|

市場調查報告書

商品編碼

1628782

亞太地區個人護理包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia Pacific Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

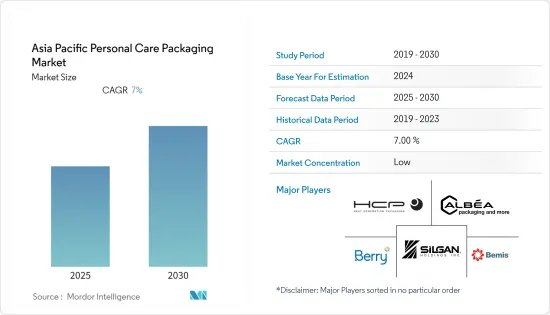

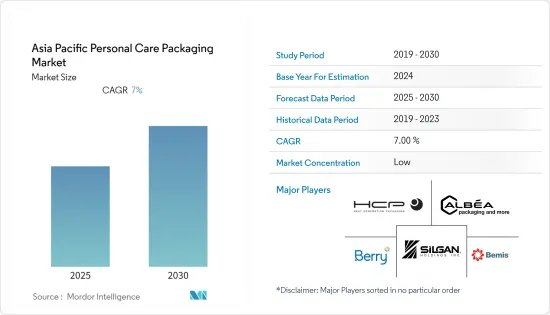

預計亞太地區個人護理包裝市場在預測期內的複合年成長率為 7%。

由於全球工廠長期關閉導致供應鏈中斷,COVID-19 的傳播對市場產生了負面影響。對於瓶子、紙盒和泵浦製造商來說,向個人護理公司供貨在物流上有困難。在大多數國家,政府已將個人護理行業納入其運作的基本類別。儘管如此,生產箔片、包裝材料、印刷機和煤球/天然氣(運作鍋爐所需)等公共事業消耗品的輔助設備的運作尚不清楚。因此,在缺乏明確指導的情況下,地方政府往往不承認輔助單位是必需的商品和服務,導致輔助單位的運作困難。

主要亮點

- 個人護理包裝對於美容和化妝品行業至關重要。這就是為什麼許多公司繼續投資於護髮、護膚和除臭劑等產品的視覺吸引力包裝。

- 化妝品包裝構成個人護理包裝市場的重要組成部分。近年來,化妝品行業的包裝顯著成長。化妝品行業的包裝要求是所有其他行業中最多樣化的。使用各種材料,包括不同的金屬、玻璃、紙張和塑膠,來製造各種形狀和尺寸的容器和分配器機構。

- 此外,在亞洲,可支配收入的增加以及含有天然和有機成分的護膚品的日益普及仍然是主要的成長動力。該地區的社會人口變化正在影響化妝品和相關產品中天然成分的需求。該地區(韓國、中國、日本、印度)的人口老化正在增加對具有抗衰老等活性特性的天然成分的需求。

- 此外,護髮品牌在沙龍和家庭中都充分利用了包裝。零售護髮行業競爭激烈,護髮品牌依靠包裝差異化與消費者建立連結。

- 此外,該地區對嬰兒護理包裝的需求也在增加。此外,政府提高新手父母對兒童衛生意識的措施也促進了嬰兒個人照護產業的發展。例如,印度馬哈拉斯特拉邦拉邦政府已開始分發嬰兒護理套件,以遏制嬰兒死亡。這些舉措將對嬰兒護理產品產生積極影響,因為它們將提高新父母對嬰兒健康的認知,這將對市場成長產生積極影響。

亞太地區個人護理包裝市場趨勢

護膚市場佔有率最高

- 護膚品健康成長,臉部保養、醫學護膚需求旺盛。抗衰老產品和污染防治產品也有成長潛力。例如,在中國,經濟成長放緩和消費者支出信心明顯惡化正在影響中國的護膚產業。

- 此外,人們對潤膚露、沐浴皂和保濕產品等護膚品的高度認知預計將很快推動市場成長。例如,2021年5月,澳洲自然通道護膚公司Sukin宣布推出其最新臉部護膚產品系列Purely Ageless系列。包裝採用碳中性和灰水安全設計,並採用可回收包裝。

- 2021 年 2 月,寶潔旗下個人護理和美容品牌吉列宣布了最新的合資企業。 Planet Kind 是一個新的刮鬍子和護膚品牌,與塑膠銀行合作,限制海洋中的塑膠廢棄物。

- 而且,為了維持激烈的競爭並在日本市場獲得最大佔有率,一些公司正在增加產能。例如,資生堂計劃在2022年在日本開設兩家新工廠,並計劃投資1,200億日圓。此外,資生堂目前正在大田原建造一座新工廠。此類投資預計將促進日本護膚包裝的成長。

- 此外,對護膚製造的投資,加上旨在增強材料能力的研發活動的增加,預計將成為市場成長的強大推動力。例如,生產護膚品的泰日合資企業Milot Laboratories計劃投資約5億泰銖,進軍泰國不斷發展的美容產業。這項投資將用於在北欖府班胡里建造一個平方公尺的倉庫。

中國佔有很大的市場佔有率

- 中國化妝品市場是近年來成長最快的產業之一,不斷擴大的消費群體推動了市場成長。此外,消費者在化妝品上的支出持續增加,並且有越來越多的趨勢是購買昂貴的、加工和包裝的產品。護膚和裝飾化妝品健康成長,臉部保養和醫學護膚需求強勁。此外,抗衰老產品和旨在防止環境污染的產品也有成長潛力。

- 天貓創新中心數據顯示,90歲以上年輕女性已成為拉動中國化妝品產業成長的最重要消費群組。 90後擁有獨立消費能力,該族群對美容護膚的興趣日益濃厚,同步大幅成長。這正在推動該國化妝品包裝市場的發展。

- 該行業的公司正在提高其國內製造能力,以抓住新的機會。例如,化妝品包裝公司 Albea 計劃於 2020 年開始在中國營運新的製造工廠,希望利用不斷成長的電子商務機會。

- 同樣在 2020 年 3 月,總部位於美國伊利諾伊州的全球包裝和分銷解決方案提供商 Apter Group 關閉了位於托靈頓和斯特拉特福德的兩家美國工廠,作為其美容業務戰略步驟的一部分,計劃收購49% 的股份。

- 然而,在 COVID-19 大流行之後,封鎖和自我隔離規則的影響已導致公司轉向從中國採購,並重新考慮包裝中使用的原料。同時,APC Packaging 等公司表示,他們在中國的製造工廠正在滿載運作,並定期接收貨物。

亞太地區個人護理包裝產業概況

由於參與企業數量眾多,亞太個人護理包裝市場競爭非常激烈。結果,市場顯得碎片化。此外,市場上許多公司正在採取產品創新、聯盟、併購和收購等策略。主要進展包括:

- 2021 年 5 月 - 高露潔推出印度首款經過認證的純素牙膏,採用可回收牙膏管。

- 2020 年 6 月 - Manjushree Technopak Ltd. (MTL) 是一家硬質塑膠包裝公司,為個人護理和家庭護理行業提供再生包裝材料,並推出新產品,以支持該品牌打造綠色世界的舉措。與塑膠廢棄物收集生態系統的垂直整合減少了送往掩埋的塑膠廢棄物量,並為客戶的個人和家庭護理帶來接近原始品質的 PCR(消費後回收)樹脂(PP 和 HDPE)。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 擴大化妝品消費

- 越來越注重創新和有吸引力的包裝

- 市場挑戰

- 對永續性的興趣日益濃厚

第6章市場細分:依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

第7章市場細分:依包裝類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管和棒

- 蓋子和封口

- 其他包裝類型(幫浦和分配器、軟質塑膠包裝)

第8章市場細分:依產品類型

- 口腔護理

- 頭髮護理

- 護膚

- 香味

- 其他產品類型(除毛產品、嬰兒及兒童照護、防曬護理)

第9章各國市場

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 印尼

- 其他亞太地區

第10章競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc(Berry Global Group)

- Silgan Holdings Inc.

- Bemis Company Inc.

- Graham Packaging Company

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor Limited

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

- Gerresheimer AG

第11章投資分析

第12章投資分析市場的未來

The Asia Pacific Personal Care Packaging Market is expected to register a CAGR of 7% during the forecast period.

The spread of COVID-19 negatively impacted the market due to disruptions in the supply chain resulting from extended factory closures globally. Logistically, it has been difficult for bottle, carton, and pump makers to provide to personal care companies. In most countries, the governments put the personal care industry under the essential commodity category, allowing them to function. Still, there is no clarity on the operation of ancillary units that make the foil, packaging material, printers, and utility consumables, like briquettes/gases (required to run boilers). Thus, in the absence of clear guidance, the local administration often does not recognize ancillary units as essential commodities and services, which hampers their operations.

Key Highlights

- Personal care packaging is essential for the beauty and cosmetic industry since it adds to the visual appeal and increases its aesthetic value. Thus, many players continually invest in visually attractive packaging for hair care, skin care, deodorants, etc.

- Cosmetic packaging is a significant part of the personal care packaging market. The packaging in the cosmetic industry has grown significantly in recent years. The cosmetic industry has the most varied packaging requirements of all the other sectors. The materials used vary, from different metals, glass, paper, and plastics, and these materials are used to make containers with different shapes and sizes and dispensing mechanisms.

- Moreover, in Asia, the rise in disposable incomes and the growing popularity of skincare products from natural and organic ingredients will remain the primary factors driving the growth. Socio-demographic changes in the region are affecting the demand for natural ingredients for cosmetics and related products. The region's aging populations (in Korea, China, Japan, and India) increase the demand for natural ingredients with active properties, such as anti-aging.

- Furthermore, haircare brands also use packaging to their advantage, both in salons and homes. Haircare for the retail segment is highly competitive, and hair care brands rely on packaging differentiation to forge a connection with consumers.

- Further, the region is also witnessing an increase in demand for baby-care packaging. Furthermore, the government's initiatives in increasing awareness among new parents regarding child hygiene also help grow the baby personal care industry. For instance, the Maharashtrian Government in India had started distributing baby care kits to curb infant deaths. Such initiatives create awareness about infant health among the new parents and, thus, positively impact baby care products, positively impacting the market's growth.

APAC Personal Care Packaging Market Trends

Skin Care Accounted for The Highest Market Share

- Skincare products are growing soundly, with facial care and medical skincare witnessing a robust demand. Moreover, growth potential is also provided by anti-aging products and those intended to protect against environmental pollution. For instance, in China, the diminishing economic growth and a tangible downturn in Chinese consumers' willingness to spend leverage China's skincare sector.

- Moreover, high awareness regarding Skincare products, such as body lotion, body soap, and Moisturizer products, is expected to drive the market's growth shortly. For instance, in May 2021, Sukin, a skincare company in the Natural channel in Australia, has announced the launch of its newest facial skincare product range, the Purely Ageless line. The packaging is made with carbon neutral and grey water safe and incorporates recyclable packaging.

- In February 2021, the P&G-owned personal care and grooming brand Gillette has announced its latest venture. The new Planet KIND shave and skincare brand have partnered with Plastic Bank to limit plastic waste in the oceans.

- Further, to sustain the increasing competition and capture maximum market share in Japan, a few players are increasing their production capacities. For instance, Shiseido plans to open two new plants before 2022 in Japan, for which it has the intended investment of JPY 120 billion. Also, the company has an ongoing new plant in Otawara. Such investments are anticipated to augment the growth of skincare packaging in the country.

- Further, the investments in skincare manufacturing, coupled with the increase in R & D activities that target enhanced material capabilities, are expected to provide a strong impetus for market growth. For instance, Milott Laboratories Co, the Thai-Japanese contract manufacturer for skincare products, is planning to infuse about 500 million baht to cash in on the growing beauty industry in Thailand. The investment is being used to build a 30,000-square-metre warehouse in Bang Phli, Samut Prakan province.

China to Account for Significant Share in the Market

- The cosmetics market in China has been one of the fastest-growing sectors in the last few years, benefitting from an increasingly engaged consumer base, augmenting the market's growth. In addition, consumer spending on cosmetics continues to grow, facilitating the trend toward adopting processed, packaged, and expensive products. Skincare and decorative cosmetics are growing soundly, with facial care and medical skincare witnessing a robust demand. Moreover, growth potential is also provided by anti-aging products and those intended to protect against environmental pollution.

- According to Tmall Innovation Center, the young women of the post-90s generation have become the most crucial consumer group driving growth in China'sChina's cosmetic sector. The post-90s age has independent consuming power, and a simultaneous surge of interest in beauty and skincare amongst this demographic has translated into significant growth. This is aiding the development of the cosmetic packaging market in the country.

- Players in the industry are strengthening their manufacturing capabilities in the country to tackle new opportunities. For instance, in 2020, Albea, a cosmetic packaging company, is planning to begin the operations of their new manufacturing facility in China on the lookout to capitalize on the growing e-commerce opportunities.

- Also, in March 2020, AptarGroup, a global provider of a range of packaging delivery solutions based out of Illinois, United States, has planned to close two of its US-based facilities in Torrington and Stratford, as part of strategic steps in its Beauty business, to acquire 49% equity interest in China'sChina's BTY and of Fusion Packaging.

- However, in the wake of the COVID-19 pandemic, the effects caused by rules about lockdown and self-isolation have resulted in companies moving to source away from China and reconsidering the raw materials used in packaging. At the same time, companies such as APC Packaging have stated that their manufacturing plant in China is up and running at total capacity and has been receiving shipments regularly.

APAC Personal Care Packaging Industry Overview

The Asia Pacific Personal Care Packaging Market is highly competitive, owing to many players in the market. As a result, the market appears to be fragmented in nature. In addition, many companies in the market are adopting strategies like product innovation, partnership, mergers, and acquisitions. Some of the key developments are:

- May 2021 - Colgate has launched their vegan-certified toothpaste that comes in a 'first-of-its-kind' recyclable toothpaste tube in India that can toss in the blue bin after the last squeeze.

- June 2020 - Manjushree Technopack Limited (MTL), a rigid plastics packaging company, has launched its new initiative "Born Again" to deliver recycled packaging material to the personal and home care Industry and support brands in their journey of creating a greener world. It is vertically integrated with the plastic waste collection ecosystem to reduce the amount of plastic waste going to landfills and deliver virgin-like quality PCR (Post Consumer Recycled) resin (PP and HDPE) to personal and home care customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Challenges

- 5.2.1 Growing Sustainability Concerns

6 MARKET SEGMENTATION - BY MATERIAL TYPE

- 6.1 Plastic

- 6.2 Glass

- 6.3 Metal

- 6.4 Paper

7 MARKET SEGMENTATION - BY PACKAGING TYPE

- 7.1 Plastic Bottles and Containers

- 7.2 Glass Bottles and Containers

- 7.3 Metal Containers

- 7.4 Folding Cartons

- 7.5 Corrugated Boxes

- 7.6 Tube and Stick

- 7.7 Caps and Closures

- 7.8 Other Product Types (Pump and Dispenser, Flexible Plastic Packaging)

8 MARKET SEGMENTATION - BY PRODUCT TYPE

- 8.1 Oral Care

- 8.2 Hair Care

- 8.3 Skin Care

- 8.4 Fragrances

- 8.5 Other Products (Depilatories, Baby and Child Care, and Sun Care)

9 MARKET SEGMENTATION - BY COUNTRY

- 9.1 China

- 9.2 India

- 9.3 Japan

- 9.4 Australia

- 9.5 South Korea

- 9.6 Indonesia

- 9.7 Rest of Asia Pacific

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Albea SA

- 10.1.2 HCP Packaging Co. Ltd

- 10.1.3 RPC Group Plc (Berry Global Group)

- 10.1.4 Silgan Holdings Inc.

- 10.1.5 Bemis Company Inc.

- 10.1.6 Graham Packaging Company

- 10.1.7 Libo Cosmetics Company Ltd

- 10.1.8 AptarGroup Inc.

- 10.1.9 Amcor Limited

- 10.1.10 Quadpack Industries SA

- 10.1.11 Rieke Packaging Systems Ltd

- 10.1.12 Gerresheimer AG