|

市場調查報告書

商品編碼

1521758

定時交付:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Time Definite Courier Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

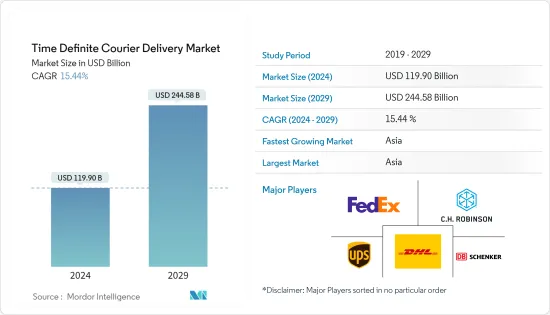

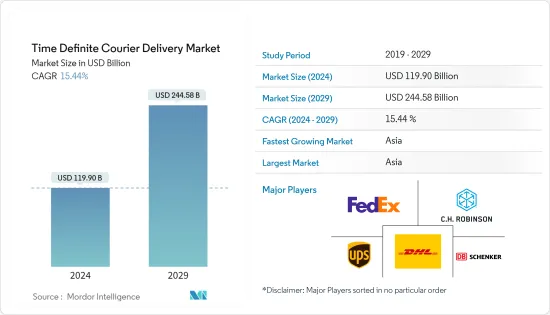

特定時間配送市場規模預計到 2024 年為 1,199 億美元,預計到 2029 年將達到 2,445.8 億美元,在預測期內(2024-2029 年)複合年成長率為 15.44%。

由於對準確、及時的配送服務的需求不斷成長,定時配送市場已成為物流行業的一個充滿活力的部分。隨著電子商務和網路購物的持續成長,消費者和企業正在為高效的運輸選擇支付溢價。

貨運整合商是一家宅配或快遞公司,在控制每批貨物移動的網路內安排特定時間的門到門運輸。

例如,DHL 報告稱,它在 220 個國家和地區每個工作日將超過 100 萬個小包裹從 A 點運送到 B 點。 DHL 在全球擁有超過 250 萬名客戶,擁有超過 12 萬名經過認證的國際專家組成的團隊,致力於滿足客戶對每批貨件的期望。

利用無人機和智慧儲物櫃等技術的最後一哩交付解決方案受到關注,以解決交付過程最後階段的挑戰。隨著這個市場不斷發展以滿足全球化和數位化互聯世界不斷變化的需求,對永續性、即時追蹤和交付窗口客製化的承諾進一步體現了這個市場的特徵。

特定時間配送市場的趨勢

電子商務的繁榮增加了對特定時間交付的需求

隨著亞馬遜等電子商務巨頭提供當日和隔天送貨選項,消費者越來越期望更快、更方便的送貨。這些增加的期望有助於滿足最後期限並透過定時交付服務提供精確的交付視窗。

2024年1月,亞馬遜宣布將在2023年實現全球最快的Prime會員配送速度,當天或隔天送達超過70億件商品,其中歐洲超過20億件,美國40億件。

隨著跨境電子商務的興起,人們對可靠的國際宅配服務、提供及時遞送選擇的需求日益成長。當跨越不同時區或國界運送產品時,滿足交貨期限變得更加重要。

對於 2023 年,聯邦快遞公佈了完整的遞送時間表,以確保包裹在 12 月 24 日之前到達目的地。此公告對於計劃在假期季節期間向海外寄送包裹的企業和個人來說非常重要。

無人機送貨將改變亞太地區的物流

十年後,物流可能成為無人機經濟中最大的市場。然而,無人機送貨業務的廣泛採用需要明確的法律規範、強大的無人空中交通管理基礎設施以及廣泛的社區認可。

2023 年 3 月,一架日本郵政無人機降落在距離郵局約 2 公里的一處私人住宅上,並向東京以西郊區奧多摩市的鄉村投放了一個小包裹。

在地形複雜和偏遠地區,無人機可以克服傳統的物流障礙,成為一種經濟高效、及時的交付手段。例如,2023年6月,醫療無人機交付領域的領導者Skyports Drone Services為泰國醫療無人機委員會完成了醫療無人機交付演示。醫療無人機委員會由泰國民航局(CAAT)、公共衛生部、國家廣播和通訊公司(NBTC)、Aerotaha 和沙敦府的成員組成。

截至2024年2月,馬來西亞無人機業務解決方案供應商Aerodyne Group已與新加坡DroneDash Technologies簽署協議,提供跨國無人機送貨服務。馬來西亞和新加坡之間的無人機送貨服務將利用兩國的專業知識,提高兩國的物流效率,並加強區域送貨和供應鏈能力。

定時配送產業概述

定時配送市場由全球主要參與者主導,例如: UPS、FedEx 和 DHL 均提供全面的國際時效遞送服務。為了滿足各行業的需求,這些公司利用先進的物流技術、廣泛的網路和多樣化的服務組合。在不斷發展的行業中也不斷出現創新新興企業和技術主導的平台,包括群眾外包交付模式和最後一英里最佳化解決方案。隨著業界擁抱技術進步和永續性,現有企業和新參與企業都將努力滿足對可靠和準時的宅配服務不斷成長的需求,競爭動態將不斷發展。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 市場概況

- 政府法規和舉措

- 產業技術趨勢

- 價值鏈/供應鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 電子商務快速擴張

- 相互關聯的全球經濟

- 市場限制因素

- 成本壓力

- 市場機會

- 最後一哩創新

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按類型

- 電子商務

- 除了電商以外

- 依產品

- B2B

- B2C

- 透過交通工具

- 航空

- 水路

- 路

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東/非洲

- 埃及

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 世界其他地區

- 北美洲

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- FedEx Corp.

- DHL

- CH Robinson Worldwide

- DB Schenscher

- UPS

- DSV A/S

- Exel

- Gati

- GEODIS

- Aramex

- 其他公司

第8章 機會與未來趨勢

第9章 附錄

The Time Definite Courier Delivery Market size is estimated at USD 119.90 billion in 2024, and is expected to reach USD 244.58 billion by 2029, growing at a CAGR of 15.44% during the forecast period (2024-2029).

The time definite courier delivery market is a dynamic segment in the logistics industry, driven by the increasing demand for precise and timely delivery services. With the ongoing growth of e-commerce and online shopping, consumers and businesses are paying a premium on efficient shipping options.

Freight integrators are courier or express delivery companies that arrange time definite door-to-door transportation in their network, where each shipment movement is controlled.

For instance, DHL's reports claim that it moves over 1 million parcels per working day from point A to point B in 220 countries and territories. It has more than 2.5 million customers worldwide, and a team of 120,000+ certified international specialists strive to meet their expectations on every shipment.

Last-mile delivery solutions, powered by technologies like drones and smart lockers, are gaining prominence, addressing the challenges of the final leg of the delivery process. Sustainability initiatives, real-time tracking, and customization of delivery windows further characterize this market as it evolves to meet the ever-changing demands of a globalized and digitally connected world.

Time Definite Courier Delivery Market Trends

E-commerce Boom Fuels Demand for Time Definite Courier Delivery

Consumers increasingly expect quicker and more convenient delivery as e-commerce giants like Amazon offer same-day or next-day delivery options. These increased expectations help meet these deadlines and provide precise delivery windows through time-definite courier services.

In January 2024, Amazon declared it achieved its fastest global delivery speeds to Prime members in 2023, with more than 7 billion units arriving the same or the next day, including more than 2 billion in Europe and more than 4 billion in the United States.

With the rise of cross-border e-commerce, there is an increased need for reliable international courier services that provide timely delivery options. Meeting delivery deadlines becomes even more critical when shipping products across different time zones and borders.

In 2023, to ensure packages reach their destination on or before December 24, FedEx issued a complete timetable for delivery. This announcement is of great importance for businesses and individuals who plan to send packages abroad during the holiday season.

Drone Deliveries Reshape Asia-Pacific Logistics

By the end of the decade, logistics could be the largest market in the drone economy. However, a clear regulatory framework, uncrewed solid air traffic management infrastructure, and broad community acceptance are needed for widespread drone delivery operations.

In March 2023, after landing at a house about 2 kilometers from the post office, the Japan Post drone released a small package into the Okutama countryside, a suburb west of Tokyo.

In regions with challenging terrain or remote locations, drones serve as a cost-effective and timely means of delivery, overcoming traditional logistics hurdles. For instance, in June 2023, Skyports Drone Services, a leader in medical drone delivery, completed a demonstration of medical drone delivery for Thailand's Medical UAV Committee. The Medical UAV Committee comprises members from the Thai Civil Aviation Administration (CAAT), Ministry of Public Health, National Broadcasting and Telecommunications Corporation (NBTC), Aerotaha, and Satun Province.

As of February 2024, Aerodyne Group, a drone business solutions provider based in Malaysia, signed an agreement with DroneDash Technologies in Singapore to provide delivery services for drones across borders. To improve logistics efficiency in both countries and enhance the region's delivery and supply chain capabilities, the drone delivery services between Malaysia and Singapore use specialized technology from both parties.

Time Definite Courier Delivery Industry Overview

The time definite courier delivery market is dominated by major global players such as UPS, FedEx, and DHL, each offering comprehensive time definite delivery services internationally. To meet the needs of different industries, these companies use advanced logistics technology, extensive networks, and a diversified service portfolio. Innovative start-ups and technology-driven platforms, including crowdsourced delivery models and last-mile optimization solutions, are also emerging in the evolving landscape. The competitive dynamics continue to evolve, with established players and new entrants striving to meet the growing demand for reliable and time definite courier services as the industry embraces technological advances and sustainability initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends in the Industry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Rapid Expansion of Ecommerce

- 5.1.2 Interconnected Global Economy

- 5.2 Market Restraints

- 5.2.1 Cost Pressures

- 5.3 Market Opportunities

- 5.3.1 Last-Mile Innovation

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 E-Commerce

- 6.1.2 Non-E-Commerce

- 6.2 By Product

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Mode of Transportation

- 6.3.1 Airways

- 6.3.2 Waterways

- 6.3.3 Roadways

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Australia

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.4.1 Egypt

- 6.4.4.2 South Africa

- 6.4.4.3 Saudi Arabia

- 6.4.4.4 Rest of Middle-East and Africa

- 6.4.5 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 FedEx Corp.

- 7.2.2 DHL

- 7.2.3 C.H. Robinson Worldwide

- 7.2.4 DB Schenscher

- 7.2.5 UPS

- 7.2.6 DSV A/S

- 7.2.7 Exel

- 7.2.8 Gati

- 7.2.9 GEODIS

- 7.2.10 Aramex*

- 7.3 Other Companies