|

市場調查報告書

商品編碼

1685675

北美貨運和物流:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

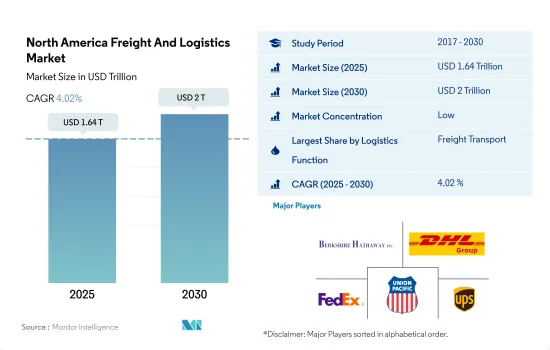

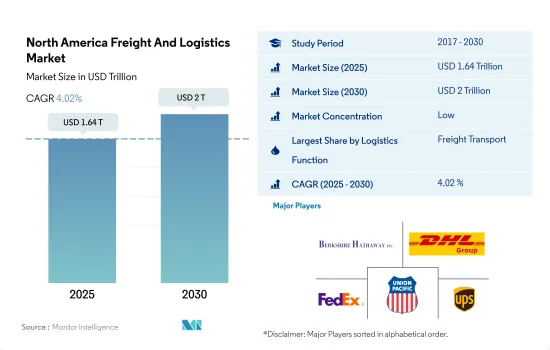

北美貨運和物流市場規模預計在 2025 年達到 1.64 兆美元,預計到 2030 年將達到 2 兆美元,預測期內(2025-2030 年)的複合年成長率為 4.02%。

印尼、泰國和印度對從北美進口的外國商品的需求不斷成長,推動了運輸業的成長。

- 自2024年10月1日起,加拿大將對中國生產的電動車徵收100%的關稅,理由是中國採取的不公平貿易行為損害了全球電動車市場。此外,自2024年10月15日起,將對中國鋼鐵和鋁進口徵收25%的關稅。這些關稅針對的是中國生產的混合動力汽車、卡車和巴士。加拿大政府認為,中國的產能過剩以及薄弱的勞工和環境標準正在損害全球電動車勞動力,並威脅加拿大未來的繁榮。加拿大政府認為這些措施對於保護加拿大產業和確保公平競爭至關重要。加拿大的決定與拜登政府 5 月宣布的對中國產電動車徵收 100% 關稅的決定如出一轍,也是西方國家反對不公平貿易行為的更廣泛舉措的一部分。

- 2022年,美國承諾2030年實現零排放卡車佔全國銷售量的30%,到2040年達到100%。為此,領先的廢棄物管理和環境服務公司共和服務公司於2023年推出了首款全電動回收和廢棄物收集卡車。該公司計劃在 2023 年推出另外兩款完全整合的電動回收和垃圾收集卡車原型。

美國(3,100 萬美元)、加拿大(23 億美元)和墨西哥(440 億美元)政府投資,以加強北美貨運和物流業

- 至2023年12月,北美所有運輸方式的跨國貨運量將達1,216億美元,較去年同期與前一年同期比較下降0.1%。其中,美國與加拿大之間的貿易額為611億美元,比去年同期成長0.7%;美國與墨西哥之間的貿易額為604億美元,比去年同期下降0.9%。在總貨運量中,卡車貨運量為732億美元,鐵路貨運量為164億美元,船舶貨運量為110億美元,管道貨運量為91億美元,空運貨運量為46億美元。

- 2022年10月,美國運輸部撥款約3,100萬美元,用於加強貨運基礎設施及強化供應鏈。美國政府已承諾2022年將投入14億美元用於鐵路基礎建設的現代化。墨西哥政府宣布了一項 2020-2024 年 440 億美元的計劃,重點用於交通基礎設施建設,這是國家私營部門基礎設施投資協議的一部分。加拿大政府已向國家貿易走廊基金投入超過23億美元,用於加強貨運。

北美貨運和物流市場趨勢

美國是該地區 GDP 的最大貢獻者,這得益於加強港口和供應鏈的基礎設施計畫。

- 高效可靠的交通系統對經濟至關重要。透過國家貿易走廊基金,加拿大政府正在投資改善供應鏈、減少貿易壁壘和孵化企業以尋找未來的經濟機會。 2024年5月,交通部長宣布該基金將向19個數位基礎設施計劃提供高達5,120萬美元的資金。加拿大政府正在利用創新技術加強供應鏈,以便為加拿大人提供更快、更便宜的送貨服務。該計劃將促進與全國各地相關人員在數計劃上的合作,以有效解決運輸瓶頸、脆弱性和港口堵塞問題。

- 在美國,由於基礎設施建設和電子商務的興起,運輸和倉儲行業的就業預計將成長。根據美國勞工統計局 (BLS) 的數據,預計該行業從 2022 年到 2032 年將以每年 0.8% 的成長率成長,從而在此期間增加近 57 萬個就業機會。預計宅配和信使行業以及倉儲和儲存業將對該行業預計就業成長的 80% 左右做出重大貢獻。

中東地區緊張局勢加劇影響了石油供應,導致該地區油價大幅上漲。

- 到2024年10月,也就是總統大選前,美國汽油價格預計將在三年多來首次跌破每加侖3美元。燃料價格下跌主要由於需求放緩和原油價格下跌,為成本上漲而引發通貨膨脹的消費者帶來了一絲安慰。此類事態發展可能會增強包括副總統卡馬拉·哈里斯在內的民主黨人的支持,因為他們正在回應共和黨對油價飆升的批評。截至2024年9月,普通汽油平均價格為每加侖3.25美元,比上月下降19美分,比去年同期下降58美分。

- 預計2024年加拿大油砂廠的年度維護將照常進行。但工會領導人警告稱,由於兩個新的行業計劃,亞伯達將在 2025 年的轉折季節面臨勞動力短缺。亞伯達的生產商每年都會僱用數千名技術純熟勞工,用於油砂升級工廠、火力發電發電工程和煉油廠的關鍵維護。加拿大是世界第四大石油生產國,每天生產的 490 萬桶原油中約有三分之二來自亞伯達北部的油砂。短缺可能導致燃料價格最快在 2025 年上漲。

北美貨運及物流業概況

北美貨運和物流市場較為分散,主要有五家市場參與者:伯克希爾哈撒韋公司(旗下包括 BNSF 鐵路公司)、DHL 集團、聯邦快遞、聯合太平洋鐵路和美國主要企業包裹服務公司 (UPS)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 卡車運輸成本

- 卡車持有量(按類型)

- 物流績效

- 主要卡車供應商

- 模態共享

- 海運能力

- 班輪連結性

- 停靠港和演出

- 貨運趨勢

- 貨物噸位趨勢

- 基礎設施

- 法律規範(公路和鐵路)

- 加拿大

- 墨西哥

- 美國

- 法律規範(海空)

- 加拿大

- 墨西哥

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 物流功能

- 快遞、快遞和小包裹(CEP)

- 目的地

- 國內的

- 國際的

- 貨物

- 按交通方式

- 航空

- 海上和內陸水道

- 其他

- 貨物

- 交通方式

- 航空

- 管道

- 鐵路

- 路

- 海上和內陸水道

- 倉庫存放

- 溫度管理

- 無溫度控制

- 溫度管理

- 其他服務

- 快遞、快遞和小包裹(CEP)

- 國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- AP Moller-Maersk

- AIT Worldwide Logistics

- Americold

- ArcBest

- Arrive Logistics

- Ascent Global Logistics

- Berkshire Hathaway Inc.(including BNSF Railway Company)

- Brookfield Infrastructure Partners LP(including Genesee & Wyoming Inc.)

- Burris Logistics

- CH Robinson

- Canada Post Corporation(including Purolator)

- Canadian National Railway Company

- Canadian Pacific Kansas City Ltd.

- Capstone Logistics LLC

- Congebec

- CSX Corporation

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Excel Group

- Expeditors International of Washington, Inc.

- Fastfrate Inc.

- FedEx

- Fomento Economico Mexicano, SAB de CV(including Solistica)

- GEODIS

- Grupo Mexico

- GXO Logistics

- Hub Group Inc.

- JB Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Kuehne+Nagel

- Landstar System Inc.

- Lineage, Inc.

- M3 Transport LLC

- Mactrans Logistics

- MODE Global LLC

- NFI Industries

- Nippon Express Holdings

- Norfolk Southern Railway

- Old Dominion Freight Line

- Omni Logistics

- OnTrac

- Patriot Rail Company

- Penske Corporation(including Penske Logistics)

- Polaris Development Corporation

- Ryder System, Inc.

- Schneider National, Inc.

- SEKO Bansard

- SF Express(KEX-SF)

- TFI International Inc.

- Total Quality Logistics, LLC

- Transportation Insight Holding Company

- Traxion

- Uber Technologies Inc.

- Union Pacific Railroad

- United Parcel Service of America, Inc.(UPS)

- Werner Enterprises Inc.

- XPO, Inc.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 46190

The North America Freight And Logistics Market size is estimated at 1.64 trillion USD in 2025, and is expected to reach 2 trillion USD by 2030, growing at a CAGR of 4.02% during the forecast period (2025-2030).

Rising demand for foreign goods in Indonesia, Thailand, and India imported from North America is driving the growth of the transport sector

- Starting October 01, 2024, Canada will impose a 100% tariff on electric vehicles manufactured in China, citing unfair trade practices detrimental to the global EV market. Also, a 25% tariff on imports of Chinese steel and aluminum was set to take effect on October 15, 2024. These tariffs encompass hybrid vehicles, trucks, and buses produced in China. The Canadian government argues that China's overproduction and weak labor and environmental standards harm global EV workers and threaten Canada's future prosperity. The government sees these measures as crucial to protecting domestic industries and ensuring fair competition. Canada's decision mirrors the Biden administration's May announcement of a 100% tariff on Chinese EVs, part of a broader Western push against unfair trade practices.

- In 2022, the US committed to achieving 30% nationwide sales of zero-emission trucks by 2030, with a further goal of 100% by 2040. In line with this, in 2023, Republic Services, a leading waste disposal and environmental services firm, unveiled its first fully integrated electric recycling and waste collection truck. The company had plans to introduce two more fully integrated electric recycling and garbage truck prototypes in 2023.

Enhancing the North American freight & logistics industry through government investments from the United States (USD 31 million), Canada (USD 2.3 billion), and Mexico (USD 44 billion)

- By December 2023, the transborder freight value in North America, across all transportation modes, reached USD 121.6 billion, marking a marginal 0.1% YoY decline. Freight between the US and Canada amounted to USD 61.1 billion, showing a 0.7% YoY increase, while freight between the US and Mexico totaled USD 60.4 billion, experiencing a 0.9% YoY dip. Of the overall freight, trucks accounted for USD 73.2 billion, railways moved USD 16.4 billion, vessels transported USD 11 billion, pipelines carried USD 9.1 billion, and air freight amounted to USD 4.6 billion.

- In October 2022, the US Department of Transportation allocated about USD 31 million to bolster cargo infrastructure and fortify the supply chain. In a bid to modernize rail infrastructure, the US government pledged USD 1.4 billion in 2022. Mexico's government unveiled a USD 44 billion plan for 2020-2024, with a key focus on transportation infrastructure, as part of the National Private Sector Infrastructure Investment Agreement. Canada's government channeled over USD 2.3 billion into the National Trade Corridors Fund to bolster freight transportation.

North America Freight And Logistics Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America Freight And Logistics Industry Overview

The North America Freight And Logistics Market is fragmented, with the major five players in this market being Berkshire Hathaway Inc. (including BNSF Railway Company), DHL Group, FedEx, Union Pacific Railroad and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Canada

- 4.21.2 Mexico

- 4.21.3 United States

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Canada

- 4.22.2 Mexico

- 4.22.3 United States

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 AIT Worldwide Logistics

- 6.4.3 Americold

- 6.4.4 ArcBest

- 6.4.5 Arrive Logistics

- 6.4.6 Ascent Global Logistics

- 6.4.7 Berkshire Hathaway Inc. (including BNSF Railway Company)

- 6.4.8 Brookfield Infrastructure Partners L.P. (including Genesee & Wyoming Inc.)

- 6.4.9 Burris Logistics

- 6.4.10 C.H. Robinson

- 6.4.11 Canada Post Corporation (including Purolator)

- 6.4.12 Canadian National Railway Company

- 6.4.13 Canadian Pacific Kansas City Ltd.

- 6.4.14 Capstone Logistics LLC

- 6.4.15 Congebec

- 6.4.16 CSX Corporation

- 6.4.17 Deutsche Bahn AG (including DB Schenker)

- 6.4.18 DHL Group

- 6.4.19 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.20 Excel Group

- 6.4.21 Expeditors International of Washington, Inc.

- 6.4.22 Fastfrate Inc.

- 6.4.23 FedEx

- 6.4.24 Fomento Economico Mexicano, S.A.B. de C.V. (including Solistica)

- 6.4.25 GEODIS

- 6.4.26 Grupo Mexico

- 6.4.27 GXO Logistics

- 6.4.28 Hub Group Inc.

- 6.4.29 J.B. Hunt Transport, Inc.

- 6.4.30 Knight-Swift Transportation Holdings Inc.

- 6.4.31 Kuehne+Nagel

- 6.4.32 Landstar System Inc.

- 6.4.33 Lineage, Inc.

- 6.4.34 M3 Transport LLC

- 6.4.35 Mactrans Logistics

- 6.4.36 MODE Global LLC

- 6.4.37 NFI Industries

- 6.4.38 Nippon Express Holdings

- 6.4.39 Norfolk Southern Railway

- 6.4.40 Old Dominion Freight Line

- 6.4.41 Omni Logistics

- 6.4.42 OnTrac

- 6.4.43 Patriot Rail Company

- 6.4.44 Penske Corporation (including Penske Logistics)

- 6.4.45 Polaris Development Corporation

- 6.4.46 Ryder System, Inc.

- 6.4.47 Schneider National, Inc.

- 6.4.48 SEKO Bansard

- 6.4.49 SF Express (KEX-SF)

- 6.4.50 TFI International Inc.

- 6.4.51 Total Quality Logistics, LLC

- 6.4.52 Transportation Insight Holding Company

- 6.4.53 Traxion

- 6.4.54 Uber Technologies Inc.

- 6.4.55 Union Pacific Railroad

- 6.4.56 United Parcel Service of America, Inc. (UPS)

- 6.4.57 Werner Enterprises Inc.

- 6.4.58 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219