|

市場調查報告書

商品編碼

1636417

德國電動車電池分離器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

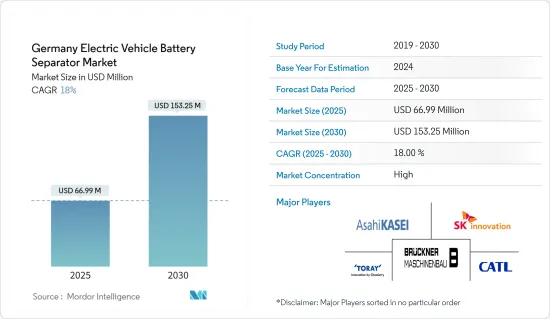

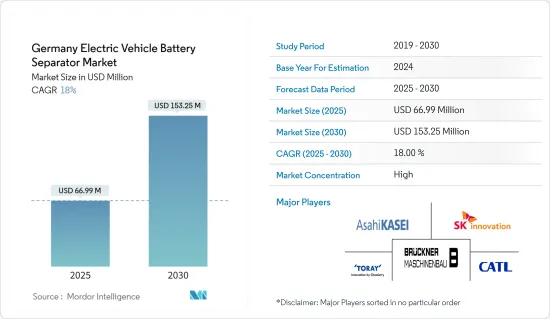

德國電動車電池隔膜市場規模預計到2025年為6,699萬美元,預計2030年將達到1.5325億美元,預測期內(2025-2030年)複合年成長率為18%。

主要亮點

- 從中期來看,電動車滲透率的提高、鋰離子電池價格的下降以及政府對電動車的推廣預計將在預測期內推動德國電動車電池隔膜市場的發展。

- 另一方面,電池材料供應鏈的缺口,如原料短缺和分銷瓶頸,預計將抑制德國電動車電池隔膜市場的未來成長。

- 然而,其他電池化學材料(例如固態電池、先進鋰離子化學材料和鈉離子電池)的持續研究和開發預計將在未來提供市場機會。

德國電動車電池隔膜市場趨勢

鋰離子電池領域可望主導市場

- 電池隔膜是一種多孔膜,對於鋰離子電池至關重要。透過將陰極和陽極分開並僅允許鋰離子通過,可以防止電短路。德國是建立強大的鋰離子電動車電池隔膜市場的先驅。

- 最初,德國的鋰離子電池產業主要針對消費性電子領域。然而,隨著時間的推移,發生了一個重要的轉變。電動車(EV)製造商已成為鋰離子電池的主要消費者,帶動了鋰離子電池隔膜的需求。這項變化是由電動車(尤其是插電式混合動力汽車(PHEV))銷量的增加所推動的。

- 根據國際能源總署 (IEA) 的資料,主要基於鋰離子技術的純電動車 (BEV) 在德國的銷量將從 2022 年的 47 萬輛增至 2023 年的 52 萬輛。這意味著採用鋰離子技術的電動車銷量成長了10.6%,凸顯了該產業在德國電動車電池隔膜市場的主導地位。

- 2024 年 7 月 總部位於英國、在德國開展業務的 Luxinar Ltd. 於 7 月 17 日至 18 日在德國慕尼黑舉行的雷射電動移動研討會上介紹了雷射切割鋰離子電池隔膜的好處。會議期間,該公司展示了用於電池隔膜的CO2雷射切割技術,強調了該技術在減少磨損和徹底改變德國鋰離子電動車電池生產方面的潛力。

- 根據國際能源總署(IEA)預測,98%以上依賴鋰離子技術且與電動車電池隔膜市場密切相關的德國電池電動商用卡車銷量將從2022年的1100輛成長到2023年。增加至2,200個,一年內加倍。隨著德國電動卡車銷量的持續成長,這一趨勢顯示電池隔離膜的前景光明。

- 鑑於電動車銷量的成長和鋰離子電池隔膜技術的進步,鋰離子產業很可能將主導德國電動車電池隔離膜市場。

德國政府政策推動市場

- 德國頒布了多項法律、政策和法律來排放溫室氣體(GHG)和二氧化碳排放。此外,該國還推出了針對純電動車的各種激勵措施,為電動車電池及相關設備製造商創造了有利條件。

- 德國政府承諾在 2022 年將 100% 的民用車隊轉變為零排放輕型車輛 (LDV)。此外,到 2035 年,我們的目標是使所有中型和重型車輛 (M/HDV) 實現零排放。德國的目標是到 2030 年所有新車或替換汽車都配備環保技術,到 2025 年至少 50% 為電動車。這些努力推動了德國電動車產量的激增,並增加了對電池隔膜的需求。

- 德國政府規定,到 2030 年,二氧化碳排放在 50 克/公里以下或續航里程在 60 公里以上(從 2025 年增加到 80 公里)的電動車可免徵車輛稅。此外,政府打算給予電動車在德國道路上的特權,例如使用專用公車道和專用停車位。

- 由於德國政府的支持政策,電池隔膜產業的許多企業正在共同努力,加強在德國的製造業。例如,2023 年 11 月,在德國擁有重要業務的全球工程材料供應商 Glatfelter Corporation 與藍寶石科技集團結成策略聯盟。該合資企業專注於先進的電池安全技術。兩家公司正在共同開發一種與 Safire Group 的 SAFe 抗震電解相匹配的新型電池隔膜,以滿足優先考慮提高鋰離子 (Li-ion) 應用性能和安全性的客戶的需求。

- 德國政府也主張在英國增加電動車充電站。國際能源總署的資料顯示,英國超快電動車充電站數量已從 2022 年的 71,000 個增加到 2023 年的 87,000 個。此次擴張將間接拉動德國電動車電池隔膜市場的需求。隨著充電站網路的擴大,電動車變得越來越流行,對電池隔離膜的需求也隨之增加。

- 此外,德國政府正在應對市場上鋰離子電池價格的下跌。 2023年,電動車(EV)電池組的平均價格降至139美元/kWh,較2022年大幅下降13%。據預測,到2025年,電價將進一步下降至113美元/度,2030年將達到80美元/度。這些趨勢將支持德國電動車電池隔膜市場的成長。

- 摘要,上述幾點凸顯了德國政府共同努力提高電動車佔有率,並直接影響該國電動車電池隔膜市場動態。

德國電動汽車電池隔膜產業概況

德國電動車電池隔膜市場正走向半固體。市場主要企業包括(排名不分先後)Contemporary Amperex Technology Co., Limited、SK Innovation、Asahi Kasei Corporation、Bruckner Maschinenbau GmbH 和 Toray Industries Europe GmbH。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 有利的政府政策

- 鋰離子電池價格下降

- 抑制因素

- 供應鏈缺口

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子

- 鉛酸電池

- 其他電池類型

- 依材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Contemporary Amperex Technology Co.

- SK Innovation Co. Ltd.

- Asahi Kasei Corporation

- Bruckner Maschinenbau GmbH

- Coperion GmbH

- Toray Industries Europe GmbH

- Delfort Germany GmbH

- SEMCORP Advanced Materials Group

- Sepion Technologies

- List of Other Prominent Companies

- Market Ranking/Share(%)Analysis

第7章 市場機會及未來趨勢

- 鋰離子電池隔膜材料的持續研究與進展

The Germany Electric Vehicle Battery Separator Market size is estimated at USD 66.99 million in 2025, and is expected to reach USD 153.25 million by 2030, at a CAGR of 18% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles, the decreasing price of lithium-ion batteries, and the Government's push for Electric vehicles are expected to drive the Germany Electric Vehicle Battery Separator Market during the forecast period.

- On the other hand, the supply chain gap in battery materials, such as ingredient shortages or distribution bottlenecks, is expected to restrain Germany's Electric Vehicle Battery Separator Market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

Germany Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital for lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass. Germany has been a pioneer in establishing a robust market for Li-ion Electric Vehicle battery separators.

- Initially, in Germany, the lithium-ion battery industry primarily catered to the consumer electronics sector. However, over time, a pivotal shift took place. Electric vehicle (EV) manufacturers became the primary consumers of lithium-ion batteries, subsequently driving the demand for Li-ion battery separators. This shift was propelled by the rising sales of EVs, particularly Plug-in Hybrid Electric Vehicles (PHEVs), attributed to their high energy density, extended cycle life, and overall efficiency.

- Data from the International Energy Agency (IEA) indicates that in 2023, sales of Battery Electric Vehicles (BEVs) in Germany, predominantly utilizing Li-ion technology, reached 520,000, up from 470,000 in 2022. This marks a notable 10.6% growth in Li-ion technology EV sales, underscoring the segment's dominance in Germany's Electric Vehicle Battery Separator Market.

- In July 2024, Luxinar Ltd., a United Kingdom-based company with operations in Germany, showcased the advantages of laser cutting Li-ion battery separator foils at the Laser EMobility Workshop held in Munich, Germany, from July 17 to 18. During the conference, the company demonstrated its CO2 laser cutting technology for battery separators, emphasizing its potential to reduce wear and tear and revolutionize Li-ion electric vehicle battery cell production in Germany.

- According to the International Energy Agency (IEA), sales of Battery Electric Commercial Trucks in Germany, which are over 98% reliant on Li-ion technology and closely tied to the Electric Vehicle Battery Separator Market, surged from 1,100 in 2022 to 2,200 in 2023, effectively doubling in a year. This trend indicates a promising future for battery separators as EV truck sales continue to climb in Germany.

- Given the rising EV sales and advancements in Li-ion battery separator technology, the Li-ion segment is poised to dominate the Electric Vehicle Battery Separator Market in Germany.

Policies of the German Government Driving the Market

- Germany has enacted numerous legislations, policies, and acts to curb greenhouse gas (GHG) emissions and carbon dioxide output. Additionally, the country has rolled out various incentives for battery-electric vehicles, creating favorable conditions for manufacturers of EV batteries and related equipment.

- In 2022, the German Government committed to transitioning 100% of its civil government-operated fleets to zero-emission light-duty vehicles (LDVs). Furthermore, they aim for all medium and heavy-duty vehicles (M/HDVs) to be zero-emission by 2035. By 2030, Germany targets all new or replacement vehicles to adopt environmentally friendly technologies, with a minimum of 50% being electric by 2025. These initiatives are propelling the surge in EV production in Germany and boosting the demand for battery separators.

- The German Government has enacted a motor tax exemption for electric vehicles (EVs) that emit less than 50g of CO2/km or have a range of at least 60km (increasing to 80km from 2025) until 2030. Moreover, the government intends to offer electric cars special privileges on German roads, including access to bus lanes and exclusive parking spots.

- Due to supportive policies from the German Government, many players in the battery separator industry are collaborating to bolster manufacturing in Germany. For instance, in November 2023, Glatfelter Corporation, a global supplier of engineered materials with a significant presence in Germany, forged a strategic alliance with Safire Technology Group, Inc. This venture-backed firm specializes in advanced battery safety technologies. Together, they're developing a new battery separator tailored for Safire Group's SAFe Impact Resistant Electrolyte, catering to clients prioritizing enhanced performance and safety in their Lithium-ion (Li-ion) applications.

- The German government is also advocating for an increase in electric vehicle charging stations in the United Kingdom. Data from the International Energy Agency indicates that superfast EV charging points in the UK grew from 71,000 in 2022 to 87,000 in 2023. This expansion indirectly boosts the demand for the Electric Vehicle Battery Separator Market in Germany. As the network of charging stations expands, it bolsters the adoption of electric vehicles, subsequently driving up the demand for battery separators.

- Moreover, the German government is responding to the declining prices of Li-ion batteries in the market. In 2023, average battery pack prices for electric vehicles (EVs) fell to USD 139/kWh, a significant 13% drop from 2022. Projections estimate prices will further decline to USD 113/kWh by 2025 and reach USD 80/kWh by 2030. Such trends bolster the growth of the Electric Vehicle Battery Separator Market in Germany.

- In summary, the aforementioned points underscore the German Government's concerted efforts to amplify the share of electric vehicles, directly influencing the dynamics of the Electric Vehicle Battery Separator Market in the country.

Germany Electric Vehicle Battery Separator Industry Overview

The Germany Electric Vehicle Battery Separator Market is semi-consolidated. Some of the major players in the market (in no particular order) include Contemporary Amperex Technology Co., Limited, SK Innovation Co. Ltd., Asahi Kasei Corporation, Bruckner Maschinenbau GmbH, and Toray Industries Europe GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.1.3 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other Battery Type

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Contemporary Amperex Technology Co.

- 6.3.2 SK Innovation Co. Ltd.

- 6.3.3 Asahi Kasei Corporation

- 6.3.4 Bruckner Maschinenbau GmbH

- 6.3.5 Coperion GmbH

- 6.3.6 Toray Industries Europe GmbH

- 6.3.7 Delfort Germany GmbH

- 6.3.8 SEMCORP Advanced Materials Group

- 6.3.9 Sepion Technologies

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Li-ion Battery Separator Material