|

市場調查報告書

商品編碼

1639506

英國工廠自動化和工業控制系統:市場佔有率分析、行業趨勢和成長預測(2025-2030)United Kingdom Factory Automation and Industrial Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

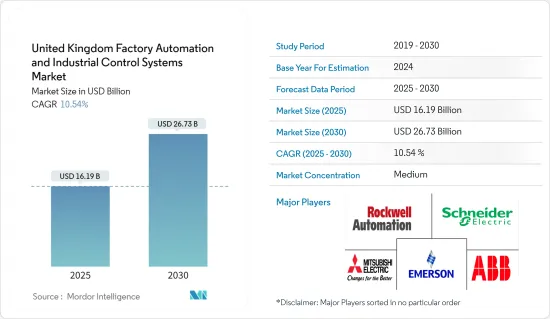

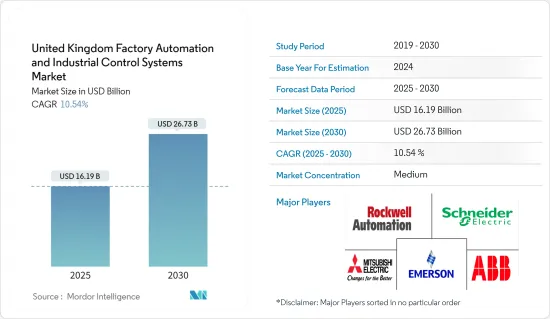

預計2025年英國工廠自動化和工業控制系統市場規模為161.9億美元,2030年將達267.3億美元,預測期內(2025-2030年)複合年成長率為10.54%。

COVID-19 的爆發和英國各地的封鎖規定影響了全國各地的工業活動。該禁令的影響包括供應鏈中斷、原料供應、勞動力短缺、價格波動和運輸問題。

主要亮點

- 隨著該地區為 2019 年議會提出的第四次工業革命做準備,英國工業 4.0 市場預計將成長。第四次革命的特點是人工智慧、基因編輯和先進機器人等技術的融合。

- 隨著競爭的迅速加劇和最終用戶需求的不斷變化,英國製造業也被迫採用更新的技術創新和數位轉型解決方案,以使業務流程盡可能高效。例如,馬達和感測器等現場設備為汽車行業提供了快速響應市場需求、減少製造停機時間、提高供應鏈效率和擴大生產力的機會。

- 此外,英國政府還啟動了一個新計劃,旨在創建全自動藥物發現設施,以加速新藥的生產並改造製藥業。位於剪切機哈韋爾的羅莎琳德富蘭克林研究所將啟動免持分子發現,據信生產新藥的速度比平常快 10 倍以上。

- 在供應方面,許多產業正在引入有望顛覆現有工業價值鏈的技術,例如工業物聯網(IIoT)和機器人技術。

- 這些自動化系統的高成本與有效且強大的硬體和高效的軟體有關。這些自動化設備需要高資本支出,投資自動化技術可能需要花費數億美元來設計、製造和安裝。

英國工廠自動化與工業控制系統市場趨勢

製造執行系統(MES)可望推動市場成長

- MES 是一種用於製造業的電腦化系統,用於規劃、安排、追蹤和增強業務。 MES的功能是確保所有流程高效運作。隨著製造流程變得越來越複雜,MES 軟體變得至關重要。

- MES 系統的範圍從調度任務到在整個製造過程中執行效能分析。組織一直在使用 MES 來協調整個工廠的活動。 MES 也充當流程管理系統和企業資源規劃系統(ERP) 之間的橋樑。

- 製造公司面臨著提高製造盈利、提高收益、降低業務風險和加強客戶關係流程等挑戰。公司開始採用 MES 來克服這些業務挑戰,事實證明這是製造公司處理營運的傳統方法。

- 透過將MES與ERP系統整合,製造企業可以有效地協調工作訂單和其他資源需求,實現即時生產調整、準確的需求預測、準時交貨和緊急訂單,這有助於薄型化製造業,例如。問題並提供無縫變更指令。

- 在這個市場上,各行業的MES實施合約不斷增加。例如,2020 年 7 月,普銳特冶金技術訂單了為巴西米納斯吉拉斯州 Ouro Blanco 的 Gerdau 綜合工廠熔煉車間安裝製造執行系統 (MES) 的合約。這項新解決方案取代了運行幾年後提供有限升級選項的現有系統。該計劃將由普銳特冶金技術與 PSI Metals 合作實施,匯集鋼鐵行業領先的自動化、冶金和軟體專業知識。

汽車和運輸業預計將推動該國市場成長

- 汽車工業是重要產業之一,在全球自動化製造設備中佔有很大佔有率。各種汽車製造商的生產設施都實現了自動化,以保持效率。以電動車取代傳統汽車的趨勢日益明顯,預計將進一步增加汽車產業的需求。

- 製造過程中擴大採用自動化、數位化和人工智慧的參與是推動汽車產業對工業機器人需求的關鍵因素。根據 IFR 的數據,英國汽車業是機器人最大的用戶之一,截至 2019年終,佔運作機器人總數 11,000 台的 52%。

- 具有高承重能力和可伸縮臂的大型工業機器人能夠點焊重型汽車車身面板。小型機器人焊接輕型零件,例如安裝座和支架。機器人鎢極惰性氣體焊接機和金屬惰性氣體焊接機可以在每個循環期間將焊槍定位在相同的方向。

- 物聯網不僅幫助重新構想製造和設計,還幫助重新構想汽車洞察體驗和分銷服務。物聯網 (IoT) 有助於提高汽車製造的生產效率、品質並最終降低成本。

- 根據汽車製造商和貿易商工業的數據,英國汽車工業是該地區最有價值的經濟資產之一,每年為經濟貢獻約 227 億美元。此外,該行業在國內僱用了數十萬人從事高技能、高價值的工作。此類案例可能會促進該國市場的成長。

英國工廠自動化和工業控制系統產業概況

英國工廠自動化和工業控制設備市場適度整合。儘管大公司主導市場,但越來越多的新興企業進入市場。這些新興企業得到了英國政府計劃的大力支持。

- 2021 年 9 月 - 數位轉型和工業自動化領域的領導者羅克韋爾自動化公司已完成對 Plex Systems 的收購。此次收購將使羅克韋爾增強其雲端交付的智慧製造解決方案,並將智慧製造帶入客戶的業務中。

- 2021 年 5 月-施耐德電機宣佈在歐洲市場推出符合 IP 和 NEMA 標準的 EcoStruxure 微型資料中心 R 系列。這些資料中心提高了安全性、生產力和自動化能力,並為具有挑戰性的製造和工業環境提供了快速且有彈性的解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場概況

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 自動化技術的興起

- 積極的政府措施和充滿活力的新興企業生態系統

- 市場問題

- 行業法規政策

- 關鍵案例及實施場景

第6章 市場細分

- 按類型

- 工業控制系統

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控/資料採集(SCADA)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 人機介面 (HMI)

- 其他工業控制系統

- 現場設備

- 機器視覺

- 工業機器人

- 馬達和驅動器

- 安全系統

- 感測器和發射器

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 飲食

- 汽車/交通

- 製藥

- 其他

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

第8章投資分析

第9章 未來展望

The United Kingdom Factory Automation and Industrial Control Systems Market size is estimated at USD 16.19 billion in 2025, and is expected to reach USD 26.73 billion by 2030, at a CAGR of 10.54% during the forecast period (2025-2030).

The COVID-19 outbreak and lockdown restrictions across UK affected the industrial activities across the country. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials, labor shortages, fluctuating prices, shipping problems, etc.

Key Highlights

- The market for Industry 4.0 in the United Kingdom is expected to grow in the future as the region gets ready for the Fourth Industrial Revolution, which was presented to the parliament in 2019. The fourth revolution is characterized by a fusion of technologies such as artificial intelligence, gene editing, and advanced robotics.

- With the rapid increase in competition and evolving end-user requirements, manufacturing units in the United Kingdom are also being forced to adopt newer technological innovations and digital transformation solutions to make their business process as efficient as possible. For instance, field devices, like motors and sensors, offer opportunities to the automotive industry to react faster to market requirements, reduce manufacturing downtimes, enhance the efficiency of supply chains, and expand productivity.

- Moreover, the government of UK has undertaken a new project to create a fully-automated drug discovery facility to speed up the production of new medicines and transform the pharma industry. The Rosalind franklin institute in Harwell, Oxfordshire, would initiate hands-free molecular discovery to generate new drugs at a speed more than ten times of the norm.

- On the supply side, many industries are already witnessing the introduction of technologies, such as Industrial Internet of Things (IIoT) and robotics, which are expected to disrupt the well-established industry value chains.

- The high cost of these automated systems is associated with the effective and robust hardware and efficient software. These automation equipment requires the high capital expenditure in order to invest in automation technologies which can cost millions of dollars to design, fabricate, and install.

United Kingdom Factory Automation and Industrial Control Systems Market Trends

Manufacturing Execution System (MES) are Expected to Drive the Growth of Market

- MES is a computerized system that is used in manufacturing to plan, schedule, track, and enhance operations. The function of MES is to ensure that all processes work in an efficient way. As the manufacturing process becomes more complex, MES software is essential.

- The scope of MES systems ranges from scheduling tasks to carrying out performance analysis across the entirety of the manufacturing process. Organizations have been using MES to coordinate activities across the factory floor. It also serves as a bridge between process control systems and enterprise resource planning (ERP).

- Manufacturing organizations face challenges in increasing manufacturing profitability, obtaining a higher return on assets, lowering business risk, and enhancing customer relationship processes. Companies started adopting MES to overcome these business challenges, which turned out to be a traditional approach toward handling the operations in manufacturing companies.

- The integration of MES with ERP systems enables manufacturers to coordinate work orders, and other resource needs effectively, as well as helps make manufacturing leaner with real-time production adjustments, accurate demand forecasts, just-in-time deliveries, the ability to avoid rush orders and seamless change orders.

- The market is witnessing an increase in contracts for the implementation of MES across different industries. For instance, in July 2020, Primetals Technologies received an order for the installation of a Manufacturing Execution System (MES) for Gerdau's integrated plant melt shop in Ouro Branco, Minas Gerais, Brazil. The new solution will replace an existing system, which offers only limited upgrade options after several years of operation. The project will be executed by Primetals Technologies in cooperation with PSI Metals, thus, combining leading automation, metallurgical, and software know-how in the steel industry.

Automotive and Transportation Industry Expected to Drive the Market Growth in the Country

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with EVs is expected to further augment the automotive industry's demand.

- The growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots' demand in the automotive sector. According to IFR, the automotive industry in the UK is one of the largest users of robots, accounting for 52% of robots' total operational stock at 11,000 units by the end of 2019.

- Large industrial robots with a higher payload and extended arms capabilities handle spot welding on heavy body panels. Smaller robots weld lighter parts such as mounts and brackets. Robotic tungsten inert gas and metal inert gas welders can position the torch in the same orientation for every cycle.

- IoT is helping reshape not only manufacturing and design but also vehicle insight experiences and distribution services. Internet of Things (IoT) helps improve automotive manufacturing production efficiency, improve quality, and, ultimately, reduce costs.

- According to the Society of Motor Manufacturers and Traders, the UK's automotive industry is one of the region's most valuable economic assets, contributing roughly USD 22.7 billion per year to the economy. In addition, the industry employs hundreds of thousands of people across the country in high-skill and high valued jobs. Such instances are likely to augment the market growth in the country.

United Kingdom Factory Automation and Industrial Control Systems Industry Overview

The UK factory automation and industrial controls market is moderately consolidated. The market is dominated by major players but is increasingly witnessing the entry of new start-ups. These start-ups are getting ample support from the UK government programs.

- September 2021 - Rockwell Automation, Inc., the largest digital transformation and industrial automation company completed the acquisition of Plex Systems. This acquisition allows Rockwell to strengthen their cloud-delivered intelligent manufacturing solutions and provide smart manufacturing in customer operations.

- May 2021 - Schneider Electric announced the availability of their IP and NEMA rated EcoStruxure Micro Data Center R-Series in the European market. These data centers offer quick to deploy and resilient solutions to challenging manufacturing and the industrial environment with increased safety, production, and automation capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID -19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies

- 5.1.2 Proactive Government Policies and a Vibrant Startup Ecosystem

- 5.2 Market Challenges

- 5.3 Industry Policies and Regulations

- 5.4 Key Case Studies and Implementation Scenarios

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Motors and Drives

- 6.1.2.4 Safety Systems

- 6.1.2.5 Sensors & Transmitters

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Fanuc Corporation