|

市場調查報告書

商品編碼

1636446

歐洲電動車電池隔膜:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

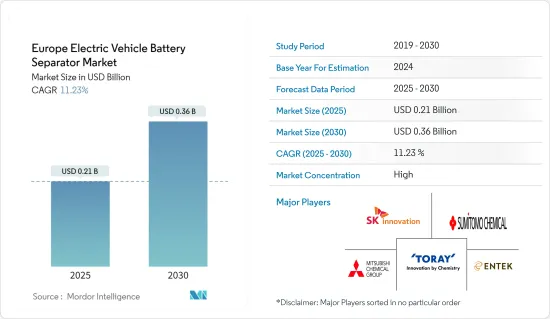

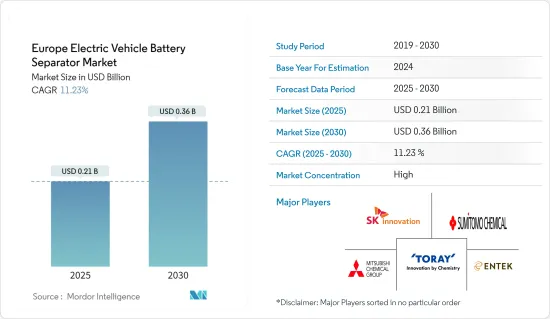

預計2025年歐洲電動車電池隔膜市場規模為2.1億美元,2030年將達3.6億美元,預測期內(2025-2030年)複合年成長率為11.23%。

主要亮點

- 電動車的普及和鋰離子電池價格的下降預計將在中期推動市場發展。

- 相反,歐洲電池產業正遭受原物料成本上漲的影響。尤其是隔膜製造所必需的聚乙烯(PE)和聚丙烯(PP)等關鍵材料的價格大幅上漲。這種趨勢對市場擴張提出了潛在的挑戰。

- 然而,固態電池、先進鋰離子電池和鈉離子電池等替代電池化學材料的研究和開發正在蓬勃發展,為未來的市場成長帶來了廣闊的前景。

- 德國可能在預測期內的市場擴張中發揮關鍵作用,柏林、漢堡和慕尼黑等城市引領需求激增。

歐洲電動車電池隔膜市場趨勢

鋰離子電池領域可望主導市場

- 近年來,歐洲鋰離子電池市場出現了顯著的快速成長。由於有前景的投資,特別是公共基礎設施和公共交通等公私合營計劃,該國的鋰離子電池銷售顯著增強。

- 除了非洲大陸擴大採用電動車之外,電池隔膜也受益於旨在遏制碳排放的各種政府舉措。這些舉措是成長的催化劑。此外,聚烯和陶瓷氧化物增強型鋰離子電池的推出,以其穩定性、安全性、減少收縮和顆粒侵入的能力而聞名,正在為市場帶來進一步的動力。

- 汽車的混合動力化和電氣化正在全球範圍內取得進展。這包括混合動力汽車(HEV)、插電式混合動力汽車和全電動汽車 (EV)。主導《巴黎協定》的歐洲積極推動內燃機汽車向電動車轉型,並在此過程中實現了顯著成長。

- 根據《2023 年歐洲運輸與環境報告》,到 2030 年,英國鋰礦開採能力預計將達到 7,000 噸。此外,2023年11月,英國政府宣布了一項25億美元的先進製造計畫。該計劃包括一項由政府資助約 5,400 萬美元的新電池策略,旨在 2030 年培育具有競爭力的電池供應鏈。該計劃旨在隨著汽車製造商轉向本地電池生產並轉向純電動車(BEV),增強供應鏈的彈性。電池策略擴大了對零排放汽車、電池及其供應鏈的重點支持,在截至 2030 年的五年內提供專門資本和研發資金。

- 2023 年,全球隔膜製造領導者 Alteo 與 W Scope 簽署協議,建立歐洲最大的隔膜製造廠。該合資企業對於培育法國和歐洲價值鏈至關重要,特別是考慮到多個超級工廠計劃。特別值得注意的是,該工廠將是歐洲唯一完全依賴電能運作的工廠,生產的隔膜將由 SEPal 的高性能氧化鋁製成。

- 基於這些發展,鋰離子電池領域預計將在未來幾年引領歐洲電動車電池隔膜市場。

德國可望主導市場

- 德國是領先的電動車(EV)中心,政府正在積極推動電動車的採用以減少排放。德國擁有世界上最好的充電基礎設施之一,引領歐洲成為最大的電動車市場。與全球趨勢類似,由於向永續交通途徑的轉變,德國對電動車的需求正在迅速成長,這推動了電池隔離膜市場的發展。

- 隨著消費者和企業擴大採用電動車,對電池隔膜的需求也迅速增加。這一勢頭的推動因素包括環境問題、政府支持電動車採用的獎勵以及電池技術的突破性進步,這些技術使電動車變得更容易獲得和實用。

- 到2023年,德國插電式混合動力車銷量將超過18萬輛。展望未來,德國的目標是到 2030 年擁有 1500 萬輛電動車。這項宏偉目標的核心是政府的支持政策和獎勵。例如,在德國,政府和電動車製造商各自為售價高達 60,000 歐元的電動車提供 2,000 歐元,總合4,000 歐元。此外,電動車可免徵10年車輛稅,並且根據電池尺寸還有特殊稅收獎勵。

- 德國的吸引力超越了國界,吸引了全球投資建立鋰離子電池製造中心。作為這一趨勢的證據,寧德時代新能源科技有限公司(CATL)於 2023 年在德國開設了一家新的鋰離子電池工廠。

- 另一個重要舉措是,獲得德國政府 10 億歐元資金的 Northvolt AB 宣布計劃於 2023 年 5 月在德國北部建造第二座電池製造工廠。

- 歐洲產業政策預計,到2030年歐洲電池產能將超過1,000GWh,年增率超過20%。新推出的歐盟電池法規強調加強本地供應鏈。鑑於這些預測,德國對濕式分離器的需求將顯著成長。

- 隨著德國電動車市場的持續擴大,電動車電池隔膜的需求預計在預測期內也會增加。

歐洲電動汽車電池隔膜產業概況

歐洲電動車電池隔膜市場正在變得半固體。該市場的主要企業(排名不分先後)包括 Entek Manufacturing LLC、SK Innovation、三菱化學集團、東麗和住友化學。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池價格下降

- 抑制因素

- 原料成本上漲

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 其他電池類型

- 按材質

- 聚丙烯

- 聚乙烯

- 其他材料

- 地區

- 英國

- 德國

- 義大利

- 西班牙

- 法國

- 荷蘭

- 比利時

- 其他歐洲國家

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Entek Manufacturing LLC

- SK Innovation Co. Ltd

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- UBE Corp

- Teijin Ltd

- Yunnan Enjie New Materials Co. Ltd

- Cangzhou Mingzhu Plastic Co. Ltd

- Senior Europe

- Market Ranking/Share(%)Analysis

- List of Other Prominent Companies

第7章 市場機會及未來趨勢

- 活性化其他電池化學的研究和開發

簡介目錄

Product Code: 50003713

The Europe Electric Vehicle Battery Separator Market size is estimated at USD 0.21 billion in 2025, and is expected to reach USD 0.36 billion by 2030, at a CAGR of 11.23% during the forecast period (2025-2030).

Key Highlights

- The growing adoption of electric vehicles and the decreasing price of lithium-ion batteries are expected to drive the market over the medium term.

- Conversely, the European battery sector grapples with rising raw material costs. Key materials, especially polyethylene (PE) and polypropylene (PP) - crucial for separator manufacturing - are seeing significant price hikes. This trend poses a potential challenge to the market's expansion.

- However, heightened research and development into alternative battery chemistries, including solid-state batteries, advanced lithium-ion variants, and sodium-ion batteries, present promising opportunities for future market growth.

- Germany is set to play a pivotal role in the market's expansion during the forecast period, with cities like Berlin, Hamburg, and Munich leading the demand surge.

Europe Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- In recent years, the European nation has seen a notable surge in its lithium-ion battery market. Sales of lithium-ion batteries in the country have been significantly bolstered by promising investments from public-private partnership projects, particularly in civil infrastructure and public transit.

- In addition to the continent's growing adoption of electric vehicles, battery separators are reaping benefits from various government initiatives aimed at curbing carbon emissions. These initiatives serve as a catalyst for growth. Furthermore, the introduction of lithium-ion batteries enhanced with polyolefins and ceramic oxides-known for their stability, safety, and ability to reduce shrinkage and particle penetration-adds further momentum to the market.

- Globally, vehicles are increasingly adopting hybridization and electrification. The spectrum includes hybrid electric vehicles (HEVs), plug-in hybrids, and fully electric vehicles (EVs). Europe, being the initiator of the Paris Climate Pact, has actively championed the transition from internal combustion vehicles to EVs, witnessing substantial growth in the process.

- As per the European Transport & Environment Report 2023, the UK's lithium mining capacity is projected to reach 7,000 tonnes by 2030. Additionally, in November 2023, the UK government unveiled a USD 2.5 billion Advanced Manufacturing Plan. This plan encompasses a new Battery Strategy, backed by approximately USD 54 million in government funding, aimed at fostering a competitive battery supply chain by 2030. This initiative seeks to bolster supply chain resilience as automakers pivot towards localized battery production, aligning with the broader transition to battery electric vehicles (BEVs). The Battery Strategy is set to extend focused support for zero-emission vehicles, batteries, and their supply chains, with dedicated capital and R&D funding spanning five years, up to 2030.

- In 2023, global separator production leader Alteo, in collaboration with W-Scope, inked a deal to establish Europe's largest separator production facility. This venture is integral to nurturing both French and European value chains, especially in light of multiple gigafactory projects. Notably, this facility will be Europe's sole site powered entirely by electric energy, and the separators produced will feature SEPal's high-performance aluminas.

- Given these developments, the lithium-ion battery segment is poised to lead the European electric vehicle battery separator market in the coming years.

Germany is Expected to Dominate the Market

- Germany stands as a prominent hub for electric vehicles (EVs), with the government actively promoting their adoption to curb emissions. Boasting one of the world's most advanced charging infrastructures, Germany leads Europe as its largest EV market. Echoing global trends, Germany has witnessed a surge in EV demand, driven by a collective shift towards sustainable transportation solutions, subsequently bolstering the battery separator market.

- With the rising adoption of EVs by consumers and businesses alike, the demand for battery separators has surged in tandem. This momentum is fueled by environmental concerns, government incentives championing EV adoption, and breakthroughs in battery technology, rendering EVs more accessible and practical.

- By 2023, sales of plug-in hybrid electric vehicles in Germany surpassed 180,000 units. Setting its sights on the future, Germany aims to have 15 million EVs gracing its roads by 2030. Central to this ambitious goal are the government's supportive policies and incentives. For instance, both the government and EV manufacturers in Germany contribute EUR 2,000 each, totaling EUR 4,000 for electric cars valued up to EUR 60,000. Additionally, EVs enjoy a decade-long exemption from vehicle tax, complemented by a special tax bonus based on battery size.

- Germany's allure extends beyond its borders, drawing global investments to establish lithium-ion battery manufacturing hubs. A testament to this trend, in 2023, Contemporary Amperex Technology Co. Limited (CATL) inaugurated its new lithium-ion battery cell plant in Germany, starting with an 8 GWh annual capacity, with plans to scale up to 14 GWh.

- In another significant move, Northvolt AB, backed by a EUR 1 billion commitment from the German government, unveiled plans for its second battery manufacturing facility in northern Germany in May 2023.

- Looking ahead, European Industrial Policy forecasts Europe's battery production capacity to surpass 1,000 GWh by 2030, boasting a robust annual growth rate exceeding 20%. The newly introduced EU Battery Regulation emphasizes bolstering localized supply chains. Given these projections, the demand for wet process separators in Germany is poised for substantial growth.

- Given these dynamics, as Germany's electric vehicle landscape continues to expand, the demand for electric vehicle battery separators is set to rise correspondingly during the forecast period.

Europe Electric Vehicle Battery Separator Industry Overview

The Europe Electric Vehicle Battery Separator Market is semi-consolidated. Some of the major players in the market (in no particular order) include Entek Manufacturing LLC, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sumitomo Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Escalating Raw Material Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Material

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Spain

- 5.3.5 France

- 5.3.6 Netherlands

- 5.3.7 Belgium

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek Manufacturing LLC

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Toray Industries Inc.

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 UBE Corp

- 6.3.8 Teijin Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.3.11 Senior Europe

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219