|

市場調查報告書

商品編碼

1683797

南美電動自行車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2029 年)South America E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

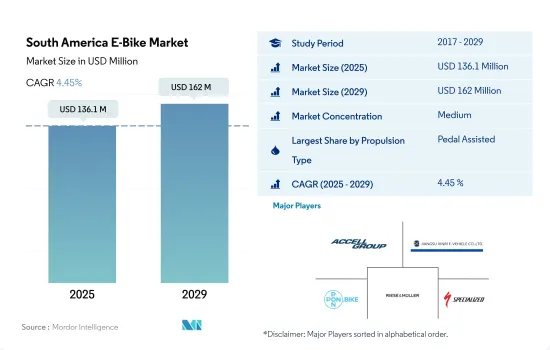

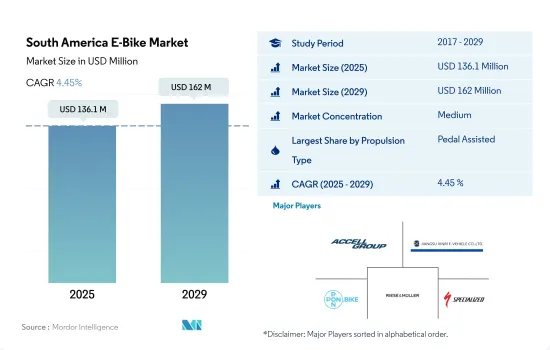

南美電動自行車市場規模預計在 2025 年達到 1.361 億美元,預計在 2029 年達到 1.62 億美元,預測期內(2025-2029 年)的複合年成長率為 4.45%。

推進系統細分市場概覽

- 南美洲電動自行車市場的特點是推進類型多樣,正在經歷顯著的成長和轉型。在各種推進類型中,踏板輔助和按需油門電動自行車最受歡迎。助力電動自行車因其效率和提供更傳統的騎行體驗而越來越受歡迎,這與注重健康和環保的消費者群體非常契合。按需油門電動自行車適合追求方便和易用的消費者,尤其是在以快速和輕鬆通勤為優先的城市環境中。

- 然而,由於一些主要市場地區出現經濟危機,在全球遭受新冠肺炎疫情衝擊之前,阿根廷在 2020 年就已面臨第三年的經濟衰退。現在,疫情帶來的經濟衝擊正導致這個受危機影響的國家出現創紀錄的經濟萎縮。然而,在不久的將來,隨著政府採取必要措施使經濟重回成長軌道,市場預計將進一步成長。

- 隨著政府加強電動自行車計劃,許多共享自行車平台已進入中國,以利用其創造的商機。政府和私人投資者在該國推出了多個自行車共享項目,旨在普及電動自行車並減少污染。例如,2019年11月,加拿大共享單車公司PBSC Urban Solutions宣佈在阿根廷首都布宜諾斯艾利斯成功擴張,向首都引入4000輛ICONIC單車,使該市共享單車的數量增加一倍。

南美洲各國市場

- 儘管拉丁美洲的電動車市場仍處於起步階段,但該地區至少 45% 的國家已經採取了有利於電動車發展的措施。一些本地和全球公司也決定在當地部分更換現有車隊,以實現溫室氣體減排目標並降低成本。拉丁美洲地區尤其可以從加速向電動車轉型中受益,因為該地區擁有世界上溫室排放最低的發電矩陣之一,這要歸功於其較高的水力發電量和市場上其他再生能源來源的逐步發展。公共也支持南美經濟體的電動車市場。

- 南美洲電動自行車市場高度分散,並非由少數幾家壟斷生產和銷售產品的大公司所主導。相反,市場競爭激烈,沒有一家企業佔據主導地位。銷售量較高的品牌包括 Giant Bicycles、Merida、Trek Bikes 和 Riese & Muller。

- 隨著汽油價格的上漲,政府和一般民眾選擇電動車的趨勢日益成長。踏板輔助電動自行車非常適合短途旅行,因此 Speed Pedelec 成為電動自行車最實用的選擇的那一天可能很快就會到來。未來幾年,隨著功率和速度的提升,人們預計會更加青睞高速電動自行車。在南美,法律禁止使用油門輔助電動自行車,但禁止程度遠低於腳踏輔助電動自行車。

南美洲電動自行車市場趨勢

阿根廷和巴西呈現溫和成長,顯示它們是新興市場,未來具有顯著擴張的潛力。

- 南美洲電動自行車市場目前處於初期,只有少數國家電動機車銷量可觀,佔全球電動機車銷量的比例相對較小。主要原因是電動自行車價格昂貴,且被視為豪華二輪車。

- 該地區共用電動自行車市場呈現高速成長。阿根廷和巴西的大多數共享單車營運商都已將電動自行車納入其共享單車服務或擴大持有。

- 市場較為分散,眾多新興企業和 Giant Bicycles、EDG 和 Trek Bicycle Corporation 等公司進入市場。相比之下,大型電動自行車租賃公司正在擴大其市場範圍並增加其電動自行車持有。

在南美洲,每日通勤5至15公里的人數整體增加,反映出人們通勤習慣逐漸改變。

- 該地區擁有多個有前途的自行車運動國家,其中包括巴西和阿根廷。南美洲有許多有前途的自行車運動國家,其中包括巴西和阿根廷。越來越多的南美人選擇騎自行車出行近距離(最多 15 公里)。巴西是南美洲每天通勤距離 5 至 15 公里的人口比例最高的國家。

- 自從新冠肺炎疫情爆發以來,人們意識到騎自行車是最高效的通勤方式。此外,由於疫情期間人們選擇騎自行車運動或參加週末休閒,2021 年全部區域每天出行 5 至 15 公里的通勤人數與 2020 年相比有所增加。此外,功能先進、續航里程長達 40-45 公里的電動自行車的推出,也鼓勵消費者選擇自行車作為日常通勤工具。

- 南美洲各地解除對新冠肺炎疫情的限制,以及辦公室和企業的重新開放,也促進了騎行數量的增加。許多人已經開始定期騎自行車上班。在巴西等國家,自行車上下班越來越受歡迎,因為它有多種好處,包括無碳交通、燃油經濟性和減少旅行時間。預計在預測期內,這些因素將加速南美洲 5-15 公里之間的通勤距離。

南美洲電動自行車產業概況

南美洲電動自行車市場中等整合,前五大公司佔據45.18%的市場。該市場的主要企業有:Accell Group、江蘇新日電動車、Pon Bicycle Holding BV、Riese & Muller 和 Specialized Bicycle Components(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均國內生產毛額

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5-15 公里的人口/通勤者百分比

- 自行車出租

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 徒步人數

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 應用程式類型

- 城市/城區

- 健行

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 國家

- 阿根廷

- 巴西

- 南美洲其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Accell Group

- Giant Manufacturing Co. Ltd.

- Jiangsu Xinri E-Vehicle Co. Ltd.

- Merida Industry Co. Ltd.

- Pedego LLC

- Pon Bicycle Holding BV

- Riese & Muller

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Yadea Group Holdings Ltd.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 93679

The South America E-Bike Market size is estimated at 136.1 million USD in 2025, and is expected to reach 162 million USD by 2029, growing at a CAGR of 4.45% during the forecast period (2025-2029).

Propulsion Segment Market Overview

- The South American e-bike market, characterized by its diverse range of propulsion types, is experiencing significant growth and transformation. Among the various propulsion types, pedal-assisted and throttle-on-demand e-bikes are the most prevalent. Pedal-assisted e-bikes are favored for their efficiency and the ability to offer a more traditional cycling experience, aligning well with the health-conscious and environmentally aware consumer base. Throttle-on-demand e-bikes cater to those seeking convenience and ease of use, particularly in urban settings where quick and effortless commuting is a priority.

- However, because of the economic crisis in some of the major market regions, which was there even before the world was hit by the COVID-19 pandemic and Argentina was facing a third year of recession in 2020. Now, with the pandemic's economic shock, it is expected that a record contraction in the crisis-prone country. Yet, it is expected that in the near future, the government of the country will take the necessary steps to bring the economy back to the growth trajectory, and the market will grow even at a high rate.

- With the government ramping up the country's e-bikes, many bike-sharing platforms have entered Argentina to leverage the business opportunities created. The government and private investors are launching several bike-sharing programs in the country to promote e-bikes and control environmental pollution. For instance, in November 2019, Canadian bike-sharing company, PBSC Urban Solutions, announced a successful rollout in Buenos Aires, the capital of Argentina, introducing 4,000 ICONIC bikes to the capital city, doubling the shared bikes available in the city.

SOUTH AMERICA COUNTRY LEVEL MARKET OVERVIEW

- Although the Latin American market for electric mobility is nascent, at least 45% of the countries in the region have already adopted measures that favor its growth. Some local and global companies have also decided to make partial replacements of their existing fleets regionally to adapt to GHG reduction targets and reduce their costs. The Latin American region can particularly benefit from the accelerated transition to electric mobility, considering that it has one of the electricity generation matrices with lower GHG emissions due to the high hydroelectricity generation and the progressive evolution of other renewable energy sources in the market. In the South American economies, public policies are also helping drive the market for electric vehicles.

- The South American electric bicycle market is highly fragmented and not dominated by a few major players with a monopoly over manufacturing and sales of the product. Instead, the market is highly competitive without any dominant players. The companies recording the highest sales include Giant Bicycles, Merida, Trek Bikes, and Riese & Muller.

- In line with rising gasoline costs, governments and the general public are increasingly expected to choose electric vehicles. The speed pedelec will soon be the most practical choice among e-bikes because the pedal-assisted e-bike is better suited for shorter trips. Over the coming years, people are expected to gravitate toward speed pedelecs as their power and speed capabilities advance. Although throttle-assisted e-bikes are prohibited by law in South America, they are far less common than pedal-assisted e-bikes.

South America E-Bike Market Trends

Argentina and Brazil show gradual growth, signaling emerging markets with potential for significant expansion.

- The South American e-bike market is currently in the pre-emerging stage, with a few countries witnessing notable unit sales of electric bikes, which is a relatively small fraction of global electric bike sales. The major reason for this is the high price of e-bikes and the perception of e-bikes as premium two-wheelers.

- In the region, the e-bike market in the shared category is witnessing higher growth. The majority of bike-sharing operators present in Argentina and Brazil are either integrating or increasing the fleet of e-bikes in their bike-sharing services.

- The market is fragmented with a number of startups and companies, such as Giant Bicycles, EDG, Trek Bicycle Corporation, and others. In contrast, major e-bike rental companies are expanding their market reach and adding more e-bikes to their fleet.

South America shows a general increase in the population commuting 5-15 km daily, reflecting a gradual change in commuting habits across the continent.

- The region has various bicycle potential countries, such as Brazil and Argentina. The countries falling under the South America region is witnessing a decent demand for bicycles over the past few years. People in South America are gradually opting for bicycles for short distances (up to 15 km). Brazil has the highest percentage of daily commuters in the range of 5 to 15 km in South America.

- People found bicycles as the most efficient and effective way of commuting after the COVID-19 outbreak. Moreover, people opted to exercise during the pandemic by bicycling or going on weekend recreational activities, which increased the number of commuters with a daily travel distance of 5 to 15 km in 2021 over 2020 across the region. Additionally, the introduction of e-bikes with advanced features and a higher range of 40 to 45 km is encouraging consumers to opt for bicycles for daily commuting.

- Removal of the COVID-19 restrictions and resumption of offices and business operations across South America contributed to the growth of bicycle users. Many people have regularly started to commute by bicycle to their places of employment. Bicycle commuting is becoming popular due to its various benefits, such as carbon-free rides, fuel efficiency, and time-saving in traffic in countries such as Brazil. Such factors are expected to accelerate commuters with journey distances of 5 to 15 km across South America during the forecast period.

South America E-Bike Industry Overview

The South America E-Bike Market is moderately consolidated, with the top five companies occupying 45.18%. The major players in this market are Accell Group, Jiangsu Xinri E-Vehicle Co. Ltd., Pon Bicycle Holding BV, Riese & Muller and Specialized Bicycle Components (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 City/Urban

- 5.2.2 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Rest-of-South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group

- 6.4.2 Giant Manufacturing Co. Ltd.

- 6.4.3 Jiangsu Xinri E-Vehicle Co. Ltd.

- 6.4.4 Merida Industry Co. Ltd.

- 6.4.5 Pedego LLC

- 6.4.6 Pon Bicycle Holding BV

- 6.4.7 Riese & Muller

- 6.4.8 Specialized Bicycle Components

- 6.4.9 Trek Bicycle Corporation

- 6.4.10 Yadea Group Holdings Ltd.

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219