|

市場調查報告書

商品編碼

1536968

鋰離子電池隔膜:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Lithium-ion Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

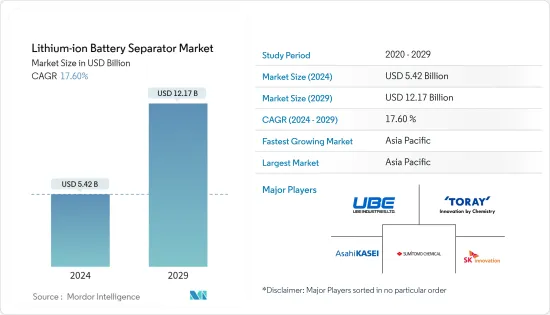

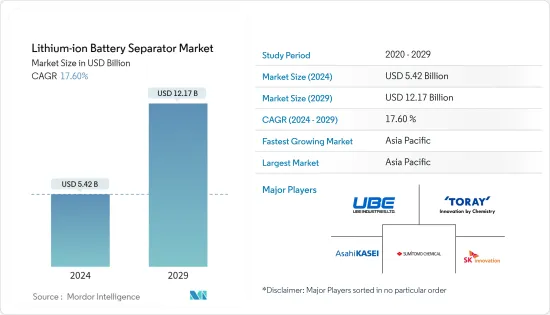

預計2024年鋰離子電池隔膜市場規模為54.2億美元,2029年預計將達到121.7億美元,在預測期內(2024-2029年)複合年成長率為17.60%。

*從中期來看,市場預計將受到鋰離子電池價格下降和電動車日益普及的推動。

*與此同時,原料供需不匹配預計將在預測期內抑制市場成長。

*此外,電池技術的進步大大增加了對改進隔膜設計的需求。目前的隔膜,無論是在商業性用途還是在開發階段,都尚未達到防止電池技術效率和可靠性下降所需的高穩定性和壽命性能標準。因此,在預測期內調查的市場可能會出現巨大的機會。

*亞太地區預計將成為預測期內最大、成長最快的市場,大部分需求來自中國、日本等國家。

鋰離子電池隔離膜市場趨勢

電動車的普及預計將推動市場發展

*中國、日本和韓國引領全球鋰離子電池供應鏈。澳洲、印度和越南等國家也計劃在預測期內在本國建立電池製造設施。

*亞太地區很大一部分人口沒有電,依靠煤油和柴油等傳統燃料照明和行動電話充電。由於其相關的技術優勢和鋰離子電池價格的下降,鋰離子電池整合能源儲存解決方案的採用率可能會提高。預計這將在預測期內為鋰離子電池隔膜製造商創造重大商機。

*由於新能源汽車(NEV)和併網和離網應用的ESS的採用,預計該地區對鋰離子電池的需求將快速成長。

*此外,預計到2030年,中國將佔全球電動車市場的57%佔有率。充電基礎設施的發展正在支持電動車在該國的普及。截至2023年8月,EVCIPA已確認,中國總合充電基礎設施(公共+私人)720.8萬個,其中公共充電站227.2萬個,私人充電站。

*日本的目標是到2050年建立「從油井到車輪的零排放」政策,並專注於能源供應和汽車創新,與全球零排放努力保持一致。透過將所有汽車替換為電動車,每輛車的溫室氣體排放量可以減少約 80%,其中每輛乘用車減少約 90%。此類政府措施可能會增加對電動車的需求,進而增加對鋰離子電池的需求。

*韓國也是主要的汽車製造市場,擁有現代汽車、起亞汽車和雷諾等大公司。隨著電動車的普及,預計該國對鋰離子電池和鋰離子電池隔膜等供應鏈配件的需求將會增加。

*因此,由於上述因素,預計亞太地區在預測期內將主導鋰離子電池隔離膜市場。

亞太地區預計將主導市場

- 該地區國家是全球鋰離子電池供應鏈的主要推動者,其中中國、日本和韓國處於領先地位。澳洲、印度和越南等國家也正在推進在預測期內在本國建立電池製造設施的計畫。

- 據估計,亞太地區很大一部分人口沒有電,依靠煤油和柴油等傳統燃料照明和行動電話充電。由於其相關的技術優勢和鋰離子電池價格的下降,鋰離子電池整合能源儲存解決方案的採用率可能會提高。預計這將在預測期內為鋰離子電池隔膜製造商創造重大商機。

- 由於新能源汽車(NEV)和儲能系統在併網和離網應用中的採用,預計該地區對鋰離子電池的需求將快速成長。

- 此外,預計到2030年,中國將佔全球電動車市場的57%佔有率。充電基礎設施的發展正在支持電動車在該國的普及。截至2023年8月,EVCIPA已確認,中國總合7,208,000個充電基礎設施(公共+私人),其中2,272,000個為公共充電站,4,936,000個為私人充電站。

- 日本的目標是到2050年建立「從油井到車輪的零排放」政策,與全球零排放的努力保持一致,重點是能源供應和汽車創新。透過將所有汽車替換為電動車,每輛車的溫室氣體排放量可以減少約 80%,其中每輛乘用車減少約 90%。此類政府措施可能會增加對電動車的需求,進而增加對鋰離子電池的需求。

- 韓國也是汽車製造市場的主要企業,擁有現代汽車、起亞汽車和雷諾等大公司。隨著電動車的普及,預計該國對鋰離子電池和鋰離子電池隔膜等供應鏈配件的需求將會增加。

- 因此,由於上述因素,亞太地區預計將在預測期內主導鋰離子電池隔離膜市場。

鋰離子電池隔膜產業概況

鋰離子電池隔離膜市場適度分散。進入該市場的主要企業包括(排名不分先後)旭化成、東麗、住友化學、SK Innovation 和宇部興產。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029 年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 鋰離子電池價格下降

- 電動車的擴張

- 抑制因素

- 原料供需不匹配

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 法國

- 俄羅斯

- 西班牙

- 德國

- 北歐的

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 馬來西亞

- 印尼

- 澳洲

- 泰國

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Asahi Kasei Corp.

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- Entek International LLC

- SK Innovation Co. Ltd

- Ube Industries Ltd

- Mitsubishi Paper Mills Ltd

- Dreamweaver International

- W-SCOPE CORPORATION

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 改進分離器設計的技術進步

The Lithium-ion Battery Separator Market size is estimated at USD 5.42 billion in 2024, and is expected to reach USD 12.17 billion by 2029, growing at a CAGR of 17.60% during the forecast period (2024-2029).

* Over the medium term, factors such as declining lithium-ion battery prices and the increasing adoption of electric vehicles are expected to drive the market.

* On the other hand, the demand-supply mismatch of raw materials is expected to restrain the market growth during the forecast period.

* Moreover, advancements in battery technology have dramatically increased the demand for improvements in separator design. Current separators, either in commercial usage or under the development stage, have yet to meet the high stability and lifespan performance standards necessary to prevent deterioration in the efficiency and reliability of battery technologies. This will likely create immense opportunities for the market studied during the forecast period.

* The Asia-Pacific is expected to be the largest and fastest-growing market during the forecast period, with most of the demand coming from countries like China, Japan, etc.

Lithium Ion Battery Separator Market Trends

Increasing Adoption of Electric Vehicles is Expected to Drive the Market

* Countries in the region are the leading proponents of the global lithium-ion battery supply chain, with China, Japan, and South Korea leading the way. Countries like Australia, India, and Vietnam are also following plans to set up battery manufacturing facilities in their countries during the forecast period.

* A significant fraction of Asia-Pacific's population is estimated to live without electricity and depend on conventional fuels, such as kerosene and diesel, for their lighting and mobile phone charging needs. Lithium-ion battery integrated energy storage solutions are likely to witness an increasing rate of adoption due to the technical benefits associated with it and declining lithium-ion battery prices. This, in turn, is expected to create significant opportunities for li-ion battery separator manufacturers during the forecast period.

* The demand for lithium-ion batteries in the region is expected to grow rapidly, owing to the adoption of new energy vehicles (NEVs) and ESS for on-grid and off-grid applications.

* Furthermore, China is expected to dominate with a 57% share of the global EV market by 2030. The development of charging infrastructure is propelling EV adoption in the country. As of August 2023, EVCIPA confirmed that there were a total of 7,208,000 charging infrastructure units (public + private) in China, of which 2,272,000 charging stands were public and 4,936,000 were private.

* By 2050, Japan aims to establish a 'Well-to-Wheel Zero Emission' policy, in line with the global efforts to eliminate emissions, focusing on energy supply and vehicle innovation. Replacing all vehicles with EVs can reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle. Such government initiatives are likely to increase the demand for electronic vehicles, which, in turn, is likely to increase the demand for lithium-ion batteries.

* South Korea is also a major player in the car manufacturing market, with large corporations like Hyundai, Kia Motors, and Renault. The increasing adoption of electric vehicles is expected to increase the demand for lithium-ion batteries and their supply chain accessories, such as lithium-ion battery separators, in the country.

* Therefore, based on the factors mentioned above, Asia-Pacific is expected to dominate the lithium-ion battery separator market during the forecast period.

The Asia-Pacific is Expected to Dominate the Market

- Countries in the region are the leading proponents of the global lithium-ion battery supply chain, with China, Japan, and South Korea leading the way. Countries like Australia, India, and Vietnam are also following plans to set up battery manufacturing facilities in their countries during the forecast period.

- A significant fraction of Asia-Pacific's population is estimated to be living without electricity and dependent on conventional fuels, such as kerosene and diesel, for their lighting and mobile phone charging needs. Lithium-ion battery integrated energy storage solutions are likely to witness an increasing rate of adoption due to the technical benefits associated with it and declining lithium-ion battery prices. This, in turn, is expected to create significant opportunities for li-ion battery separator manufacturers during the forecast period.

- The demand for lithium-ion batteries in the region is expected to grow rapidly, owing to the adoption of new energy vehicles (NEVs) and ESS for on-grid and off-grid applications.

- Furthermore, China is expected to dominate with a 57% share of the global EV market by 2030. The development of charging infrastructure is propelling EV adoption in the country. As of August 2023, EVCIPA confirmed that there were a total of 7,208,000 charging infrastructure units (public + private) in China, of which 2,272,000 charging stands were public and 4,936,000 were private.

- By 2050, Japan aims to establish a 'Well-to-Wheel Zero Emission' policy, in line with the global efforts to eliminate emissions, focusing on energy supply and vehicle innovation. Replacing all vehicles with EVs can reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle. Such government initiatives are likely to increase the demand for electronic vehicles, which, in turn, is likely to increase the demand for lithium-ion batteries.

- South Korea is also a major player in the car manufacturing market, with large corporations like Hyundai, Kia Motors, and Renault. The increasing adoption of electric vehicles is expected to increase the demand for lithium-ion batteries and their supply chain accessories, such as lithium-ion battery separators, in the country.

- Therefore, based on the factors mentioned above, the Asia-Pacific region is expected to dominate the lithium-ion battery separator market during the forecast period.

Lithium-ion Battery Separator Industry Overview

The lithium-ion battery separator market is moderately fragmented. Some of the major players operating in this market include (in no particular order) Asahi Kasei Corp., Toray Industries Inc., Sumitomo Chemical Co. Ltd, SK Innovation Co. Ltd, and Ube Industries Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 The Increasing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 The Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.1.4 Rest of North America

- 5.1.2 Europe

- 5.1.2.1 United Kingdom

- 5.1.2.2 France

- 5.1.2.3 Russia

- 5.1.2.4 Spain

- 5.1.2.5 Germany

- 5.1.2.6 NORDIC

- 5.1.2.7 Italy

- 5.1.2.8 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 India

- 5.1.3.2 China

- 5.1.3.3 Japan

- 5.1.3.4 Malaysia

- 5.1.3.5 Indonesia

- 5.1.3.6 Australia

- 5.1.3.7 Thailand

- 5.1.3.8 Vietnam

- 5.1.3.9 Rest of Asia-Pacific

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Columbia

- 5.1.4.4 Rest of South America

- 5.1.5 Middle East and Africa

- 5.1.5.1 United Arab Emirates

- 5.1.5.2 Saudi Arabia

- 5.1.5.3 Qatar

- 5.1.5.4 Nigeria

- 5.1.5.5 Egypt

- 5.1.5.6 South Africa

- 5.1.5.7 Rest of Middle East and Africa

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Asahi Kasei Corp.

- 6.3.2 Toray Industries Inc.

- 6.3.3 Sumitomo Chemical Co. Ltd

- 6.3.4 Entek International LLC

- 6.3.5 SK Innovation Co. Ltd

- 6.3.6 Ube Industries Ltd

- 6.3.7 Mitsubishi Paper Mills Ltd

- 6.3.8 Dreamweaver International

- 6.3.9 W-SCOPE CORPORATION

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement for the Improvements in Separator Design