|

市場調查報告書

商品編碼

1685794

義大利貨運和物流:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Italy Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

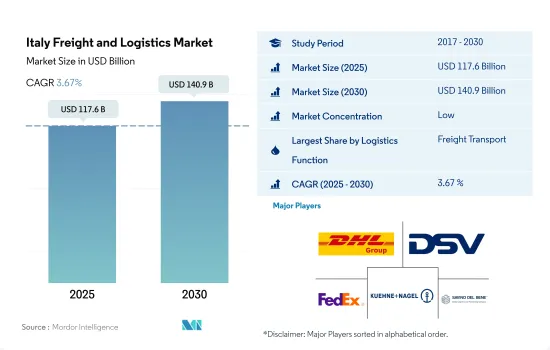

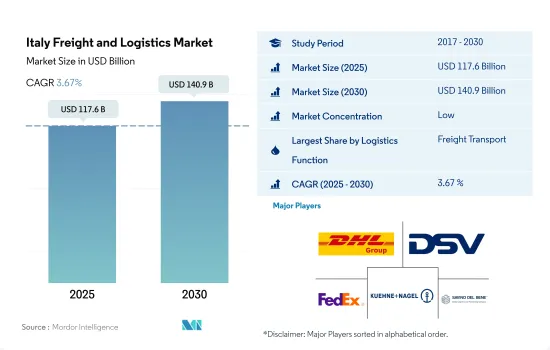

義大利貨運和物流市場規模預計在 2025 年為 1,176 億美元,預計到 2030 年將達到 1,409 億美元,預測期內(2025-2030 年)的複合年成長率為 3.67%。

貿易、就業機會和投資的增加正在推動該國的貨運需求

- 到 2023 年 12 月,義大利安科納港將進行重大升級,建成一條耗資 1.08 億歐元(1.1528 億美元)的新航運線路。該計劃由 BESIX 和 Donati 的合資企業訂單,涉及義大利公路公司 Anas 委託委託的3.3 公里公路。該公路由兩條隧道和一座高架橋組成,預計需要三年時間完成。一旦投入營運,它將連接安科納國際港口和托雷特環形交叉路口的亞得里亞海國家公路 16 號。

- 歐盟在2050年實現氣候中和的戰略高度重視向鐵路運輸模式轉換,跨境運輸在實現歐盟綠色交易目標方面發揮著至關重要的作用。然而,義大利鐵路運輸面臨著包括缺失環節和各種阻礙其競爭力的障礙在內的挑戰。儘管存在這些障礙,義大利鐵路部門仍保持著 10% 的運輸方式分擔率。值得注意的是,FS集團等公司製定了雄心勃勃的投資計劃,到2030年將在基礎設施方面投資1600億歐元(1707.9億美元),在陸路運輸方面投資1900億歐元(2028.2億美元)。

義大利貨運和物流市場趨勢

義大利計畫2026年前徹底改造其超重型貨運車輛,提升未來前景

- 2024年7月,義大利運輸部核准在米蘭和波隆那中間的皮亞琴察建立鐵路貨運站的計劃。新車站將位於皮亞琴察東部,具體位於勒莫斯區。此外,勒莫斯已經是皮亞琴察多式聯運碼頭的所在地,由 Hupac監督。現有的終點站目前正在進行大規模擴建,預計2024年底或2025年初完工。隨著這些發展,皮亞琴察的鐵路貨運未來前景光明。

- 義大利計劃在2024年升級其超重型貨運車輛,理由是這些車輛狀況不佳且不符合歐盟標準。面對俄烏衝突和歐盟監管趨嚴等挑戰,托運人和運輸業者正在敦促政府實施公共獎勵計畫。該計畫要求2026年投資7.4724億美元,在三年內逐步淘汰25%至30%的老舊、污染最嚴重和最不安全的車輛。義大利對貨運業的支持落後於法國和德國,但預計最早在 2024 年底就會改變。

2022 年底燃油相關消費稅折扣結束後,義大利的燃油價格大幅上漲。

- 過去三年,義大利一直是歐洲主要市場中平均批發電價最高的國家。這主要是因為其嚴重依賴天然氣發電,這項策略使其有別於其他歐洲市場。 2023年,義大利批發電價平均為每兆瓦時137.80美元,比德國和法國的平均價格高出三分之一,比西班牙高出50%以上。預計到2024年,義大利的電力成本將持續上漲,近期批發價格比法國高出近40%,比西班牙高出60%。

- 截至 2024 年 3 月,義大利電力和天然氣監管機構 Arela 已將 2025 年至 2027 年新容量競標的支付上限提高至 86,466.7 美元/兆瓦。上一屆競標於 2022 年至 2024 年舉行,新產能拍賣價格最高為 74,724.3 美元/兆瓦,現有產能拍賣價格最高為 35,227.2 美元/兆瓦,分 15 年支付。未來幾年,隨著電動車、熱泵和電解槽等電氣化程度的提高,義大利的電力需求將會成長。

義大利貨運和物流行業概況

義大利貨運和物流市場較為分散,主要有五家參與者(按字母順序排列):DHL 集團、DSV A/S(De Sammensluttede Vognmaend af Air and Sea)、聯邦快遞、Kuehne+Nagel 和 Savino Del Bene SpA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 卡車運輸成本

- 卡車持有量(按類型)

- 物流績效

- 主要卡車供應商

- 模態共享

- 海運能力

- 班輪連結性

- 停靠港和演出

- 貨運趨勢

- 貨物噸位趨勢

- 基礎設施

- 法律規範(公路和鐵路)

- 義大利

- 法律規範(海運和空運)

- 義大利

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 物流功能

- 快遞、快遞和小包裹(CEP)

- 目的地

- 國內的

- 國際的

- 貨物

- 按交通方式

- 航空

- 海上和內陸水道

- 其他

- 貨物

- 交通方式

- 航空

- 管道

- 鐵路

- 路

- 海上和內陸水道

- 倉庫存放

- 溫度管理

- 無溫度控制

- 溫度管理

- 其他服務

- 快遞、快遞和小包裹(CEP)

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Arcese Trasporti SpA

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- FedEx

- Fercam SpA

- GRUBER Logistics SpA

- Italsempione

- Italtrans

- Kuehne+Nagel

- Savino Del Bene SpA

- Transmec Group

- United Parcel Service of America, Inc.(UPS)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 47630

The Italy Freight and Logistics Market size is estimated at 117.6 billion USD in 2025, and is expected to reach 140.9 billion USD by 2030, growing at a CAGR of 3.67% during the forecast period (2025-2030).

Rising trade, employment opportunities, and investment values are driving freight transport demand in the country

- By December 2023, Italy's port of Ancona is slated for a significant upgrade with the completion of a new EUR 108 million (USD 115.28 million) transportation link. The project, awarded to a joint venture between BESIX and Donati, encompasses a 3.3 km road commissioned by Anas, an Italian road firm. This road, featuring two tunnels and a viaduct, is expected to take three years to finish. Once operational, it will connect the international port of Ancona to the Strada Statale 16 Adriatica at the Torrette roundabout.

- The European Union's strategy to achieve climate neutrality by 2050 places a strong emphasis on a modal shift to rail, with cross-border transport playing a pivotal role in realizing the EU's Green Deal objectives. However, rail transport in Italy faces challenges, including missing links and various barriers that hinder its competitiveness. Despite these hurdles, Italy's rail sector holds a 10% modal split. Notably, companies like FS Group have ambitious investment plans, earmarking EUR 160 billion (USD 170.79 billion) for infrastructure and EUR 190 billion (USD 202.82 billion) for overland transport by 2030.

Italy Freight and Logistics Market Trends

Growing future prospects due to planned overhaul of superheavy cargo transport fleet by 2026 in Italy

- In July 2024, the Italian Ministry of Transport greenlit a project to establish a rail freight station in Piacenza, strategically placed between Milan and Bologna. The upcoming station will be situated in the eastern part of Piacenza, specifically in the Le Mose area. Moreover, Le Mose already hosts the Piacenza Intermodal Terminal, overseen by Hupac. This existing terminal is currently undergoing significant enhancements, with completion slated for late 2024 or early 2025. These developments paint a promising future for Piacenza's rail freight prospects.

- In 2024, Italy plans to upgrade its superheavy cargo transport fleet due to poor conditions and failure to meet EU standards. Shippers and carriers are urging the government to implement a public incentive plan amid challenges from the Russian-Ukrainian conflict and stricter EU regulations. The plan requires a USD 747.24 million investment by 2026 to phase out 25-30% of the oldest, most polluting, and least safe vehicles over three years. Italy's support for the freight sector has lagged behind France and Germany, but changes are expected as early as late 2024.

Fuel prices surged in Italy after the discount on fuel-related excise duties expired at the end of 2022

- For the last three years, Italy has consistently held the record for the highest average wholesale power prices among major European markets. This is primarily due to its heavy reliance on natural gas for electricity generation, a strategy that sets it apart from its European counterparts. In 2023, Italy's wholesale power prices stood at an average of USD 137.80 per megawatt hour, a figure that was a third higher than both Germany's and France's averages, and over 50% more than Spain's. Moving into 2024, Italy's power costs have continued to surge, with recent wholesale prices sitting nearly 40% above France's and a striking 60% higher than Spain's.

- As of March 2024, Italy's power and gas regulator, Arera, has increased the maximum payments in capacity auctions for 2025-2027 to USD 86,466.7/MW for new capacity. Previous auctions for 2022-2024 offered maximum payments of USD 74,724.3/MW for new capacity and USD 35,227.2/MW for existing capacity, payable over 15 years. In coming years, Italian power demand will rise due to increased electrification from electric vehicles, heat pumps, and electrolyzers.

Italy Freight and Logistics Industry Overview

The Italy Freight and Logistics Market is fragmented, with the major five players in this market being DHL Group, DSV A/S (De Sammensluttede Vognmaend af Air and Sea), FedEx, Kuehne+Nagel and Savino Del Bene SpA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Italy

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Italy

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arcese Trasporti SpA

- 6.4.2 Deutsche Bahn AG (including DB Schenker)

- 6.4.3 DHL Group

- 6.4.4 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.5 FedEx

- 6.4.6 Fercam SpA

- 6.4.7 GRUBER Logistics SpA

- 6.4.8 Italsempione

- 6.4.9 Italtrans

- 6.4.10 Kuehne+Nagel

- 6.4.11 Savino Del Bene SpA

- 6.4.12 Transmec Group

- 6.4.13 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219