|

市場調查報告書

商品編碼

1683465

英國電動自行車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2029)United Kingdom E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

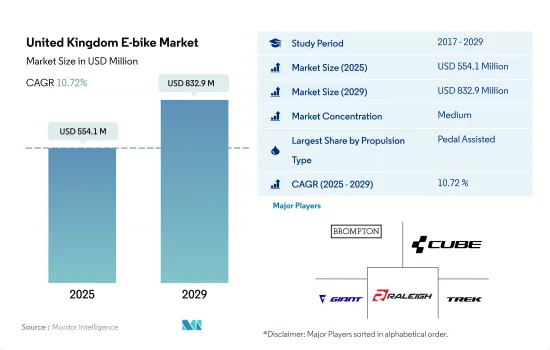

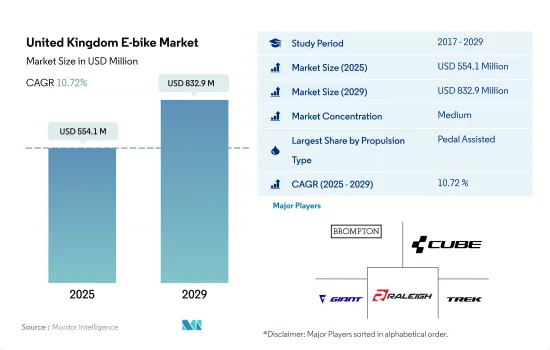

英國電動自行車市場規模預計在 2025 年為 5.541 億美元,預計到 2029 年將達到 8.329 億美元,預測期內(2025-2029 年)的複合年成長率為 10.72%。

推進系統市場概覽

- 2018 年是英國電動自行車銷售創紀錄的一年。隨著消費者對電動自行車認知的不斷提高,以及可供選擇的電動自行車範圍從入門級、經濟實惠的電動自行車到具有更長電池壽命和高性能車架和零件的高級電動自行車,電動自行車市場預計將大幅成長。

- 受共享單車公司的興起、使用電動自行車的電子商務和宅配服務的成長以及政府透過改善自行車基礎設施來促進騎自行車的舉措的推動,英國電動自行車市場預計將經歷長期成長。

- 支持基礎設施成長的改善政策正在幫助英國電動自行車市場成長。英國優先發展電動自行車基礎設施,並增加年度支出以加速建立互聯、安全的自行車網路。蘇格蘭和英國地方政府自行車共享計畫的興起大大增加了對電動自行車的需求。對更便利、更安全的公共交通選擇和社交距離的需求使得當地人和遊客經常使用電動自行車。科羅拉多大學博爾德分校的一項研究量化了從汽車轉換1 級電動機車通勤對健康的益處,並提高了消費者對電動機車健康益處的認知。研究發現,透過使用電動自行車代替汽車,參與者能夠在一個月內達到規定的運動量,同時改善血糖控制和心血管耐力。

英國電動自行車市場趨勢

英國的電動自行車普及率呈現穩定成長,反映出市場接受度和消費者興趣的不斷成長。

- 近年來,英國人口對自行車的需求大幅增加。電動自行車相對於傳統自行車的優勢導致英國各地對電動自行車的需求激增。騎乘便利、無污染、節省時間、成本效益等是人們選擇電動交通途徑而不是其他交通工具作為日常通勤的主要因素。因此,2019 年電動自行車的普及率與 2018 年相比增加了 2%。

- 新冠肺炎疫情引發英國民眾恐慌。人們避免使用公共交通和共用交通工具,影響了包括電動自行車在內的私人車輛的銷售和使用。與其他交通途徑相比,電動自行車更受歡迎,因為它們是最便宜、最無憂的交通方式之一(與其他交通方式相比,幾乎不需要維護)。因此,英國電動自行車銷量和消費者電動自行車普及率從 2019 年的 3.90% 成長至 2020 年的 5.90%。

- 英國民眾對電動自行車的認知不斷增強,這正在改變消費者的態度。騎乘時所需力度小、零燃料成本、環保的交通途徑和運動好處是推動電動自行車成長的一些因素。在該國,2021年的電動自行車普及率預計將與2020年相比在1.20%左右,而在英國,預計預測期內將達到24.40%。

在英國,每天通勤5至15公里的人數一直在穩定增加,反映出出行距離的逐漸變化。

- 隨著英國許多地方的人們逐漸開始接受自行車文化,英國對自行車的需求正在激增。大約50%的自行車使用者選擇騎自行車去上班、上學等。人們受到影響而選擇騎自行車而不是開車。在英國,騎自行車的需求正在上升,2020 年出行距離在 5-15 公里之間的通勤者數量與 2019 年相比增加了 0.2%。

- 對 COVID-19 疫情的擔憂對英國自行車市場產生了顯著的正面影響。人們選擇步行或騎自行車上班,而不是搭乘公共運輸工具。自疫情爆發以來,使用公共運輸的人越來越少。 2020 年,每天騎自行車上班的人數比 2019 年增加了 0.2% 以上,功能先進、電池壽命更長的電動自行車的推出鼓勵了更多人選擇騎自行車,2021 年英國境內 5 至 15 公里通勤距離的人數比 2020 年有了更大的增加。

- 隨著疫情後的限制措施解除,人們現在經常騎自行車上班。如今,許多人每天騎車在5至15公里的範圍內前往工作地點、辦公室或當地市場。越來越多的人選擇騎自行車上班,因為這樣更有利於健康、排放碳通勤並且可以避免交通堵塞而節省時間。預計這些因素將使預測期內英國5-15 公里的通勤距離增加 2% 以上。

英國電動自行車產業概況

英國電動自行車市場中等整合,前五大公司佔41.01%的市場。市場的主要企業是:Brompton Bicycle、CUBE Bikes、Giant Manufacturing、Raleigh Bicycle Company 和 Trek Bicycle Corporation(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均國內生產毛額

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5 至 15 公里的人口/通勤者百分比

- 自行車出租

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 徒步人數

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 應用程式類型

- 貨運/公用設施

- 城市/城區

- 健行

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Brompton Bicycle

- CUBE Bikes

- Evans Cycles Limited(Pinnacle)

- Giant Manufacturing Co. Ltd.

- Gocycle Eu BV

- MAXON MOTOR UK LTD

- POWABYKE UK LIMITED(Powabyke)

- Raleigh Bicycle Company

- Tandem Group Cycles(DAWES)

- Trek Bicycle Corporation

- Volt Electric Bikes

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The United Kingdom E-bike Market size is estimated at 554.1 million USD in 2025, and is expected to reach 832.9 million USD by 2029, growing at a CAGR of 10.72% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- The record year in the United Kingdom for electric bike sales was 2018. Along with increased consumer awareness of what an electric bike is, a significant amount of e-bike market growth is anticipated due to a wider selection of electric bikes, ranging from entry-level, reasonably priced e-bikes to premium e-bikes with longer-lasting batteries and performance frames and components.

- The e-bike market in the United Kingdom is poised for growth in the long term, fueled by the rise of bike-sharing companies, the growth of e-commerce and delivery services using e-bikes, and government efforts to promote bicycles through improved cycling infrastructure.

- The policy improvements to support growth in infrastructure contribute to the UK e-bike market's expansion. The United Kingdom has prioritized building e-bike infrastructure and is attempting to increase yearly spending to speed up the development of a connected and secure bike network. The increased number of municipal bike-sharing schemes in Scotland and the United Kingdom has greatly increased the demand for electric bikes. Due to the need for more accessible and safe public transit choices and social distancing, locals and visitors are utilizing e-bikes more regularly. Raising Consumer Awareness of Electric Bikes' Health Benefits research from the University of Colorado Boulder quantified the health benefits of converting from driving to a class 1 e-bike for commuting. According to the research, utilizing an electric bike instead of a car allowed participants to reach their prescribed levels of physical activity in a month while improving blood sugar management and cardiovascular endurance.

United Kingdom E-bike Market Trends

The UK's E-Bike adoption rates show a steady increase, reflecting growing market acceptance and consumer interest.

- The demand for bicycles has been rising significantly across the population of the United Kingdom over the past few years. The advantages of the e-bike over the traditional bicycle have sparked a surge in demand for e-bikes across the United Kingdom. Convenient rides, pollution-free transportation, time savings, and cost-efficiency are some of the major factors contributing to the usage of e-bikes over other vehicles for commuting daily to nearby places. As a result, e-bike adoption increased by 2% in 2019 compared to 2018.

- The COVID-19 pandemic created fear among the people of the United Kingdom. People started avoiding public and shared transportation, which impacted the sales and usage of personal vehicles, including e-bikes. People prefer e-bikes over other modes of transportation because they are one of the cheapest and most carefree vehicles (requiring very little maintenance compared to other vehicles). As a result, the sales of e-bikes and the adoption rate of e-bikes among consumers increased to 5.90% in 2020 compared to 3.90% in 2019 in the United Kingdom.

- The growing awareness of e-bikes among the people of the United Kingdom is changing the consumer's mindset. Factors such as minimal effort while riding, zero fuel expenses, eco-friendly rides, cheap modes of transportation, and exercise benefits are responsible for the growth of e-bikes. The country has witnessed an e-bike adoption rate of around 1.20% in 2021 over 2020, which is projected to reach 24.40% during the forecast period in the United Kingdom.

The UK exhibits a steady increase in the population commuting 5-15 km daily, reflecting a gradual change in travel distances.

- The United Kingdom has witnessed a sharp rise in bicycle demand as people in many places across the country have begun progressively adopting the bicycle culture. Approximately 50% of bicycle users choose to use bicycles to travel to their places of employment, education, etc. People are influenced to ride bicycles instead of cars. The demand for bicycles in the United Kingdom has increased as a result of a 0.2% increase in commuters with 5-15 km of travel in 2020 over 2019.

- The concerns about the COVID-19 pandemic have significantly and positively impacted the market for bicycles in the United Kingdom. People choose to walk or cycle instead of taking public transportation to work. After the pandemic's effects, fewer people used public transportation. The number of people who commuted daily by bicycle increased by more than 0.2% in 2020 over 2019, and the introduction of e-bikes with advanced features and longer battery lives encouraged more people to choose bicycles, which further increased the number of commuters who made trips of 5 to 15 kilometers in 2021 over 2020 across the United Kingdom.

- People now commute by bicycle regularly due to the removal of limitations following the pandemic. Today, many people travel daily by bicycle within a radius of 5 to 15 kilometers to get to their places of employment, businesses, and local markets. Due to the increased health advantages, carbon-free commutes, and time savings from avoiding traffic bottlenecks, more people are choosing to commute by bicycle. During the forecast period, these factors are expected to result in a more than 2% increase in commuter travel between 5 and 15 kilometers in the United Kingdom.

United Kingdom E-bike Industry Overview

The United Kingdom E-bike Market is moderately consolidated, with the top five companies occupying 41.01%. The major players in this market are Brompton Bicycle, CUBE Bikes, Giant Manufacturing Co. Ltd., Raleigh Bicycle Company and Trek Bicycle Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Brompton Bicycle

- 6.4.2 CUBE Bikes

- 6.4.3 Evans Cycles Limited (Pinnacle)

- 6.4.4 Giant Manufacturing Co. Ltd.

- 6.4.5 Gocycle Eu BV

- 6.4.6 MAXON MOTOR UK LTD

- 6.4.7 POWABYKE UK LIMITED (Powabyke)

- 6.4.8 Raleigh Bicycle Company

- 6.4.9 Tandem Group Cycles (DAWES)

- 6.4.10 Trek Bicycle Corporation

- 6.4.11 Volt Electric Bikes

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms