|

市場調查報告書

商品編碼

1628839

美國飲料包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)US Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

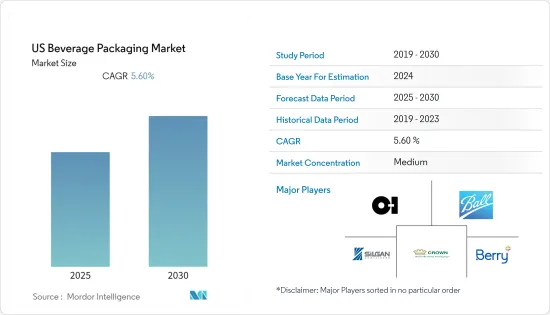

美國飲料包裝市場預計在預測期內複合年成長率為 5.6%

主要亮點

- 由於碳酸飲料、能量飲料、果汁等的需求不斷成長, 寶特瓶和金屬罐是首選材料。另一方面,具有可回收特性的玻璃面臨著生產和回收成本增加的挑戰。最近,飲料包裝的永續性趨勢越來越青睞玻璃。

- 此外,由於塑膠因其降低的製造、耐用性和物流成本而長期以來一直是全球飲料製造商的首選包裝選擇,因此向永續包裝的過渡將鼓勵這些包裝製造商和裝瓶公司做出承諾和承諾。到使用更新的資料。

- 我們宣布,美國飲料協會是該地區多家軟性飲料製造商共同投資 1 億美元以促進美國寶特瓶回收並減少該行業對原生塑膠的使用。多個地區和國家的類似趨勢表明,裝瓶商和包裝製造商正被迫改變其產品開發策略。

- 例如,截至 2020 年 2 月,波爾公司計劃在 2021 年擴大其美國金屬罐產量。該公司的特種飲料罐計劃在亞利桑那州和美國東北部開始營運,這符合該公司先前承諾的到2021年終新增至少80億罐產能的承諾。

- 由於 COVID-19 對回收的影響,我們看到多家廢棄物處理公司暫停或減少了回收和收集流程。在美國,廢棄物管理部門已暫停一些資源回收設施 (MRF) 的運作。

美國飲料包裝市場趨勢

酒精飲料佔據很大的市場佔有率

酒精飲料類別包括葡萄酒、啤酒、烈酒等,包裝形式有瓶子、桶子、紙盒、罐子等。

- 就酒精飲料而言,隨著全球無氣泡葡萄酒消費放緩,葡萄酒產業在包裝形式方面發生了重大轉變。因此,美國釀酒廠正在推動包裝創新,以降低成本並吸引年輕消費者。

- 另一方面,啤酒包裝多種多樣,包裝形式因地區而異,受到當地法律法規、偏好、文化等因素的影響。

- 在美國,由於新型冠狀病毒感染疾病 ( COVID-19) 導致現場關閉,生啤酒銷售已停止。因此,精釀啤酒製造商轉而採用可按需填充和密封的 32 盎司罐裝啤酒,以便在桶裝啤酒氧化之前將其出售。這導致當前手工生產對包裝的需求增加。在封鎖的情況下,包裝製造商本身也報告說,他們的營運人員減少了,從而帶來了供應主導的挑戰。

- 包裝材料、較小尺寸和永續性的變化都對包裝發展的變化做出了重大貢獻。烈酒罐頭和盒子仍在開發中,因為新形式的酒精飲料面臨消費者接受度、保存期限限制以及缺乏罐頭製造合作夥伴等挑戰。

- 在創造碳足跡方面,二氧化碳的最大貢獻是小瓶的生產和運輸,因此酒精公司採用環保的生產方法。事實上,供應鏈的這兩個要素佔葡萄酒產品碳足跡的 51% 至 68%。

金屬包裝在飲料中的高需求

與餐廳相比,家庭消費飲料和食品的需求正在增加。許多知名市場相關人員已宣布投資建立新的製造基礎設施,以滿足不斷成長的需求。

- 金屬包裝的最大優點之一是其高度可回收。金屬包裝可以在其生命週期結束時進行回收,而不會劣化其質量,這就是為什麼金屬包裝領先於塑膠和瓶子等其他材料,成為各個飲料公司品牌的首選包裝類型。罐頭中使用的鋁幾乎 100% 都可以熔化並再次使用。

- 此外,美國正在建造幾座新的鋁罐製造設施,以滿足國家的各種飲料需求。例如,2021年9月,罐頭製造商Canpack開始在印第安納州東部建造一座新的鋁罐工廠,預計每年生產約36億罐。 Canpac是波蘭Giorgi Global的子公司,該工廠預計長期僱用約340名員工。

- 華盛頓州鋁業協會表示,回收流中的塑膠污染主要是由於塑膠標籤、收縮套管和類似產品的使用增加所造成的,這可能會給回收商帶來營運甚至安全問題。 2020年9月,鋁協會發布了《鋁容器設計指南》,以進一步應對這些挑戰並向飲料公司推薦解決方案。解決這些問題的解決方案以及替代塑膠和玻璃的案例正在推動市場對鋁罐的需求。

- 此外,美國生產的鋁罐平均含有約 73% 的回收成分,而玻璃瓶的回收成分為 23%,塑膠瓶的回收成分不到 6%。此外,鋁罐廢料比玻璃或塑膠更有利可圖,這使得鋁罐成為美國回收系統財務可行性的重要驅動力。

- 然而,隨著人們越來越意識到塑膠對環境的影響,越來越多的人選擇罐裝飲料而不是寶特瓶。此外,美國啤酒公司百威啤酒已開始包裝 Icon,以展示其對永續性的承諾。百威啤酒包裝上新的 100%可再生能源標誌是該品牌向消費者傳達其啤酒是由可再生能源動力來源的啤酒廠生產的方式。

美國飲料包裝產業概況

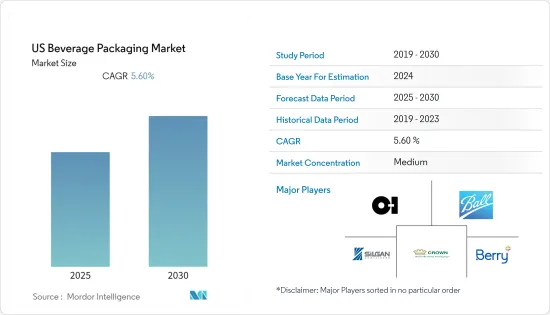

美國飲料包裝市場是細分的,包括 Owens-Illinois Inc.、Ball Corporation、Cronw Holdings Inc.、Berry Global Inc. 和 Sonoco Products Compnay 等主要企業。這些公司在美國投資研發以開發新的包裝產品。

- 2021 年 3 月 - Owens-illinois Inc. 宣布擴張安第斯市場,為玻璃包裝的永續市場提供服務。該公司已投資約 7,500 萬美元擴建其位於哥倫比亞的Zipaquira 工廠。該計劃預計於 2022年終完工後,將使該公司美洲部門的產能增加約 2%,每年生產約 5 億瓶。

- 2021 年 9 月 - 波爾公司宣布計劃在內華達州北拉斯維加斯建造一座新的美國鋁製飲料包裝工廠。該多線工廠計劃於 2022 年下半年開始生產,全面運作後預計將創造近 180 個製造業就業機會。

- 2021 年 10 月 - Crown Holdings, Inc. 宣布與 Velox Ltd. 建立合作關係。 Crown 和 Velox 正在結合各自的專業知識,為希望擴大產品範圍的知名品牌和希望利用完全可回收飲料罐 Cut it open 優勢的小型生產商帶來新的可能性。該技術和解決方案是市場首創,運行速度比現有數位解決方案快五倍以上,創造了更多的品牌設計選擇。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 市場限制因素

第6章 市場細分

- 按材質

- 塑膠

- 金屬

- 玻璃

- 紙板

- 依產品類型

- 瓶子

- 能

- 小袋

- 紙盒

- 啤酒桶

- 按用途

- 酒精飲料

- 牛奶

- 能量飲料

- 其他

第7章 競爭格局

- 公司簡介

- Owens-illinois Inc.

- Ball Corporation

- Crown Holdings Inc.

- Silgan Containers Inc.

- Berry Global Inc.

- Sonoco Products Company

- CCL Containers Inc

- Ardagh Group

- Amcor Limited

- Berlin Packaging

- Westrock

第8章投資分析

第9章市場的未來

The US Beverage Packaging Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- The growing demand for carbonated drinks, energy drinks, and juices, among others, is indicative of rising PET bottles and metal cans as preferred materials for the same. Glass, on the other hand, with its recyclable properties, has been challenged by increased costs of production and recycling. The preference for the same has been growing recently concerning sustainability trends across beverage packaging.

- Moreover, as plastic has been a long-standing and preferred packaging option by global beverage manufacturers, due to the reduced manufacturing, durability, and logistics costs, the transition towards sustainable packaging has driven these packaging manufacturers and bottling companies to pledge and commit usage of newer materials for the same.

- The American Beverage Association, amongst multiple soft drink producers in the region, announced a USD 100 million joint investment to drive PET bottle recycling in the United States and reduce the industry's use of virgin plastic. Similar trends across multiple regions and countries have been suggestive of a landscape influencing bottlers and packaging manufacturers to pivot product development strategies.

- For instance, as of February 2020, Ball Corporation is expected to expand the United States Metal Can production by 2021. Its specialty beverage can would commence operations in Arizona and the northeastern US, in line with the company's previous commitment to add at least 8 billion units of capacity by the end of 2021.

- Due to COVID-19 impact on the recycling front, multiple waste companies have been observed to have stopped or reduced recycling and collection processes. In the United States, Waste Management suspended operations at some of its materials recovery facilities (MRFs).

US Beverage Packaging Market Trends

Alcohol Beverages to hold significant market share

The categorization of alcoholic beverages includes wine, beer, spirits, etc., being packaged using formats such as bottles, kegs, cartons, and cans, to name a few.

- When it comes to Alcoholic beverages, there has been a significant transitioning of the wine industry concerning packaging format has been observed, as the global consumption across still wine has been slowing down. This has led the Unites States-based wineries to drive packaging innovations to cut costs and appeal to younger consumers.

- On the other hand, Beer's packaging is highly diverse; the formats packaging type preference has been driven by different regions where local laws, regulations, tastes, culture, and other drivers influence the packaging landscape.

- The draft beer sales stopped flowing in the United States due to on-premise shutdowns caused by efforts in the wake of novel coronavirus disease COVID-19. Therefore, allied craft brewers turned to 32 oz. Cans filled and sealed on demand to sell out leftover beer in kegs before oxidization. This has led to an increased demand for packaging towards current production in hand. Amidst the lockdown scenarios, packaging manufacturers have themselves reported operability with a reduced workforce, creating a supply-driven challenge.

- Changes in packaging materials, smaller sizes, and sustainability have all contributed significantly to changes in packaging development. Canned and boxed spirits are still in development as new forms of alcoholic beverages face challenges such as consumer acceptance, shelf life constraints, and lack of canning partners.

- Alcohol companies are adopting green production methods as when it comes to carbon footprint creation, the largest contribution of CO2 actually comes from the production and transportation of vials. In fact, these two components of the supply chain can account for 51% to 68% of a wine product's carbon footprint.

Metal Packaging holds high demand in beverages

Beverages demand home consumption, and grocery is increased compared to restaurants. Many prominent market players have announced investments to set up new manufacturing infrastructures to fulfill the increased demand.

- One of the biggest benefits of metal packaging is that they are highly recyclable. Metal packaging can be recycled at the end of their lifecycle without its quality degradation, and which makes metal packaging the preferred packaging type for brands across various beverage companies, ahead of other materials, such as plastic and bottle. Nearly 100% of the aluminum used in the cans can be melted down and used again.

- Further, the United States is witnessing several new aluminum can production facilities catering to various beverage needs in the country. For instance, in September 2021, Canpack, a can manufacturer, began constructing a new aluminum can factory in eastern Indiana and is expected to produce approximately 3.6 billion cans per year. The Canpack is a subsidiary of the Polish company Giorgi Global and the factory is expected to employ approximately 340 people in the long run.

- The Aluminum Association, Washington stated that plastic contamination in the recycling stream is driven mainly by increased use of plastic labels, shrink sleeves, and similar products, which can cause operational and even safety issues for recyclers. In September 2020, the Aluminum Association released an aluminum container design guide to further address some of these challenges and recommend solutions to beverage companies. Such solutions to address the challenges and instances of replacing plastic and glass drive the demand for aluminum cans in the market.

- Further, the average aluminum can produced in the United States contains approximately 73% recycled content, compared to 23% for glass bottles and less than 6% for plastic. Furthermore, aluminum can scrap more beneficial than glass or plastic, making aluminum a vital driver of the financial viability of the United States' recycling system.

- However, as people become more aware of the environmental impact of plastic, they are increasingly opting to buy beverages in cans rather than bottles. Additionally, Budweiser -an American beer company, started packaging icons to showcase its commitment to sustainability. The new 100% Renewable Energy logo on Budweiser packaging is a way for the brand to tell consumers the beer is made in breweries powered by renewable energy.

US Beverage Packaging Industry Overview

The United States Beverage Packaging Market is fragmented with the presence of key players such as Owens-Illinois Inc, Ball Corporation, Cronw Holdings Inc, Berry Global Inc., and Sonoco Products Compnay. These players are investing in R&D for new product innovations of packaging in the United States.

- March 2021 - Owens-illinois Inc announced an expansion in Andean Market to serve a sustainable market in glass packaging. The company invested approximately USD 75 million in an expansion at its Zipaquira, Colombia facility. Upon completion by the end of 2022, the project is expected to add nearly 2 percent of capacity to the company's Americas segment and produce about 500 million bottles annually.

- September 2021 - Ball Corporation announced plans to build a new U.S. aluminum beverage packaging plant in North Las Vegas, Nevada. The multi-line plant is scheduled to begin production in late 2022 and is expected to create nearly 180 manufacturing jobs when fully operational.

- October 2021 - Crown Holdings, Inc. announced a collaboration with Velox Ltd. Crown and Velox brought together their expertise to unlock new possibilities for major brands wishing to increase product offerings, as well as smaller producers are taking advantage of the benefits of fully recyclable beverage cans. The technology and solution deliver market firsts and create greater brand design options with running speeds over five times faster than existing digital solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Beer kegs

- 6.3 By Application

- 6.3.1 Alcoholic Beverages

- 6.3.2 Milk

- 6.3.3 Energy Drinks

- 6.3.4 Other applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens-illinois Inc.

- 7.1.2 Ball Corporation

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Containers Inc.

- 7.1.5 Berry Global Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 CCL Containers Inc

- 7.1.8 Ardagh Group

- 7.1.9 Amcor Limited

- 7.1.10 Berlin Packaging

- 7.1.11 Westrock