|

市場調查報告書

商品編碼

1627219

北美飲料包裝:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

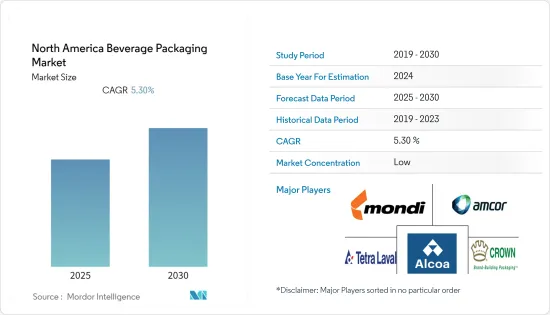

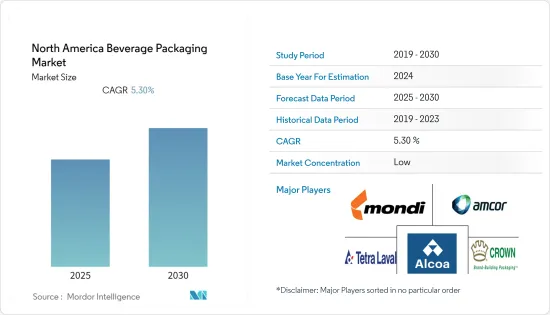

北美飲料包裝市場預計在預測期內複合年成長率為 5.3%

主要亮點

- 技術創新、永續性關注和有吸引力的經濟效益是過去二十年美國飲料包裝顯著成長的原因。消費者看待包裝和與包裝互動的方式正在改變。由於對永續性的日益關注,傳統的硬質包裝解決方案正在被創新且更永續性的軟包裝所取代。市場對客戶友善包裝和增強產品保護的需求不斷成長,預計將推動軟包裝成為可行且具成本效益的替代品。

- 由於碳酸飲料、能量飲料、果汁等的需求不斷成長, 寶特瓶和金屬罐已成為首選材料。另一方面,具有可回收特性的玻璃面臨著製造和回收成本增加的挑戰。最近,在飲料包裝的永續性趨勢方面,人們越來越偏好玻璃。

- 此外,由於塑膠可以降低製造成本、耐用性和物流成本,多年來一直是全球飲料製造商的首選包裝選擇,因此向永續包裝的過渡將有助於這些包裝製造商和裝瓶公司成為該地區的推動力。

- 例如,寶特瓶承諾到 2030 年將回收盡可能多的寶特瓶。為此,該公司與世界各地的非政府組織合作,協助改善館藏。此外,截至 2020 年 1 月,雀巢已承諾投入 21 億美元用於回收塑膠包裝的使用。

- 在供應商方面,我們看到金屬、玻璃和再生聚酯產能增加,以補充飲料製造商不斷成長的需求。例如,截至 2020 年 2 月,波爾公司計劃在 2021 年擴大美國金屬罐產量。該公司的特種飲料罐將在亞利桑那州和美國東北部開始營運,這符合其先前承諾的到2021年終新增至少80億罐產能的承諾。

北美飲料包裝市場趨勢

電子商務可望推動市場佔有率

- 電子商務將佔據很大的市場佔有率,因為許多公司尚未針對電子商務進行最佳化包裝,並且在將產品從物流中心運送到消費者手中時過度包裝很常見,預計會產生積極影響。由於貨物通常被分成單獨的包裹進行分發,零售鏈的這種複雜性會導致進一步的浪費、能源消耗和污染。

- 此外,飲料包裝還具有防水、輕質材料和更好的尺寸重量優勢等性能特點,使其對該地區的電子商務提供者俱有吸引力。

- 根據《商業內幕》報道,電子商務實際上正在推動零售業的成長,對飲料包裝的影響可能會在該地區產生。由於沃爾瑪、克羅格和艾伯森等老牌食品零售商的存在,美國零售業競爭激烈,推動了該國市場的成長。

- 此外,總部位於美國的沃爾瑪是世界上最大的零售公司和最大的參與者。世界十大零售公司中有五家位於美國,使美國成為主要的零售業。

- 此外,飲料包裝產品的需求通常是由該地區的千禧世代客戶所推動的。因為他們非常喜歡單份飲料和外帶飲料。這些產品通常設計為便攜、耐用且輕便,使得軟包裝成為包裝此類產品的熱門選擇。

酒精飲料佔據最大的市場佔有率

- 酒精飲料包括葡萄酒、啤酒和烈酒,有瓶子、小桶、紙盒和罐頭等包裝形式。就酒精飲料而言,隨著全球無氣泡葡萄酒的消費放緩,我們觀察到葡萄酒產業在包裝形式方面發生了重大轉變。這促使美國釀酒廠創新包裝以降低成本並吸引年輕消費者。

- 因此,便攜性和便利性已成為葡萄酒包裝創新的關鍵驅動力,Bota Box 和 Black Box 利用了利樂、盒中袋葡萄酒和紙箱等替代包裝。矽谷銀行《2020年葡萄酒產業狀況報告》顯示,2019年國產罐裝葡萄酒儘管僅佔總量的0.5%,但成長了80%。

- 此外,罐裝葡萄酒正在增加其他酒精飲料的單份選擇的足跡。在這裡,375ml 和 500ml 玻璃規格的罐小型化的經濟性保持不變。例如,100至200毫升的小瓶裝和罐裝啤酒佔全球整體啤酒量的90%。

- 另一方面,啤酒包裝多種多樣。包裝格式偏好因地區而異,當地法律、法規、偏好、文化和其他促進因素會影響包裝條件。

- 此外,多家包裝公司報告稱,由於新冠肺炎 (COVID-19) 疫情的爆發和美國各地酒精飲料需求的激增,導致庫存短缺。例如,在美國,由於新型冠狀病毒感染疾病COVID-19 導致現場關閉,生啤酒的銷售停止了。因此,精釀啤酒製造商轉而使用 32 盎司的罐裝啤酒,這種罐裝啤酒可以按需填充和密封,以便在桶裝啤酒氧化之前出售。這導致當前手工生產的包裝需求增加。在停工的情況下,包裝製造商自己也報告說,他們能夠在勞動力減少的情況下營運,從而帶來了供應主導的挑戰。

北美飲料包裝產業概況

北美飲料包裝市場競爭適中,主要企業很少,新參與企業也很少。公司不斷創新並結成策略夥伴關係以維持市場佔有率。

- 2021 年 4 月 - Amcor Ltd 宣布對 ePac 軟包裝進行策略性投資,ePac 是一家用於軟包裝的高品質短版數位印刷部門。該投資價值 1,000 萬美元至 1,500 萬美元,包括 ePac Holdings LLC 的少數股權以及一個或多個 ePac專利權場所的融資。

- 2020 年 11 月 - TransContinental 推出 30% 經消費後回收 (PCR) 驗證的收縮薄膜「Interglitite」。這種新型包裝薄膜在 Sam's 的部分地點有售,包括俄亥俄州、維吉尼亞、馬裡蘭州、西維吉尼亞、印第安納州、南卡羅來納州、北卡羅來納州、阿肯色州、田納西州、肯塔基州、密西西比州和德拉瓦,並應用於氣泡水的印刷包裝盒。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 市場範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 主要法規和環境考慮因素

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 電子商務產業的成長

- 市場限制因素

- 對塑膠的環境問題

第6章 市場細分

- 按材質

- 玻璃

- 塑膠

- 紙板

- 金屬

- 依產品類型

- 能

- 瓶子

- 小袋

- 紙盒

- 其他產品類型

- 按用途

- 碳酸飲料/果汁飲料

- 酒精飲料(啤酒、葡萄酒、烈酒)

- 瓶裝水

- 牛奶

- 能量和運動飲料

- 其他用途

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Amcor Limited

- Mondi Group

- Tetra Laval International SA

- Crown Holdings, Inc.

- Alcoa Inc.

- Berry Global Inc.

- Saint Gobain SA

- Reynolds Group Holdings Limited

- Rexam PLC

- Owens Illinois Inc.

- Graham Packaging Company

- Westrock Company

- Ball Corporation

第8章市場展望

簡介目錄

Product Code: 51479

The North America Beverage Packaging Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- Technological innovation, sustainability trepidations, and attractive economics are the reasons for the remarkable growth of beverage packaging in the last two decades in the United States. The way consumers view and interact with packages is altering. Due to the rising focus on sustainability, traditional rigid packaging solutions are being substituted by innovative, more sustainable, flexible packaging. The growing market demand for customer-friendly packages and heightened product protection is expected to boost flexible packaging as a viable and cost-effective substitute.

- The growing demand for carbonated drinks, energy drinks, and juices, among others, indicates rising PET bottles and metal cans as preferred materials for the same. On the other hand, with its recyclable properties, Glass has been challenged by increased costs of production and recycling. The preference for the same has been growing recently concerning sustainability trends across beverage packaging.

- Moreover, as plastic has been a long-standing and preferred packaging option by global beverage manufacturers, due to the reduced manufacturing, durability, and logistics costs, the transition towards sustainable packaging has driven these packaging manufacturers and bottling companies to pledge and commit usage of newer materials for the same in the region.

- For instance, Coca-Cola shared its commitment towards recycling as many plastic bottles as it uses by 2030. For the same, the company has been partnering with NGOs globally to help improve collection. Then, as of January 2020, Nestle committed USD 2.1 billion towards using recycled plastic packaging.

- On the vendor front, increased capacities across the metal, glass, and rPET have been observed to complement the increasing demand rising from beverage manufacturers. For instance, as of February 2020, Ball Corporation is expected to expand United States Metal Can to increase production by 2021. Its specialty beverage can would commence operations in Arizona and the northeastern US, in line with its previous commitment to add at least 8 billion units of capacity by the end of 2021.

North America Beverage Packaging Market Trends

E-commerce is Expected to Drive the Market Share

- The significant share contributed by e-commerce is expected to positively impact the market as many companies have not yet optimized packaging for e-commerce, and overpacking is common while shipping products from a distribution center to a consumer. Because shipments are usually broken down into individual packages for delivery, this causes additional wastage, energy consumption, and pollution due to the increasing complexity of this retail chain.

- Moreover, Beverage packaging offers performance features, such as waterproof and lightweight materials and better dimensional weight benefits, which are attractive to e-commerce providers in the region.

- As business insider reports, e-commerce is driving retail growth virtually, and its influence on beverage packaging may develop in the region. The retail industry in the US is highly competitive due to established food retailers such as Walmart, Kroger, and Albertsons, thereby driving the growth of the country's market.

- Moreover, based out of the United States, Walmart is the largest global retailer and the largest. Five of the top 10 largest retail companies globally are based out of the United States, making the country the primary retail industry.

- Also, the demand for beverage packaging products is generally driven by millennial customers in the region, as they have an ardent preference for single-serving and on-the-go beverages. These products are generally designed to be portable, durable, and lightweight; flexible packaging stands as a famous option to pack such products.

Alcoholic Beverages Accounts For the Largest Market Share

- The categorization of alcoholic beverages includes wine, beer, spirits, etc., being packaged using formats such as bottles, kegs, cartons, and cans, to name a few. When it comes to Alcoholic beverages, there has been a significant transitioning of the wine industry concerning packaging format has been observed, as the global consumption across still wine has been slowing down. This has led the Unites States-based wineries to drive packaging innovations to cut costs and appeal to younger consumers.

- Therefore, portability and convenience became significant drivers in wine packaging innovation, leading Bota Box and Black Box to leverage alternative packagings, such as tetra packs and bag-in-box wine and cartons. According to the State Of Wine Industry Report 2020 by Silicon Valley Bank, canned wine in the country has recorded an 80% growth in 2019, despite the 0.5% as an overall share.

- Moreover, Cans have been observed increasing footprints across other alcoholic single-serve options. Here, the economies of smaller sizes remain the same for cans for 375- and 500-milliliter glass formats. For instance, small-sized bottles and cans, such as 100-200 milliliters, hold 90% of beer volume globally.

- Beer's packaging, on the other hand, is highly diverse. The format packaging type preference has been driven by different regions where local laws, regulations, tastes, culture, and other drivers influence the packaging landscape.

- Further, with the COVID-19 outbreak and an upsurge in demand for alcoholic beverages across the United States, multiple packagers have reported running on low stocks. For instance, the draft beer sales stopped flowing in the United States due to on-premise shutdowns caused by efforts in the wake of novel coronavirus disease COVID-19. Therefore, allied craft brewers turned to 32 oz. Cans filled and sealed on demand to sell out leftover beer in kegs before oxidization. This has led to an increased demand for packaging towards current production in hand. Amidst the lockdown scenarios, packaging manufacturers have themselves reported operability with a reduced workforce, creating a supply-driven challenge.

North America Beverage Packaging Industry Overview

The North America Beverage Packaging Market is moderately competitive with few dominant and few new entrants. The companies keep on innovating and entering into strategic partnerships to retain their market share.

- April 2021 - Amcor Ltd is pleased to announce a strategic investment in ePac Flexible Packaging, a high-quality, short-run length digital printing segment for flexible packaging. The investment will range between USD 10 to USD 15 million, including a minority ownership interest in ePac Holdings LLC and funding for one or more ePac franchise sites.

- November 2020 - Transcontinental Inc. launched the Intergritite, a 30% post-consumer recycled (PCR) collation shrink film. The new packaging film is applicable for Sparkling Water printed case wrap appearing on select Sam's and BJ's Club Store shelves in countries like Ohio, Virginia, Maryland, West Virginia, Indiana, South Carolina, North Carolina, Arkansas, Tennessee, Kentucky, Mississippi, and Delaware.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Competitive Rivalry within the Industry

- 4.3 Key Regulations and Environmental considerations

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Covid-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing e-commerce industry

- 5.2 Market Restraints

- 5.2.1 Environmental concerns against plastic

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.1.3 Paperboard

- 6.1.4 Metal

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.2 Bottles

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Other Product Types

- 6.3 By Application Type

- 6.3.1 Carbonated Soft Drinks & Fruit Beverages

- 6.3.2 Alcoholic (Beer, Wine & Distilled Spirits)

- 6.3.3 Bottled Water

- 6.3.4 Milk

- 6.3.5 Energy & Sport Drinks

- 6.3.6 Other Applications

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Mondi Group

- 7.1.3 Tetra Laval International S.A.

- 7.1.4 Crown Holdings, Inc.

- 7.1.5 Alcoa Inc.

- 7.1.6 Berry Global Inc.

- 7.1.7 Saint Gobain S.A.

- 7.1.8 Reynolds Group Holdings Limited

- 7.1.9 Rexam PLC

- 7.1.10 Owens Illinois Inc.

- 7.1.11 Graham Packaging Company

- 7.1.12 Westrock Company

- 7.1.13 Ball Corporation

8 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219