|

市場調查報告書

商品編碼

1639500

歐洲塑膠包裝:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

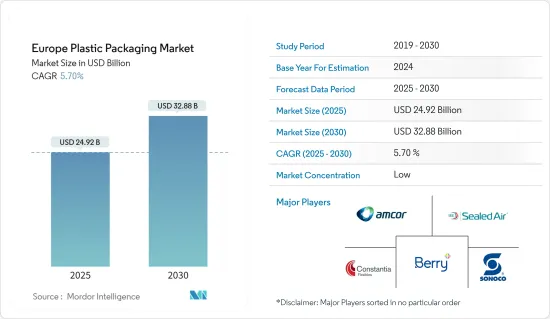

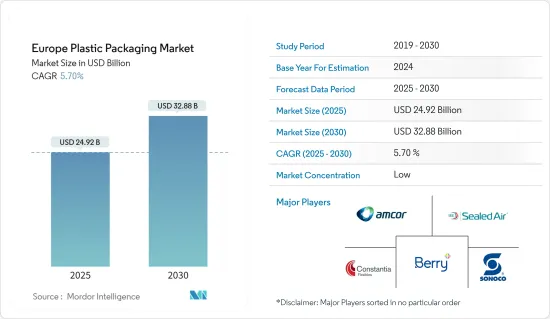

歐洲塑膠包裝市場規模預計到2025年為249.2億美元,預計2030年將達到328.8億美元,預測期內(2025-2030年)複合年成長率為5.7%。

技術進步和最終用戶產業不斷增加的包裝應用是推動所研究的市場成長的關鍵因素。

主要亮點

- 在大多數歐洲國家,人口不斷成長,人均包裝材料使用量不斷增加。這是由於消費行為趨勢的影響,例如便利產品的使用增加以及塑膠作為其他包裝材料的替代品的使用增加。

- 推動這個市場的因素有很多,這些因素對短期、中期和長期都有不同的影響。其中包括對加工食品的需求持續成長以及輕質和軟質食品的採用。此外,客戶對當地生產的產品品質的讚賞正在增加對冷凍食品包裝的需求。由於經濟擴張和生活方式的改變,歐洲對冷凍食品包裝的需求不斷成長,預計未來幾年該市場將出現盈利成長。

- 儘管人們對塑膠包裝對環境的影響表示嚴重擔憂,但歐洲對塑膠包裝的需求仍在持續成長。然而,由於歐洲政府法規和不斷成長的消費者需求,促使製造商尋找生物分解性或源自永續來源的塑膠包裝解決方案,市場也面臨挑戰。

- 預計市場將面臨重大挑戰,主要是由於環境問題日益嚴重而導致監管標準動態變化。該地區各國政府正在透過訂定法規來最大程度地減少環境廢棄物並改善廢棄物管理流程,以回應公眾對塑膠包裝廢棄物(尤其是塑膠包裝廢棄物)的擔憂。

- 歐洲塑膠加工商協會 (EuPC) 由 50,000 家中小企業組成,目前正在努力減輕冠狀病毒危機的影響。產業和當局全力致力於危機管理,暫停所有非必要活動,以關注歐洲公民的健康和安全。

歐洲塑膠包裝市場趨勢

軟包裝快速成長

- 歐洲各地對包裝食品和非食品產品的需求不斷增加,零售業也不斷擴張。預計這將對軟包裝解決方案產生獨特的需求,並顯著加速塑膠包裝市場的成長。

- 軟包裝透過延長保存期限和採用可透過軟包裝實現的冷凍食品等新產品來提高產品的永續性。疫情爆發之初,食品產量出現了前所未有的激增,一些快速消費品 (FMCG) 製造商重新調整了生產線的用途。

- 各個供應商都致力於加強其在軟包裝領域的地位,擴大其永續解決方案組合併擴大其區域影響力。 2022 年 5 月,英國支持軟質塑膠包裝回收和再循環的最重要合作計劃之一 FlexCollect 開始支持英國研究與創新 (UKRI)。 FlexCollect 也幫助組織了解如何將軟質塑膠包裝納入不同地區和人口的現有家庭收集服務中,以最大限度地收集和回收。

- 2022 年 3 月,英國研究與創新 (UKRI) 的智慧永續塑膠包裝 (SSPP) 挑戰賽將支持英國塑膠公約的實施,並確定 18 個有潛力改變英國與塑膠的關係和管理的想法包裝宣佈為聯合計劃提供 3000 萬英鎊(3900 萬美元)的資金。 SSPP 挑戰是政府在永續塑膠包裝和廢棄物管理方面最大的投資之一。經過兩次資金籌措競賽,5個大型示範計劃和13個公司主導的研發計劃受益於此支持。

- 此外,隨著德國解決方案供應商和各種最終用戶的許多改進,軟質塑膠包裝解決方案擴大被採用。客戶對德國製造產品的典型認知為該地區的軟包裝業務提供了理想的績效環境。德國政府對該國塑膠包裝產業制定了一些嚴格的法律。德國包裝方法要求使用可回收和可再生材料,並在包裝設計時考慮到回收和可再生潛力。到2022年,政府希望將塑膠包裝的回收率從2018年的40%提高到63%。預計此類行動將在預期期限內對目標市場產生重大影響。

飲料業務預計將大幅成長

- 飲料產業在歐洲發揮重要作用。推動該地區飲料產業成長的關鍵因素包括人口、人均收入的穩定成長和生活方式的改變。此外,可支配收入高、交通便利、生活水準不斷提高、產品種類多樣化以及市場上本地和國際參與企業的存在等因素正在支撐該地區的飲料行業。

- 許多歐洲知名品牌都提供一系列帶有水果和甜味的非酒精飲料,這些飲料已成為他們最受歡迎的產品。此外,EMA還推出了舉措,鼓勵製造商減少食品和飲料產品中的鹽、糖和脂肪含量。已宣布將遵守的公司包括瑪氏和雀巢。

- 此外,如果放鬆酒精消費限制,酒精消費量將會上升,預計歐洲人將優先考慮店外消費而不是店內消費。在有執照的場所外消費酒精有利於軟包裝產業的擴張。在受調查的行業中,單份袋裝酒精飲料只是越來越受歡迎的產品之一。

- 地區飲料公司三得利 (Suntory) 承諾在 2030 年之前從其包裝產品組合中消除原生塑膠,例如源自石化燃料的塑膠。其他行業參與企業的此類努力可能會限制預測期內的市場成長。

- 此外,公司正在投資擴大飲料生產能力。例如,2022 年 5 月,歐洲有機和植物來源替代品專家 Ecotone 宣布投資 2,000 萬歐元(2,150 萬美元),在義大利北部巴迪亞波萊西內建立植物來源飲料生產基地。這項重大投資促成了新生產線的建立,並使該公司成為歐洲領先的植物來源飲料主要企業之一。新工廠和生產線將使這家跨國食品公司每年額外生產 2,700 萬公升植物飲料,產能提高 30%。

- 根據非酒精飲料經濟協會的估計,到 2022 年,德國人平均消耗能量礦物質飲料 6.6 公升,而前一年為 6.4 公升。為了適應產品數量的增加,由於礦物質和能量飲料的消費量增加,對包裝材料的需求可能會更大。這可能會增加對塑膠瓶、瓶蓋和其他包裝元件的需求,尤其是這些飲料。

歐洲塑膠包裝產業概況

由於多個參與企業的存在,歐洲塑膠包裝市場被分割。主要企業正在採取產品創新、併購和業務擴張等策略,以保持在該地區的競爭力。該市場的主要參與企業包括 Amcor PLC、Sealed Air Corporation 和 Berry Global Inc.。

- 2024 年 1 月 - Berry Global Group, Inc. 展示了 PVC 保鮮膜的高性能替代品。該公司表示,這種新型薄膜是自有品牌製造商難以回收的 PVC 薄膜的「高品質」替代解決方案,具有易用性和透明度,同時減輕包裝重量,以提高產量比率並減輕包裝重量。保護和最大的商店吸引力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 更多採用輕質包裝

- 護膚領域需求旺盛

- 市場限制因素

- 原物料價格上漲

第6章:歐洲貿易分析與供應鏈現狀

第7章 市場區隔

- 類型

- 硬質塑膠包裝

- 軟質塑膠包裝

- 材料類型

- PE(聚乙烯)

- PP(聚丙烯)

- PVC(聚氯乙烯)

- PET(聚對苯二甲酸乙二醇酯)

- 其他材料類型

- 最終用戶產業

- 食物

- 醫療和藥品(包括非處方藥)

- 飲料

- 化妝品/個人護理

- 其他

- 國家名稱

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 波蘭

- 歐洲其他地區

第8章 競爭格局

- 公司簡介

- Amcor PLC

- Coveris Holdings

- Sealed Air Corporation

- Berry Global Inc.

- Constantia Flexibles GmbH

- Sonoco Products Company

- Berry Global Inc.

- Huhtamaki Group

- Albea SA

- Quadpack Industries SA

第9章投資分析

第10章投資分析市場的未來

The Europe Plastic Packaging Market size is estimated at USD 24.92 billion in 2025, and is expected to reach USD 32.88 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

The increasing technological advancements and end-user industry packaging applications are the significant factors driving the market growth studied.

Key Highlights

- In most European countries, the population is growing, and the use of packaging per person is increasing. It is due to consumer behavior trends, such as the growth in the use of convenience products and the increasing use of plastic as a substitute for other packaging materials.

- The market is driven by several reasons, with different effects over the short, medium, and long-term periods. These causes include a consistent increase in the demand for processed foods and the adoption of lightweight flexibles. Additionally, there is a rise in demand for frozen food packaging due to customer appreciation of the quality of local products. The need for frozen food packaging has expanded in Europe due to the expansion of the economy and shifting lifestyles, and the market is anticipated to grow profitably over the next years.

- The demand for plastic packaging continues to rise in Europe even though serious concerns are being raised about its impact on the environment. However, the market also faces challenges due to the government regulations in Europe and increasing consumer demand that pushes manufacturers to look for plastic packaging solutions that are biodegradable or derived from sustainable sources.

- The market is expected to face significant challenges due to dynamic changes in regulatory standards, mainly due to growing environmental concerns. The region's government has responded to public concern about plastic packaging waste, especially plastic packaging waste, by introducing regulations to minimize environmental waste and improve waste management processes.

- The European Plastics Converters (EuPC) is composed of 50,000 SMEs, and it is currently working to mitigate the effects of the coronavirus crisis. Industries and authorities are directing their full attention to the management of the crisis, and they have put on hold all inessential activities to concentrate on the health and safety of the European citizens.

Europe Plastic Packaging Market Trends

Flexible Packaging to Grow Significantly

- The retail industry is expanding due to rising demand for packaged food and non-food items across Europe. It creates a one-of-a-kind demand for flexible packaging solutions, which is expected to accelerate the growth of the plastic packaging market significantly.

- Flexible packaging increases product sustainability by increasing shelf life and enabling the introduction of new products, such as frozen food, which can realize through flexible packaging. Food production experienced an unprecedented surge at the pandemic's start, while some fast-moving consumer goods (FMCG) manufacturers repurposed production lines.

- Various vendors have been focusing on strengthening their position in flexible packaging, broadening their portfolio of sustainable solutions, and expanding their regional reach. In May 2022, FlexCollect, one of the most significant collaborative projects to support the collection and recycling of flexible plastic packaging in the United Kingdom, launched UK Research and Innovation (UKRI) support. FlexCollect would also help organizations understand how to incorporate flexible plastic packaging into existing household collection services across various geographies and demographics to maximize recovery and recycling.

- In March 2022, UK Research and Innovation's (UKRI) Smart Sustainable Plastic Packaging (SSPP) Challenge announced GBP 30 million (USD 39 million) in funding for 18 collaborative projects that support the achievement of the UK Plastics Pact and have the potential to alter the UK's relationship with and management of, plastic packaging. The SSPP Challenge represents one of the largest government investments in sustainable plastic packaging and waste management. The results of the two funding competitions witness 5 large-scale demonstrator projects, and 13 business-led research and development projects benefit from this backing.

- Further, due to many improvements in Germany by solution providers and various end users, flexible plastic packaging solutions are increasingly being adopted. The usual customer view of "Made in Germany" products has given the area's local, flexible packaging businesses an ideal performance environment. The German government has enacted several strict laws for the country's plastic packaging sector. The German package Law mandates using recyclable and renewable materials and package design for recycling and recyclability. By 2022, the government wanted to recycle 63 percent more plastic packaging than in 2018, up from 40 percent. Such actions are anticipated to significantly influence the target market in the expected time frame.

Beverage Segment is Expected to Witness Significant Growth

- The beverage industry plays an essential role in the European region. The primary factors driving the region's growth in the beverage industry include steadily increasing population, per capita income, and changing lifestyles. Furthermore, factors such as high disposable income, ease of availability, improved living standards, a diverse product offering, and the presence of domestic and international players in the market fuel the beverage industry in the region.

- Many of the leading brands in Europe have a variety of fruit and sweet-flavored non-alcoholic beverages, and these are the most popular products. Besides, the EMA has introduced an initiative encouraging manufacturers to cut salt, sugar, and fat content in food and beverages. Companies that have pledged to follow this include Mars and Nestle.

- Furthermore, it is anticipated that Europeans would prioritize off-premise consumption over on-premise consumption when alcohol consumption rises steadily once the lockdown limitations are relaxed. Alcohol consumption outside licensed establishments is beneficial for expanding the flexible packaging industry. In the industry under study, alcoholic beverages sold in single-serve pouches are only a few significant examples of products becoming increasingly popular.

- Suntory, the beverage company in the region, has pledged to eliminate virgin plastics, such as fossil-fuel-based plastics, from its packaging portfolio by 2030. Such initiatives from other industry players may limit the market's growth during the forecast period.

- Moreover, the companies are investing in beverage manufacturing capacity expansion. For instance, in May 2022, Ecotone, a specialized player in organic and plant-based alternatives in Europe, announced a EUR 20 million (USD 21.5 million) investment in its plant-based beverage production site in Badia Polesine, Northern Italy. The significant investment has enabled the creation of a new production line, making it one of the key players in European plant-based drinks producers. This new site and production line will allow the multinational food company to produce an additional 27 million liters of plant-based beverages per year, a 30 percent increase in production capacity.

- The Economic Association of Non-Alcoholic Beverages estimates that the typical German used 6.6 liters of energy and mineral drinks in 2022 and 6.4 liters in the previous year. To accommodate the rising number of goods, there will likely be a more significant demand for packaging materials as mineral and energy drink consumption rise. This may increase the need for plastic bottles, caps, and other packaging elements, especially for these drinks.

Europe Plastic Packaging Industry Overview

The Europe Plastic Packaging Market is fragmented, owing to multiple players in the market. The major players are adopting strategies like product innovation, mergers and acquisitions, and expansion to stay competitive in the region. Some of the major players in the market are Amcor PLC, Sealed Air Corporation, and Berry Global Inc., among others.

- January 2024 -Berry Global Group, Inc. showcased high-performance alternatives to PVC cling films. According to the packaging giant, the new film represents a 'high-quality' alternative solution to hard-to-recycle PVC films for private label manufacturers, offering usability and clarity while lowering packaging weights for improved yields and delivering adequate product protection and maximum on-shelf appeal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 High Demand from the Skin Care Segment

- 5.2 Market Restraints

- 5.2.1 High Price of Raw Material

6 Trade Analysis and Current Supply Chain Scenario in Europe

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Rigid Plastic Packaging

- 7.1.2 Flexible Plastic Packaging

- 7.2 Material Type

- 7.2.1 PE (Polyethylene)

- 7.2.2 PP (Polypropylene)

- 7.2.3 PVC (Polyvinyl Chloride)

- 7.2.4 PET (Polyethylene Terephthalate)

- 7.2.5 Other Material Types

- 7.3 End-user Industry

- 7.3.1 Food

- 7.3.2 Healthcare and Pharmaceutical (includes OTC)

- 7.3.3 Beverage

- 7.3.4 Cosmetics and Personal Care

- 7.3.5 Other End-user Industries

- 7.4 Country

- 7.4.1 United Kingdom

- 7.4.2 Germany

- 7.4.3 France

- 7.4.4 Spain

- 7.4.5 Italy

- 7.4.6 Poland

- 7.4.7 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 Coveris Holdings

- 8.1.3 Sealed Air Corporation

- 8.1.4 Berry Global Inc.

- 8.1.5 Constantia Flexibles GmbH

- 8.1.6 Sonoco Products Company

- 8.1.7 Berry Global Inc.

- 8.1.8 Huhtamaki Group

- 8.1.9 Albea SA

- 8.1.10 Quadpack Industries SA