|

市場調查報告書

商品編碼

1683791

亞太電動自行車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2029 年)Asia-Pacific E-bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

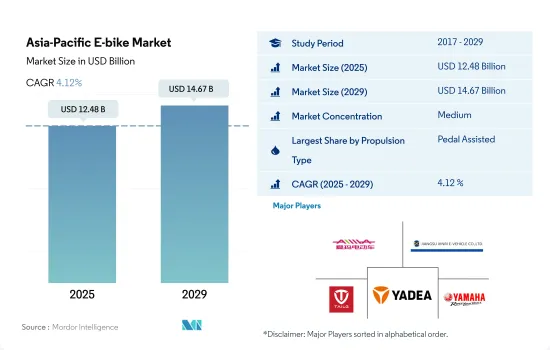

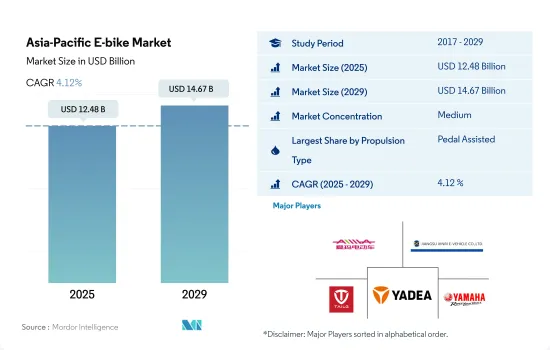

亞太地區電動自行車市場規模預計在 2025 年為 124.8 億美元,預計到 2029 年將達到 146.7 億美元,預測期內(2025-2029 年)的複合年成長率為 4.12%。

推進系統細分市場概覽

- 個人健身意識的增強、日益成長的環境問題、日益嚴重的交通堵塞以及政府推廣騎自行車的努力是成長要素。中國和日本是電動自行車越來越受歡迎的兩個最引人注目的國家。亞太地區消費者採用和騎乘電動自行車的主要原因包括健康益處、避免交通堵塞、環境效益以及對電動自行車作為運動配件的需求日益成長。

- 新冠疫情期間,韓國對自行車的需求增加。自行車不僅用作交通途徑,還用於其他活動,例如體育、運動和遠足。大眾對踩踏腳踏對健康的益處的認知不斷提高,這推動了需求的成長。隨著消費者尋求更安全、更舒適、更環保的交通方式,相關企業正加緊開發創新的自行車踏板配件。共用出行公司的興起增加了對此類日常出行車輛的需求。

- 年輕人對上坡騎行等運動的興趣日益濃厚,對健康積極生活方式的好處的了解也日益加深,預計將在未來幾年推動市場需求。輔助自行車對於短程出行來說十分便捷,但隨著動力和速度性能的提升,高速輔助自行車有望成為未來最便捷的選擇。

亞太地區各國市場

- 自行車賽事的增加以及政府和雇主的積極舉措可能會推動該行業的發展。亞太地區有許多組織,例如印度自行車聯合會和中國自行車協會,致力於推廣公路賽、休閒休閒自行車賽、場地賽、越野賽事和山地自行車賽事。

- 由於新冠疫情管制措施導致全國範圍內線下零售店關閉,自行車銷售量最初出現下滑。但最近,由於消費者擔心感染病毒而避免搭乘大眾運輸,對自行車的公共增加。隨著消費者健康意識的增強,騎自行車越來越被視為一種更可靠、更健康的交通方式,有助於提高銷售量。同時,隨著電池價格下降和消費者偏好的轉變,電動自行車的市場佔有率逐漸增加。銷量也迅速擴大,目前有超過 50 家公司提供多種型號。這些變數預計會影響市場成長。

- 中國和日本是電動自行車越來越受歡迎的兩個最引人注目的國家。亞太地區採用和騎乘電動自行車的主要原因包括健康益處、避免交通堵塞、環境效益以及對電動自行車作為一項體育活動的需求日益成長。近年來,健康、環境品質和智慧城市理念已成為騎自行車廣泛普及的驅動力。然而,這些因素所推動的成長卻因許多城市糟糕的騎行環境和基礎設施而受到阻礙。

亞太地區電動自行車市場趨勢

中國大規模的普及顯示了電動自行車巨大的市場潛力和文化融合。

- 亞太地區佔據了全球電動自行車銷量的最大佔有率,這主要歸功於該地區的二輪車文化、政府以稅收優惠形式對電動車不斷增加的支持、對傳統燃油汽車的高額稅收、不斷擴大的電子商務和食品宅配系統以及快速的都市化。電動自行車還提供其他好處,例如無需駕駛執照、保險、檢查或停車許可證,從而提供更好的用戶體驗。

- 在亞太地區,自行車出遊早已成為中國、日本、印度及東南亞國家的主要交通途徑。中國和日本的電氣化正在興起,該地區的電動自行車總數已達到 1.5 億輛,預計在不久的將來還會進一步成長。由於許多國家對電動自行車的速度和功率進行限制,因此踏板輔助電動自行車市場在亞太地區佔據主導地位。其中大部分的馬達功率限制為250W,速度限制為25km/h。在一些國家,政府推出了限制油門輔助電動機車功率輸出的法規,導致其銷售市場佔有率較低。

- 電動自行車市場,尤其是中國和日本的腳踏輔助電動自行車市場,已經達到飽和點,銷售成長陷入停滯。然而,由於當地二輪車和低速電動車製造商採取了一系列戰略舉措,以及政府計劃快速實現二輪車電動化,預計印尼、印度、新加坡和韓國將在不久的將來實現顯著成長。印度、新加坡和泰國的電動自行車共用系統的成長進一步推動了該地區電動自行車市場的成長。

日本保持高水準穩定,中國和印度則處於成長狀態,這些多樣化趨勢顯示通勤模式和基礎設施正在不斷發展。

- 亞太地區由自行車騎行人口相當大比例的國家組成,其中包括中國、印度和日本。該地區各國對自行車的需求近期有所增加。亞太地區的人們使用自行車進行短途通勤(最多 15 公里)以及前往附近的地點,例如工作地點或職場。中國是亞太地區通勤者比例最高的國家,每日通勤距離為5至15公里。

- 新冠疫情爆發後,亞太各國的健身房和公共運輸被迫關閉,許多人發現騎自行車是安全且隔離的交通方式。此外,在疫情期間,人們決定在週末騎自行車運動或在附近跑步。此外,配備最先進電池組的電動自行車可以將續航里程提高到 40-45 公里,這也吸引了通勤距離 5-15 公里的消費者。

- 亞太地區解除對新冠疫情的限制以及辦公室和企業的開業也促進了騎行量的增加。許多人經常騎自行車去職場或前往半徑5至15公里內的公司。在中國和日本等國家,騎自行車上班越來越受歡迎,主要是因為它健康、排放碳、省油並且節省旅行時間。預計這些因素將導致預測期內亞太地區騎行距離在 5-15 公里之間的自行車數量增加。

亞太地區電動自行車產業概況

亞太地區電動自行車市場呈現中度整合態勢,前五大廠商合計佔44.33%。該市場的主要企業為:愛瑪科技集團、江蘇新日電動車、深圳台鈴科技集團、雅迪集團控股有限公司和雅馬哈自行車(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均國內生產毛額

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5-15 公里的人口/通勤者百分比

- 自行車出租

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 徒步人數

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 應用程式類型

- 貨運/公用設施

- 城市/城區

- 健行

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 原產地

- 澳洲

- 中國

- 印度

- 日本

- 紐西蘭

- 韓國

- 亞太地區其他國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Aima Technology Group Co. Ltd

- Cycling Sports Group, Inc.

- Giant Manufacturing Co.

- Hero Cycles Limited

- Jiangsu Xinri E-Vehicle Co. Ltd

- Merida Industry Co Ltd

- Riese & Muller

- Shenzhen TAILG Technology Group Co., LTD.

- Tianjin Fuji-Ta Bicycle Co. Ltd.

- Trek Bicycle Corporation

- Yadea Group Holdings Ltd.

- Yamaha Bicycles

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 93672

The Asia-Pacific E-bike Market size is estimated at 12.48 billion USD in 2025, and is expected to reach 14.67 billion USD by 2029, growing at a CAGR of 4.12% during the forecast period (2025-2029).

PROPULSION SEGMENT MARKET OVERVIEW

- Individuals' improved fitness consciousness, greater environmental concern, increased traffic congestion, and government attempts to promote cycling are the key growth factors in this industry. China and Japan are two of the most prominent countries where e-bikes have gained popularity. Some key reasons for consumers adopting and riding e-bikes in Asia-Pacific are health benefits, traffic congestion avoidance, environmental benefits, and rising demand for e-bikes as sports equipment.

- During the COVID-19 pandemic, bicycle demand increased in South Korea. Bicycles are used for transportation and other activities such as sports, exercise, and trekking. The increased public awareness of the health benefits of pedaling is driving demand. Consumers want safer, more comfortable, and ecologically responsible vehicles, which may inspire the associated businesses to develop a range of innovative cycle pedal items. The rise of shared mobility companies has increased the demand for such vehicles for daily travel.

- Rising youth interest in sports like uphill cycling and increased knowledge of the benefits of a healthy and active lifestyle are projected to drive market demand over the coming years. A pedal-assisted bicycle is useful for short distances, but the speed pedelec is expected to be the most convenient option in the future as its power and speed capabilities improve.

ASIA-PACIFIC COUNTRY LEVEL MARKET OVERVIEW

- A growing number of cycling events, as well as favorable government and employer initiatives, are likely to drive the industry under consideration. Numerous governing bodies in Asia-Pacific promote road racing, touring and leisure cycling, track racing, off-road racing events, and mountain cycling events, such as The Cycling Federation of India and The Chinese Cycling Association.

- Bicycle sales first fell owing to the nationwide shutdown of offline retailers due to COVID-19 pandemic regulations. However, demand for bicycles has recently grown, with consumers preferring to shun public transit due to fear of getting the virus. As consumers become more health-conscious, bicycles are increasingly viewed as a more trustworthy and healthful method of transportation, which encourages sales. E-bikes, on the other hand, are progressively gaining market share as battery prices fall and client preferences shift. Sales are also expanding at a faster rate, with over 50 companies offering a diverse selection of models. Such variables are expected to have an impact on market growth.

- China and Japan are two of the most prominent countries where e-bikes have gained popularity. Some of the key reasons for adopting and driving e-bikes in Asia-Pacific are health benefits, traffic congestion avoidance, environmental benefits, and rising demand for e-bikes as sports equipment. In recent years, health and environmental quality, as well as the concept of smart cities, have arisen as drivers of bicycles increased. Nonetheless, expansion driven by these factors has been hampered by the cycle-unfriendly environment and infrastructure in most cities.

Asia-Pacific E-bike Market Trends

China's massive adoption rate showcases the vast market potential and cultural integration of e-bikes.

- The Asia-Pacific region is dominating the global e-bike sales, mainly due to the two-wheeler culture in the region, growing government support in the form of tax incentives for EVs, hefty taxes on conventional, fuel-based vehicles, expansion of the e-commerce and food delivery systems, and rapid urbanization. E-bikes also offer a good user experience with additional benefits, such as the non-requirement of driving licenses, insurance, inspections, and parking permits.

- In Asia-Pacific, bike commuting has long been the primary transportation mode in China, Japan, India, and several Southeast Asian countries. The electrification in China and Japan led to the total number of e-bikes reaching 150 million in the region, which is expected to rise in the near future. The pedal-assisted e-bike segment is dominating in the Asia-Pacific region as many countries limit e-bikes in terms of speed and power. Most of these are limited to 250 W motor power and a speed of 25 kmph. The governments in some countries have set regulations for power limits in throttle-assisted electric bikes, resulting in them accounting for a low market share in unit sales.

- The e-bike market, especially for pedal-assist e-bikes in China and Japan, is reaching a saturation point as unit sales growth becomes stagnant. However, Indonesia, India, Singapore, and South Korea are expected to witness significant growth in the near future, driven by many strategic measures taken by domestic two-wheeler and low-speed electric vehicle producers and the government's plans for rapid electrification of two-wheelers. The growth in shared e-bike systems in India, Singapore, and Thailand is further supporting the growth of the e-bike market in the region.

Varied trends with Japan stable and high, and China and India growing, indicating diverse commuting patterns and infrastructure evolution.

- Asia-Pacific is made up of several countries with a decent bicycle population, including China, India, and Japan. The demand for bicycles has grown recently among the countries in the region. People in Asia-Pacific are using bicycles for short commutes (up to 15 km) or trips to neighboring locations like businesses and workplaces. With 5 to 15 kilometers of travel per day, China has the highest percentage of daily commuters in the Asia-Pacific region.

- Numerous people discovered bicycles to be a secure, isolating means of transportation after the COVID-19 outbreak, which forced the closing of gyms and public transportation in various Asia-Pacific countries. People also decided to exercise during the pandemic by bicycling or going on weekend runs to nearby places, which increased the number of commuters with a daily travel distance of 5 to 15 kilometers in 2021 over 2020 across the region. Consumers who commuted 5 to 15 kilometers were also attracted to the introduction of e-bikes with cutting-edge battery packs that offered an increased range of up to 40 to 45 kilometers.

- The removal of COVID restrictions and the opening of offices and businesses across Asia-Pacific contributed to the growth of bicycle users. Many people regularly commute by bicycle to their workplaces and enterprises within 5 to 15 kilometers. Bicycle commuting is becoming more and more common, largely because it is healthy, carbon-free, fuel-efficient, and saves traffic time in countries like China and Japan. During the forecast period, these factors are anticipated to promote cyclists journeying 5 to 15 km across Asia-Pacific.

Asia-Pacific E-bike Industry Overview

The Asia-Pacific E-bike Market is moderately consolidated, with the top five companies occupying 44.33%. The major players in this market are Aima Technology Group Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd, Shenzhen TAILG Technology Group Co., LTD., Yadea Group Holdings Ltd. and Yamaha Bicycles (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Application Type

- 5.2.1 Cargo/Utility

- 5.2.2 City/Urban

- 5.2.3 Trekking

- 5.3 Battery Type

- 5.3.1 Lead Acid Battery

- 5.3.2 Lithium-ion Battery

- 5.3.3 Others

- 5.4 Country

- 5.4.1 Australia

- 5.4.2 China

- 5.4.3 India

- 5.4.4 Japan

- 5.4.5 New Zealand

- 5.4.6 South Korea

- 5.4.7 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aima Technology Group Co. Ltd

- 6.4.2 Cycling Sports Group, Inc.

- 6.4.3 Giant Manufacturing Co.

- 6.4.4 Hero Cycles Limited

- 6.4.5 Jiangsu Xinri E-Vehicle Co. Ltd

- 6.4.6 Merida Industry Co Ltd

- 6.4.7 Riese & Muller

- 6.4.8 Shenzhen TAILG Technology Group Co., LTD.

- 6.4.9 Tianjin Fuji-Ta Bicycle Co. Ltd.

- 6.4.10 Trek Bicycle Corporation

- 6.4.11 Yadea Group Holdings Ltd.

- 6.4.12 Yamaha Bicycles

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219