|

市場調查報告書

商品編碼

1639530

中國個人護理包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)China Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

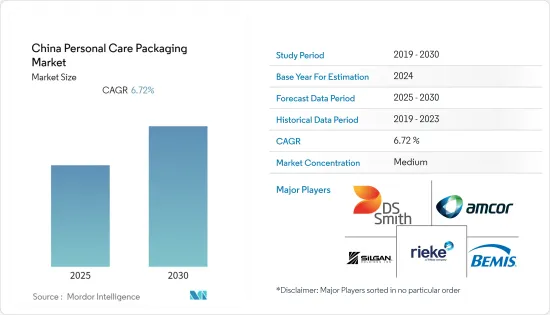

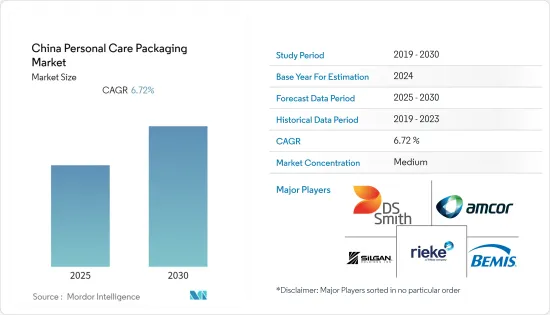

預計預測期內中國個人護理包裝市場複合年成長率為6.72%

主要亮點

- 根據同一項研究,由於 COVID-19 大流行,化妝品行業的收入在 2020 年前幾個月大幅下降,普遍影響了消費品的銷售。不過,由於中國有效的疫情管理,零售交易金額迅速恢復。此外,男性對護膚態度的改變正在推動中國男性化妝品市場的繁榮。

- 該國在美容產品銷售方面正在迅速趕上美國,即使成長放緩,預計仍將在 2023 年超過美國。消費者在化妝品和個人保健產品上的支出持續成長,推動了更多加工、包裝和更昂貴產品的趨勢。護膚和裝飾化妝品健康成長,臉部保養和醫學護膚需求強勁。此外,抗衰老產品和旨在防止環境污染的產品也有成長潛力。

- 根據天貓創新中心統計,1990年代以來的年輕女性已成為推動中國化妝品市場成長的最重要的消費群組。 90後擁有獨立消費能力,該族群對美容護膚的興趣日益濃厚,同步大幅成長。這正在推動該國化妝品包裝市場的成長。

- 為了滿足不斷成長的需求,工業企業正在提高國內製造能力並抓住新機會。例如,2020 年,化妝品包裝公司 Albea 開始在中國營運新的製造工廠,以利用不斷成長的電子商務機會。同樣在 2021 年 7 月,AptarGroup Inc. 與線上護膚解決方案公司 YAT 合作,為護膚市場開發創新產品和服務。

- 然而,由於為響應當前市場趨勢和消費者需求而改變產品設計的成本增加,開發新包裝設計所需的投資顯著增加。因此,產品供應商可能會堅持現有的包裝設計,因為他們擔心與設計變更相關的更高的成本和生產成本,從而影響市場成長。

中國個人護理品包裝市場趨勢

塑膠瓶和容器領域預計將佔據主要市場佔有率

- 塑膠因其成本低、柔韌、重量輕和耐用而成為化妝品包裝的主導元素。許多化妝品採用塑膠瓶和容器包裝,因為它們易於成型、結構、設計和保護。在化妝品行業,塑膠瓶和容器是初級包裝的首選形式,並主導市場半個世紀。

- 該地區的公司正在策略性地計劃透過使用各種元素成分來減少寶特瓶對環境的影響。例如,2020年11月,歐萊雅利用回收的碳排放開發了一種聚乙烯碳中性塑膠瓶,目標是在四年內將其商業化。此外,2021 年 6 月,歐萊雅利用 Carbios 的酵素技術開發了世界上第一個完全由回收塑膠製成的化妝品瓶。 Calbios 技術是開發用於 PET 塑膠回收的生物技術解決方案的先驅,並描述了完全由透過酵素法生產的回收材料製成的新產品的創造之路。該技術適用於所有形式的 PET(透明、彩色、不透明和多層),並具有永久可回收的優點。

- 與其他塑膠包裝產品相比,製造商更喜歡 PET,因為與其他塑膠產品相比,製造過程中原料損失較少。它是優選的,因為它是可回收的,並且可以添加多種顏色和設計。隨著消費者環保意識的增強,可再填充產品應運而生,從而創造了對該產品的需求。

- 此外,總部位於紐約的著名消費品公司高露潔棕欖 (Colgate-Palmolive) 的目標是到 2025 年實現所有產品類型的包裝 100% 回收,目前塑膠包裝的回收率達到 25%。化妝品品牌歐萊雅的目標是到 2025 年使所有塑膠包裝可充電、可再填充、可回收或可堆肥。

- 此外,歐萊雅、寶潔和聯合利華等知名品牌所有者希望在 2020 年大幅增加(在某些情況下加倍)他們在包裝中使用的消費後回收 (PCR) 樹脂的噸位。這種類型的樹脂。

預計口腔護理領域市場將高速成長

- 消費者日益渴望過著更健康的生活方式,口腔衛生已成為不可或缺的一部分,從而推動了產業的發展。人們對口腔健康的認知不斷提高以及對口腔問題根源的更好理解也促進了這一快速成長。口腔護理領域由少數公司主導,導致包裝創新方面競爭激烈。因此,公司正在尋找使自己脫穎而出的方法。

- 口腔護理產品包括牙膏、漱口水/漱口水、牙刷和牙線。牙膏是口腔護理領域中消費最多的產品。一般來說,大多數牙膏管都是由塑膠層壓板製成的。

- 牙膏管每天被數以百萬計的消費者使用,但傳統牙膏管的多層結構對回收設施提出了挑戰,並且傳統上不會被回收。隨著市場上的幾家公司轉向可回收解決方案,這種趨勢即將改變。例如,2021 年 5 月,聯合利華旗下口腔護理品牌 Signal、Pepsodent 和 Closeup 宣布計劃在 2025 年將其整個牙膏產品組合轉換為可回收管。

- 同樣在 2020 年 12 月,寶潔口腔護理為其牙膏品牌 Oral-B、Crest 和 Blend-a-med 推出了最新的包裝創新。為了實施正確的解決方案並使牙膏管更具永續性,寶潔公司一直在與多家 HDPE 管供應商進行討論,並已與 Albea 達成協議,開始使用其專有的 Greenleaf Generation 2 管技術。

中國個人護理包裝產業概況

中國的個人護理包裝市場與 Amcor PLC、Silgan Holdings Inc. 和 Albea 等主要參與者競爭適度。該行業的參與企業正在利用製造能力的研發生態系統來推動創新並保持市場競爭力。

- 2021 年 8 月 - 負責任包裝開發和生產領域的全球領導者 Amcor PLC 宣布計劃開設兩個新的先進研發中心。位於比利時根特和中國江陰的新工廠將於 2022 年中期迎接客戶,並將在未來兩年內全面建成。預計總投資約3500萬美元。更廣泛的網路將使公司世界各地的客戶能夠利用該公司深厚的材料科學專業知識和包裝開發能力。

- 2020 年 6 月 - 消費品硬包裝解決方案供應商 Silgan Holdings Inc. 宣布收購 Albea Group 的分配器業務。該公司是一家全球領先的公司,為主要在美容和個人護理市場的知名品牌消費品公司提供精心設計的泵、噴霧器和泡沫分配器解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 擴大化妝品消費

- 越來越注重創新和有吸引力的包裝

- 市場限制因素

- 對永續性的興趣日益濃厚

第6章 市場細分

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 按包裝類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管棒

- 蓋子與封口裝置

- 泵浦分配器

- 軟質塑膠包裝

- 依產品類型

- 口腔護理

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 除臭劑

第7章 競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc

- Silgan Holdings Inc.

- DS Smith PLC

- Amcor PLC

- Bemis Company Inc.

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

第8章投資分析

第9章 未來展望

簡介目錄

Product Code: 51031

The China Personal Care Packaging Market is expected to register a CAGR of 6.72% during the forecast period.

Key Highlights

- According to the same study, the cosmetics industry witnessed a significant decrease in revenue during the first months of 2020 due to the COVID-19 pandemic, which generally affected consumer goods sales. However, due to China's effective pandemic management, the retail trade value quickly recovered. In addition, the changing attitude among men toward skincare fosters the booming of the men's cosmetics market in China.

- The country has quickly gained on the United States in beauty sales and is set to overtake it by 2023, even if growth slows. Consumer spending on cosmetics and personal care products continues to grow, which is facilitating the trend toward adopting processed, packaged, and expensive products. Skincare and decorative cosmetics are growing soundly, with facial care and medical skincare witnessing a robust demand. Moreover, growth potential is also provided by anti-aging products and those intended to protect against environmental pollution.

- According to Tmall Innovation Center, the young women of the post-90s generation have become the most crucial consumer group driving growth in China's cosmetic sector. The post-90s generation has independent consuming power and a simultaneous surge of interest in beauty and skincare amongst this demographic has translated into significant growth. This is aiding the growth of the cosmetic packaging market in the country.

- To cater to the increasing demand, the players in the industry are strengthening their manufacturing capabilities in the country to tackle new opportunities. For instance, in 2020, Albea, a cosmetic packaging company, began the operations of its new manufacturing facility in China on the lookout to capitalize on the growing e-commerce opportunities. Also, in July 2021, AptarGroup Inc. and YAT, an online skincare solutions company, collaborated to develop an innovative range of products and services for the skincare market.

- However, the investments involved in developing the design for new packaging are significantly higher as the costs go up in changing the product design according to the current market trends and consumer requirements. This is challenging the growth in the market as product vendors may stick to their existing packaging designs in the wake of incurring higher costs associated with the change of design and production costs.

China Personal Care Packaging Market Trends

The Plastic Bottles and Containers Segment is Expected to Hold the Major Market Share

- Plastic is a prominent element in cosmetic packaging due to its low cost, flexibility, lightweight, durability, and other factors. Numerous cosmetic products come in plastic bottles and containers, owing to the material's easy molding, structuring, design capability, and protection. In the cosmetics industry, plastic bottles and containers are preferred forms of primary packaging and have held a major prominent share in the market for half a decade.

- The companies in the region are strategically planning to reduce the impact of plastic bottles on the environment by using different element compositions. For instance, in November 2020, Loreal developed a carbon-neutral plastic bottle of polyethylene from recycled and captured carbon emissions, which the company hopes to commercialize in four years. Also, in June 2021, L'Oreal developed the world's first cosmetic bottle made entirely of recycled plastic with Carbios' enzymatic technology. Carbios' technology, which was a pioneer in developing biotech solutions for the recycling of PET plastics, provides the path for creating new goods composed entirely of recycled materials produced through its enzymatic process. It has the advantage of being compatible with all forms of PET, including transparent, colored, opaque, multilayer, and eternally recyclable.

- Manufacturers prefer PET over other plastic packaging products, as it has a minimum loss of raw material during the manufacturing process when compared to other plastic products. Its recyclability and the feature to add multiple colors and designs augment it to become a preferred choice. Refillable products have emerged with the rising consumer awareness for the environment and have acted in creating demand for the product.

- Moreover, Colgate-Palmolive, a prominent consumer products company based in New York, committed to 100% recyclability of packaging across all its product categories by 2025 and achieving a 25% recycled content currently from plastic packaging. L'Oreal, a cosmetics brand, is working toward ensuring that all its plastic packaging will be rechargeable, refillable, recyclable, or compostable by 2025.

- Moreover, major brand owners, such as L'Oreal, P&G, and Unilever, have already announced their interests toward significantly increasing and, in some cases, doubling the current tonnage of post-consumer recycled (PCR) resin in their packaging by 2020, for which PET would be an apt resin type.

The Oral Care Segment is Expected to Witness a High Market Growth

- Oral health acts as an integral part of consumers' increasing desire to lead healthier lifestyles, resulting in industry growth. Rising awareness of oral health and an improved understanding of the underlying causes of oral issues also contribute to the surge. The oral care segment is dominated by a handful of players, resulting in aggressive competition in terms of packaging innovation. As a result, companies are progressively looking for ways to differentiate themselves.

- Several oral care products include toothpaste, mouthwashes and rinses, toothbrushes, and dental floss. Toothpaste is the most consumed product in the oral care segment. Generally, most toothpaste tubes are made from plastic laminate sheets.

- While toothpaste tubes are being utilized by millions of consumers every day, the conventional tubes could not be recycled so far as their multilayer construction poses a challenge for recycling facilities. This trend is about to change as several companies in the market are switching to recyclable solutions. For instance, in May 2021, Unilever's oral care brands, including Signal, Pepsodent, and Closeup, announced plans to convert their entire toothpaste portfolio to recyclable tubes by 2025.

- Also, in December 2020, Procter & Gamble Oral Care launched its latest packaging innovation across its toothpaste brands, Oral-B, Crest, and Blend-a-med. To introduce the correct solution and make its toothpaste tubes more sustainable, Procter & Gamble held discussions with different HDPE tube suppliers and has already formed an agreement with Albea to start utilizing its proprietary Greenleaf Generation 2 tube technology, which enables the tubes to be recyclable wherever collection schemes are present.

China Personal Care Packaging Industry Overview

The Chinese personal care packaging market is moderately competitive with the presence of major players like Amcor PLC, Silgan Holdings Inc., and Albea. The established players in the industry are leveraging their manufacturing capabilities research and development ecosystem to drive innovation and sustain their competitive position in the market.

- August 2021 - Amcor PLC, a global player in developing and producing responsible packaging, announced its plans to build two new advanced innovation centers. The new facilities in Ghent, Belgium, and Jiangyin, China, will welcome customers in mid-2022, with full build-out over the next two years. The total investment is expected to be approximately USD 35 million. The broader network will allow the company's customers globally to tap into its deep material science expertise and packaging development capabilities.

- June 2020 - Silgan Holdings Inc., a supplier of rigid packaging solutions for consumer goods products, announced its acquisition of the dispensing business of the Albea Group. This business is a leading global supplier of highly engineered pumps, sprayers, and foam dispensing solutions to major branded consumer goods product companies, primarily in the beauty and personal care markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 Growing Sustainability Concerns

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Haircare

- 6.3.3 Color Cosmetics

- 6.3.4 Skincare

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Amcor PLC

- 7.1.7 Bemis Company Inc.

- 7.1.8 Quadpack Industries SA

- 7.1.9 Rieke Packaging Systems Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219