|

市場調查報告書

商品編碼

1627137

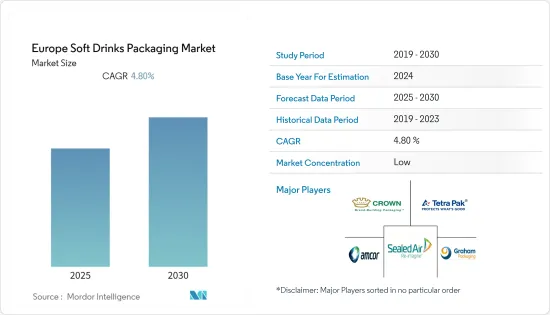

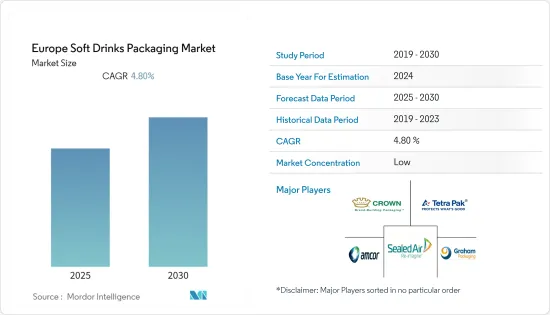

歐洲軟性飲料包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

歐洲軟性飲料包裝市場預計在預測期內複合年成長率為 4.8%

主要亮點

- 歐洲軟性飲料的成長繼續與國內生產總值的成長和消費者購買力的提高聯繫在一起。在最近的調查期間,拉丁美洲的軟性飲料消費一直是全球軟性飲料品牌所有者和裝瓶商的熱門話題,因此即飲茶和瓶裝水將是關鍵的機會領域。

- 歐洲地區的碳酸軟性飲料 (CSD)消費量很高,但消費者主導的健康趨勢可能會損害持續成長。甜菊糖和替代甜味劑為消費者提供了一種享受軟性飲料的自然方式,而即飲紅茶可能是一種替代選擇。

- 軟性飲料是僅次於水的第二大消費量飲料,而塑膠是軟性飲料包裝最常用的材料。人口成長和可支配收入的增加正在增加世界各地對軟性飲料產品的需求。包裝在軟性飲料市場中發揮重要作用。

- 高效的包裝解決方案具有易於使用、易於處置和改善使用者體驗等優點。這些優勢導致軟性飲料產業對包裝解決方案的需求增加。需求成長的另一個趨勢是新的和創新的產品,這有助於製造商區分其產品,同時提高品牌知名度。

- 卡尼的最新研究表明,儘管由於限制而導致消費量減少,但歐洲軟性飲料消費量預計將恢復到新冠疫情爆發前的水平。然而,不同國家的消費者偏好有所不同。例如,雖然德國的人均消費量可能會略有下降,但英國消費者未來可能會消費更多的軟性飲料。

歐洲軟性飲料包裝市場趨勢

塑膠預計將佔據最大的市場佔有率

- 塑膠製造起來更節能,而且比替代材料更輕,這使其成為比其他替代材料更有效的軟性飲料包裝材料。

- 例如,只需 2 磅塑膠即可輸送 10 加侖液體 (ig),而需要 3 磅鋁、8 磅鋼和超過 40 磅玻璃才能輸送相同量的液體。

- 在軟性飲料領域,由於上班族的忙碌生活,各個品牌都推出了單劑量塑膠袋。因此,即飲飲料的重要性日益增加,進一步推動了市場成長。

- HDPE 是應用最廣泛的塑膠包裝材料。它用於製造多種類型的瓶子和容器。無色瓶子半透明、耐用且具有阻隔性,使其適合包裝保存期限較短的產品,例如果汁和能量飲料。

- 顯然,隨著軟性飲料市場的擴大,對果汁、能量飲料、運動飲料等營養產品的需求不斷增加,這直接帶動了軟性飲料包裝市場。塑膠也非常耐用且易於攜帶。另外,塑膠是氣密的,因此不太可能洩漏或老化。

英國佔最大市場佔有率

- 由於人口成長和對優質飲料的需求,英國將獲得巨大的市場和動力。此外,競爭對手之間的高度敵意和可用性的便利性正在支持市場的成長。

- 近年來,碳酸飲料主導了英國軟性飲料市場。 25歲人口的減少可能對該國的銷售產生負面影響。主要市場競爭對手不斷創新其產品以保持獲利和競爭力。

- 例如,百事公司銷售的頑固蘇打水含有蔗糖和甜菊等甜味劑,並且有多種口味,包括檸檬和柳橙。對潔淨標示、無麩質、低熱量和低碳水化合物產品的需求不斷成長,導致歐洲軟性飲料行業低熱量即飲碳酸飲料市場的興起。

- 中上階層、中產階級和農村人口的消費模式等社會階層差異正在推動對包裝解決方案的需求。各種軟性飲料(包括碳酸飲料、果汁、能量飲料、酒精飲料、即飲飲料、運動飲料、瓶子和水)的包裝解決方案的需求在不久的將來將持續成長。強勁的零售市場和不斷改善的經濟活動將推動歐洲軟性飲料包裝市場的發展。

- 在英國,塑膠是軟性飲料、果汁和水的主要包裝材料。塑膠包裝的優點是具有化學惰性,不會影響產品的品質、氣味或味道。堅固、堅硬且 100% 可回收。

歐洲軟性飲料包裝產業概況

由於國內外公司眾多,軟性飲料包裝市場高度分散。市場碎片化,企業在價格、產品設計、產品創新等因素上競爭。該市場的一些主要企業包括 Amcor Ltd、Sealed Air Corporation、Tetra Pak International、Graham Packaging Company 和 Crown Holdings Incorporated。

- 2021 年 7 月 - Sealed Air Corporation 投資 3,000 萬美元用於全球產能擴張和新設備系統,以滿足對自動化包裝系統品牌解決方案不斷成長的需求。該投資主要用於俄亥俄州 Streetsboro 和 Bedford Heights 以及西維吉尼亞Keyser 工廠的產能擴張、「非接觸式」自動化和專有數位印刷技術,預計將於 2021 年完成。我們還將在 APS 位於英國馬爾文、菲律賓甲美地和中國青浦的工廠擴大產能並安裝新設備。

- 2021 年 11 月 - Amcor 宣布推出與 MGJ 合作開發的廣告曝光率技術,該技術使用 CYNK 彩色印刷技術,允許品牌客製閉合件。 Impressions 技術與 Saranex 和錫襯裡、Amcor 的 STELVIN 葡萄酒瓶蓋以及用於烈酒的 STELCAP 鋁製瓶蓋相容。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 可支配所得增加和經濟成長

- 對即用飲料的需求不斷成長

- 市場限制因素

- 政府對非生物分解產品的嚴格規定

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按材質

- 塑膠

- 金屬

- 玻璃

- 紙板

- 依產品類型

- 瓶子

- 能

- 盒子

- 紙盒

- 按地區

- 歐洲

- 英國

- 瑞典

- 德國

- 法國

- 其他歐洲國家

- 歐洲

第6章 競爭狀況

- 公司簡介

- Amcor PLC

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company

- Ball Corporation

- Owens-Illinois Inc.

- Pacific Can China Holdings Limited

- Crown Holdings Incorporated

- CAN-PACK SA

- CKS Packaging Inc.

- Refresco Group NV

- Tetra Pak Inc.

- Ardagh Group SA

第7章 投資分析

第8章 市場機會及未來趨勢

The Europe Soft Drinks Packaging Market is expected to register a CAGR of 4.8% during the forecast period.

Key Highlights

- The growth of soft drinks in Europe will remain tied to GDP growth and increasing consumer purchasing power. RTD teas and bottled waters will be key opportunity areas as soft drinks consumption in Latin America have been the global bright spot for soft drinks brand owners and bottlers over the recent review period.

- Although Carbonated Soft Drinks (CSD) consumption is high in European regions, consumer-led health and wellness trends could take their toll on continued growth. Stevia and alternative sweeteners offer a natural way for consumers to enjoy indulgent soft drinks, with RTD tea a possible alternative.

- Soft drinks are the second most-consumed drink after water, with plastic being the most used material for soft drinks packaging. The increasing population and rising disposable income have led to the increasing demand for soft drinks products across the world. Packaging plays an important role in the soft drinks market.

- Efficient packaging solutions offer benefits like ease of use, disposability, and enhanced user experience. These benefits have led to the growth in demand for packaging solutions for the soft drinks segment. The other trend that is augmenting the demand is the new and innovative products, which helps manufacturers enhance their brand visibility while offering product differentiation.

- A new Kearney study finds that soft drink consumption in Europe is expected to return to pre-COVID levels despite declining consumption due to restrictions. However, consumer preferences vary from country to country. For example, per capita consumption in Germany may decline slightly, while consumers in the UK are likely to consume more soft drinks in the future.

Europe Soft Drinks Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for soft drinks packaging than other alternatives because plastics are energy efficient to manufacture, and they are also lighter than alternative materials.

- For instance, just two pounds of plastic can deliver 10 gallons of Liquid, i.e., milk, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of Liquid.

- In the soft drinks segment, the busy life of working people has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready-to-consume drinks and further boosts market growth.

- HDPE is the most widely used type of plastic packaging material. It is used to make many types of bottles and containers. Unpigmented bottles are translucent and sturdy, have good barrier properties, and are well suited for packaging products with a shorter shelf life, such as Juices, Energy Drinks.

- With the expanding soft drinks market, it is evident that nutritional product demand, such as Juices, Energy drinks, sports drinks, is increasing, and it is directly driving the soft drinks packaging market. It is also durable, and people can carry them without hassle. Moreover, plastics are airtight, so the chances of leakage and getting stale is unlikely.

United Kingdom to Hold the Largest Market Share

- The United Kingdom is to gain significant market and momentum due to the increase in population and demand for premium drinks. Moreover, high competitive rivalry and easy availability are supporting the growth of the market.

- For the last few years, the Carbonated drinks segment has dominated the United Kingdom soft drinks market. The shrinking base population of age 25 years is likely to affect the sales in the country negatively. The key market players are continuously innovating products to maintain profit and a competitive edge.

- For instance, PepsiCo introduces Stubborn Soda, which contains sweeteners like sugar cane and stevia, and it is available in different flavors such as lemon, orange, etc. The growing demand for clean-label, gluten-free, low-calorie, and low-carb products has led to the elevation of the low-calorie RTD carbonated beverages market in the soft drinks industry of Europe.

- The social class differences like the ones between the upper-middle class, middle class, and the rural population consumption patterns are driving the demand for packaging solutions. The demand for packaging solutions for different soft drinks like Carbonated Drinks, Juices, Energy Drinks, Alcoholic Drinks, RTD Beverages, Sports Drinks, Bottles, Water, and others will continue to witness growth in the near future. The robust retail market and improving economic activity will drive the Europe Soft Drinks Packaging Market.

- In the United Kingdom, plastic is the conventional method for packaging soft drinks, fruit juices, and water. The advantage of plastic packaging is that it is chemically inert and will not affect the quality, odor, or taste of the product. It is strong, rigid, and 100% recyclable.

Europe Soft Drinks Packaging Industry Overview

The Soft Drinks Packaging market is highly fragmented, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Sealed Air Corporation, Tetra Pak International, Graham Packaging Company, Crown Holdings Incorporated, among others.

- July 2021 - Sealed Air Corporation has dedicated more than $30 million in capital to expand global production capacity and invest in new equipment systems to meet the accelerating demand for Automated Packaging Systems brand solutions. The investment is for capacity expansion, "touchless" automation, and proprietary digital printing technologies primarily in facilities in Streetsboro and Bedford Heights, Ohio, and Keyser, West Virginia, and will be completed in 2021. The company will also expand capacity and install new equipment at APS sites in Malvern, UK; Cavite, Philippines; and Qingpu, China.

- November 2021 - Amcor has announced that it will launch Impressions technology that's developed in partnership with MGJ that uses CYNK color printing technology enabling brands to customize closure linders. The Impressions technology is compatible with Saranex and tin liners, as well as Amcor's STELVIN closures for wine and STELCAP aluminum closures for spirits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Disposable Income and Growing Economies

- 4.3.2 Growing Demand for Ready-to-use Drinks

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations Against Non-biodegradable Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.1.4 Paper and Paperboard

- 5.2 By Product Type

- 5.2.1 Bottle

- 5.2.2 Can

- 5.2.3 Boxes

- 5.2.4 Cartons

- 5.3 By Geography

- 5.3.1 Europe

- 5.3.1.1 United Kingdom

- 5.3.1.2 Sweden

- 5.3.1.3 Germany

- 5.3.1.4 France

- 5.3.1.5 Rest of Europe

- 5.3.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Toyo Seikan Group Holdings Ltd

- 6.1.3 Graham Packaging Company

- 6.1.4 Ball Corporation

- 6.1.5 Owens-Illinois Inc.

- 6.1.6 Pacific Can China Holdings Limited

- 6.1.7 Crown Holdings Incorporated

- 6.1.8 CAN-PACK SA

- 6.1.9 CKS Packaging Inc.

- 6.1.10 Refresco Group NV

- 6.1.11 Tetra Pak Inc.

- 6.1.12 Ardagh Group SA