars deliver a cohesive display suggestive of perfume bottle silhouettes.

- Companies dedicated to the development of shampoos and hair care products have also been looking to expand into retail stores to maximize any possible revenue. For instance, in November 2021, Olaplex Holdings, Inc. formed a distribution partnership with Ulta Beauty Salons, designed around increasing retail channels for their products by using the salons as stores. The Company's retail products will be available in more than 1,250 Ulta stores and on ulta.com from January 2022.

- Many hair care brands are entering into partnerships to provide better packaging alternatives. Companies are increasingly engaging in refilling initiatives that encourage consumers to bring back their bottles and refill them at a subsidized price, compared to if they would have purchased the product independently. In October 2020, P&G Beauty announced its first-ever refillable aluminum bottle system to launch at-scale, with its Head & Shoulders, Pantene, Herbal Essences, and Aussie brands in Europe. The refill system uses a new reusable 100% aluminum bottle and recyclable refill pouch, made using 60% less plastic (per mL versus standard brand bottle). It is expected to pave the way in changing the way consumers buy, use and dispose of their shampoo bottles.

Plastic to Hold Major Market Share

- Plastic is a prominent material in personal care product packaging due to its low cost, lightweight, flexibility, durability, and other factors. For personal care products, plastics are a material of choice for manufacturing shatterproof and 'no-spill' bottles, jars, tubes, caps, and closures.

- According to the Packaging Machinery Manufacturers Institute (PMMI), at 61% market share, plastic packaging, such as bottles, jars, compacts, and tubes, dominate in beauty and other personal care products, where bottles are the most commonly used containers, accounting for 30% of the market.

- Personal care product bottles produced from HDPE are the most common and least expensive, which are economical, impact-resistant, and maintain a good moisture barrier. Lotion bottles come in all different shapes, sizes, and forms, whereas some lotions are kept in capped tubes. These tubes are usually made from plastic, depending on their size. However, there are lotion bottles that are also made of plastic, but instead of the capped tops, they have pump dispensers. This is helpful for many people who do not want to have to screw a top on and off or not want to flip up a cap.

- Gerresheimer Plastic Packaging, which is committed to environmental concerns, offers PET ranges with different mixtures of post-consumer recycled materials. It can produce cosmetic bottles made of up to 100% R-PET. Besides using recycled materials, Gerresheimer is also motivated to help its customers reduce greenhouse gas emissions by using biomaterials. Biomaterials are renewable alternatives to conventional PE/PET. Sugarcane is one of the substances used to make biomaterials, where ethanol is taken from the sugarcane plant, and after converting into green ethylene, it goes to the polymerization plants, where it is converted into green PE/PET.

- Moreover, to fully eliminate the use of virgin plastic, companies are exploring other materials, including bioplastic made primarily from sugarcane, which will very soon provide viable alternatives to virgin petro-based plastics.

North America Personal Care Packaging Industry Overview

The North America Personal Care Packaging Market is highly fragmented due to the presence of players, like Amcor, AptarGroup Inc., Gerresheimer AG, RPC Group Plc (Berry Global Group) Silgan Holdings Inc. are up-scaling the market with substantial R&D investments, drive towards the sustainability and digitization of the packaging industry in North America.

- June 2021- Amcor launched new machines that will produce ultra-clear and heat resistance films. The AmPrima line uses machine-direction orientation technology to produce films that can run at speeds that competitors are unable to match in a recycle-ready solution.

- Jan 2021- Silgan Holdings Inc. partnered with Bondi Sands on the brand's newly launched self-tanning range, Pure. It makes use of Silgan Dispensing's EZ'R foamer, which features a first-to-market foam application that is 100% recyclable in polypropylene (PP) streams and made entirely from plastic components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Container

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.2.10 Other Packaging Types

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Hair Care

- 6.3.3 Color Cosmetics

- 6.3.4 Skin Care

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.3.7 Other Products Types

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging Company

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Packaging Systems Ltd

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd