|

市場調查報告書

商品編碼

1685749

法國貨運與物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)France Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

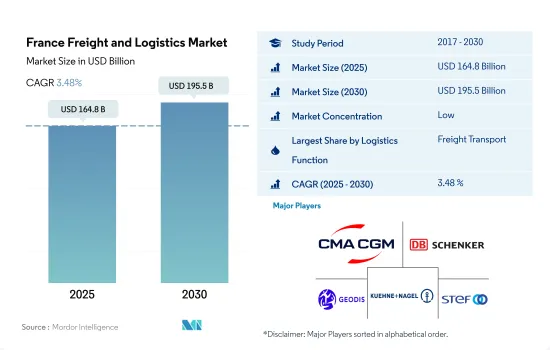

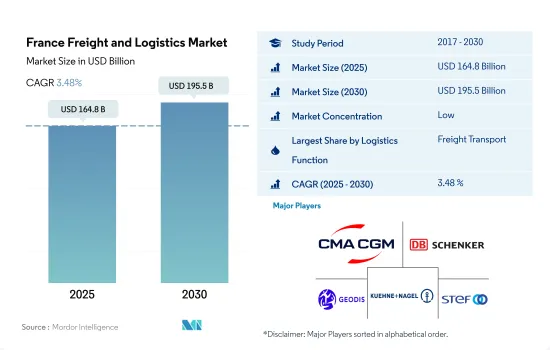

預計 2025 年法國貨運代理和物流市場規模將達到 1,648 億美元,到 2030 年預計將達到 1,955 億美元,預測期內(2025-2030 年)的複合年成長率為 3.48%。

物流業的投資具有週期性,許多建設計劃的計畫都持續到2025年。

- 2024年6月,法國政府與位於法國西南部的奧克西塔尼大區簽署了一項協議,涵蓋2023年至2027年,該協議包含一項價值1.7658億美元的貨運專項投資計畫。此外,法國國家鐵路公司 Reseau Occitanie 將出資 3.3109 億美元,用於振興該地區的主要鐵路網。國家和奧克西塔尼大區政府相關人員就加強基礎設施的重要性達成共識,強調強大的鐵路樞紐的重要角色。主要地點包括塞特港、佩皮尼昂-聖查爾斯港、勒布盧港和新港。

- 作為 2028 年的基礎設施支出計畫的一部分,法國政府已撥款 51 億歐元(54.4 億美元)用於高速公路的開發和建設。根據法國 2030 投資計劃,政府已承諾投入 25 億歐元(26.6 億美元),到 2030 年將電動和混合動力汽車汽車的產量提高到 200 萬輛左右。此外,從 2022 年開始,我們將開始呼籲開展計劃,推動電動車高功率充電站的普及。法國政府的這些戰略舉措將加強該國的短程貨運情勢。

法國貨運及物流市場的趨勢

法國正在投資 10.6 億美元用於道路現代化,並投資 1,060 億美元用於鐵路基礎建設,以促進其物流業的發展。

- 2023年,法國宣布了一項1,067.4億美元的投資策略,預計在2040年完成。這項由政府主導的計劃重點是加強和現代化該國的鐵路基礎設施。該計畫的核心是引進高速通勤列車到各大城市,並效法巴黎著名的 RER 系統。該項目涉及法國國家鐵路公司 SNCF、歐盟和地方當局之間的合作。

- 2024 年 7 月,Solaris訂單。這些公車預計將於 2025 年初交付,將加強 Artois Mobility 減少二氧化碳排放的努力,特別是在蘭斯和貝瑟訥地區。 Solaris Urbino 12 氫氣公車的車頂配備了 70 kW 燃料電池,並配有 Solaris 高功率牽引電池,以便在電力需求高峰時提供額外支援。

俄羅斯將增加對法國的液化天然氣供應,以因應俄烏戰爭造成的燃料短缺

- 截至 2024 年 7 月 12 日當週,法國柴油和超級無鉛燃料的價格略有上漲。柴油價格為每公升 1.84 美元(含稅)。 2024 年頭三個月,與 2023 年相比,俄羅斯對法國的液化天然氣供應量增加超過歐盟其他國家。 2024 年迄今,巴黎已向俄羅斯支付了超過 6.4049 億美元的天然氣供應,並敦促法國削減購買量。在俄羅斯入侵烏克蘭兩年後,馬克宏尋求採取更強硬的立場支持基輔,烏克蘭與俄羅斯的天然氣貿易也隨之成長。

- 2027年,歐盟將推出新的碳定價體系-排放交易體系2(ETS2)。歐盟立法者最初同意在 2023 年實現二氧化碳排放上限為每噸 48.03 美元,並對每公升柴油和汽油徵收 10 美分的附加稅。

法國貨運及物流業概況

法國貨運代理商和物流市場較為分散,主要有五家參與者:達飛集團(包括 CEVA Logistics)、德國鐵路股份公司(包括 DB Schenker)、GEODIS、Kuehne+Nagel 和 STEF 集團(按字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的 GDP 分佈

- 經濟活動帶來的 GDP 成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業生產毛額

- 出口趨勢

- 進口趨勢

- 燃油價格

- 卡車運輸成本

- 卡車持有量(依類型)

- 物流績效

- 主要卡車供應商

- 模態共享

- 海運能力

- 班輪連結性

- 停靠港和演出

- 貨運趨勢

- 貨物噸位趨勢

- 基礎設施

- 法律規範(公路和鐵路)

- 法國

- 法律規範(海運和空運)

- 法國

- 價值鏈與通路分析

第5章 市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 物流功能

- 快遞、快遞和包裹 (CEP)

- 目的地

- 國內的

- 國際的

- 貨物

- 按運輸方式

- 航空

- 海上和內陸水道

- 其他

- 貨物

- 交通方式

- 航空

- 管道

- 鐵路

- 路

- 海上和內陸水道

- 倉庫存放

- 透過溫度控制

- 無溫度控制

- 溫度管理

- 其他服務

- 快遞、快遞和包裹 (CEP)

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介.

- Balguerie Group

- CLASQUIN

- CMA CGM Group(including CEVA Logistics)

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DIMOTRANS Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- FedEx

- GEODIS

- Kuehne+Nagel

- Savino Del Bene SpA

- SEKO Bansard

- STEF Group

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 技術進步

- 資訊來源和進一步閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 46912

The France Freight and Logistics Market size is estimated at 164.8 billion USD in 2025, and is expected to reach 195.5 billion USD by 2030, growing at a CAGR of 3.48% during the forecast period (2025-2030).

A wave pattern has been followed in investments for the logistics sector, with many construction projects lined up till 2025

- In June 2024, the French State inked a deal with the Occitanie region, located in the southwest of France, spanning the years 2023 to 2027. The agreement featured a dedicated investment package of USD 176.58 million, exclusively earmarked for freight. Additionally, SNCF Reseau Occitanie is contributing a substantial USD 331.09 million to rejuvenate the core rail network of the region. Officials from the State and the Occitanie region have reached a consensus on the importance of bolstering infrastructures, emphasizing the pivotal role of robust rail hubs. Key locations identified include the port of Sete, Perpignan Saint-Charles, Le Boulou, and Port-la-Nouvelle.

- As part of its infrastructure spending initiatives through 2028, the French government designated EUR 5.1 billion (USD 5.44 billion) for highway maintenance and construction. Under the France 2030 investment plan, the government committed EUR 2.5 billion (USD 2.66 billion) to bolster the production of nearly two million electric and hybrid vehicles by 2030. Additionally, in 2022, the government issued a call for projects to facilitate the rollout of high-power charging stations for electric vehicles. These strategic moves by the French government are set to fortify the landscape of short-haul trucking in the country.

France Freight and Logistics Market Trends

France is boosting its logistics industry with USD 1.06 billion investments toward road modernization and USD 106 billion towards rail infrastructure

- In 2023, France unveiled a USD 106.74 billion investment strategy slated for completion by 2040, aligning with its commitment to slash carbon emissions. The initiative, spearheaded by the government, focuses on bolstering and modernizing the nation's rail infrastructure. Central to the plan is the introduction of high-speed commuter trains, mirroring Paris's renowned RER system, in key urban centers. Collaborating on this endeavor are France's national rail entity, SNCF, alongside the European Union and regional administrations.

- In July 2024, Solaris secured an order from Artois Mobilites, part of the TADAO transport network in northern France, for four 12-meter Urbino hydrogen buses. These buses, slated for delivery in early 2025, will bolster Artois Mobilites' efforts to reduce carbon emissions, particularly in the Lens and Bethune regions. The Solaris Urbino 12 hydrogen buses will boast 70 kW fuel cells on their roofs and will be complemented by Solaris High Power traction batteries, providing additional support during peak electricity demand.

Increase in Russian LNG deliveries to France catering to fuel shortages caused by Russia-Ukraine war

- For the week ending July 12, 2024, diesel and super unleaded motor fuel prices in France saw a modest uptick. Diesel was priced at USD 1.84 per liter, inclusive of all taxes. In the first three months of 2024, Russian LNG deliveries to France increased more than to any other EU country compared to 2023. Paris has paid over USD 640.49 million to Russia for gas supplies since the start of 2024, prompting calls for France to reduce its purchases. This growing gas trade with Russia occurs as Macron aims to take a tougher stance in support of Kyiv, two years after Russia's full-scale invasion of Ukraine.

- In 2027, the EU is set to implement a new carbon pricing scheme, the Emissions Trading System 2 (ETS2), targeting CO2 emissions from buildings and road transport. Initially agreed upon in 2023, EU legislators assured that the pricing would cap at USD 48.03 per tonne of CO2, translating to an estimated 10-cent surcharge on each liter of diesel or petrol.

France Freight and Logistics Industry Overview

The France Freight and Logistics Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Deutsche Bahn AG (including DB Schenker), GEODIS, Kuehne+Nagel and STEF Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 France

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 France

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Balguerie Group

- 6.4.2 CLASQUIN

- 6.4.3 CMA CGM Group (including CEVA Logistics)

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DIMOTRANS Group

- 6.4.7 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.8 FedEx

- 6.4.9 GEODIS

- 6.4.10 Kuehne+Nagel

- 6.4.11 Savino Del Bene SpA

- 6.4.12 SEKO Bansard

- 6.4.13 STEF Group

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219