|

市場調查報告書

商品編碼

1629790

拉丁美洲個人護理包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

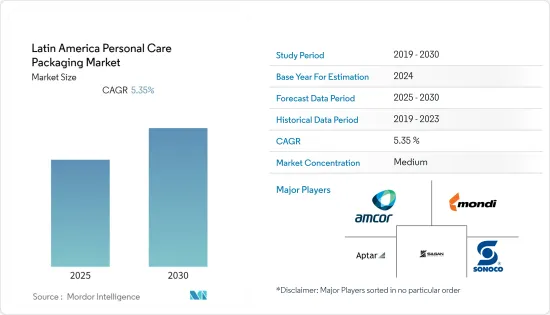

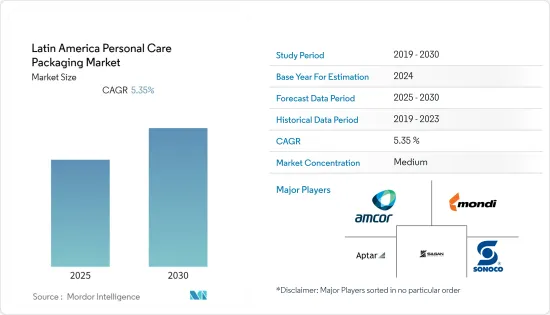

拉丁美洲個人護理包裝市場預計在預測期內複合年成長率為 5.35%

主要亮點

- 獨立、無包裝的商店預計將成為跨行業零售市場的驅動力之一。品牌應該有簡單的品牌名稱和有吸引力的店內補充機會。這改善了品牌形象並增加了消費者對提供永續產品包裝解決方案的品牌的興趣。

- 預計將推動市場擴張的一個關鍵行業趨勢是擴大使用紙管來包裝個人保養用品。例如,去年10月,歐萊雅和化妝品包裝企業Alvea宣布推出首款紙質化妝品管。在預期期間,此類尖端包裝解決方案的即將推出預計將有助於市場成長。

- 進入市場的供應商正在透過制定應對氣候變遷的策略和減少包裝對環境的影響來發揮作用。在過去的十年中,公眾對塑膠使用有害影響的認知迅速提高。拉丁美洲各國政府所進行的一系列公共宣傳活動和措施提高了公眾的意識。

- COVID-19 的爆發進一步影響供應商從根本上改變其品牌 ID 驗證,而推動提供永續包裝解決方案進一步增加了研發和製造的投資。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

拉丁美洲個人護理包裝市場趨勢

預計護膚市場將顯著成長

- 市面上各種護膚品的供應商提供時尚的乳液瓶、帶有奢華細節的乳霜罐以及帶有施用器的包裝管。更先進的無氣點膠系統、滴管施用器和點膠蓋為特定產品提供了解決方案。例如,最大的化妝品包裝批發商之一 Alvea Packaging 生產管用軟型螺旋蓋。這款化妝品帽是所有護膚產品的理想解決方案,帽子的圓形邊緣傳達了配方的柔軟性。

- 此外,真空護膚包裝和3D列印技術等技術進步正在推動護膚包裝的銷售。燙金箔印刷和柔印膠印等先進且流行的印刷技術使製造商能夠為化妝品品牌提供創新且引人注目的護膚包裝,進一步擴大個人護理包裝市場。

- 歐萊雅2021年市場佔有率大幅擴大,在智利、墨西哥和巴西表現優異。電子商務和線下銷售都對成長做出了貢獻。該集團的品牌利用「Buen Fin」和「黑色星期五」等重要線上活動,透過有針對性的活化來歡迎顧客進入商店,同時保持數位參與和線上活化。

巴西市場預計將顯著成長

- 巴西向阿根廷、哥倫比亞和智利出口香水、化妝品和沐浴產品,從法國、阿根廷和美國進口化妝品。巴西製成品仍依賴進口。為此,巴西政府開徵進口稅,促進生產在地化,Alvea等主要企業都著力實現化妝品包裝的在地化。

- 此外,SEBRAE for Micro and Small Enterprises 指出,巴西男性化妝品市場在過去五年中成長了兩倍。預計這將推動專為男性設計的包裝模組的進一步成長。

- 環保措施的投資也很活躍。數百萬雷亞爾將投資於自然資源管理、自然保護以及環保產品和工藝的研發,例如在包裝中使用綠色塑膠以及天然成分和自然資產的供應商、合作夥伴和社區的發展。

- 此外,市場也確認了製造業的投資活動。例如,去年初,法國香精香料集團Robertet投資916萬美元在聖保羅興建工廠。透過這項業務,該公司希望將其在聖保羅的生產和儲存能力增加兩倍。該團隊使公司能夠提高生產力並進一步推動包裝需求。

拉丁美洲個人護理包裝產業概況

拉丁美洲個人護理市場與許多地區參與企業的競爭適中。創新產品正在推動市場,每個供應商都在技術創新上進行投資。主要參與企業包括 Amcor Ltd、Mondi Group、Aptar Group 和 Sonoco。

2022 年 9 月 - Smurfit Kappa 宣布收購巴西 PaperBox,擴大在拉丁美洲的業務。此次收購將加強我們在該國的足跡,提高我們的製造能力,使我們能夠抓住新的機會並與客戶建立新的關係。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對個人護理包裝市場的影響

- 市場促進因素

- 隨著可支配收入的增加,個人保健產品的消費增加

- 越來越注重創新和有吸引力的包裝

- 市場限制因素

- 新包裝解決方案的研發和製造成本較高

第5章市場區隔

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 按包裝類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管和棒

- 蓋子與封口裝置

- 泵浦和分配器

- 軟質塑膠包裝

- 其他

- 依產品類型

- 口腔護理

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 除臭劑

- 其他

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- Amcor Ltd.

- Mondi Group

- AptarGroup

- Silgan Holdings

- Sonoco

- RPC Group Plc(Berry Global Group INC.)

- Cosmopal Ltd

- Gerresheimer AG

第7章 投資分析

第8章市場的未來

The Latin America Personal Care Packaging Market is expected to register a CAGR of 5.35% during the forecast period.

Key Highlights

- Independent packaging-free stores are expected to be one of the driving factors in the retail market across the industry. Brands are expected to create simple branded and engaging refill opportunities in the store. This enhances the brand image and attracts consumers increasingly leaning toward brands that offer sustainable product packaging solutions.

- A significant industry trend anticipated to support market expansion is the expanding usage of paper-based tubes for the packaging of personal care goods. For instance, in October last year, L'Oreal and the cosmetic packaging business Albea announced the introduction of the first paper-based cosmetic tube. Over the anticipated period, market growth will be aided by the impending launch of such a cutting-edge packaging solution.

- Market Vendors are attempting to make a difference by developing a strategy to combat climate change and reduce packaging's environmental impact. Since the last decade, awareness among the population regarding the harmful effects of plastic usage has been growing drastically. Many public campaigns and initiatives by the Latin American governments have increased awareness among the public.

- The outbreak of COVID-19 has further influenced the vendors to make drastic changes to their brand identity, and the push towards offering sustainable packaging solutions further increases their investments in R&D and manufacturing. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Latin America Personal Care Packaging Market Trends

Skin Care Expected to Witness Significant Growth in the Market

- Suppliers of different skincare products in the market offer stylish bottles for lotions, jars with luxe details for creams, and tubes equipped with applicators for packaging. More advanced airless dispensing systems, dropper applicators, and dispensing caps provide solutions for specific products. For instance, Albea packaging, one of the largest cosmetic packaging wholesalers, makes soft-shaped screw caps for tubes. This cosmetic cap is the ideal solution for all skincare products and communicates the softness of the formula due to the rounded edges of the cap.

- Furthermore, technological encroachments, such as airless skincare packaging and 3-D printing technology, are driving skincare packaging sales. Advanced and trending printing technologies, such as hot-stamp foil printing and flexo-offset printing, enable manufacturers to offer innovative and eye-catching skincare packaging for cosmetic brands, further growing the personal care packaging market.

- L'Oreal increased its market share significantly in FY 2021, performing remarkably well in Chile, Mexico, and Brazil. E-commerce and offline sales both contributed to growth. The Group's brands welcomed customers back to their stores with targeted activation while maintaining their digital engagement and online activation, utilizing important online events like Buen Fin and Black Friday.

Brazil Expected to Witness Significant Growth in the Market

- Brazil exports perfumery, cosmetics, and bath products to Argentina, Colombia, and Chile and imports cosmetics from France, Argentina, and the United States. The country remains dependent on imports for finished products. This has led the Brazilian government to introduce import taxes to localize production, and Companies like Albea are focusing on localizing their cosmetic packaging activities.

- Further, SEBRAE for Micro and Small Enterprises stated that Brazil's men's cosmetics market has tripled in the past five years. This is expected to facilitate further growth of packaging modules designed exclusively for men.

- There are multiple investments in environmental policies. Millions of Reals are invested in natural resource management, nature conservation, and the R&D of environmentally friendly products and processes, such as using green plastic in the packaging and developing supplier partner communities of natural ingredients and assets.

- Moreover, the market is also witnessing manufacturing investment activities. For instance, early last year, the French group of fragrances and aromas, Robertet, invested USD 9.16 million in constructing a unit in Sao Paulo. With its operation, the company is looking to triple its production and storage capacity in the country. The team allowed the company to increase its productivity and further drive demand for packaging.

Latin America Personal Care Packaging Industry Overview

The Latin America Personal Care Market is moderately competitive, with many regional players. Innovation drives the market in product offerings, and each vendor invests in innovation. Key players include Amcor Ltd, Mondi Group, Aptar Group, and Sonoco.

September 2022 - Smurfit Kappa announced Latin American expansion with the PaperBox acquisition in Brazil. This acquisition will strengthen their footprint in the nation, increase manufacturing capacity, and enable them to seize new possibilities and build new relationships with clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID -19 on the Personal Care Packaging Market

- 4.5 Market Drivers

- 4.5.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 4.5.2 Growing Focus on Innovative and Attractive Packaging

- 4.6 Market Restraints

- 4.6.1 High Costs of R&D and Manufacturing of New Packaging Solution

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper

- 5.2 By Packaging Type

- 5.2.1 Plastic Bottles and Containers

- 5.2.2 Glass Bottles and Containers

- 5.2.3 Metal Containers

- 5.2.4 Folding Cartons

- 5.2.5 Corrugated Boxes

- 5.2.6 Tube and Stick

- 5.2.7 Caps and Closures

- 5.2.8 Pump and Dispenser

- 5.2.9 Flexible Plastic Packaging

- 5.2.10 Other Packaging Types

- 5.3 By Product Type

- 5.3.1 Oral Care

- 5.3.2 Hair Care

- 5.3.3 Color Cosmetics

- 5.3.4 Skin Care

- 5.3.5 Men's Grooming

- 5.3.6 Deodorants

- 5.3.7 Other Products Types

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Mondi Group

- 6.1.3 AptarGroup

- 6.1.4 Silgan Holdings

- 6.1.5 Sonoco

- 6.1.6 RPC Group Plc (Berry Global Group INC.)

- 6.1.7 Cosmopal Ltd

- 6.1.8 Gerresheimer AG